Hard Empty Capsule Market Report 2025–2030

Global Hard Empty Capsule Market Report 2025–2030

Market Overview

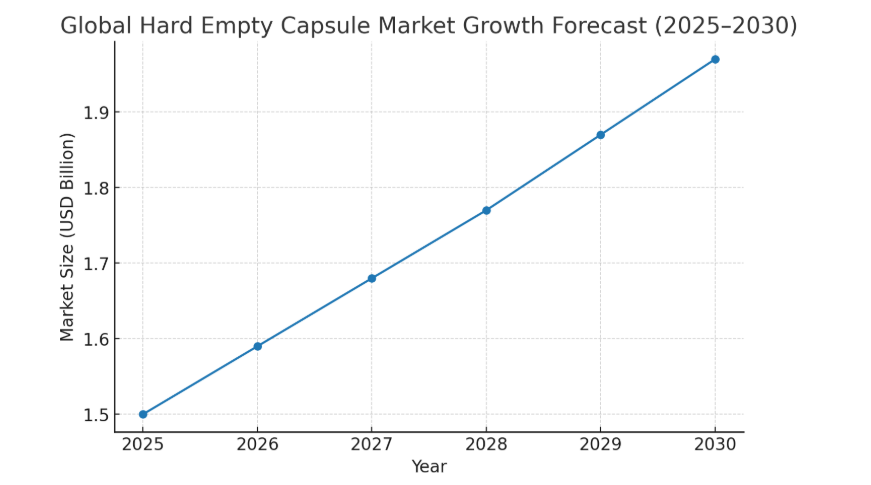

The global hard empty capsule (HEC) market is projected to reach USD 1.5 billion by 2025, supported by a 5.5% compound annual growth rate (CAGR) through 2030. Hard empty capsules, essential in the pharmaceutical and nutraceutical supply chain, continue to gain traction due to their ability to ensure accurate dosing, improved bioavailability, and consumer convenience.

Product Definition

Hard empty capsules are cylindrical shells made from gelatin or plant-based polymers. They consist of a shorter cap and a longer body that interlock to form a hermetically sealed chamber. Capsules are widely used to package medications and supplements, offering the following advantages:

-

Accurate dosage delivery

-

High bioavailability compared to tablets

-

Safety and portability

-

Ease of consumption

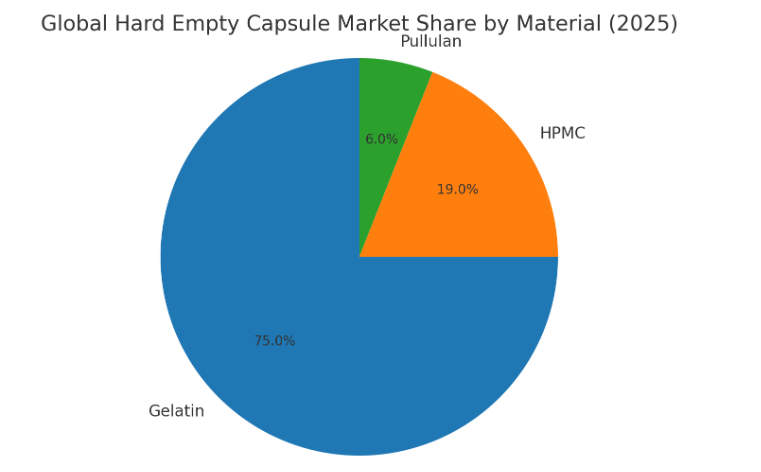

Capsule Types by Material

-

Gelatin Capsules (75%): Derived from animal collagen (pig, cow, fish).

-

Hydroxypropyl Methylcellulose (HPMC) Capsules (19%): Plant-based, chemically stable, with low moisture content and high toughness.

-

Pullulan Capsules (6%): Plant-based, transparent, with low oxygen permeability.

While gelatin capsules dominate, plant-based capsules are gaining momentum due to consumer demand for vegetarian and vegan-friendly products. However, their higher production cost remains a barrier.

Industry Landscape

The global HEC market is highly consolidated. Six major companies—Lonza, Qualicaps, ACG, Farmacapsulas S.A., Seohung Co. Ltd., and Anhui Huangshan Capsule Co. Ltd.—account for about 70% of worldwide revenues.

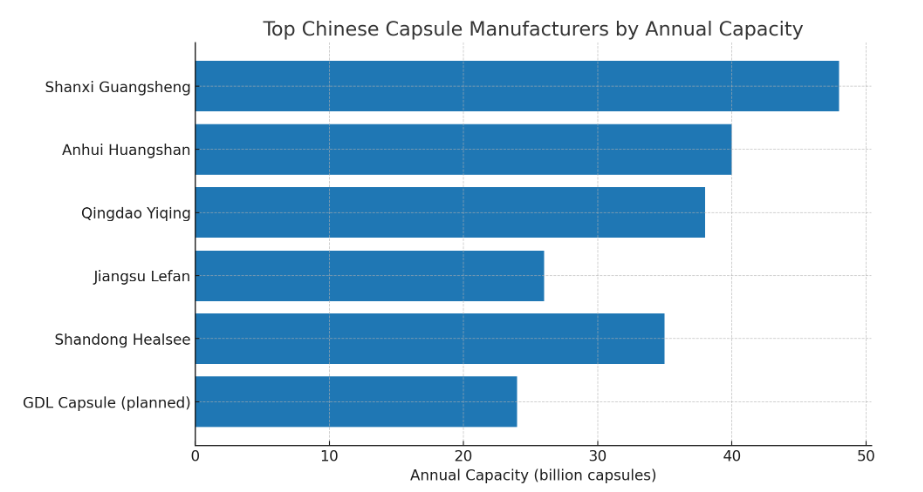

China’s Leading Role

China is the largest producer, consumer, and exporter, with annual output exceeding 600 billion capsules. More than 13 Chinese firms have production capacities above 10 billion capsules each. Leading players include:

-

Shanxi Guangsheng Medicinal Capsule Co. Ltd. – 48 billion capsules (96 production lines)

-

Anhui Huangshan Capsule Co. Ltd. – 40 billion capsules

-

Qingdao Yiqing Biotechnology Co. Ltd. – 38 billion capsules

-

Jiangsu Lefan Capsule Co. Ltd. – 26 billion capsules

-

Shandong Healsee Capsule Ltd. – 35 billion capsules (58 production lines)

-

Guang De Li (GDL) Capsule Company – 24 billion planned capacity (32 lines, with phased rollout by 2026)

These capacities demonstrate China’s central role in ensuring global supply stability.

Growth Drivers

-

Pharmaceutical expansion: Rising generic drug manufacturing supports capsule demand.

-

Nutraceutical boom: Growing global health awareness and aging populations drive supplement consumption.

-

Plant-based shift: Increasing vegetarian and vegan lifestyles boost demand for HPMC and pullulan capsules.

Market Challenges

-

High production costs for plant-based capsules limit market penetration.

-

Raw material volatility, including gelatin and plant fibers, creates supply chain risks.

-

Regulatory compliance: Stricter safety and quality standards require ongoing investment in advanced manufacturing.

Opportunities and Investment Value

-

Sustainability & ESG Alignment: Plant-based capsules (HPMC and pullulan) are well-positioned to meet rising consumer and regulatory demand for sustainable, non-animal-derived products. Companies investing in green production technologies may gain a long-term competitive edge.

-

Premium Nutraceutical Market: Demand for clean-label, allergen-free, and vegan nutraceuticals is growing fastest in developed regions such as North America and Europe, creating higher-margin opportunities.

-

Global Expansion: Emerging markets in Asia, Africa, and Latin America present untapped demand for cost-effective gelatin capsules, while developed markets increasingly favor plant-based alternatives.

-

Technology Upgrades: Automation and advanced production lines are enhancing efficiency, reducing defect rates, and enabling scalable capacity expansion. Firms with stronger technological capabilities may achieve faster market share gains.

-

Strategic Partnerships: Collaborations between capsule manufacturers and pharmaceutical/nutraceutical brands can secure long-term supply contracts, creating stable revenue streams.

Market Outlook (2025–2030)

-

The HEC market is forecast to expand steadily, with gelatin capsules continuing to dominate in the near term.

-

Plant-based capsules will grow faster, reshaping the competitive landscape and capturing new consumer segments.

-

Asia, led by China, will remain the epicenter of global production, while Western markets may see accelerated adoption of premium, plant-based alternatives.

Key Takeaways

-

Market size: USD 1.5 billion in 2025

-

Growth rate: 5.5% CAGR (2025–2030)

-

Market share: Gelatin 75%, HPMC 19%, Pullulan 6%

-

Top 6 companies: 70% of global revenue

-

China: 600+ billion capsules annually, largest global producer