Polyolefin Elastomer (POE) Market at a Crossroads: Rapid Growth Meets Overcapacity Risk

Polyolefin Elastomer (POE) Market at a Crossroads: Rapid Growth Meets Overcapacity Risk

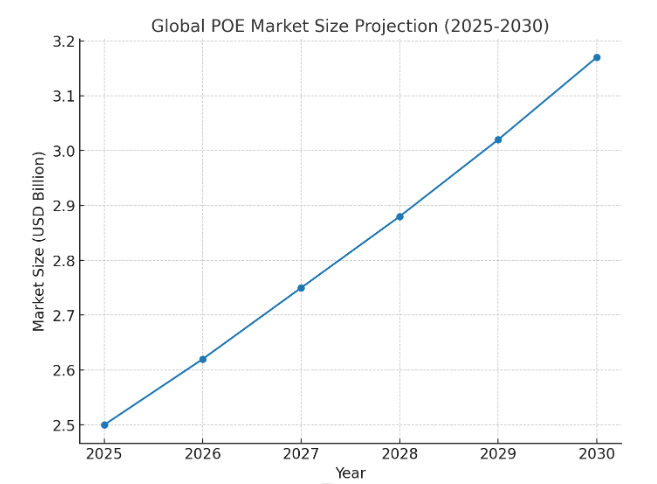

The polyolefin elastomer (POE) industry is undergoing one of the most dynamic phases in its development. With demand steadily rising across automotive, photovoltaics, packaging, and cable sectors, the market is projected to reach around USD 2.5 billion by 2025 and expand at a compound annual growth rate (CAGR) of 4.8% through 2030. Yet, behind the steady growth trajectory lies an urgent challenge: aggressive capacity additions—particularly in China—are raising fears of structural overcapacity and price pressure in the coming years.

What is POE?

Polyolefin elastomers are thermoplastic elastomers produced through metallocene-catalyzed copolymerization of ethylene with α-olefins (such as 1-butene, 1-hexene, or 1-octene). Structurally, POE combines both plastic and rubber properties:

-

The polyethylene crystalline domains act as physical crosslinking points, imparting thermoplastic processability.

-

The amorphous ethylene-α-olefin segments provide elasticity comparable to conventional rubbers.

This unique balance gives POE a wide application spectrum—lightweight automotive parts, photovoltaic encapsulants, wire and cable insulation, adhesives, and packaging films.

Competing Technologies: Insite vs. Exxpol

The global POE market has been shaped by two dominant process technologies:

Insite Solution Polymerization (Dow Chemical, LG Chem)

-

Developed using Dow’s Constrained Geometry Catalyst (CGC) platform.

-

Enables high-temperature solution polymerization with precise control of polymer structure.

-

Allows incorporation of long-chain branching, enhancing processability and transparency.

-

Typical Engage POE products contain >20% octene comonomer, giving improved elasticity and softness.

Exxpol High-Pressure Technology (ExxonMobil, Mitsui Chemicals)

-

Based on ExxonMobil’s metallocene catalyst patents introduced in the late 1980s.

-

Delivers narrow molecular weight distribution, uniform comonomer distribution, and chain-length control.

-

Requires ultra-high pressure (100–200 MPa), supported by advanced catalyst dispersion systems.

-

Commercialized first at Mitsui’s U.S. Baton Rouge facility in the early 1990s.

These proprietary technologies remain closely held by multinational majors, giving them technical leadership. However, with Chinese companies pushing pilot and industrial trials of homegrown processes, technology localization is emerging as a competitive factor.

China’s Expansion Drive

Wanhua Chemical

-

Completed pilot-scale production in 2021.

-

200,000 t/y POE unit came online in June 2024.

-

400,000 t/y unit in Shandong (Penglai) expected to start by end-2025.

-

Once fully operational, Wanhua will reach 600,000 t/y, making it one of the top global players.

Sinopec Maoming Petrochemical

-

Ran a 1,000 t/y pilot unit in 2022.

-

Successfully commissioned a 50,000 t/y industrial trial plant in April 2025.

-

The RMB 9.98 billion investment reflects Sinopec’s intent to scale POE production rapidly.

Hainan Beiouyi Technology

-

Built China’s first industrial POE plant (30,000 t/y) in 2023.

-

Introduced Betopp-PV and Betopp-G product lines for PV encapsulants, automotive modification, and cables.

-

Announced in 2025 that its Fujian subsidiary will add a 200,000 t/y POE unit, aiming for nationwide coverage.

Zhejiang Zhiying New Materials

-

Achieved 1,000 t/y pilot success in 2024.

-

Licensed process technology to Rongsheng New Materials (200,000 t/y) and Zhejiang Petroleum & Chemical (400,000 t/y).

Taken together, China’s announced POE expansion pipeline now exceeds 4 million tons per year, dwarfing current domestic demand. This points toward a looming supply-demand imbalance by the second half of the decade.

Global Capacity Footprint

While China dominates headlines, other producers continue to play important roles:

-

Korea Nexlene Company (joint venture of LG Chem, Daelim, and Cheil): ~300,000 t/y.

-

Dow Chemical: Global footprint with multiple Engage POE plants.

-

ExxonMobil: Strong position in North America and Asia.

-

Mitsui Chemicals: Early adopter of Exxpol technology, with production in Japan and abroad.

These companies differentiate through premium-grade POE targeting specialty markets such as medical devices, adhesives, and solar applications, where product quality and performance outweigh price.

Market Drivers

Automotive Lightweighting

Automakers use POE for bumpers, seals, and interior trims.

Its lightweight and impact resistance support fuel efficiency and electric vehicle design.

Photovoltaics

POE encapsulants are gaining share from EVA due to superior transparency, durability, and weather resistance.

Global solar installation growth (particularly in China, India, and the U.S.) drives demand.

Wire & Cable

Excellent flexibility and insulation make POE suitable for power cables, telecom cables, and charging stations.

Packaging & Films

Transparency and toughness support food packaging, stretch films, and adhesives.

Challenges and Risks

Despite strong demand fundamentals, the industry faces several risks:

-

Overcapacity in China: With more than 4 million tons of planned capacity, utilization rates could drop sharply, triggering price wars.

-

Technology Gaps: Domestic Chinese POE technologies remain relatively new compared to Insite and Exxpol. Achieving consistent quality for high-end applications may take time.

-

Competitive Pressures: Global incumbents may struggle to defend margins if commoditization accelerates.

-

Capital Intensity: Building and operating POE plants require billions in investment, raising risks if demand growth underperforms.

-

Trade & Environmental Factors: Tariffs, carbon footprint regulations, and recycling challenges may alter demand and supply dynamics.

Opportunities for Differentiation

Leading producers are expected to shift focus toward value-added and niche applications:

-

High-performance solar encapsulants with anti-UV and anti-hydrolysis properties.

-

Medical-grade POE with superior purity and biocompatibility.

-

Adhesive resins for advanced packaging and construction.

-

Sustainability-driven POE with recyclability and bio-based feedstock integration.

In addition, vertical integration (from ethylene to downstream applications) will be a key advantage, ensuring feedstock security and cost competitiveness.

Outlook: Growth with Turbulence

The POE industry stands at a crossroads. On one hand, downstream industries will continue to expand, supporting steady demand growth at ~5% CAGR. On the other, the unprecedented wave of Chinese capacity threatens to overwhelm markets, triggering intense competition and margin erosion.

The winners in this environment will likely be:

-

Technology leaders capable of delivering consistent high-end products.

-

Companies with broad customer partnerships in automotive, solar, and cable sectors.

-

Players with the financial strength to endure cyclical downturns and the strategic foresight to target specialty niches rather than commodity competition.

As the market evolves toward 2030, balancing scale efficiency with product differentiation will determine which companies capture value and which are squeezed in the race to the bottom.