Thermoplastic Polyolefin Elastomer (TPO) Market Poised for Steady Growth Amid Expanding Automotive and Industrial Applications

Global Thermoplastic Polyolefin Elastomer (TPO) Market Poised for Steady Growth Amid Expanding Automotive and Industrial Applications

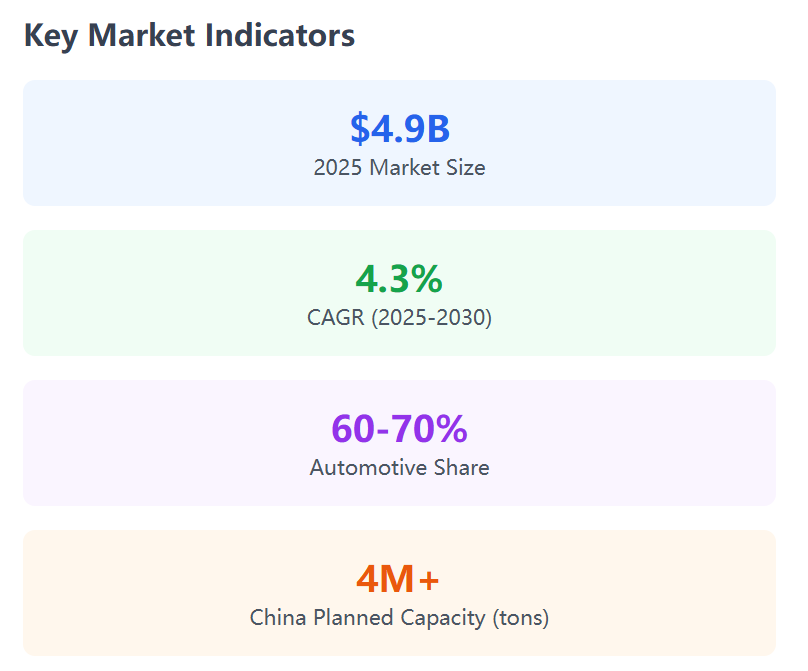

The global market for thermoplastic polyolefin elastomers (TPOs) is entering a new phase of expansion, driven by rising demand from the automotive industry and increasing innovation in polyolefin-based materials. Valued at approximately USD 4.9 billion in 2025, the market is projected to grow at a compound annual growth rate (CAGR) of 4.3% through 2030, underpinned by advancements in lightweighting technologies and the shift toward sustainable, recyclable polymers.

Market Overview

TPOs represent a family of elastomers that combine the advantages of plastics and rubbers. Structurally composed of alternating hard and soft segments, TPOs deliver a balance of toughness, flexibility, and processability. Within this category, three major types dominate:

-

Polyolefin Elastomer (POE), the largest segment by volume and market share, produced through metallocene-catalyzed copolymerization of ethylene with α-olefins.

-

Thermoplastic Vulcanizate (TPV), derived from dynamic vulcanization of rubbers such as EPDM and NBR blended with polypropylene or polyethylene.

-

Olefin Block Copolymer (OBC), a newer innovation developed exclusively by Dow through chain-shuttling polymerization.

The automotive sector remains the primary consumer of TPOs, accounting for 60–70% of global demand, where these materials are used in bumper systems, dashboards, seals, and under-the-hood applications. Other key applications include construction materials, wire and cable coatings, and photovoltaic films.

Competitive Landscape

POE dominates both production and market scale. Global leaders include LyondellBasell, Dow, ExxonMobil, Mitsui Chemicals, LG Chem, Borealis, Korea Nexlene Company, Wanhua, Hainan Beiouyi Technology, and Sinopec Maoming Petrochemical Company.

For TPVs, notable producers include Celanese, LCY Group, Mitsubishi Chemical, Shandong Dawn Polymer, Teknor Apex, and NANTEX Industry. OBCs, meanwhile, are produced solely by Dow, underscoring its technological exclusivity in this niche.

Capacity Developments and Investments

China has emerged as a focal point of capacity expansion in POE production, with multiple new projects announced since 2023. Key developments include:

-

Korea Nexlene Company with 300,000 tons/year capacity.

-

Wanhua Chemical launched its first 200,000 tons/year POE line in June 2024 and is on track to add another 400,000 tons/year by 2025, bringing its total capacity to 600,000 tons/year.

-

Zhejiang Zhiying New Materials achieved milestone pilot runs in September 2024, subsequently licensing its technology to Rongsheng New Materials (200,000 tons planned) and Zhejiang Petroleum & Chemical (400,000 tons planned).

-

Hainan Beiouyi Technology commissioned China’s first commercial-scale POE unit (30,000 tons/year) in December 2023, followed by a 200,000-ton expansion plan in Fujian.

-

Sinopec Maoming Petrochemical successfully started up a 50,000 tons/year POE facility in April 2025, complementing its earlier pilot operations.

Together, these projects push China’s planned POE capacity beyond 4 million tons/year, signaling strong national ambitions to reduce reliance on imports and establish global competitiveness.

In TPVs, Shandong Dawn Polymer leads with 90,000 tons/year capacity, while international players continue to dominate high-performance applications.

Market Opportunities and Challenges

The outlook for TPOs is buoyed by several growth drivers:

-

Automotive lightweighting: As automakers pursue higher fuel efficiency and electric vehicle adoption accelerates, TPOs are replacing heavier materials in both structural and aesthetic applications.

-

Renewable energy and construction: POE-based materials are increasingly used in photovoltaic encapsulation films and building membranes, tapping into the global sustainability trend.

-

Technology innovations: Breakthroughs such as Dow’s OBC and China’s domestically developed POE processes are expected to reshape the competitive dynamics.

However, the market also faces challenges:

-

Raw material volatility, particularly ethylene and α-olefins, could pressure margins.

-

Intellectual property and licensing barriers, as evidenced by Dow’s exclusive hold on OBC technologies, may limit diversification.

-

Competition from alternative elastomers, including TPU and SBS-based materials, which are gaining ground in specialty applications.

Future Outlook

Industry analysts expect steady but competitive growth for TPOs through 2030. While established players continue to expand their global footprint, Chinese producers are rapidly scaling up and innovating in process technologies, setting the stage for a more fragmented and regionally balanced market. The next five years will likely see TPOs consolidating their role as essential materials in mobility, energy, and infrastructure applications.