Car Safety Seat Market Demonstrates Steady Growth Amid Demographic Shifts and Regulatory Evolution

Global Car Safety Seat Market Demonstrates Steady Growth Amid Demographic Shifts and Regulatory Evolution

Market Reaches USD 2.8 Billion in 2025 with 3.2% CAGR Through 2030 Despite Aging Population Trends

The global car safety seat market is maintaining steady expansion, with industry valuations reaching approximately USD 2.8 billion in 2025 and projected compound annual growth rates of 3.2% through 2030. This moderate yet consistent growth trajectory reflects the market's strategic importance within automotive safety segments, driven by expanding regulatory frameworks, rising parental safety awareness, and technological innovations in child protection systems, despite facing demographic headwinds from declining birth rates in developed economies.

Car safety seats represent critical safety devices designed to prevent and reduce vehicular injuries among children during transportation. These systems utilize various restraint mechanisms to ensure child safety across different weight and age categories, with effectiveness demonstrated through research showing 70% reduction in child passenger fatality rates and 67% decrease in serious injury rates when properly utilized.

China Dominates Global Manufacturing with 80% Production Share

China has established itself as the world's largest car safety seat manufacturing hub, accounting for approximately 80% of global production volume. This manufacturing dominance reflects the country's established automotive supply chain infrastructure, cost-competitive production capabilities, and proximity to major consumer markets throughout Asia-Pacific regions.

The concentration of manufacturing capabilities in China creates both opportunities and challenges for global market dynamics. While cost efficiencies support market accessibility and affordability, supply chain dependencies and quality assurance requirements demand ongoing attention from international buyers and regulatory authorities. Chinese manufacturers continue to invest in technology advancement and quality control systems to meet increasingly stringent international certification standards.

Regulatory Frameworks Drive Market Development Across Major Economies

The car safety seat industry operates within increasingly comprehensive regulatory environments that mandate usage and establish performance standards across multiple jurisdictions. Current certification standards include China's 3C certification, European ECE R44/04 and ECE R129 (i-Size) standards, German ADAC certification, and US FMVSS 213 certification, each establishing specific performance requirements and testing protocols.

Sweden pioneered regulatory leadership in 1982 by requiring safety devices for children under seven years during vehicle transportation. Australia established comprehensive legislation in 1985 mandating child restraint systems for children aged 0-7 years, with specific requirements including rear-facing installation for children aged 6 months to 4 years and prohibition of front-seat positioning.

Germany requires appropriate restraint systems for children under 12 years or shorter than 150cm height. The Netherlands mandates safety seat usage for children under 18 years with height below 1.35 meters, while the United Kingdom requires appropriate restraint systems for children under 12 years or shorter than 135cm, with penalties ranging from £20-£500 for non-compliance among children under 3 years.

The United States introduced initial child safety seat legislation in 1978, with mandatory usage requirements established across all states by 1985. Current regulations require safety seats for children under 4 years or weighing less than 18kg, with rear-facing installation mandated for children under 1 year using infant or convertible safety seats.

Additional regulatory frameworks include New Zealand's requirements for children under 7 years, Canada's mandates for children under 18kg, South Korea's requirements for children under 6 years with enhanced enforcement in designated child protection zones, and Japan's obligations for children under 10 years with administrative penalties for violations.

China implemented 3C certification standards in 2015, prohibiting manufacture, sale, import, or commercial use of uncertified products. Current traffic regulations require safety seat usage for children under 4 years and prohibit children under 12 years from occupying front passenger seats.

Demographic Trends Present Complex Market Dynamics

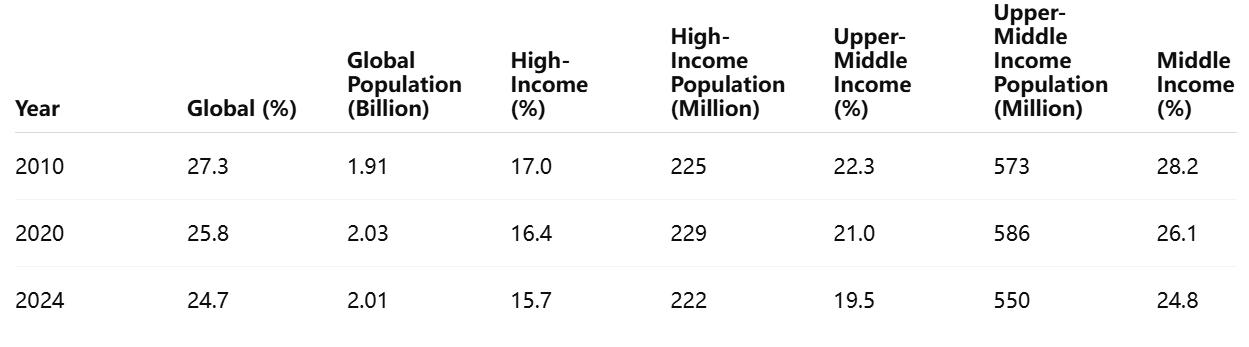

Global demographic patterns present significant challenges for long-term market development, with declining birth rates and aging populations affecting potential customer bases. According to World Bank statistics, the global population aged 0-14 years decreased from 27.3% in 2010 (1.91 billion children) to 25.8% in 2020 (2.03 billion children) and further declined to 24.7% in 2024 (2.01 billion children), indicating accelerating population aging trends.

High-income countries demonstrate particularly pronounced demographic shifts, with children aged 0-14 years declining from 17.0% of total population in 2010 (225 million children) to 16.4% in 2020 (229 million children) and 15.7% in 2024 (222 million children). These trends directly impact addressable market size in key developed economies where regulatory compliance and purchasing power support premium product adoption.

Upper-middle-income countries show similar patterns, with 0-14 age demographics declining from 22.3% in 2010 (573 million children) to 21.0% in 2020 (586 million children) and 19.5% in 2024 (550 million children). Middle-income countries demonstrate more moderate declines from 28.2% in 2010 (1.445 billion children) to 26.1% in 2020 (1.504 billion children) and 24.8% in 2024 (1.472 billion children).

Table Global 0–14 Population Percentage (2010–2024)

Regional Vehicle Ownership Patterns Support Market Foundation

Global passenger car ownership provides fundamental market infrastructure for safety seat adoption. According to OICA statistics, total global passenger car ownership reached 1.181 billion vehicles in 2020, with Asia-Pacific representing the largest regional market at 525 million vehicles, followed by Europe at 373 million vehicles, North America at 176 million vehicles, South America at 69 million vehicles, and Middle East & Africa at 38 million vehicles.

The substantial Asia-Pacific vehicle population, combined with China's manufacturing dominance, creates significant domestic market opportunities despite demographic challenges. European markets benefit from stringent regulatory frameworks and high safety awareness levels, supporting premium product adoption and consistent replacement cycles. North American markets demonstrate established regulatory compliance and purchasing power supporting market stability and innovation adoption.

Usage Rate Disparities Highlight Development Opportunities

Significant disparities exist between developed and developing economies regarding safety seat adoption rates. Western developed countries achieve usage rates exceeding 90%, reflecting comprehensive regulatory frameworks, established safety cultures, and economic capabilities supporting product acquisition and proper utilization.

Developing and underdeveloped countries typically demonstrate usage rates below 10%, attributed to economic development levels, incomplete regulatory frameworks, and insufficient public awareness regarding child passenger safety importance. These disparities represent substantial market development opportunities as economic conditions improve and regulatory frameworks expand globally.

Traffic injury statistics underscore the critical importance of safety seat adoption, with 43.9% of child traffic fatalities occurring during vehicle transportation, and motor vehicle fatalities representing 2.3 times the rate of non-motor vehicle incidents among children. These statistics support ongoing advocacy efforts and regulatory development initiatives worldwide.

Market Opportunities Emerge from Multiple Drivers

The car safety seat market benefits from several significant growth opportunities despite demographic challenges. Regulatory expansion in emerging markets creates new compliance-driven demand as governments implement child passenger safety requirements. Economic development in middle-income countries supports increased purchasing power and safety awareness among growing middle-class populations.

Technological innovation continues to enhance product functionality and user experience, with developments in crash protection systems, ease-of-use features, and smart connectivity creating premium product categories and replacement demand. The integration of IoT sensors, installation verification systems, and mobile app connectivity represents emerging opportunities for value-added products.

The electric vehicle transition creates opportunities for specialized safety seat designs optimized for EV characteristics, including unique interior configurations, enhanced crash protection requirements, and integration with advanced vehicle safety systems. Autonomous vehicle development may generate demand for adaptive safety systems accommodating different seating configurations and usage scenarios.

E-commerce expansion and direct-to-consumer sales channels improve market accessibility, particularly in regions with limited retail infrastructure. Online platforms enable better consumer education, product comparison, and access to premium products previously unavailable in local markets.

Sustainability initiatives drive demand for eco-friendly materials and manufacturing processes, creating opportunities for differentiated products appealing to environmentally conscious consumers. Recyclable materials, sustainable production methods, and extended product lifecycles represent growing market segments.

Industry Challenges Require Strategic Navigation

The car safety seat industry confronts several significant challenges affecting long-term market development. Demographic trends in key developed markets create structural headwinds for market expansion, requiring companies to adapt strategies for slower-growth environments and focus on market share gains rather than overall market expansion.

Economic sensitivity affects purchasing decisions, particularly in middle-income markets where safety seats represent significant household investments. Price competition intensifies as manufacturers compete for market share in slower-growth environments, potentially impacting profitability and innovation investment capabilities.

Regulatory compliance complexity increases operational costs and market entry barriers as standards evolve and enforcement mechanisms strengthen. Companies must invest continuously in research and development, testing capabilities, and certification processes to maintain market access across multiple jurisdictions.

Supply chain dependencies, particularly the concentration of manufacturing in China, create potential risks related to trade policies, logistical disruptions, and quality control challenges. Geopolitical tensions and trade policy changes may impact cost structures and market access for both manufacturers and consumers.

Consumer education remains challenging in markets with low usage rates, requiring sustained investment in awareness campaigns, educational programs, and retail training initiatives. Cultural resistance to safety device adoption and misconceptions about product necessity require ongoing address through targeted marketing and education strategies.

Technology integration costs and complexity may limit adoption in price-sensitive markets while creating development expenses for manufacturers pursuing premium product positioning. Balancing innovation investment with cost competitiveness requires careful strategic planning and market segmentation approaches.

Industry Outlook Balances Growth Drivers Against Demographic Constraints

Industry analysts maintain cautiously optimistic outlooks for car safety seat market development through 2030, recognizing both supportive trends and structural challenges. Regulatory expansion, technology advancement, and safety awareness improvements support continued market development despite demographic headwinds in developed economies.

The 3.2% projected CAGR through 2030 reflects moderate but sustainable growth expectations, with opportunities for companies successfully navigating demographic challenges through geographic diversification, product innovation, and market penetration improvements in underdeveloped regions.

Emerging market development represents the most significant long-term opportunity, as economic development, urbanization, and regulatory framework implementation create new demand sources offsetting demographic declines in developed economies. Companies investing in emerging market presence and affordable product development are positioned to benefit from these structural shifts.

Technology integration and premium product development offer opportunities for value creation and margin improvement in mature markets, while cost optimization and manufacturing efficiency improvements support competitiveness in price-sensitive segments. The industry's ability to balance innovation investment with cost competitiveness will determine long-term success in evolving market conditions.