Electronic-Grade Isopropyl Alcohol Market Poised for Robust Growth Amid Semiconductor and Clean Energy Boom

Electronic-Grade Isopropyl Alcohol Market Poised for Robust Growth Amid Semiconductor and Clean Energy Boom

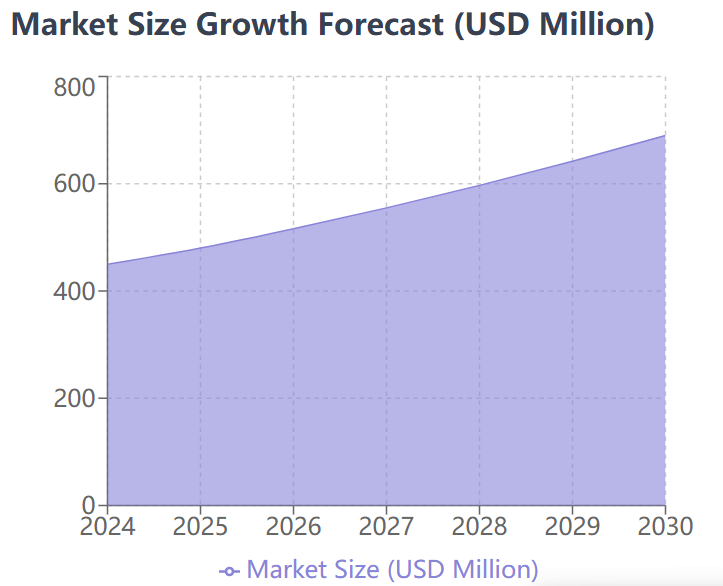

The global market for electronic-grade isopropyl alcohol (IPA), a critical solvent in semiconductor and advanced electronics manufacturing, is on track to reach USD 480 million by 2025. With a projected compound annual growth rate (CAGR) of around 7.5% through 2030, the market is entering a new phase of accelerated expansion, fueled by the twin forces of surging semiconductor demand and global decarbonization initiatives.

At a Glance: Electronic-Grade IPA Market

-

Market Size 2025: USD 480 million

-

CAGR (2025–2030): ~7.5%

-

Largest Application: Integrated Circuits (55–65% of consumption)

-

Top Producer: Tokuyama Corporation (104,000 tons global capacity)

-

Key Trend: Recycling initiatives (e.g., TSMC Fab 15B reducing 2,400 tons of new IPA annually)

-

Regional Hotspot: Asia-Pacific (largest production and consumption base)

Defining the Market: What Is Electronic-Grade IPA?

Electronic-grade IPA, typically defined by purities of 99.99% (4N) and above, is indispensable for ultra-clean cleaning and drying processes in integrated circuit (IC) fabrication, solar cell production, LCD panel manufacturing, and LED assembly. Its applications range from wafer cleaning to glass substrate treatment, ensuring defect-free production in some of the world’s most advanced technologies. The IC sector alone accounts for an estimated 55–65% of total consumption, underscoring its dominance in this specialized market.

Production Landscape and Key Players

Asia-Pacific continues to serve as the global hub for electronic-grade IPA production and consumption, aligning with its role as the world’s semiconductor and photovoltaic manufacturing center. Tokuyama Corporation leads the global market with a production capacity exceeding 104,000 metric tons. The company operates facilities in Japan (30,000 tons), China (12,000 tons), and Taiwan (62,000 tons), the latter bolstered by a joint venture with Formosa Tokuyama Advanced Chemicals. The Taiwan base supplies leading chipmakers such as TSMC and United Microelectronics.

Other notable players are also scaling up aggressively. Chang Chun Group maintains a 12,960-ton capacity from IPA recovery, while LCY Group’s Zhenjiang subsidiary currently operates at 5,000 tons with a bold roadmap to expand to 20,000 tons by late 2025, 30,000 tons by 2026, and 50,000 tons by 2028. Domestic Chinese suppliers such as Zhejiang Jianye Chemical (3,000 tons) and Jiangsu Xingfu Electronic Materials (20,000 tons, set to launch by end-2025) are also ramping up their positions.

Outside Asia, ExxonMobil, which has produced 99.99% IPA since 1992, announced plans to commission a U.S.-based facility in Baton Rouge by 2027, capable of producing 99.999% ultra-pure IPA. This strategic move is closely tied to U.S. policies incentivizing local semiconductor production and heightened purity requirements for next-generation chips.

Key Capacity Data and Expansion Plans

-

Tokuyama Corporation

• Global capacity: 104,000 tons

• Japan: 30,000 tons

• China: 12,000 tons

• Taiwan: 62,000 tons (incl. JV with Formosa Tokuyama, 30,000 tons) -

Chang Chun Group

• Recovery capacity: 12,960 tons -

LCY Group (Zhenjiang LCY High Performance Materials Co., Ltd.)

• Current: 5,000 tons

• Expansion roadmap:

– 20,000 tons by end-2025

– 30,000 tons by end-2026

– 50,000 tons by March 2028 -

Zhejiang Jianye Chemical Co., Ltd.

• Current capacity: 3,000 tons -

Jiangsu Xingfu Electronic Materials Co., Ltd.

• New project: 20,000 tons, start-up by end-2025 -

ExxonMobil

• Producing 99.99% IPA since 1992

• Baton Rouge (USA) plant: 99.999% ultra-pure IPA, expected 2027 -

TSMC Fab 15B (Taiwan)

• Introduced recycled IPA in January 2025

• Annual impact:

– Reduces new liquid procurement by 2,400 tons

– Cuts carbon emissions by 486 tons

Recycling and Sustainability Milestones

A defining trend shaping the market is the recycling of used IPA solutions. After wafer cleaning, wastewater typically contains 10 wt% IPA and 90 wt% water. Recovery and purification processes can regenerate the solvent into high-purity grades, reducing both costs and environmental burdens. A milestone was recently achieved in January 2025, when TSMC’s Fab 15B introduced recycled electronic-grade IPA, reducing annual new liquid procurement by 2,400 metric tons and cutting carbon emissions by 486 metric tons. This initiative marks an industry-first in resource efficiency and sets a precedent for sustainable practices.

Market Drivers and Opportunities

The market outlook remains strongly positive, with several reinforcing factors:

-

Semiconductor Demand: The rise of AI, high-performance computing, and automotive electronics is driving unprecedented wafer demand, directly supporting IPA usage.

-

Clean Energy Growth: Expanding solar cell and LED industries continue to rely on high-purity solvents for defect-free performance.

-

Policy Support: Regional industrial policies in the U.S. and Europe are accelerating reshoring of semiconductor manufacturing, creating new demand clusters for IPA.

-

Sustainability and Circular Economy: Advances in IPA recycling and recovery strengthen cost competitiveness and ESG compliance for manufacturers.

Challenges Ahead

Despite strong fundamentals, the market faces hurdles. Maintaining ultra-high purity standards (up to 99.999%) requires advanced purification infrastructure, representing high capital intensity for new entrants. Supply chain localization efforts in Europe and the U.S. may also challenge Asia’s dominance, forcing producers to adapt with new investments in Western markets. Furthermore, the balance between sustainable recovery processes and cost efficiency remains a delicate one, particularly as environmental regulations tighten globally.