Enterprise SSD Market Poised for Explosive Growth as AI and Cloud Computing Drive Demand

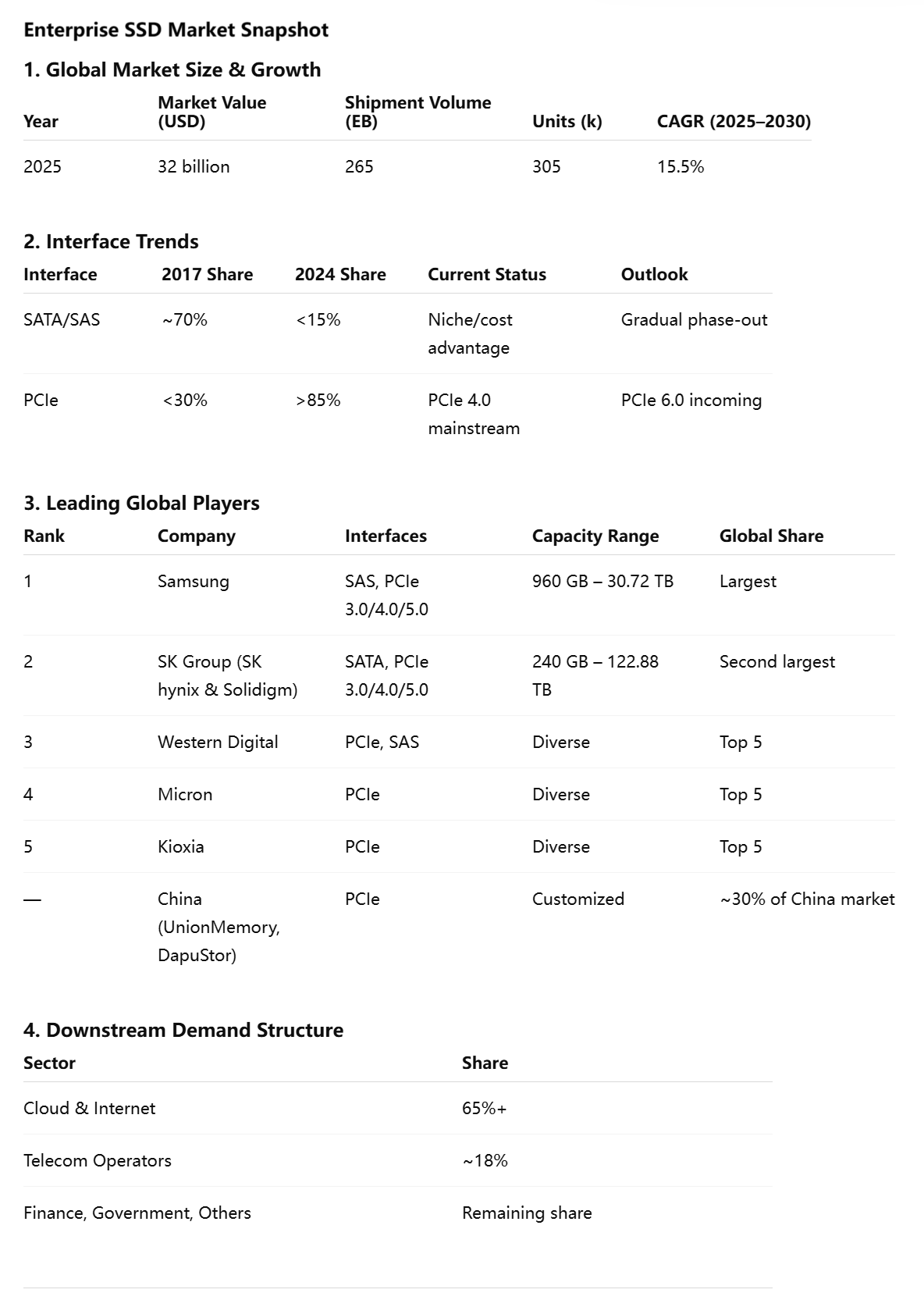

The global enterprise solid-state drive (SSD) market is experiencing unprecedented growth, with projections indicating a market value of $32 billion in 2025. This represents a total global enterprise SSD shipment capacity of 265 exabytes, translating to approximately 305,000 enterprise SSD units. Industry analysts forecast a robust compound annual growth rate (CAGR) of 15.5% through 2030, driven by accelerating demand for faster data processing, low-latency storage solutions, and cost efficiencies in high-density computing environments.

Technology Evolution: PCIe Interface Dominates the Landscape

The enterprise SSD market has undergone a significant technological transformation, with PCIe interfaces rapidly displacing traditional SATA and SAS connections. PCIe SSDs now command over 85% of the enterprise SSD market share, a dramatic increase from less than 30% in 2017. This shift reflects the superior performance characteristics of PCIe technology, with PCIe 4.0 x4 interfaces delivering theoretical bandwidths of up to 8GB/s, significantly outperforming SATA SSDs' 500-550 MB/s transfer rates.

The evolution of PCIe standards continues to accelerate:

- PCIe 4.0 remains the current market mainstream

- PCIe 5.0 has entered volume production

- PCIe 6.0 is positioned for future market entry

This progression from PCIe 1.0's 8Gb/s bandwidth to PCIe 6.0's projected 256Gb/s represents a 32-fold improvement in data transmission capabilities, positioning PCIe as the definitive "superhighway" for enterprise data transfer.

AI Revolution Reshapes Storage Requirements

The artificial intelligence boom has fundamentally altered enterprise storage demands. AI training processes require specialized storage performance characteristics across different workflow stages:

Data ingestion demands high-capacity storage with optimal sequential write performance, while training phases require frequent random data access to update model parameters. The preprocessing stage needs seamless data handling capabilities, and inference operations prioritize rapid random read/write performance. Checkpoint storage requires quick model state preservation, while archival storage focuses on capacity and cost-effectiveness.

The impact on total cost of ownership is substantial. Case studies demonstrate that SSD-based solutions can reduce server requirements by 9-fold, decrease rack footprint by 89%, improve power density by 2.7 times, and reduce five-year energy expenditure by 4.4 times, resulting in a 40% reduction in total cost of ownership compared to traditional HDD solutions.

Market Dynamics and Customer Segmentation

Cloud computing and internet enterprises dominate the enterprise SSD customer base, representing over 65% of market demand. Major buyers include technology giants such as X Corp., OpenAI, Google, Amazon, Alibaba, Tencent, and ByteDance. Telecommunications operators account for approximately 18% of market share, with financial institutions, government entities, and other enterprises comprising the remainder.

Competitive Landscape: Asian Dominance with Emerging Chinese Players

Samsung maintains its position as the global enterprise SSD market leader, offering comprehensive product lines spanning SAS, PCIe 3.0, PCIe 4.0, and PCIe 5.0 interfaces with capacities ranging from 960GB to 30.72TB. The SK Group, including SK Hynix and Solidigm (formerly Intel's NAND Flash and SSD business acquired in 2021), holds the second position globally with products covering SATA, PCIe 3.0, PCIe 4.0, and PCIe 5.0 interfaces and capacities from 240GB to 122.88TB.

Western Digital, Micron, and KIOXIA occupy the third, fourth, and fifth positions respectively. The top five global manufacturers collectively control approximately 90% of market share.

Chinese Market Dynamics: Local Players Gain Ground

China's rapidly expanding cloud computing and data center infrastructure, coupled with the nation's technology sovereignty initiatives, has created opportunities for domestic players. Notable Chinese enterprises including Shenzhen UnionMemory Information System Limited and DapuStor Corporation have achieved a combined 30% market share in China during 2024, signaling significant localization trends in this strategic technology sector.

Market Opportunities and Growth Drivers

Several factors are propelling enterprise SSD market expansion:

Digital Transformation Acceleration: Organizations' migration to cloud-based infrastructures continues driving SSD adoption as enterprises prioritize performance over traditional cost-per-gigabyte metrics.

AI and Machine Learning Proliferation: The exponential growth of AI applications creates unprecedented demands for high-performance storage solutions capable of handling massive dataset processing and real-time inference operations.

Hyperscale Data Center Expansion: Major cloud service providers' continued infrastructure investments require storage solutions that maximize performance per rack unit while minimizing power consumption.

Edge Computing Growth: The proliferation of edge computing applications demands reliable, high-performance storage solutions in distributed environments.

Industry Challenges and Considerations

Despite robust growth prospects, the enterprise SSD market faces several challenges:

Supply Chain Complexity: Global semiconductor supply chain disruptions continue affecting production schedules and component availability.

Technological Transition Costs: Organizations must balance the benefits of newer PCIe standards against infrastructure upgrade costs and compatibility considerations.

Market Concentration Risks: Heavy reliance on a small number of major manufacturers creates potential supply and pricing vulnerabilities.

Geopolitical Factors: Trade tensions and technology sovereignty concerns may impact global supply chains and market access.

Future Outlook: Sustained Growth Trajectory

The enterprise SSD market's future appears exceptionally promising. The convergence of AI advancement, cloud computing expansion, and digital transformation initiatives creates a powerful demand foundation. As PCIe 5.0 and 6.0 technologies mature, performance improvements will enable new application categories while existing workloads benefit from enhanced efficiency.

Industry experts anticipate that the 15.5% CAGR through 2030 may prove conservative if AI adoption accelerates beyond current projections. The market's evolution from a storage commodity to a critical performance enabler positions enterprise SSDs as fundamental infrastructure components for the digital economy.

The next five years will likely witness continued market consolidation among established players while presenting opportunities for specialized manufacturers to address niche requirements in emerging applications such as autonomous vehicles, IoT infrastructure, and quantum computing support systems.

Financial Media Brief: Enterprise SSD Market Report

Key Market Data

The global enterprise SSD market reaches $32 billion in 2025 with 265 EB total capacity shipments. CAGR of 15.5% through 2030 driven by AI and cloud computing demand.

Technology Shift

PCIe interfaces now dominate 85% market share, up from under 30% in 2017. PCIe 4.0 mainstream, PCIe 5.0 in production, PCIe 6.0 approaching. SATA/SAS legacy interfaces declining rapidly.

Customer Base

Cloud/internet companies command 65% demand share (OpenAI, Google, Amazon, Alibaba, ByteDance). Telecom operators 18%. AI training workflows drive specialized performance requirements across data ingestion, preprocessing, training, inference, and archival stages.

Competitive Dynamics

Samsung leads globally, SK Group (Solidigm) second. Top 5 players control 90% market share. Chinese players Shenzhen UnionMemory and DapuStor achieve 30% combined China market share in 2024, reflecting technology localization trends.

Investment Thesis

Strong fundamentals support continued expansion: AI proliferation, cloud migration, hyperscale data center growth. SSD solutions demonstrate 40% TCO reduction vs. HDD, 9x server consolidation ratios. Market evolution from cost-focused to performance-critical positioning enhances pricing power.