Kyanite Minerals Market Steadily Expands Amid Refractory Demand

Global Kyanite Minerals Market Steadily Expands Amid Refractory Demand

The global kyanite minerals market, which includes kyanite, andalusite, and sillimanite, is showing steady growth despite being a relatively mature segment of the industrial minerals sector. These minerals, all polymorphs of aluminum silicate (Al2SiO5), are widely used in refractory products, with additional applications in ceramics, abrasives, and foundries.

Kyanite is typically recognized by its blue to light-green bladed crystals and occurs in gneiss, schist, and pegmatites. Andalusite, often yellow, brown, green, or red, is known for its strong pleochroism in gem-quality varieties and occurs in prisms in metamorphic rocks. Sillimanite, meanwhile, is found in slender, needlelike crystals and is more limited in commercial production.

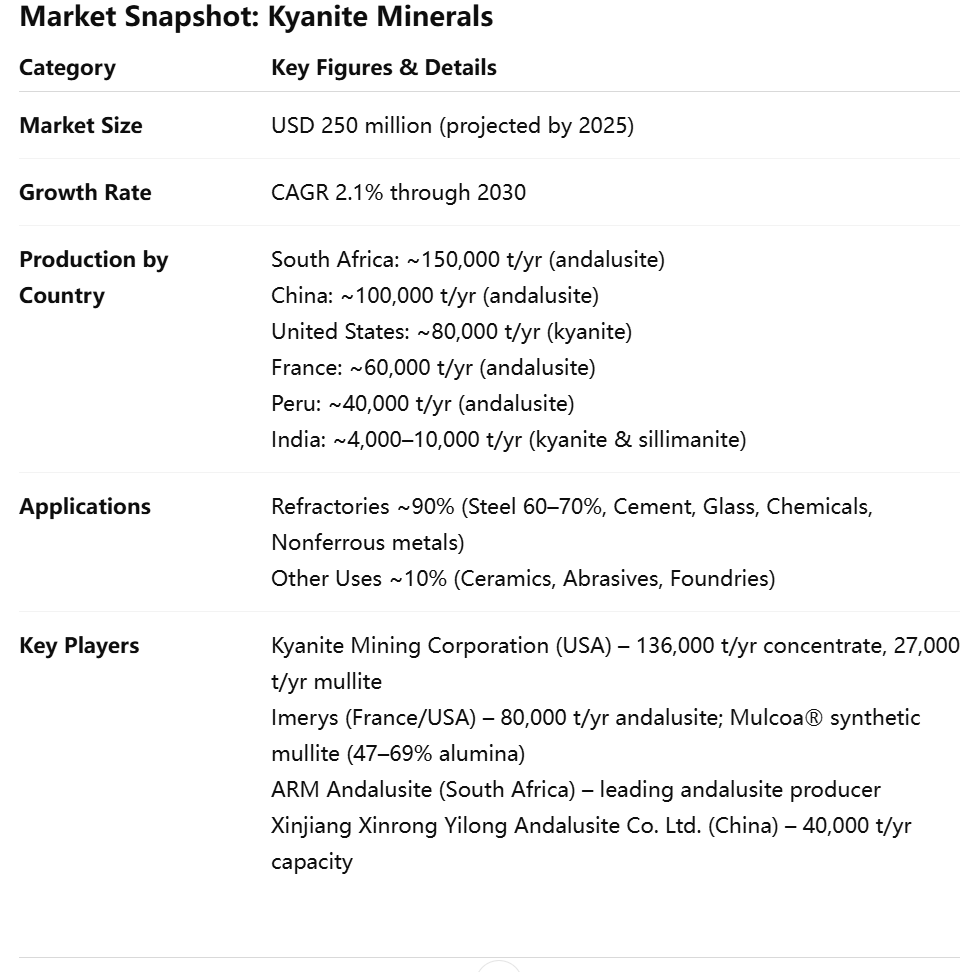

Industry sources indicate that approximately 90 percent of global consumption is linked to refractory applications, particularly in the iron and steel industries, which alone account for 60 to 70 percent of demand. Other industries using these minerals in refractory products include cement, glass, chemicals, and nonferrous metals. The remaining 10 percent of demand is shared among ceramics, abrasives, and foundries.

By 2025, the global kyanite minerals market is projected to reach around USD 250 million, with a compound annual growth rate of 2.1 percent through 2030. Analysts attribute the modest but stable expansion to two dynamics: the maturity of steel and refractory markets, and the gradual diversification into ceramics and abrasives. While growth rates remain lower than in more rapidly expanding mineral sectors, the reliability of downstream demand underpins resilience in the kyanite market.

Production is concentrated in a handful of countries. South Africa leads global output with approximately 150,000 metric tons of andalusite annually. China follows with an estimated 100,000 tons, also mainly andalusite. The United States produces roughly 80,000 tons of kyanite per year, while France mines around 60,000 tons of andalusite. Peru contributes 40,000 tons, and India’s combined kyanite and sillimanite output is estimated between 4,000 and 10,000 tons.

Key industry players continue to shape the competitive landscape. Kyanite Mining Corporation (KMC), based in Virginia, has operated since 1945 and reports an annual production capacity of 136,000 tons of kyanite concentrate and 27,000 tons of calcined kyanite, or mullite. The company serves both domestic and export markets, supplying by rail, truck, and air.

In Europe, Imerys France extracts up to 80,000 tons of andalusite annually from deposits near Glomel in Brittany. Its Kerphalite KF brand is widely used in foundry applications for its low thermal expansion. Imerys also produces synthetic mullite at its U.S. operations in Andersonville, Georgia, with its Mulcoa product range spanning alumina contents from 47 to 69 percent.

South Africa’s ARM Andalusite (Pty) Ltd. remains a leading producer of high-quality andalusite, benefiting from the country’s dominance in reserves. In Asia, Xinjiang Xinrong Yilong Andalusite Co. Ltd. operates with a production capacity of 40,000 tons, strengthening China’s role in the global market.

Looking ahead, the market faces both opportunities and challenges. On the positive side, the sustained global steel output and ongoing infrastructure development support refractory demand, while ceramics and abrasives open avenues for incremental growth. However, the industry remains vulnerable to steel sector volatility, energy costs, and environmental regulations affecting mining and refractory production. Additionally, competition from synthetic substitutes such as synthetic mullite may weigh on natural mineral demand.

Despite these uncertainties, the kyanite minerals market retains its strategic importance as a specialized segment of the industrial minerals industry. Its steady growth trajectory, anchored by steel and refractory needs, provides a foundation for long-term stability while leaving room for gradual diversification into new applications.