Medical Ultrasound System Market Outlook and Policy Updates

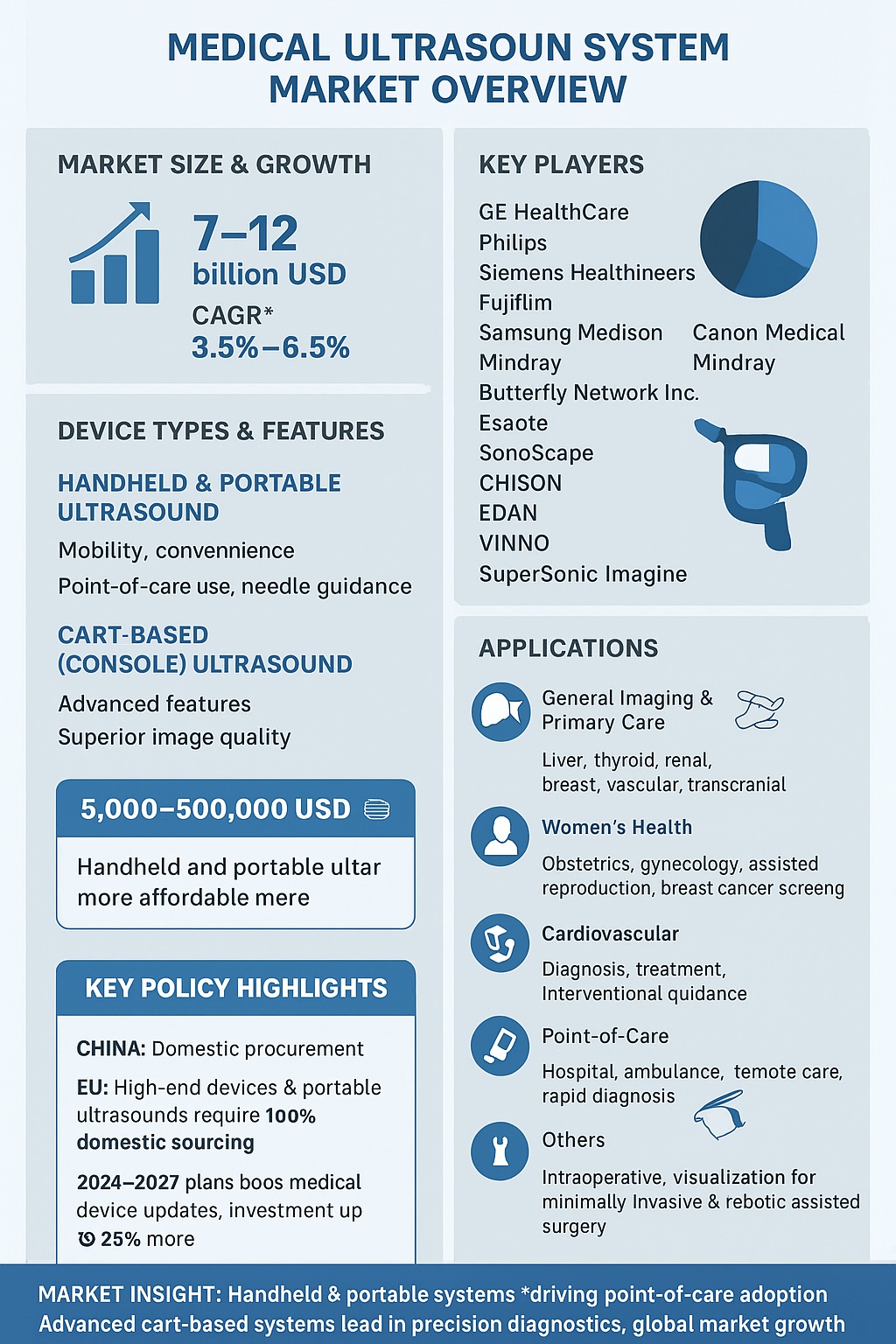

The global Medical Ultrasound System market is projected to reach between 7 and 12 billion USD in 2025, with a compound annual growth rate (CAGR) of 3.5% to 6.5% through 2030. Key players in this market include GE HealthCare, Philips, Siemens Healthineers, Fujifilm, Samsung Medison, Canon Medical, Mindray, Butterfly Network Inc., Esaote, Shantou Institute of Ultrasonic Instruments Co. Ltd., SonoScape Medical Corp., CHISON Medical Technologies Co. Ltd., EDAN Instruments Inc., VINNO Technology (Suzhou) Co. Ltd., SuperSonic Imagine, and Alpinion Medical Systems.

GE HealthCare remains the largest producer globally, with a production scale roughly twice that of the second-largest manufacturer, Philips. In China, Mindray leads domestic production, with an annual capacity exceeding 50,000 units and annual sales surpassing 45,000 units. Shanghai United Imaging Medical Technology Co. Ltd., the country’s largest medical imaging company, is planning to officially launch its self-developed ultrasound product series globally between late 2025 and early 2026. Butterfly Network Inc. and CHISON Medical Technologies focus on handheld ultrasound devices.

Ultrasound systems are categorized as handheld, portable, and cart-based (also referred to as console-based) systems. Handheld and portable ultrasound devices excel in mobility and convenience, allowing effortless scanning and easy transitions across departments and exams. These systems are commonly used for point-of-care applications and needle guidance during percutaneous procedures. Cart-based systems provide advanced features and superior image quality, suitable for high-precision diagnostic applications. Prices range from 5,000 to 500,000 USD, with handheld and portable systems generally being more affordable than cart-based systems.

The primary application areas include general imaging and primary care, women’s health, cardiovascular, point-of-care, and others. General imaging supports precise diagnoses across the whole body, including liver, thyroid, renal, breast, vascular, and transcranial assessments. Women’s health ultrasound covers obstetrics, gynecology, assisted reproductive medicine, and supplemental breast cancer screening, with products designed to enhance patient comfort and workflow efficiency. Cardiovascular ultrasound assists in diagnosing, treating, and monitoring heart disease, and is also used during interventional, electrophysiology, and surgical procedures. Point-of-care ultrasound allows clinicians to provide rapid diagnosis and treatment in hospitals, ambulances, and remote locations. Additional applications, including intraoperative visualization, support minimally invasive and robotic-assisted surgeries by providing real-time imaging to guide surgical interventions safely and accurately.

Policy developments in key markets are expected to influence market dynamics significantly. In China, the Ministry of Finance and the Ministry of Industry and Information Technology issued the 2021 Government Procurement Imported Product Review Guidance Standard, which prioritizes domestic products for medical equipment procurement. Specific ultrasound devices, including portable color Doppler and fully digital breast ultrasound systems, are required to be 100% domestically sourced. Further initiatives, such as the 2024 Equipment Renewal and Consumer Goods Replacement Plan and the Implementation Plan for Medical Equipment Updates, aim to expand medical device investment, especially in high-end equipment, enhancing the capabilities of county-level healthcare facilities.

In the European Union, the 2025/1197 Implementing Regulation restricts Chinese medical device manufacturers’ access to EU public procurement markets. The regulation follows a series of investigations under the Infringement of Public Procurement Investigation (IPI) framework, addressing concerns over preferential procurement of domestic products and pricing practices in China. As a result, EU imports of Chinese medical devices may decline by 15%-20% annually.

In the United States, the Department of Commerce launched a Section 232 investigation under the Trade Expansion Act on September 2, 2025, targeting imports of robotics, industrial machinery, medical devices, medical consumables, and personal protective equipment. The investigation assesses potential risks to U.S. national security and could result in additional tariffs, continuing the trade strategy initiated during the previous administration.

Overall, the global Medical Ultrasound System market continues to grow steadily, driven by technological innovations, the increasing demand for point-of-care diagnostics, and supportive domestic policies. At the same time, international trade restrictions and regulatory measures in major markets are reshaping the competitive landscape for manufacturers worldwide.