Polyester Catalyst Market Trends 2025: Industry Shifts Toward Titanium and Aluminum Alternatives Amidst Supply Chain Constraints

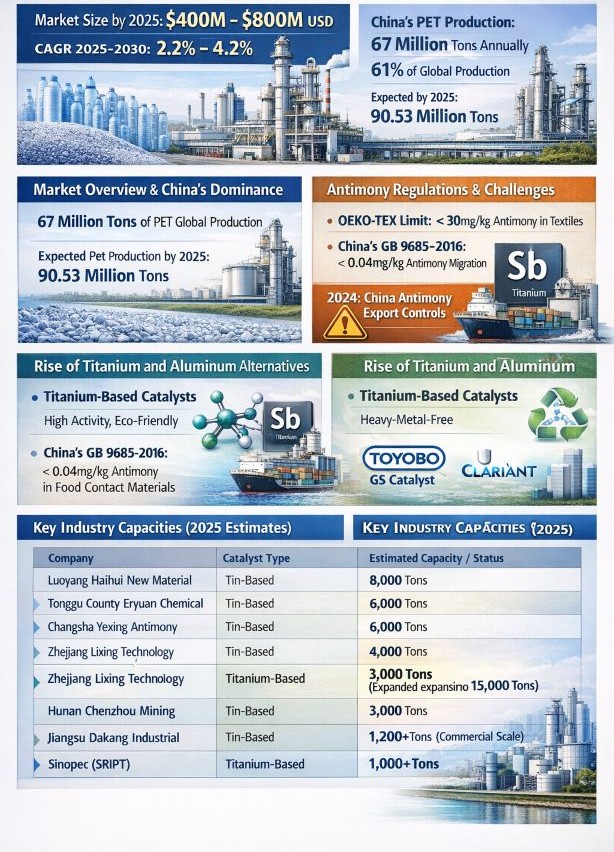

HDIN Research, a leading market research firm, has released its latest analysis on the Global Polyester Catalyst Market. As of 2025, the market valuation is estimated between 400 million and 800 million USD. With the global demand for sustainable materials rising and supply chains evolving, the market is projected to grow at a CAGR of 2.2% to 4.2% from 2025 to 2030.

Market Overview and China's Dominance

The polyester catalyst market is intrinsically linked to the production of Polyethylene Terephthalate (PET). China remains the powerhouse of this industry, producing approximately 67 million tons of PET annually, which accounts for 61% of global production. By the end of 2025, China's PET production capacity is expected to reach nearly 90.53 million tons. This massive scale underscores the critical need for efficient catalytic solutions, such as Ethylene Glycol Antimony, Titanium-based, and Aluminum-based systems.

The Antimony Conundrum and Environmental Regulations

Traditionally, Antimony-based catalysts have dominated the sector. Ethylene Glycol Antimony is preferred over Antimony Trioxide due to its lower impurity content and higher catalytic activity, which improves the spinnability of the polyester. Unlike Antimony Acetate, it does not contain acetate radicals, thereby preventing equipment corrosion and reducing wastewater contamination.

However, the industry faces significant headwinds regarding antimony. Recent years have seen stricter regulations due to environmental and health concerns. For instance, the OEKO-TEX Standard 100 limits extractable heavy metal antimony in textiles to less than 30mg/kg. Similarly, China's GB 9685-2016 standard for food contact materials limits antimony migration to 0.04mg/kg. Furthermore, China implemented export controls on antimony in 2024, creating supply chain uncertainties for global manufacturers relying on traditional catalysts.

The Rise of Titanium and Aluminum Alternatives

The market is witnessing a strategic pivot toward Titanium and Aluminum-based catalysts as sustainable alternatives.

Aluminum-based catalysts, such as those pioneered by Toyobo, offer cost advantages and produce polyester with superior color transparency. However, their industrial application has been historically limited by slower polymerization rates. Toyobo has made strides here; their TOYOBO GS Catalyst is the world's first heavy-metal-free aluminum catalyst, recently recognized by APR Design for Recyclability.

Titanium-based catalysts are gaining traction as the primary alternative to antimony due to their high activity and eco-friendly profile. While they face challenges regarding hydrolysis and potential product yellowing, major players are innovating to overcome these hurdles. Clariant recently presented its new AddWorks titanium-based solutions, set to launch in 2026. This technology aims to support the circular economy and serves as a high-performance alternative across the entire polyester family, including PET, PBT, and emerging polyesters like PEF.

Capacity Updates and Corporate Developments

Manufacturers are actively adjusting their capacities to meet diverse market demands. Sinopec's subsidiary, SRIPT, has developed proprietary titanium-based catalysts with a thousand-ton production setup, supplying major entities like Sinopec Yizheng Chemical Fibre. Zhejiang Lixing Technology is also aggressively expanding, with plans to increase its titanium-based catalyst capacity to 15,000 tons.

Summary

About HDIN Research

HDIN Research is a premier market research and consulting firm providing comprehensive analysis and strategic insights across various industries. We help businesses navigate complex market landscapes with accurate data and actionable intelligence.

Media Contact:

Company Name: HDIN Research

Website: www.hdinresearch.com

Email: sales@hdinresearch.com