Global Seed Industry Report 2020-2026: Technology Convergence, Geopolitics, and the Rise of Bio-Breeding

Date : 2026-01-29

Reading : 374

HDIN Research, an independent market consulting firm, has released its latest in-depth analysis of the global seed industry value chain for the period 2020-2026. The report identifies a critical inflection point in global agriculture, marking a transition from a resource-driven model to a growth cycle defined by biotechnology, digitalization, and yield-driven performance.

According to the report, the global seed market is undergoing a structural transformation driven by the convergence of gene editing technologies (CRISPR), artificial intelligence in breeding, and a complex geopolitical landscape. This shift is reshaping supply chains into a tri-polar structure centered around North America, China, and South America.

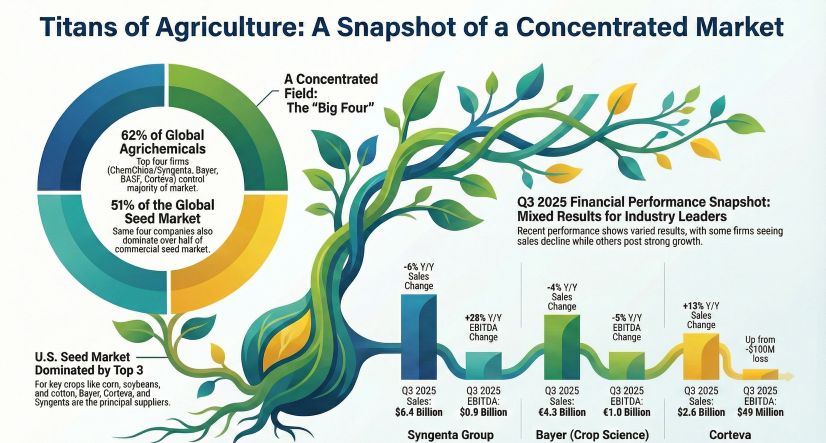

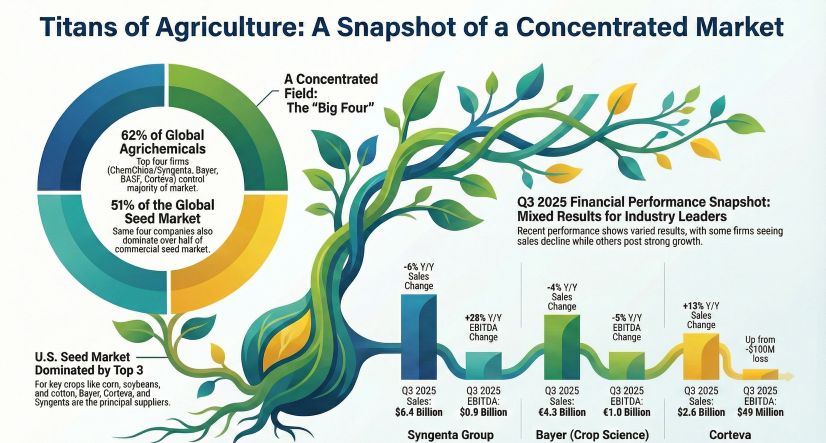

Figure Titans of Agriculture: A Snapshot of a Concentrated Market

Production Trends and Regional Shifts

The report highlights that despite supply chain disruptions caused by the pandemic and regional conflicts, global crop production is stabilizing through technological breakthroughs. For the 2025/2026 period, the report projects significant milestones in major crops. Maize production in the United States is forecast to reach a record 17 billion bushels with yields improving to 186.5 bushels per acre. Simultaneously, China is expected to reach a historical high of 301.2 million tons, driven by its Seed Industry Revitalization program and bio-breeding pilots.

Soybean cultivation continues its gravitational shift toward South America, with Brazil expected to reach a peak production of 178 million tons in the 2025/2026 season. Meanwhile, wheat supply remains robust, with Argentina projecting a 45% increase in yield, and the global vegetable sector is rapidly transitioning toward controlled-environment agriculture to secure record yields in crops like tomatoes and potatoes.

Competitive Landscape: The Integration of Traits and Data

The competitive environment has evolved from selling single-trait seeds to offering integrated systems comprising seeds, crop protection, and digital services. Major industry players are leveraging high R&D intensity to maintain market leadership. The report utilizes the following data to summarize the strategic positioning of key global seed producers:

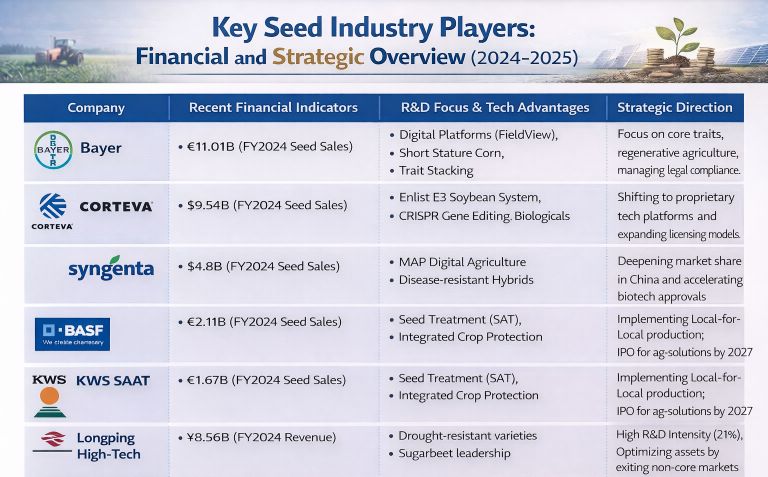

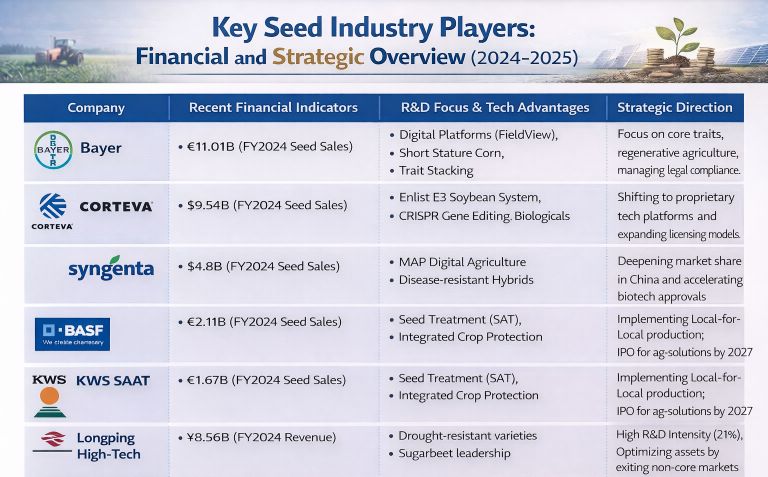

Figure Key Seed Industry Players: Financial and Strategic Overview (2024-2025)

Technological Frontiers: Beyond Traditional Breeding

HDIN Research identifies three primary technological pillars driving value in the 2026 horizon:

1. Gene Editing and AI: The integration of CRISPR/Cas9 and AI-driven germplasm screening is drastically reducing breeding cycles. Companies like Longping High-Tech report shortening breeding timelines from 8-10 years to 4-6 years using DH-GS (Doubled Haploid and Genomic Selection) technologies.

2. Trait Stacking and Resilience: Innovation is focused on climate resilience. Advancements include Short Stature Corn systems from Bayer and Corteva to resist wind damage, and KWS's drought-tolerant varieties.

3. Biologicals and Seed Treatment: The market is seeing a surge in biological seed treatments (SAT) that combine biostimulants with traditional protection, offering a new profit center and sustainable solutions for farmers.

Geopolitics and Regulatory Dynamics

The report emphasizes that seeds have elevated from agricultural inputs to strategic national resources. Geopolitical factors, including the Russia-Ukraine conflict and trade fragmentation, are forcing companies to adopt Local-for-Local supply chain strategies to mitigate tariff risks and supply disruptions.

A significant regulatory breakthrough is occurring in China. The industrialization of bio-breeding has moved from pilot stages to market promotion. The report estimates that China's planting area for genetically modified corn and soybeans will expand significantly by 2025. Additionally, the implementation of new labeling rules and the Essential Derived Varieties (EDV) system in China will strengthen intellectual property protection, favoring R&D-centric firms.

Meanwhile, the European Union is showing signs of policy shifts regarding New Genomic Techniques (NGTs), potentially opening pathways for gene-edited crops that were previously restricted under strict GMO regulations.

Future Outlook

Looking toward 2030, HDIN Research predicts that the industry will be defined by the ability to balance profitability with sustainability. Success will depend on mastering the convergence of biological technology (BT) and data technology (DT). Companies that can navigate the complex regulatory landscape while delivering climate-resilient, high-yield solutions will capture the highest value in the evolving global market.

Please click to watch the YouTube video of the report presentation.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Contact:

HDIN Research

Website: www.hdinresearch.com

Email: sales@hdinresearch.com

According to the report, the global seed market is undergoing a structural transformation driven by the convergence of gene editing technologies (CRISPR), artificial intelligence in breeding, and a complex geopolitical landscape. This shift is reshaping supply chains into a tri-polar structure centered around North America, China, and South America.

Figure Titans of Agriculture: A Snapshot of a Concentrated Market

Production Trends and Regional Shifts

The report highlights that despite supply chain disruptions caused by the pandemic and regional conflicts, global crop production is stabilizing through technological breakthroughs. For the 2025/2026 period, the report projects significant milestones in major crops. Maize production in the United States is forecast to reach a record 17 billion bushels with yields improving to 186.5 bushels per acre. Simultaneously, China is expected to reach a historical high of 301.2 million tons, driven by its Seed Industry Revitalization program and bio-breeding pilots.

Soybean cultivation continues its gravitational shift toward South America, with Brazil expected to reach a peak production of 178 million tons in the 2025/2026 season. Meanwhile, wheat supply remains robust, with Argentina projecting a 45% increase in yield, and the global vegetable sector is rapidly transitioning toward controlled-environment agriculture to secure record yields in crops like tomatoes and potatoes.

Competitive Landscape: The Integration of Traits and Data

The competitive environment has evolved from selling single-trait seeds to offering integrated systems comprising seeds, crop protection, and digital services. Major industry players are leveraging high R&D intensity to maintain market leadership. The report utilizes the following data to summarize the strategic positioning of key global seed producers:

Figure Key Seed Industry Players: Financial and Strategic Overview (2024-2025)

Technological Frontiers: Beyond Traditional Breeding

HDIN Research identifies three primary technological pillars driving value in the 2026 horizon:

1. Gene Editing and AI: The integration of CRISPR/Cas9 and AI-driven germplasm screening is drastically reducing breeding cycles. Companies like Longping High-Tech report shortening breeding timelines from 8-10 years to 4-6 years using DH-GS (Doubled Haploid and Genomic Selection) technologies.

2. Trait Stacking and Resilience: Innovation is focused on climate resilience. Advancements include Short Stature Corn systems from Bayer and Corteva to resist wind damage, and KWS's drought-tolerant varieties.

3. Biologicals and Seed Treatment: The market is seeing a surge in biological seed treatments (SAT) that combine biostimulants with traditional protection, offering a new profit center and sustainable solutions for farmers.

Geopolitics and Regulatory Dynamics

The report emphasizes that seeds have elevated from agricultural inputs to strategic national resources. Geopolitical factors, including the Russia-Ukraine conflict and trade fragmentation, are forcing companies to adopt Local-for-Local supply chain strategies to mitigate tariff risks and supply disruptions.

A significant regulatory breakthrough is occurring in China. The industrialization of bio-breeding has moved from pilot stages to market promotion. The report estimates that China's planting area for genetically modified corn and soybeans will expand significantly by 2025. Additionally, the implementation of new labeling rules and the Essential Derived Varieties (EDV) system in China will strengthen intellectual property protection, favoring R&D-centric firms.

Meanwhile, the European Union is showing signs of policy shifts regarding New Genomic Techniques (NGTs), potentially opening pathways for gene-edited crops that were previously restricted under strict GMO regulations.

Future Outlook

Looking toward 2030, HDIN Research predicts that the industry will be defined by the ability to balance profitability with sustainability. Success will depend on mastering the convergence of biological technology (BT) and data technology (DT). Companies that can navigate the complex regulatory landscape while delivering climate-resilient, high-yield solutions will capture the highest value in the evolving global market.

Please click to watch the YouTube video of the report presentation.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Contact:

HDIN Research

Website: www.hdinresearch.com

Email: sales@hdinresearch.com