Solar Encapsulation Film Market Projected to Reach USD 6.0 Billion by 2026 Driven by N-Type Technology Transition

Date : 2026-02-16

Reading : 112

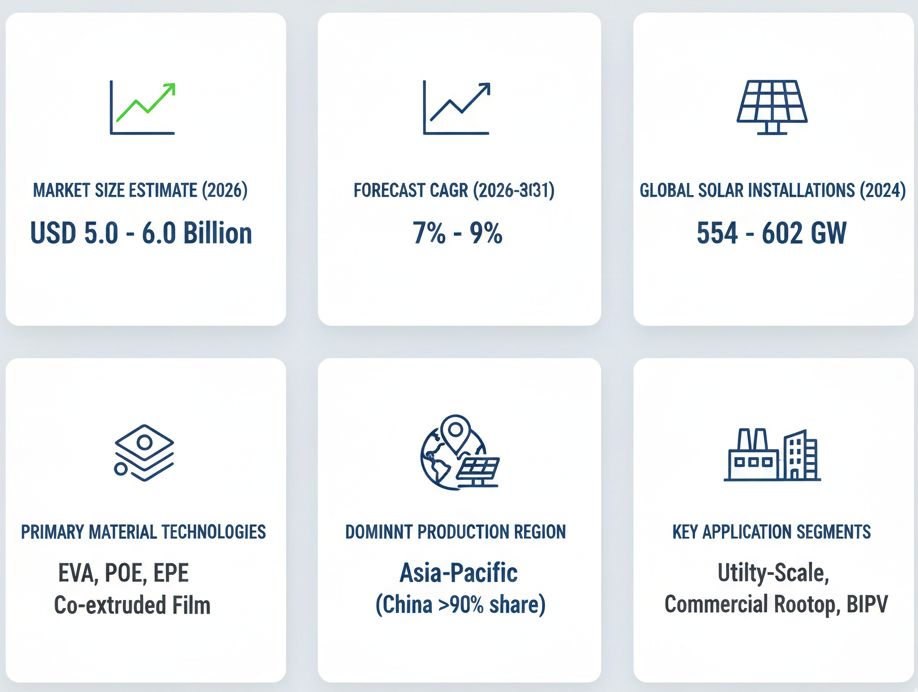

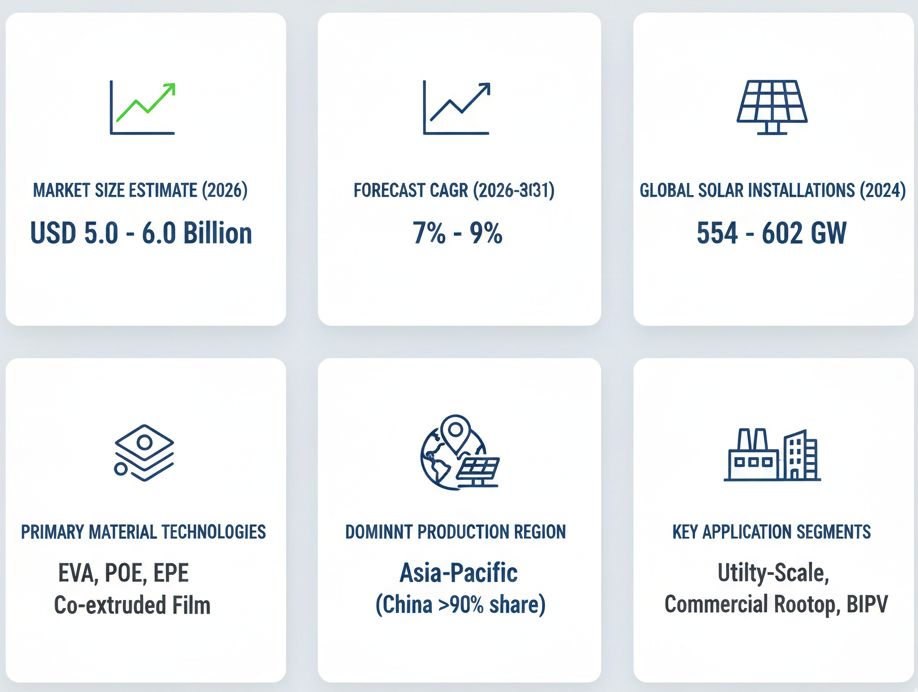

HDIN Research has released a new comprehensive market study titled Solar Encapsulation Film Global Market Insights 2026. The report analyzes the critical role of encapsulation materials in the rapidly expanding photovoltaic industry, projecting the global market value to range between USD 5.0 billion and USD 6.0 billion in 2026.

Driven by the unprecedented deployment of solar photovoltaic capacity worldwide, the market is expected to expand at a compound annual growth rate (CAGR) of 7% to 9% from 2026 through 2031. Solar encapsulation films, which protect solar cells from environmental damage while maintaining optical transparency, are evolving rapidly to meet the demands of next-generation module technologies.

Global solar PV installations reached record levels in 2024, with approximately 554 to 602 GW of new capacity commissioned. This surge in installation volume is the primary driver for encapsulation film demand, as each gigawatt of new PV installation typically requires 10 to 13 million square meters of protective film.

A significant trend identified in the report is the technological shift in material composition. While transparent Ethylene Vinyl Acetate (EVA) film remains a market leader due to its cost-effectiveness, the industry is rapidly transitioning toward advanced materials. Polyolefin Elastomer (POE) and EPE (EVA-POE-EVA) co-extruded films collectively captured 41% of the market share by 2023. This shift is necessitated by the rising adoption of high-efficiency N-type module technologies, such as TOPCon and Heterojunction (HJT), which require superior moisture resistance and anti-PID (Potential Induced Degradation) performance.

The report highlights that the Asia-Pacific region, particularly China, dominates the global supply chain. Chinese manufacturers control over 90% of global encapsulation film production capacity, mirroring the country's leadership in the broader solar value chain. Leading manufacturers, including Hangzhou First Applied Material, now command significant global market share through vertical integration and economies of scale.

Despite the positive growth outlook, the market faces challenges related to intense price competition. A sharp decline in module prices since 2023 has compressed margins across the supply chain, accelerating industry consolidation. Manufacturers are responding by optimizing formulations and investing in cost-efficient production technologies.

Figure Market Data Summary of Solar Encapsulation Film

Strategic opportunities are emerging in geographic diversification. While production is currently concentrated, trade policies and local content requirements in the United States, Europe, and India are incentivizing the establishment of regional manufacturing hubs. The report suggests that early movers in these emerging markets stand to gain competitive advantages in the coming decade.

Strategic opportunities are emerging in geographic diversification. While production is currently concentrated, trade policies and local content requirements in the United States, Europe, and India are incentivizing the establishment of regional manufacturing hubs. The report suggests that early movers in these emerging markets stand to gain competitive advantages in the coming decade.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports. The company assists clients in understanding complex market dynamics and making informed strategic decisions.

Media Contact:

Company Name: HDIN Research

Website: www.hdinresearch.com

Email: sales@hdinresearch.com

Driven by the unprecedented deployment of solar photovoltaic capacity worldwide, the market is expected to expand at a compound annual growth rate (CAGR) of 7% to 9% from 2026 through 2031. Solar encapsulation films, which protect solar cells from environmental damage while maintaining optical transparency, are evolving rapidly to meet the demands of next-generation module technologies.

Global solar PV installations reached record levels in 2024, with approximately 554 to 602 GW of new capacity commissioned. This surge in installation volume is the primary driver for encapsulation film demand, as each gigawatt of new PV installation typically requires 10 to 13 million square meters of protective film.

A significant trend identified in the report is the technological shift in material composition. While transparent Ethylene Vinyl Acetate (EVA) film remains a market leader due to its cost-effectiveness, the industry is rapidly transitioning toward advanced materials. Polyolefin Elastomer (POE) and EPE (EVA-POE-EVA) co-extruded films collectively captured 41% of the market share by 2023. This shift is necessitated by the rising adoption of high-efficiency N-type module technologies, such as TOPCon and Heterojunction (HJT), which require superior moisture resistance and anti-PID (Potential Induced Degradation) performance.

The report highlights that the Asia-Pacific region, particularly China, dominates the global supply chain. Chinese manufacturers control over 90% of global encapsulation film production capacity, mirroring the country's leadership in the broader solar value chain. Leading manufacturers, including Hangzhou First Applied Material, now command significant global market share through vertical integration and economies of scale.

Despite the positive growth outlook, the market faces challenges related to intense price competition. A sharp decline in module prices since 2023 has compressed margins across the supply chain, accelerating industry consolidation. Manufacturers are responding by optimizing formulations and investing in cost-efficient production technologies.

Figure Market Data Summary of Solar Encapsulation Film

Strategic opportunities are emerging in geographic diversification. While production is currently concentrated, trade policies and local content requirements in the United States, Europe, and India are incentivizing the establishment of regional manufacturing hubs. The report suggests that early movers in these emerging markets stand to gain competitive advantages in the coming decade.

Strategic opportunities are emerging in geographic diversification. While production is currently concentrated, trade policies and local content requirements in the United States, Europe, and India are incentivizing the establishment of regional manufacturing hubs. The report suggests that early movers in these emerging markets stand to gain competitive advantages in the coming decade.About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports. The company assists clients in understanding complex market dynamics and making informed strategic decisions.

Media Contact:

Company Name: HDIN Research

Website: www.hdinresearch.com

Email: sales@hdinresearch.com