Teijin Group Accelerates Structural Reform: Shifting Focus to High-Profit Aramid, Aerospace Carbon Fiber, and Rare Disease Treatments

Date : 2026-01-29

Reading : 69

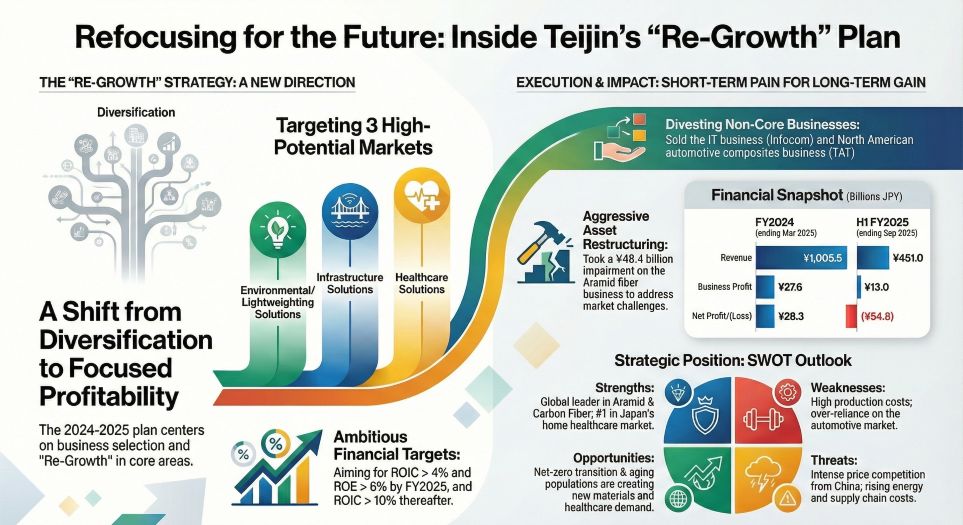

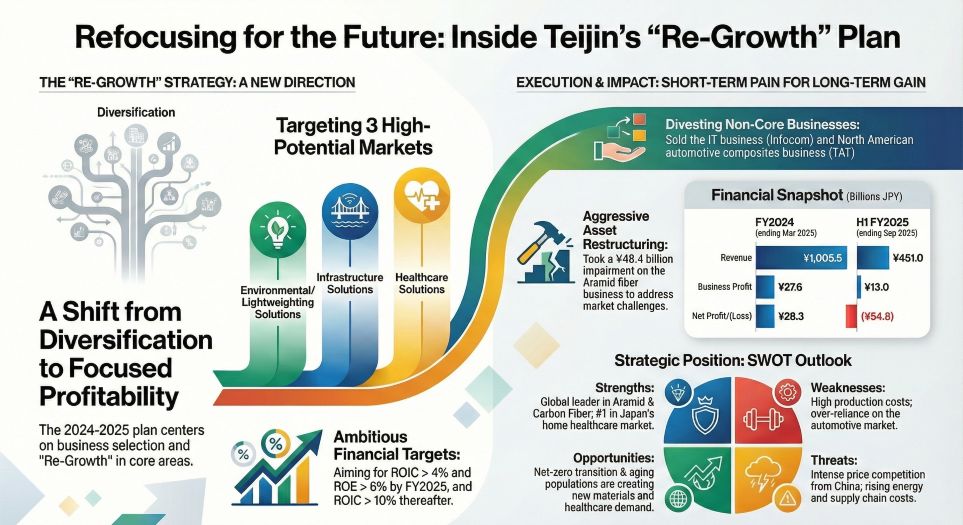

HDIN Research, an independent market consulting firm, has released a comprehensive analysis of Teijin Group's strategic transformation based on its latest financial reports and mid-term management plan. The analysis indicates that Teijin is currently undergoing a critical phase of structural reform, moving away from a strategy of volume expansion toward a model prioritizing high-quality earnings and Return on Invested Capital (ROIC).

Facing intensified global competition and shifting market dynamics, particularly from Chinese manufacturers in general-purpose materials, Teijin has initiated a decisive "selection and concentration" strategy. This involves significant asset impairments to clean up the balance sheet and a strategic withdrawal from low-margin sectors to reallocate resources to high-barrier markets.

Figure Refocusing for the Future inside Teijin's “Re-Growth” Plan

Materials Business: From Production Volume to Profit Quality

Materials Business: From Production Volume to Profit Quality

The core Materials segment, comprising Aramid and Carbon Fiber, is central to this restructuring. In the Aramid sector, Teijin is shifting from a "production guarantee" mindset to an "efficiency-first" approach. Facing soft demand in Europe and China for optical fiber applications, the company is optimizing production systems to lower the break-even point. The strategy focuses on maintaining high market shares in specialized applications such as tire reinforcement and ballistic protection, while also developing "Recycled Twaron" to capture premiums in the circular economy.

In the Carbon Fiber sector, Teijin is executing a rigorous "weeding out" of unprofitable business lines. The analysis highlights a strategic withdrawal from general industrial applications where pricing pressure is severe due to oversupply. Instead, Teijin is doubling down on the aerospace sector, leveraging the recovery in air travel and aircraft build rates. The company is aggressively expanding sales of intermediate materials (thermoplastics and prepregs) for next-generation aircraft, creating a technological moat that competitors cannot easily cross.

Healthcare and Portfolio Optimization

The Healthcare segment is also pivoting. To counter the impact of drug price reductions and patent expirations for major products like Feburic, Teijin is redefining its strategy around "Home Healthcare" and "Rare Diseases." Leveraging its dominant domestic network for home oxygen therapy (HOT) and sleep apnea treatment (CPAP), the company is building a service-based barrier against foreign competitors. Simultaneously, it is introducing new treatments for rare diseases and expanding into the CDMO (Contract Development and Manufacturing Organization) space for regenerative medicine.

Financially, Teijin is prioritizing asset efficiency. The company has made the difficult decision to divest the highly profitable but non-synergistic IT business (Infocom) and the loss-making North American automotive composite business (TAT). These moves are designed to generate cash and streamline the portfolio. While the company recorded significant impairment losses in the first half of FY2025, HDIN Research views this as a necessary "financial bath" to remove future risks and set the stage for achieving a Return on Equity (ROE) of 10% or higher.

Summary of Teijin Group Strategic Adjustments by Sector

Analyst Conclusion

Teijin Group's recent financial maneuvers, including the recording of approximately 48.4 billion JPY in impairment losses for the Aramid business in H1 FY2025, demonstrate a strong resolve to reset the company's financial baseline. By clearing historical burdens and securing substantial cash reserves through divestitures, Teijin is well-positioned to reinvest in its competitive advantages: aerospace materials and specialized healthcare services. HDIN Research suggests that the success of this turnaround will depend on the company's ability to strictly enforce cost discipline in materials and successfully launch its pipeline of rare disease treatments.

Please click to watch the YouTube video of the report presentation.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Contact: sales@hdinresearch.com

Website: www.hdinresearch.com

Facing intensified global competition and shifting market dynamics, particularly from Chinese manufacturers in general-purpose materials, Teijin has initiated a decisive "selection and concentration" strategy. This involves significant asset impairments to clean up the balance sheet and a strategic withdrawal from low-margin sectors to reallocate resources to high-barrier markets.

Figure Refocusing for the Future inside Teijin's “Re-Growth” Plan

Materials Business: From Production Volume to Profit Quality

Materials Business: From Production Volume to Profit QualityThe core Materials segment, comprising Aramid and Carbon Fiber, is central to this restructuring. In the Aramid sector, Teijin is shifting from a "production guarantee" mindset to an "efficiency-first" approach. Facing soft demand in Europe and China for optical fiber applications, the company is optimizing production systems to lower the break-even point. The strategy focuses on maintaining high market shares in specialized applications such as tire reinforcement and ballistic protection, while also developing "Recycled Twaron" to capture premiums in the circular economy.

In the Carbon Fiber sector, Teijin is executing a rigorous "weeding out" of unprofitable business lines. The analysis highlights a strategic withdrawal from general industrial applications where pricing pressure is severe due to oversupply. Instead, Teijin is doubling down on the aerospace sector, leveraging the recovery in air travel and aircraft build rates. The company is aggressively expanding sales of intermediate materials (thermoplastics and prepregs) for next-generation aircraft, creating a technological moat that competitors cannot easily cross.

Healthcare and Portfolio Optimization

The Healthcare segment is also pivoting. To counter the impact of drug price reductions and patent expirations for major products like Feburic, Teijin is redefining its strategy around "Home Healthcare" and "Rare Diseases." Leveraging its dominant domestic network for home oxygen therapy (HOT) and sleep apnea treatment (CPAP), the company is building a service-based barrier against foreign competitors. Simultaneously, it is introducing new treatments for rare diseases and expanding into the CDMO (Contract Development and Manufacturing Organization) space for regenerative medicine.

Financially, Teijin is prioritizing asset efficiency. The company has made the difficult decision to divest the highly profitable but non-synergistic IT business (Infocom) and the loss-making North American automotive composite business (TAT). These moves are designed to generate cash and streamline the portfolio. While the company recorded significant impairment losses in the first half of FY2025, HDIN Research views this as a necessary "financial bath" to remove future risks and set the stage for achieving a Return on Equity (ROE) of 10% or higher.

Summary of Teijin Group Strategic Adjustments by Sector

| Business Segment | Market Challenge | Strategic Response | Target Outcome |

|---|---|---|---|

| Aramid (Materials) | Weak demand in Europe/China; Price competition in optical fibers | Establish optimal production structure; Cut fixed costs; Focus on tire/ballistic mix | Lower break-even point; Secure profitability in downturns |

| Carbon Fiber (Materials) | Oversupply in general industrial use; Intense price war | Exit low-margin general applications; Focus on Aerospace and intermediate materials | Restore profitability; Solidify high-barrier market share |

| Healthcare | Drug price cuts; Patent expiry of key drugs | Leverage Home Healthcare service network; Launch rare disease drugs; Expand CDMO | Maximize existing asset yield; Growth in niche markets |

| Corporate Portfolio | Conglomerate discount; Inefficient capital allocation | Divest Infocom (IT) and TAT (Auto Composites); Impairment of overvalued assets | Improve D/E ratio; Concentrate resources on core material science |

Analyst Conclusion

Teijin Group's recent financial maneuvers, including the recording of approximately 48.4 billion JPY in impairment losses for the Aramid business in H1 FY2025, demonstrate a strong resolve to reset the company's financial baseline. By clearing historical burdens and securing substantial cash reserves through divestitures, Teijin is well-positioned to reinvest in its competitive advantages: aerospace materials and specialized healthcare services. HDIN Research suggests that the success of this turnaround will depend on the company's ability to strictly enforce cost discipline in materials and successfully launch its pipeline of rare disease treatments.

Please click to watch the YouTube video of the report presentation.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Contact: sales@hdinresearch.com

Website: www.hdinresearch.com