Huvis Financial Analysis: Strategic Turnaround to Profitability Through High-Value Materials and Restructuring

Date : 2026-01-29

Reading : 75

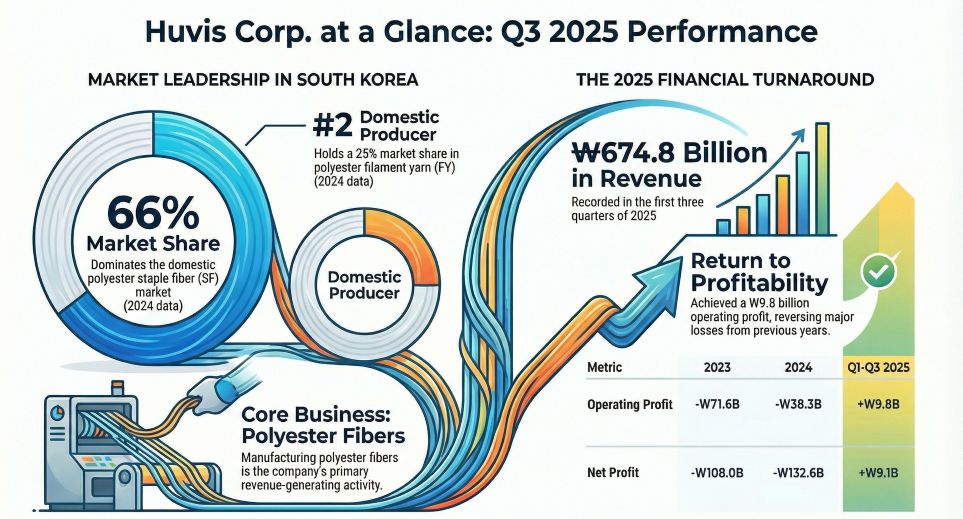

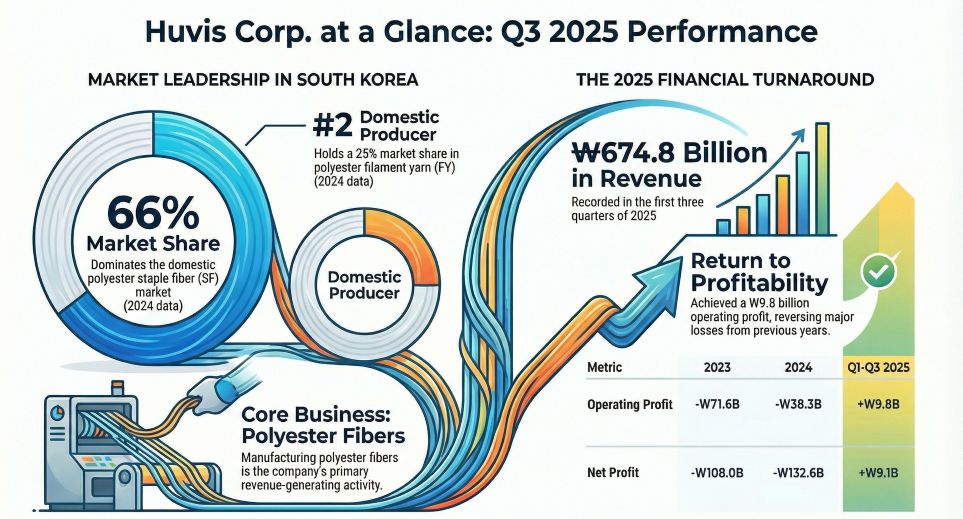

HDIN Research, an independent market consulting firm, has released a comprehensive analysis of Huvis's financial performance based on its Q3 2025 report. The analysis reveals a significant operational turnaround for the South Korean fiber giant, which has successfully transitioned from deep losses in the previous year to profitability in 2025. This recovery is attributed to a strategic shift from general-purpose fibers to high-value-added materials and a successful restructuring of production capabilities.

Financial Turnaround: Profitability Restored

For the first three quarters of 2025, Huvis reported a cumulative operating profit of 9.83 billion KRW, a stark contrast to the 18.74 billion KRW operating loss recorded in the same period of 2024. The net profit also swung to positive territory, reaching 9.06 billion KRW compared to a massive 52.21 billion KRW loss the previous year.

Figure Huvis Corp. at a Glance Q3 2025 Performance

Key drivers for this turnaround include:

Key drivers for this turnaround include:

* Production Optimization: The structural adjustments completed at the end of 2023 optimized production lines, significantly enhancing operational efficiency.

* Operational Cash Flow: Operating cash flow improved dramatically, turning from a net outflow of 35.47 billion KRW in 2024 to a net inflow of 20.25 billion KRW in 2025, indicating restored core business health.

Strategic Pivot: High-Value and Eco-Friendly Materials

Huvis is aggressively reducing its reliance on low-margin general-purpose fibers, where competition from Chinese manufacturers is intense. Instead, the company is capitalizing on its technological leadership in specialized markets:

* Market Dominance: Huvis holds a commanding 66% market share in the domestic Polyester Staple Fiber (SF) market.

* Super Fibers: The company is expanding the commercialization of Meta-Aramid and PPS fibers. These materials are critical for high-growth sectors like electric vehicle (EV) battery insulation and industrial filtration, offering high barriers to entry and superior profit margins.

* Sustainability Focus: R&D efforts are heavily concentrated on chemical recycling technologies and biodegradable fibers to meet global ESG standards. The development of "ECOPET" for automotive lightweighting and "Vegan Suede" further positions Huvis in the premium automotive supply chain.

Financial Health and Future Outlook

While the cumulative results are positive, the report notes a net loss of 3.25 billion KRW in Q3 alone, primarily due to financial costs and foreign exchange fluctuations. The company's debt-to-equity ratio remains high, with a leverage multiplier of 3.06x, indicating sensitivity to interest rate changes.

HDIN Research concludes that Huvis has successfully stabilized its "fundamental earnings power." The strategic focus on differentiated fibers (LM, Hygiene Bico) and super fibers provides a robust defense against commodity price wars. Investors are advised to monitor the commercial scaling of Meta-Aramid in the EV sector, which serves as a key catalyst for future valuation growth.

Please click to watch the YouTube video of the report presentation.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Contact: sales@hdinresearch.com

Website: www.hdinresearch.com

Financial Turnaround: Profitability Restored

For the first three quarters of 2025, Huvis reported a cumulative operating profit of 9.83 billion KRW, a stark contrast to the 18.74 billion KRW operating loss recorded in the same period of 2024. The net profit also swung to positive territory, reaching 9.06 billion KRW compared to a massive 52.21 billion KRW loss the previous year.

Figure Huvis Corp. at a Glance Q3 2025 Performance

Key drivers for this turnaround include:

Key drivers for this turnaround include:* Production Optimization: The structural adjustments completed at the end of 2023 optimized production lines, significantly enhancing operational efficiency.

* Operational Cash Flow: Operating cash flow improved dramatically, turning from a net outflow of 35.47 billion KRW in 2024 to a net inflow of 20.25 billion KRW in 2025, indicating restored core business health.

Strategic Pivot: High-Value and Eco-Friendly Materials

Huvis is aggressively reducing its reliance on low-margin general-purpose fibers, where competition from Chinese manufacturers is intense. Instead, the company is capitalizing on its technological leadership in specialized markets:

* Market Dominance: Huvis holds a commanding 66% market share in the domestic Polyester Staple Fiber (SF) market.

* Super Fibers: The company is expanding the commercialization of Meta-Aramid and PPS fibers. These materials are critical for high-growth sectors like electric vehicle (EV) battery insulation and industrial filtration, offering high barriers to entry and superior profit margins.

* Sustainability Focus: R&D efforts are heavily concentrated on chemical recycling technologies and biodegradable fibers to meet global ESG standards. The development of "ECOPET" for automotive lightweighting and "Vegan Suede" further positions Huvis in the premium automotive supply chain.

Financial Health and Future Outlook

While the cumulative results are positive, the report notes a net loss of 3.25 billion KRW in Q3 alone, primarily due to financial costs and foreign exchange fluctuations. The company's debt-to-equity ratio remains high, with a leverage multiplier of 3.06x, indicating sensitivity to interest rate changes.

HDIN Research concludes that Huvis has successfully stabilized its "fundamental earnings power." The strategic focus on differentiated fibers (LM, Hygiene Bico) and super fibers provides a robust defense against commodity price wars. Investors are advised to monitor the commercial scaling of Meta-Aramid in the EV sector, which serves as a key catalyst for future valuation growth.

Please click to watch the YouTube video of the report presentation.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Contact: sales@hdinresearch.com

Website: www.hdinresearch.com