Phthalic Anhydride Market Analysis 2026: Industry Trends, Regulatory Shifts, and Forecasts 2031

Date : 2026-01-29

Reading : 171

HDIN Research has released its comprehensive analysis of the Global Phthalic Anhydride (PA) Market for 2026. As a foundational component of the chemical industry, the market is navigating a complex landscape defined by mature growth patterns, evolving environmental regulations, and significant shifts in feedstock dynamics.

Market Overview and Growth Trajectory

The global phthalic anhydride market is characterized as a mature sector. According to the latest data, the market size is estimated to range between 2.5 and 3.5 billion USD in 2026. The industry is projected to experience a compound annual growth rate (CAGR) of 1.4% to 2.4% through 2031. This moderate growth reflects the stabilization of traditional end-use sectors and the ongoing transition within the plasticizer industry.

Phthalic anhydride serves as a critical intermediate, primarily utilized in the production of plasticizers for polyvinyl chloride (PVC). However, the sector faces structural headwinds. Regulatory bodies in Europe, North America, and increasingly Asia are restricting the use of certain phthalate-based plasticizers due to health and environmental concerns. This has accelerated the substitution toward non-phthalate alternatives, forcing PA producers to adapt their strategies. Despite these challenges, demand remains resilient in other applications such as unsaturated polyester resins (UPR) for construction and marine composites, as well as alkyd resins for coatings.

Regional Dynamics and Production Technology

The Asia-Pacific region continues to dominate the global landscape, accounting for the majority of both production capacity and consumption. China, in particular, maintains a production capacity exceeding 3.0 million metric tons annually. However, the region faces overcapacity issues where aggressive expansion has coincided with softening demand in the construction sector. This dynamic has intensified competitive pressure on pricing and operating rates.

In terms of production technology, the industry is split between the ortho-xylene oxidation route and the naphthalene oxidation route. While the o-xylene route remains predominant globally due to product purity and process control, the naphthalene route maintains a significant footprint in China, offering feedstock flexibility dependent on coal-tar derivative pricing.

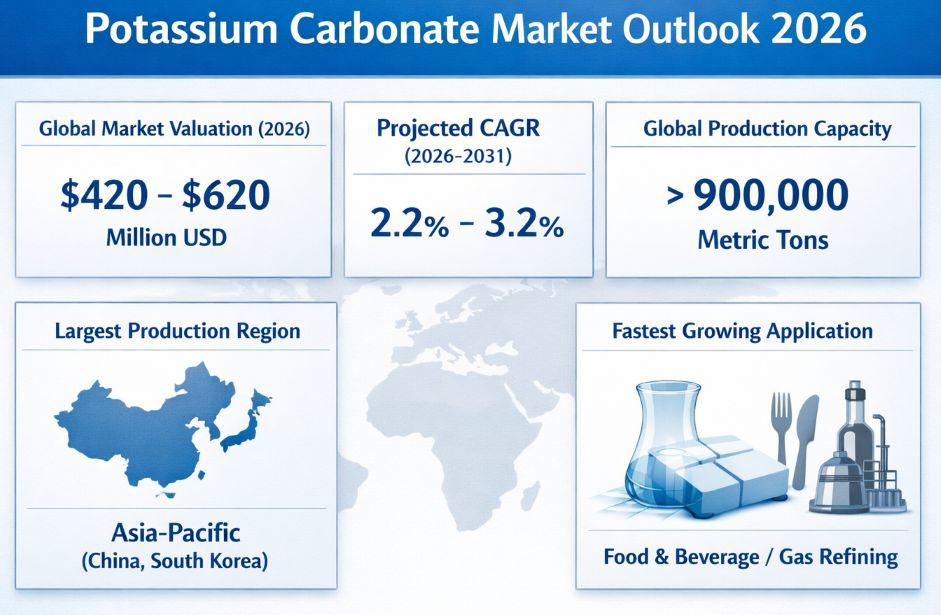

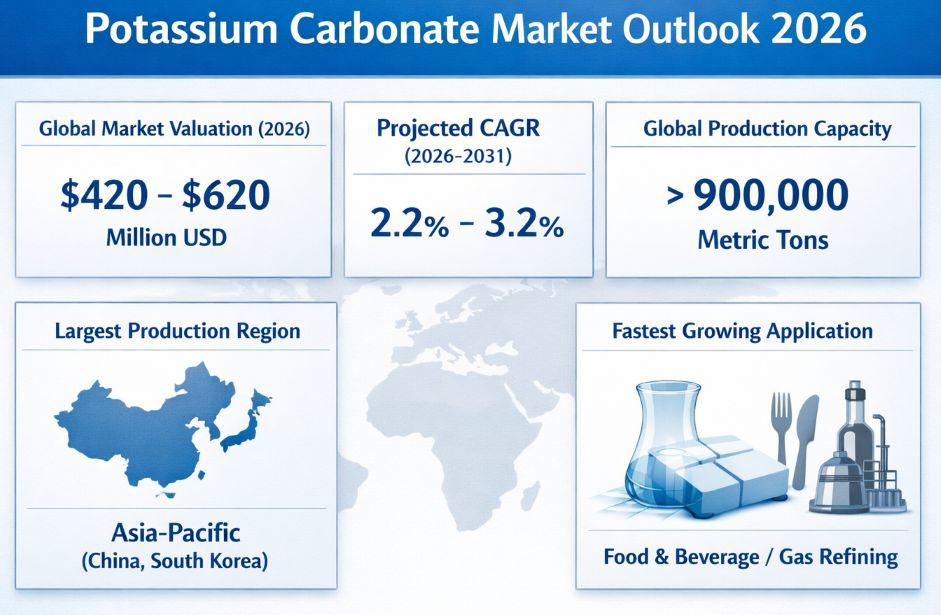

Figure Key Market Data Summary of Phthalic Anhydride Market

Competitive Landscape

Competitive Landscape

The market exhibits a tiered competitive structure. UPC Technology Corporation leads as the global market leader with a capacity exceeding 750,000 metric tons, leveraging vertical integration into plasticizers to maintain market stability. The second tier includes major regional players such as KLJ Group, Thirumalai Chemicals, and Nan Ya Plastics Corporation, which hold strong positions in Asian markets.

In Western markets, established players like Stepan Company, ExxonMobil, Polynt, and Lanxess focus on operational efficiency and specialized applications to mitigate the impact of lower-cost imports and regulatory pressures. The report highlights that future competitive advantage will likely depend on feedstock flexibility, vertical integration, and the ability to navigate the green transition in chemical manufacturing.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports. We assist companies in understanding complex market environments and making informed strategic decisions.

Media Contact:

HDIN Research

Website: www.hdinresearch.com

Email: sales@hdinresearch.com

Market Overview and Growth Trajectory

The global phthalic anhydride market is characterized as a mature sector. According to the latest data, the market size is estimated to range between 2.5 and 3.5 billion USD in 2026. The industry is projected to experience a compound annual growth rate (CAGR) of 1.4% to 2.4% through 2031. This moderate growth reflects the stabilization of traditional end-use sectors and the ongoing transition within the plasticizer industry.

Phthalic anhydride serves as a critical intermediate, primarily utilized in the production of plasticizers for polyvinyl chloride (PVC). However, the sector faces structural headwinds. Regulatory bodies in Europe, North America, and increasingly Asia are restricting the use of certain phthalate-based plasticizers due to health and environmental concerns. This has accelerated the substitution toward non-phthalate alternatives, forcing PA producers to adapt their strategies. Despite these challenges, demand remains resilient in other applications such as unsaturated polyester resins (UPR) for construction and marine composites, as well as alkyd resins for coatings.

Regional Dynamics and Production Technology

The Asia-Pacific region continues to dominate the global landscape, accounting for the majority of both production capacity and consumption. China, in particular, maintains a production capacity exceeding 3.0 million metric tons annually. However, the region faces overcapacity issues where aggressive expansion has coincided with softening demand in the construction sector. This dynamic has intensified competitive pressure on pricing and operating rates.

In terms of production technology, the industry is split between the ortho-xylene oxidation route and the naphthalene oxidation route. While the o-xylene route remains predominant globally due to product purity and process control, the naphthalene route maintains a significant footprint in China, offering feedstock flexibility dependent on coal-tar derivative pricing.

Figure Key Market Data Summary of Phthalic Anhydride Market

Competitive Landscape

Competitive LandscapeThe market exhibits a tiered competitive structure. UPC Technology Corporation leads as the global market leader with a capacity exceeding 750,000 metric tons, leveraging vertical integration into plasticizers to maintain market stability. The second tier includes major regional players such as KLJ Group, Thirumalai Chemicals, and Nan Ya Plastics Corporation, which hold strong positions in Asian markets.

In Western markets, established players like Stepan Company, ExxonMobil, Polynt, and Lanxess focus on operational efficiency and specialized applications to mitigate the impact of lower-cost imports and regulatory pressures. The report highlights that future competitive advantage will likely depend on feedstock flexibility, vertical integration, and the ability to navigate the green transition in chemical manufacturing.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports. We assist companies in understanding complex market environments and making informed strategic decisions.

Media Contact:

HDIN Research

Website: www.hdinresearch.com

Email: sales@hdinresearch.com