From Silicon to Systems: AI and Mega-Mergers Redefine the Global Electronic Design Automation (EDA) Landscape

Date : 2026-02-02

Reading : 232

The Electronic Design Automation (EDA) industry, long considered the linchpin of the semiconductor supply chain, is currently navigating its most significant paradigm shift in decades. According to the latest analysis by HDIN Research, the sector is moving rapidly from a focus on discrete chip design to a "Silicon to Systems" approach. This transition is characterized by massive cross-domain acquisitions, the aggressive integration of Generative AI, and the reshaping of global supply chains due to geopolitical friction.

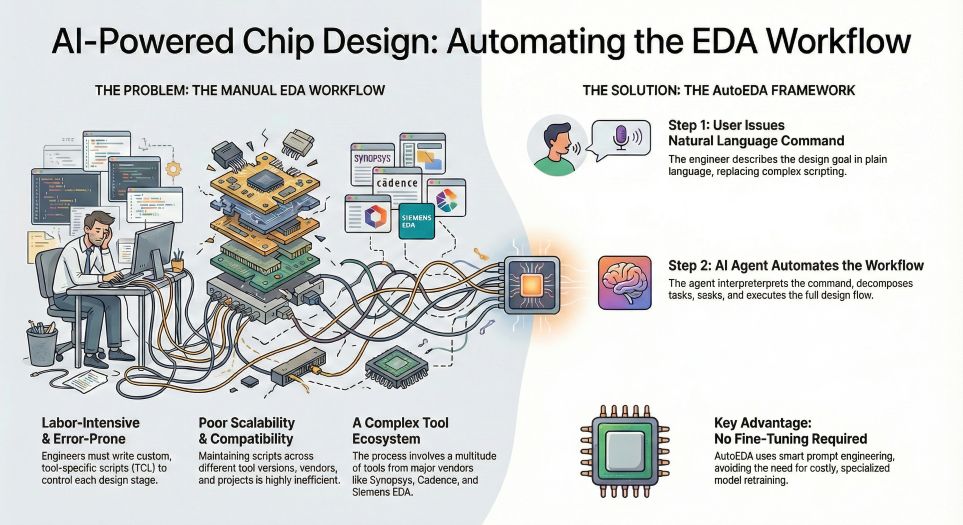

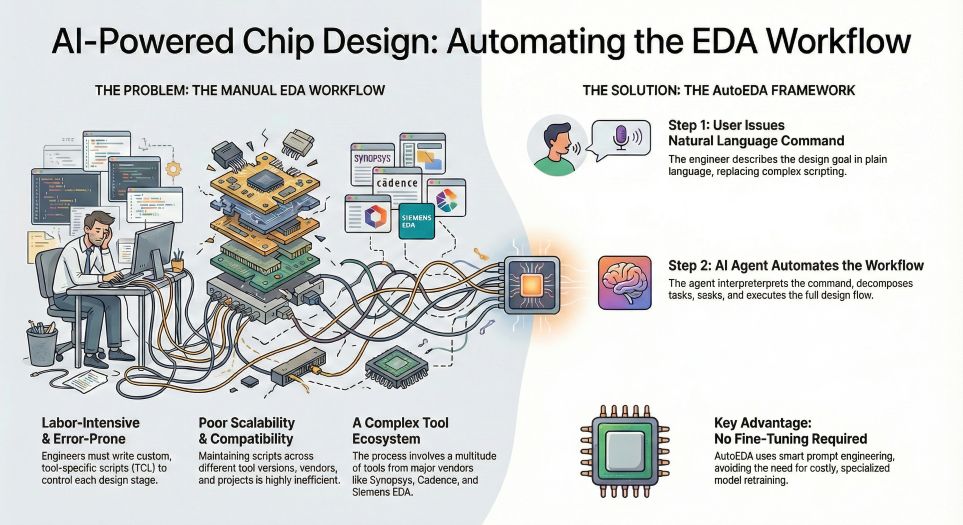

Figure Al-Powered Chip Design Automating the Electronic Design Automation (EDA) Workflow

The Era of Mega-Mergers: Bridging EDA and CAE

The Era of Mega-Mergers: Bridging EDA and CAE

Leading enterprises are no longer satisfied with providing tools for integrated circuit layout alone. They are expanding horizontally into System-Level Simulation (S&A) to address the complexities of multi-die architectures and 3D-IC packaging.

The defining moment of this trend is Synopsys' strategic acquisition of Ansys for approximately $35 billion. This deal aims to merge semiconductor design expertise with high-fidelity physics simulation, creating a unified platform capable of solving multi-physics challenges such as thermal management and electromagnetic interference at the system level. Similarly, Cadence Design Systems has expanded its portfolio by acquiring BETA CAE Systems to enter the structural analysis market and FFG Holdings to offer digital twin solutions for data centers. Siemens Digital Industries Software continues to leverage its industrial DNA, recently moving to acquire Altair to further strengthen its simulation and data analytics capabilities.

Generative AI: The New Engine of Productivity

Research indicates that Artificial Intelligence is transitioning from a supportive role to a core engine within EDA workflows. To combat the extreme complexity of Angstrom-level manufacturing processes (3nm, 2nm, and below), companies are deploying AI to automate decision-making.

Generative AI and Large Language Models (LLMs) are now being used to generate design scripts automatically, with some frameworks executing tasks 3.5 to 8.4 times faster than manual coding. In practical applications, AI-driven tools are drastically reducing iteration times. For instance, domestic Chinese leader Huada Empyrean reported that its AI-infused Andes Power tool reduced optimization cycles from one week to just one hour. Synopsys has also launched its Synopsys.ai suite, utilizing AI for Design Space Exploration (DSO) to autonomously find the optimal balance of Power, Performance, and Area (PPA).

Geopolitics and the Fragmentation of Supply Chains

The global EDA landscape is also being reshaped by export controls and trade restrictions. The US Department of Commerce has imposed stricter licensing requirements on the export of advanced EDA software (such as GAAFET and 3D-IC tools) to China. This has created operational headwinds for US-based giants, with companies like Cadence facing compliance audits and significant fines for historical violations.

Conversely, these restrictions have accelerated the "autonomous control" strategy within China. Local firms like Huada Empyrean and Primarius are rapidly filling gaps in the ecosystem through high R&D investmentintensities often exceeding 70%and targeted acquisitions of smaller IP and modeling firms like Entasys and Magwel.

Market Landscape and Strategic Focus

The following table summarizes the strategic positioning and recent developments of key players in the global EDA market.

Table 1: Strategic Positioning of Global and Regional EDA Leaders

Future Outlook

HDIN Research analysts conclude that the EDA industry is entering a period of high barriers and high growth. The competitive advantage will no longer rest solely on having the best layout editor, but on the ability to offer a comprehensive "Digital Twin" of the entire electronic system. As Generative AI further lowers the threshold for complex design tasks, the gap between market leaders capable of offering full-flow, AI-driven system simulation and niche tool providers will widen. For enterprises and governments, securing access to these advanced, AI-enabled design ecosystems will be critical for maintaining semiconductor competitiveness in the post-Moore's Law era.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

Contact: sales@hdinresearch.com

Figure Al-Powered Chip Design Automating the Electronic Design Automation (EDA) Workflow

The Era of Mega-Mergers: Bridging EDA and CAE

The Era of Mega-Mergers: Bridging EDA and CAELeading enterprises are no longer satisfied with providing tools for integrated circuit layout alone. They are expanding horizontally into System-Level Simulation (S&A) to address the complexities of multi-die architectures and 3D-IC packaging.

The defining moment of this trend is Synopsys' strategic acquisition of Ansys for approximately $35 billion. This deal aims to merge semiconductor design expertise with high-fidelity physics simulation, creating a unified platform capable of solving multi-physics challenges such as thermal management and electromagnetic interference at the system level. Similarly, Cadence Design Systems has expanded its portfolio by acquiring BETA CAE Systems to enter the structural analysis market and FFG Holdings to offer digital twin solutions for data centers. Siemens Digital Industries Software continues to leverage its industrial DNA, recently moving to acquire Altair to further strengthen its simulation and data analytics capabilities.

Generative AI: The New Engine of Productivity

Research indicates that Artificial Intelligence is transitioning from a supportive role to a core engine within EDA workflows. To combat the extreme complexity of Angstrom-level manufacturing processes (3nm, 2nm, and below), companies are deploying AI to automate decision-making.

Generative AI and Large Language Models (LLMs) are now being used to generate design scripts automatically, with some frameworks executing tasks 3.5 to 8.4 times faster than manual coding. In practical applications, AI-driven tools are drastically reducing iteration times. For instance, domestic Chinese leader Huada Empyrean reported that its AI-infused Andes Power tool reduced optimization cycles from one week to just one hour. Synopsys has also launched its Synopsys.ai suite, utilizing AI for Design Space Exploration (DSO) to autonomously find the optimal balance of Power, Performance, and Area (PPA).

Geopolitics and the Fragmentation of Supply Chains

The global EDA landscape is also being reshaped by export controls and trade restrictions. The US Department of Commerce has imposed stricter licensing requirements on the export of advanced EDA software (such as GAAFET and 3D-IC tools) to China. This has created operational headwinds for US-based giants, with companies like Cadence facing compliance audits and significant fines for historical violations.

Conversely, these restrictions have accelerated the "autonomous control" strategy within China. Local firms like Huada Empyrean and Primarius are rapidly filling gaps in the ecosystem through high R&D investmentintensities often exceeding 70%and targeted acquisitions of smaller IP and modeling firms like Entasys and Magwel.

Market Landscape and Strategic Focus

The following table summarizes the strategic positioning and recent developments of key players in the global EDA market.

Table 1: Strategic Positioning of Global and Regional EDA Leaders

| Company Name | Strategic Focus | Recent Key Acquisitions/Moves | AI & Technology Integration |

|---|---|---|---|

| Synopsys | Silicon to Systems; Full-stack AI | Acquisition of Ansys ($35B) to integrate multi-physics simulation | Synopsys.ai suite for autonomous PPA optimization; Partnership with NVIDIA for GPU acceleration |

| Cadence | Intelligent System Design; Multi-physics expansion | Acquisition of BETA CAE (Structural Analysis) and Rambus IP assets | Cerebrus Intelligent Chip Explorer; Focus on digital twins and hardware verification |

| Siemens EDA | Fusion of Industrial Software and EDA | Acquisition of Altair to bolster industrial simulation portfolio | Leveraging AI for industrial digital twins; Strong foothold in automotive and manufacturing sectors |

| Huada Empyrean | Full-flow Domestic Substitution | Acquired Xinda Chip; Investing in 3DIC verification platforms | Andes Power tool uses AI to slash optimization time; Heavy R&D investment (>70% of revenue) |

| Primarius | DTCO (Design-Technology Co-Optimization) | Absorbed subsidiaries (Entasys, Magwel) to streamline operations | Focus on memory design simulation and modeling; Building an application-driven full flow |

Future Outlook

HDIN Research analysts conclude that the EDA industry is entering a period of high barriers and high growth. The competitive advantage will no longer rest solely on having the best layout editor, but on the ability to offer a comprehensive "Digital Twin" of the entire electronic system. As Generative AI further lowers the threshold for complex design tasks, the gap between market leaders capable of offering full-flow, AI-driven system simulation and niche tool providers will widen. For enterprises and governments, securing access to these advanced, AI-enabled design ecosystems will be critical for maintaining semiconductor competitiveness in the post-Moore's Law era.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

Contact: sales@hdinresearch.com