Navigating the Global Shipbuilding Transformation: A Strategic Review of the 2021-2025 Market Super Cycle

Date : 2026-02-03

Reading : 221

The global shipbuilding industry has undergone a profound structural shift between 2021 and 2025, moving from a surplus-driven market to one characterized by a historical scarcity of high-quality production capacity. According to market analysis from HDIN Research, this period represents a watershed moment where energy transition, regulatory pressures, and geopolitical restructuring have combined to create a profit super cycle for leading shipbuilders.

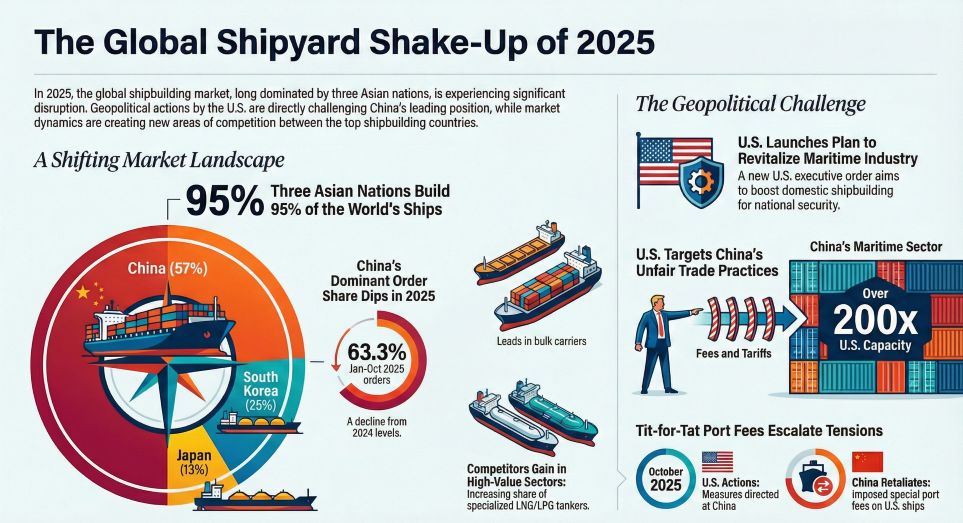

Figure The Global Shipyard Shake-Up of 2025

Market Momentum and Order Visibility

Market Momentum and Order Visibility

The market reached a 17-year peak in 2024, with contract values totaling approximately 204 billion USD across 66 million Compensated Gross Tonnage (CGT). By the end of 2025, the global order backlog climbed to 316 million Gross Tonnage (GT), the highest since 2010. Major shipyards in China and South Korea now report delivery schedules stretching into 2028 and 2029, providing unprecedented revenue visibility and strong bargaining power for builders.

Shift in Vessel Demand

The growth drivers have evolved significantly over the past five years. While 2021 and 2022 were dominated by ultra-large container ships due to supply chain crises, the focus from 2023 to 2025 shifted toward Liquefied Natural Gas (LNG) carriers and high-spec tankers. Driven by European energy security needs and major projects in Qatar, LNG carrier orders reached 39 percent of the existing fleet by late 2025. Furthermore, the resurgence of container ship orders in 2025 focused on methanol and LNG dual-fuel vessels as liners race to hedge against future carbon costs.

Regional Competition and Geopolitical Redirection

The market remains highly concentrated, with China, South Korea, and Japan accounting for 95 percent of global output.

China (CSSC) continues to lead in total volume, accounting for over 56 percent of global completions in 2024. The strategic merger between CSSC and China Shipbuilding Industry Corporation (CSIC) has created a dominant global entity focusing on independent supply chains and high-end manufacturing.

South Korea (HD Hyundai, Samsung Heavy Industries, Hanwha Ocean) maintains a technical lead in high-value-added sectors. South Korean yards have adopted a selective ordering strategy, focusing on high-margin LNG and ammonia-ready vessels. HD Hyundai expects its operating profit margin to reach 15 percent by 2026.

However, the US Section 301 investigation into Chinese shipbuilding has introduced a geopolitical risk premium. To avoid potential port fees and tariffs on Chinese-built vessels, some international shipowners have redirected high-value orders to South Korean and Japanese yards. This ally-shoring trend is further evidenced by South Korean firms like Hanwha Ocean acquiring US-based facilities like Philly Shipyard to secure long-term defense and commercial contracts in North America.

Decarbonization and Digitalization as Industry Standards

Regulatory frameworks such as the IMOs EEXI and CII, along with the inclusion of maritime transport in the EU Emissions Trading System (EU ETS), have made green shipping a mandatory requirement. In 2025, dual-fuel and alternative-fuel vessels accounted for nearly 50 percent of new tonnage.

Technologically, the industry is entering the Shipbuilding 4.0 era. Leading builders are utilizing Digital Twin technology and AI-driven platforms like HD Hyundais OceanWise to monitor carbon footprints and optimize vessel performance throughout their lifecycle. These digital tools are also crucial in addressing the acute labor shortages faced by yards in South Korea and Japan.

Table Strategic Comparison of Global Shipbuilding Capabilities

Expert Conclusion

The shipbuilding industry is currently in a profit realization phase. As high-priced orders move into intensive delivery periods starting in 2026, global yard giants are expected to record their most profitable years this century. However, success will depend on managing structural labor shortages and navigating the complexities of green fuel transitions and geopolitical compliance.

Company Information:

Company Name: HDIN Research

Company Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Official Website: www.hdinresearch.com

Contact Email: sales@hdinresearch.com

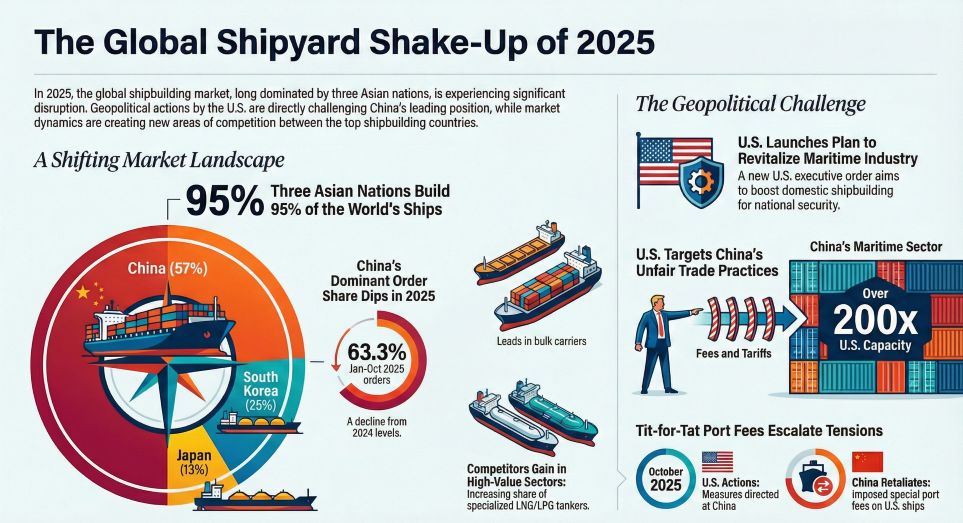

Figure The Global Shipyard Shake-Up of 2025

Market Momentum and Order Visibility

Market Momentum and Order VisibilityThe market reached a 17-year peak in 2024, with contract values totaling approximately 204 billion USD across 66 million Compensated Gross Tonnage (CGT). By the end of 2025, the global order backlog climbed to 316 million Gross Tonnage (GT), the highest since 2010. Major shipyards in China and South Korea now report delivery schedules stretching into 2028 and 2029, providing unprecedented revenue visibility and strong bargaining power for builders.

Shift in Vessel Demand

The growth drivers have evolved significantly over the past five years. While 2021 and 2022 were dominated by ultra-large container ships due to supply chain crises, the focus from 2023 to 2025 shifted toward Liquefied Natural Gas (LNG) carriers and high-spec tankers. Driven by European energy security needs and major projects in Qatar, LNG carrier orders reached 39 percent of the existing fleet by late 2025. Furthermore, the resurgence of container ship orders in 2025 focused on methanol and LNG dual-fuel vessels as liners race to hedge against future carbon costs.

Regional Competition and Geopolitical Redirection

The market remains highly concentrated, with China, South Korea, and Japan accounting for 95 percent of global output.

China (CSSC) continues to lead in total volume, accounting for over 56 percent of global completions in 2024. The strategic merger between CSSC and China Shipbuilding Industry Corporation (CSIC) has created a dominant global entity focusing on independent supply chains and high-end manufacturing.

South Korea (HD Hyundai, Samsung Heavy Industries, Hanwha Ocean) maintains a technical lead in high-value-added sectors. South Korean yards have adopted a selective ordering strategy, focusing on high-margin LNG and ammonia-ready vessels. HD Hyundai expects its operating profit margin to reach 15 percent by 2026.

However, the US Section 301 investigation into Chinese shipbuilding has introduced a geopolitical risk premium. To avoid potential port fees and tariffs on Chinese-built vessels, some international shipowners have redirected high-value orders to South Korean and Japanese yards. This ally-shoring trend is further evidenced by South Korean firms like Hanwha Ocean acquiring US-based facilities like Philly Shipyard to secure long-term defense and commercial contracts in North America.

Decarbonization and Digitalization as Industry Standards

Regulatory frameworks such as the IMOs EEXI and CII, along with the inclusion of maritime transport in the EU Emissions Trading System (EU ETS), have made green shipping a mandatory requirement. In 2025, dual-fuel and alternative-fuel vessels accounted for nearly 50 percent of new tonnage.

Technologically, the industry is entering the Shipbuilding 4.0 era. Leading builders are utilizing Digital Twin technology and AI-driven platforms like HD Hyundais OceanWise to monitor carbon footprints and optimize vessel performance throughout their lifecycle. These digital tools are also crucial in addressing the acute labor shortages faced by yards in South Korea and Japan.

Table Strategic Comparison of Global Shipbuilding Capabilities

| Region | Market Position | Competitive Edge | Strategic Focus |

|---|---|---|---|

| China | Scale Leader | Full supply chain, cost efficiency | High-end transformation, domestic autonomy |

| South Korea | Tech Leader | LNG and zero-carbon fuel systems | Profit-selective orders, US-Korea cooperation |

| Japan | Integrated Player | Automation, specialized vessels | Cost reduction through consolidation |

| European Union | High-Value Niche | Luxury cruises, high-tech systems | EU ETS regulatory leadership, Europe First |

| United States | Defense Focused | Design and military integration | Revitalization via SHIPS Act, ally-shoring |

Expert Conclusion

The shipbuilding industry is currently in a profit realization phase. As high-priced orders move into intensive delivery periods starting in 2026, global yard giants are expected to record their most profitable years this century. However, success will depend on managing structural labor shortages and navigating the complexities of green fuel transitions and geopolitical compliance.

Company Information:

Company Name: HDIN Research

Company Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Official Website: www.hdinresearch.com

Contact Email: sales@hdinresearch.com