Global Wind Power Industry Outlook 2025-2026: Balancing Rapid Expansion with Reliability and Geopolitical Resilience

Date : 2026-02-12

Reading : 134

The global wind power industry is currently navigating a complex "Super Cycle" characterized by record-breaking installation volumes and profound structural transformations. While global new capacity reached a high of 117GW in 2024 and is projected to climb to 143GW by 2025, the sector is shifting its focus from sheer scale to quality restoration and reliability verification.

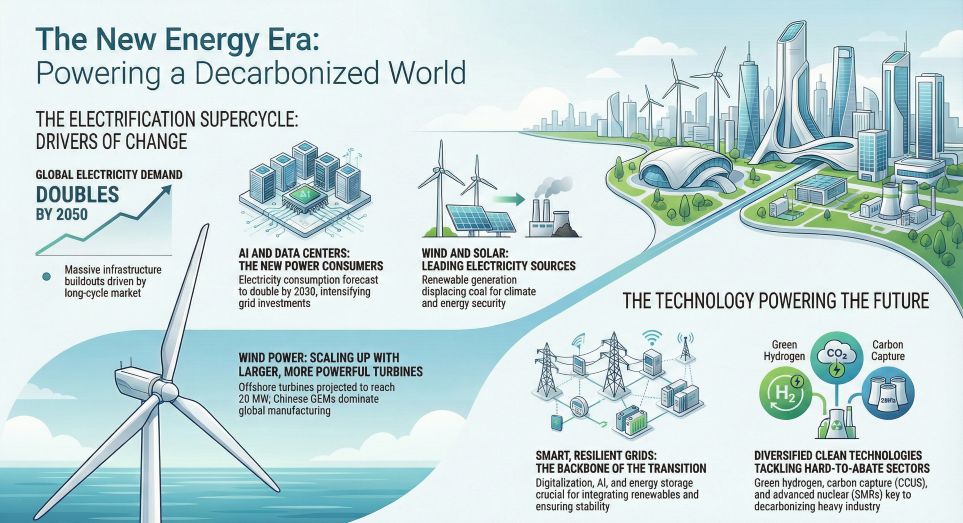

Figure The New Energy Era-Powering a Decarbonized World

The Reliability Pivot: Slowing the Race for Size

The Reliability Pivot: Slowing the Race for Size

After years of rapid turbine upsizing, the industry is experiencing a strategic slowdown. Significant technical failures and quality issues reported by major Western OEMs have prompted a return to caution. Rather than blindly chasing 25MW+ models, leading manufacturers are refocusing on validating the reliability of mature 15MW platforms. This shift aims to reduce operational expenditure (OPEX) and mitigate the massive warranty provisions that have recently impacted the profitability of top-tier players.

Geopolitical Fragmentation and the "Southern Migration" Strategy

Trade protectionism has emerged as a significant threat to the global wind supply chain. With the United States and the European Union imposing or considering substantial tariffs on Chinese-made wind equipment, a "dual supply chain" system is forming.

In response, Chinese manufacturers have executed a "Southern Migration" strategy. By shifting export focus to Belt and Road initiative countries—such as Uzbekistan, Egypt, South Africa, and Chile—Chinese firms have successfully de-risked their portfolios. These emerging markets now account for over 65% of China's wind exports. Furthermore, the transition from "product export" to "capacity export" is accelerating, with companies establishing local manufacturing bases in Brazil, India, and Kazakhstan to bypass trade barriers.

Competitive Landscape and Financial Performance

The market remains divided between high-growth Chinese OEMs and profitability-focused Western giants. In 2024, Chinese firms occupied the top four spots for global installations for the first time, led by Goldwind. Meanwhile, Western companies like Vestas are prioritizing "value over volume," achieving higher margins through service contracts and increased average selling prices.

Global Wind Turbine OEM Performance and Strategy 2025

LCOE Reduction and Technical Innovations

The Levelized Cost of Energy (LCOE) continues to decline, driven by both physical upsizing and digital innovation. In China, the LCOE for onshore wind has dropped by approximately 88% since 2002. Key drivers include:

1. Material Efficiency: Larger turbines reduce the weight-to-power ratio, lowering raw material costs per megawatt.

2. Infrastructure Savings: Higher capacity per unit reduces the number of foundations, cables, and access roads required.

3. Predictive Maintenance: AI-driven digital twins and predictive analytics are reducing maintenance costs by 10% to 20%.

4. Grid-Forming Technology: New turbines are increasingly equipped with grid-forming capabilities to handle the volatility of high-renewable energy penetration.

Future Outlook: Deep-Sea and Floating Wind

As near-shore sites become crowded, the industry is moving toward deep-sea developments (30km+ from shore). Floating wind technology is transitioning from pilot projects to early commercialization, with 16MW+ floating units expected to lead the next phase of offshore expansion.

For the 2025-2026 period, the primary challenge for the industry will be managing the "fragmented globalization" of the supply chain. While Chinese OEMs maintain a significant cost advantage (30% to 50% lower than European counterparts), the winners of the next decade will be those who can provide the highest bankability and long-term reliability in an increasingly subdivided global market.

HDIN Research

Company Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Official Website: www.hdinresearch.com

Contact Email: sales@hdinresearch.com

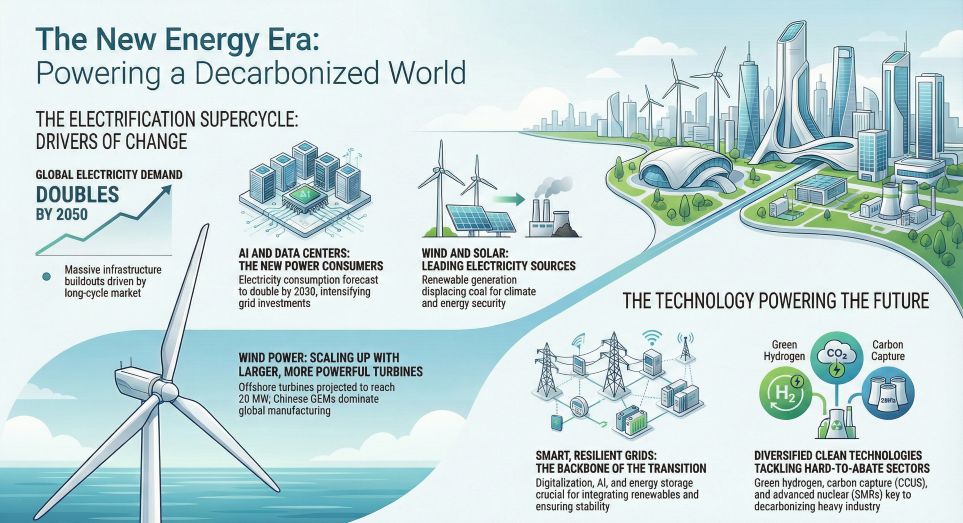

Figure The New Energy Era-Powering a Decarbonized World

The Reliability Pivot: Slowing the Race for Size

The Reliability Pivot: Slowing the Race for SizeAfter years of rapid turbine upsizing, the industry is experiencing a strategic slowdown. Significant technical failures and quality issues reported by major Western OEMs have prompted a return to caution. Rather than blindly chasing 25MW+ models, leading manufacturers are refocusing on validating the reliability of mature 15MW platforms. This shift aims to reduce operational expenditure (OPEX) and mitigate the massive warranty provisions that have recently impacted the profitability of top-tier players.

Geopolitical Fragmentation and the "Southern Migration" Strategy

Trade protectionism has emerged as a significant threat to the global wind supply chain. With the United States and the European Union imposing or considering substantial tariffs on Chinese-made wind equipment, a "dual supply chain" system is forming.

In response, Chinese manufacturers have executed a "Southern Migration" strategy. By shifting export focus to Belt and Road initiative countries—such as Uzbekistan, Egypt, South Africa, and Chile—Chinese firms have successfully de-risked their portfolios. These emerging markets now account for over 65% of China's wind exports. Furthermore, the transition from "product export" to "capacity export" is accelerating, with companies establishing local manufacturing bases in Brazil, India, and Kazakhstan to bypass trade barriers.

Competitive Landscape and Financial Performance

The market remains divided between high-growth Chinese OEMs and profitability-focused Western giants. In 2024, Chinese firms occupied the top four spots for global installations for the first time, led by Goldwind. Meanwhile, Western companies like Vestas are prioritizing "value over volume," achieving higher margins through service contracts and increased average selling prices.

Global Wind Turbine OEM Performance and Strategy 2025

| Company | Revenue (2025 Q1-Q3 / FY) | Backlog / Order Book | Strategy and Market Focus |

|---|---|---|---|

| Goldwind | 48.15 Billion RMB (Q1-Q3) | 49.9 GW | Dominating global scale; expanding into "Wind Power Plus" and deep-sea projects. |

| Vestas | 12.55 Billion EUR (Q1-Q3 approx.) | 31.6 Billion EUR (Wind only) | Prioritizing 10% EBIT margin; focusing on service and Western premium markets. |

| Siemens Gamesa | 10.38 Billion EUR (FY25) | 36.0 Billion EUR | Business restructuring and quality recovery; aiming for 2026 breakeven. |

| GE Vernova (Wind) | 6.74 Billion USD (period approx.) | 21.5 Billion USD | Implementing Lean manufacturing; selective bidding to reduce execution risk. |

| Sany Renewable | 14.45 Billion RMB (period approx.) | >28 GW | Cost leadership via vertical integration; entering the offshore market. |

LCOE Reduction and Technical Innovations

The Levelized Cost of Energy (LCOE) continues to decline, driven by both physical upsizing and digital innovation. In China, the LCOE for onshore wind has dropped by approximately 88% since 2002. Key drivers include:

1. Material Efficiency: Larger turbines reduce the weight-to-power ratio, lowering raw material costs per megawatt.

2. Infrastructure Savings: Higher capacity per unit reduces the number of foundations, cables, and access roads required.

3. Predictive Maintenance: AI-driven digital twins and predictive analytics are reducing maintenance costs by 10% to 20%.

4. Grid-Forming Technology: New turbines are increasingly equipped with grid-forming capabilities to handle the volatility of high-renewable energy penetration.

Future Outlook: Deep-Sea and Floating Wind

As near-shore sites become crowded, the industry is moving toward deep-sea developments (30km+ from shore). Floating wind technology is transitioning from pilot projects to early commercialization, with 16MW+ floating units expected to lead the next phase of offshore expansion.

For the 2025-2026 period, the primary challenge for the industry will be managing the "fragmented globalization" of the supply chain. While Chinese OEMs maintain a significant cost advantage (30% to 50% lower than European counterparts), the winners of the next decade will be those who can provide the highest bankability and long-term reliability in an increasingly subdivided global market.

HDIN Research

Company Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Official Website: www.hdinresearch.com

Contact Email: sales@hdinresearch.com