SASA Polyester Navigates Macroeconomic Headwinds with Aggressive Vertical Integration Strategy

Date : 2026-02-02

Reading : 62

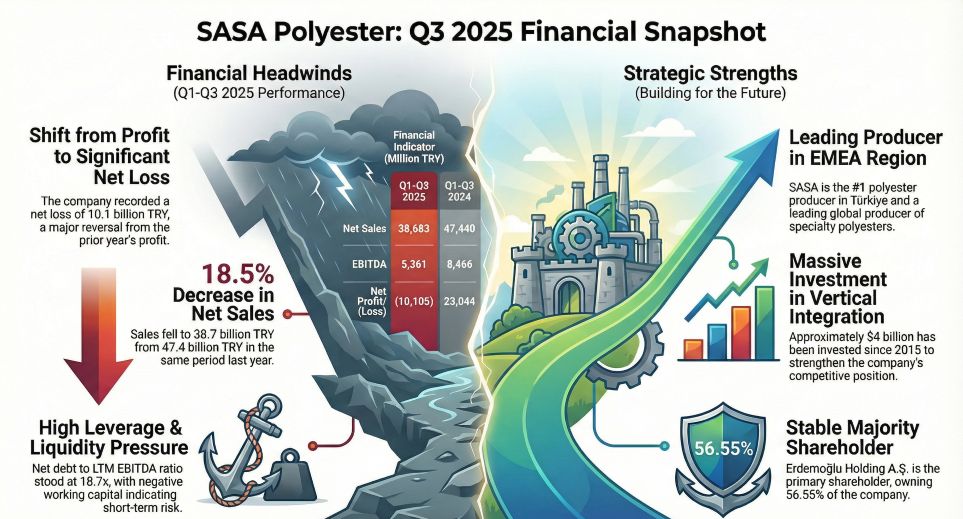

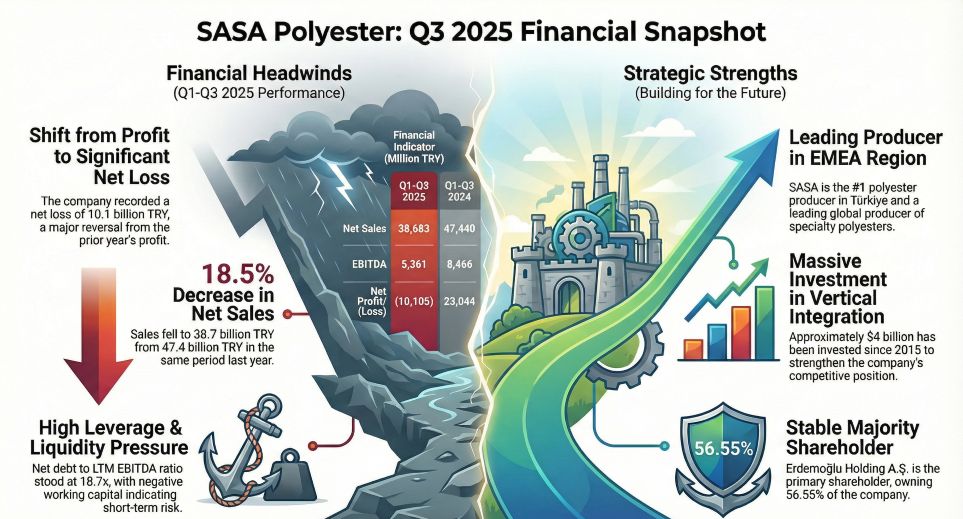

SASA Polyester Sanayi A.S., a dominant force in the polyester production landscape across Turkey and the EMEA region, has released its financial results for the first three quarters of 2025. The report reveals a company at a critical crossroads, balancing a transformative vertical integration strategy against a backdrop of severe macroeconomic challenges and liquidity constraints.

Figure SASA Polyester Q3 2025 Financial Snapshot

Strategic Transformation and Vertical Integration

Strategic Transformation and Vertical Integration

SASA is currently transitioning from a traditional polyester manufacturer to a vertically integrated petrochemical giant. A primary milestone in 2025 was the commissioning of the Purified Terephthalic Acid (PTA) production facility. With an annual capacity of 1.75 million tons and a total investment of 1.75 billion USD, the plant aims to eliminate the company's dependence on imported raw materials. This facility uses the latest Invista P8 technology, which is expected to reduce the current account deficit of Turkey by approximately 300 million USD annually.

In addition to the PTA plant, SASA continues to progress with its long-term Yumurtalik Petrochemical project. This 12-year, 25-billion-USD initiative is designed to achieve 100% import substitution for various petrochemical products, supported by its status as a Private Industrial Zone.

Financial Performance and Profitability Pressures

Despite strategic progress, the financial data for the period between January and September 2025 highlights significant stress. Net sales reached 38.68 billion TRY, representing a decline of approximately 18.5% compared to the same period in 2024. The company recorded a net loss of 10.11 billion TRY, a sharp reversal from the 23.04 billion TRY profit reported in the previous year.

The gross profit margin contracted from 20% to 8%, driven largely by rising raw material costs, which account for 75% of operating expenses, alongside increased energy and labor costs. Furthermore, the application of TAS 29 hyperinflationary accounting led to a significant monetary gain of 23.7 billion TRY, yet this was insufficient to offset the massive financing expenses of 41.7 billion TRY, primarily stemming from foreign exchange losses and interest payments.

Liquidity and Debt Profile

The company’s balance sheet shows signs of significant strain. As of September 30, 2025, the current ratio stood at 0.37, with a quick ratio of 0.19 and a cash ratio of 0.01. These figures indicate a high level of dependency on debt refinancing. The Net Debt/EBITDA ratio climbed to 18.7x, reflecting the heavy capital expenditure phase. Consequently, Fitch Ratings recently downgraded the company’s long-term credit rating to CCC, citing increased financial risks.

Market Dynamics and Operational Output

On the operational front, production volumes remained resilient. Total sales volume reached nearly 800,000 tons, an increase over the previous year. However, lower unit prices and a global slowdown in the textile industry—which accounts for 59% of SASA's end-market—prevented volume growth from translating into revenue gains. The packaging and film sector, representing 18% of sales, showed more stability due to the essential nature of PET resin products.

Table Key Financial Indicators Table (Q1-Q3 2025 vs Q1-Q3 2024)

Future Outlook

Management expects the leverage ratios to begin a downward trend as new facilities, including the PTA and MTR (Melt-to-Resin) plants, reach full capacity utilization. The company forecasts that the net leverage ratio could drop to approximately 8x by the fourth quarter of 2026. The successful issuance of a 500-million-euro convertible bond remains a vital component of the company's strategy to optimize its debt structure and alleviate short-term liquidity pressures.

Industry analysts suggest that while SASA's long-term logic of vertical integration is sound, the immediate future depends heavily on navigating the volatile Turkish Lira exchange rates and maintaining access to international credit markets.

HDIN Research

Company Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Official Website: www.hdinresearch.com

Contact Email: sales@hdinresearch.com

Figure SASA Polyester Q3 2025 Financial Snapshot

Strategic Transformation and Vertical Integration

Strategic Transformation and Vertical IntegrationSASA is currently transitioning from a traditional polyester manufacturer to a vertically integrated petrochemical giant. A primary milestone in 2025 was the commissioning of the Purified Terephthalic Acid (PTA) production facility. With an annual capacity of 1.75 million tons and a total investment of 1.75 billion USD, the plant aims to eliminate the company's dependence on imported raw materials. This facility uses the latest Invista P8 technology, which is expected to reduce the current account deficit of Turkey by approximately 300 million USD annually.

In addition to the PTA plant, SASA continues to progress with its long-term Yumurtalik Petrochemical project. This 12-year, 25-billion-USD initiative is designed to achieve 100% import substitution for various petrochemical products, supported by its status as a Private Industrial Zone.

Financial Performance and Profitability Pressures

Despite strategic progress, the financial data for the period between January and September 2025 highlights significant stress. Net sales reached 38.68 billion TRY, representing a decline of approximately 18.5% compared to the same period in 2024. The company recorded a net loss of 10.11 billion TRY, a sharp reversal from the 23.04 billion TRY profit reported in the previous year.

The gross profit margin contracted from 20% to 8%, driven largely by rising raw material costs, which account for 75% of operating expenses, alongside increased energy and labor costs. Furthermore, the application of TAS 29 hyperinflationary accounting led to a significant monetary gain of 23.7 billion TRY, yet this was insufficient to offset the massive financing expenses of 41.7 billion TRY, primarily stemming from foreign exchange losses and interest payments.

Liquidity and Debt Profile

The company’s balance sheet shows signs of significant strain. As of September 30, 2025, the current ratio stood at 0.37, with a quick ratio of 0.19 and a cash ratio of 0.01. These figures indicate a high level of dependency on debt refinancing. The Net Debt/EBITDA ratio climbed to 18.7x, reflecting the heavy capital expenditure phase. Consequently, Fitch Ratings recently downgraded the company’s long-term credit rating to CCC, citing increased financial risks.

Market Dynamics and Operational Output

On the operational front, production volumes remained resilient. Total sales volume reached nearly 800,000 tons, an increase over the previous year. However, lower unit prices and a global slowdown in the textile industry—which accounts for 59% of SASA's end-market—prevented volume growth from translating into revenue gains. The packaging and film sector, representing 18% of sales, showed more stability due to the essential nature of PET resin products.

Table Key Financial Indicators Table (Q1-Q3 2025 vs Q1-Q3 2024)

| Financial Metric | Jan–Sept 2025 (TRY Billion) | Jan–Sept 2024 (TRY Billion) | Change (%) |

|---|---|---|---|

| Net Sales | 38.68 | 47.44 | -18.47% |

| EBITDA | 5.36 | 8.47 | -36.72% |

| Net Income / (Loss) | (10.11) | 23.04 | -143.88% |

| Total Assets | 296.90 | 258.12 (YE 2024) | +15.02% |

| Gross Margin | 8% | 20% | -12.00 pts |

| Liquidity Ratio | 0.37 | 0.65 (YE 2024) | -43.08% |

Future Outlook

Management expects the leverage ratios to begin a downward trend as new facilities, including the PTA and MTR (Melt-to-Resin) plants, reach full capacity utilization. The company forecasts that the net leverage ratio could drop to approximately 8x by the fourth quarter of 2026. The successful issuance of a 500-million-euro convertible bond remains a vital component of the company's strategy to optimize its debt structure and alleviate short-term liquidity pressures.

Industry analysts suggest that while SASA's long-term logic of vertical integration is sound, the immediate future depends heavily on navigating the volatile Turkish Lira exchange rates and maintaining access to international credit markets.

HDIN Research

Company Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Official Website: www.hdinresearch.com

Contact Email: sales@hdinresearch.com