Batu Kawan Berhad Financial Analysis: Plantation Strength Mitigates Manufacturing Cycle Volatility

Date : 2026-02-02

Reading : 56

Batu Kawan Berhad (BKB), a major Malaysian diversified investment holding group, has concluded its 2025 fiscal year with a robust financial performance, characterized by strong growth in its core plantation business which successfully offset a downturn in its manufacturing and chemical divisions.

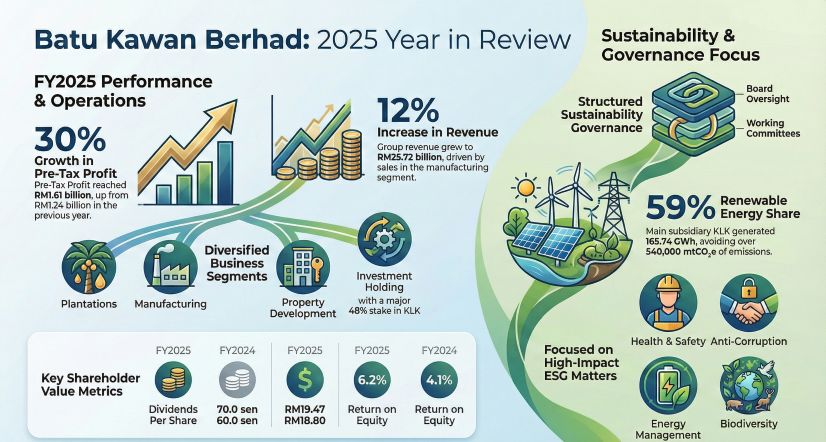

Figure Batu Kawan Berhad 2025 Year in Review

Financial Overview and Profitability Drivers

Financial Overview and Profitability Drivers

For the fiscal year ending September 30, 2025, BKB reported a total revenue of 25.72 billion MYR, marking a 12 percent increase compared to the previous year. The group's profit before tax surged by 30 percent to reach 1.61 billion MYR. This growth was primarily fueled by the plantation segment, which remains the group's profit engine. The plantation division recorded a 40 percent increase in pre-tax profit to 2.31 billion MYR, supported by a rise in the average selling prices of Crude Palm Oil (CPO) and Palm Kernel (PK).

In contrast, the manufacturing segment, encompassing oleochemicals and refining, faced a challenging year, recording a pre-tax loss of 173.6 million MYR. This decline was attributed to global overcapacity in the oleochemicals market, high raw material costs, and a specific operational disruption caused by a gas pipeline explosion at Putra Heights. Despite these hurdles, BKB's overall net profit attributable to shareholders rose by 56 percent to 467.8 million MYR.

Segmental Performance and Operational Efficiency

The group's subsidiary, Kuala Lumpur Kepong Berhad (KLK), continues to be the primary contributor to BKB's success. The plantation division maintained high operational standards, with Fresh Fruit Bunch (FFB) yields showing resilience and a cost-controlled environment. In the industrial chemical space, CCM Berhad saw a slight dip in profits due to rising sulfur prices and weakened demand from the rubber glove industry, though its chlor-alkali business remained steady through technological energy efficiency improvements.

BKB's property division showed mixed results. While Malaysian township developments saw a slight slowdown in sales, the group's Australian investments turned profitable, reflecting a successful turnaround in the Melbourne Mickleham development project.

Strategic Initiatives and Turnaround Plans

To address the current weakness in manufacturing, BKB has initiated a comprehensive turnaround strategy. This includes the commissioning of a flagship integrated complex in East Kalimantan, Indonesia (PTPSS), which combines refining, kernel crushing, and downstream oleochemical plants to optimize the value chain. Furthermore, the group is rebranding its pharmaceutical and life sciences business under the KLK OLEO Life Science identity to focus on high-margin specialized markets.

On the ESG front, BKB has made significant strides, achieving a 59 percent renewable energy usage rate across its operations. The group is actively preparing for the European Union Deforestation Regulation (EUDR) to maintain market access and has calculated the carbon footprint for 171 product groups to meet global sustainability auditing requirements.

Expert Financial Evaluation

From a financial stability perspective, BKB maintains a healthy balance sheet with a net debt-to-equity ratio of 0.57x. While the Altman Z-Score suggests the group operates in a capital-intensive environment typical of the manufacturing and plantation industries, its strong cash flow from plantation activities and an AA1 credit rating indicate very low default risk. The group's return on equity (ROE) improved significantly to 6.18 percent, driven by better profit margins in the plantation sector and improved asset turnover.

Table Batu Kawan Berhad FY2025 Key Financial Indicators

Future Outlook

Looking ahead to fiscal year 2026, management remains cautiously optimistic. The plantation sector is expected to remain firm due to tight supply and biodiesel mandates in Indonesia. For the manufacturing sector, the group anticipates a recovery as new capacities ramp up and specialized chemical products gain market share. BKB's strategic pivot toward high-value-added chemicals and industrial property development, such as the KLK TechPark collaboration, is expected to provide long-term structural growth.

HDIN Research

Company Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Official Website: www.hdinresearch.com

Contact Email: sales@hdinresearch.com

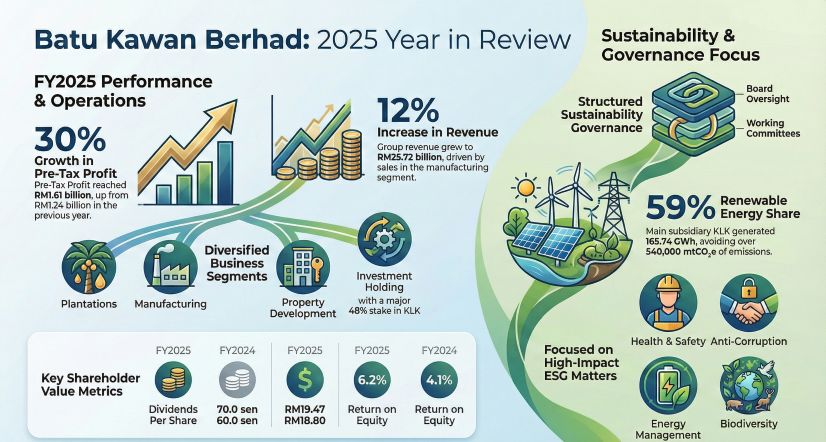

Figure Batu Kawan Berhad 2025 Year in Review

Financial Overview and Profitability Drivers

Financial Overview and Profitability DriversFor the fiscal year ending September 30, 2025, BKB reported a total revenue of 25.72 billion MYR, marking a 12 percent increase compared to the previous year. The group's profit before tax surged by 30 percent to reach 1.61 billion MYR. This growth was primarily fueled by the plantation segment, which remains the group's profit engine. The plantation division recorded a 40 percent increase in pre-tax profit to 2.31 billion MYR, supported by a rise in the average selling prices of Crude Palm Oil (CPO) and Palm Kernel (PK).

In contrast, the manufacturing segment, encompassing oleochemicals and refining, faced a challenging year, recording a pre-tax loss of 173.6 million MYR. This decline was attributed to global overcapacity in the oleochemicals market, high raw material costs, and a specific operational disruption caused by a gas pipeline explosion at Putra Heights. Despite these hurdles, BKB's overall net profit attributable to shareholders rose by 56 percent to 467.8 million MYR.

Segmental Performance and Operational Efficiency

The group's subsidiary, Kuala Lumpur Kepong Berhad (KLK), continues to be the primary contributor to BKB's success. The plantation division maintained high operational standards, with Fresh Fruit Bunch (FFB) yields showing resilience and a cost-controlled environment. In the industrial chemical space, CCM Berhad saw a slight dip in profits due to rising sulfur prices and weakened demand from the rubber glove industry, though its chlor-alkali business remained steady through technological energy efficiency improvements.

BKB's property division showed mixed results. While Malaysian township developments saw a slight slowdown in sales, the group's Australian investments turned profitable, reflecting a successful turnaround in the Melbourne Mickleham development project.

Strategic Initiatives and Turnaround Plans

To address the current weakness in manufacturing, BKB has initiated a comprehensive turnaround strategy. This includes the commissioning of a flagship integrated complex in East Kalimantan, Indonesia (PTPSS), which combines refining, kernel crushing, and downstream oleochemical plants to optimize the value chain. Furthermore, the group is rebranding its pharmaceutical and life sciences business under the KLK OLEO Life Science identity to focus on high-margin specialized markets.

On the ESG front, BKB has made significant strides, achieving a 59 percent renewable energy usage rate across its operations. The group is actively preparing for the European Union Deforestation Regulation (EUDR) to maintain market access and has calculated the carbon footprint for 171 product groups to meet global sustainability auditing requirements.

Expert Financial Evaluation

From a financial stability perspective, BKB maintains a healthy balance sheet with a net debt-to-equity ratio of 0.57x. While the Altman Z-Score suggests the group operates in a capital-intensive environment typical of the manufacturing and plantation industries, its strong cash flow from plantation activities and an AA1 credit rating indicate very low default risk. The group's return on equity (ROE) improved significantly to 6.18 percent, driven by better profit margins in the plantation sector and improved asset turnover.

Table Batu Kawan Berhad FY2025 Key Financial Indicators

| Metric | FY2025 (MYR Billion) | FY2024 (MYR Billion) | YoY Change (%) |

|---|---|---|---|

| Total Revenue | 25.72 | 23.06 | +11.5% |

| Profit Before Tax | 1.61 | 1.24 | +29.8% |

| Net Profit (Attributable to Owners) | 0.468 | 0.299 | +56.5% |

| Total Assets | 331.2 | 321.4 | +3.0% |

| Dividend Per Share (Sen) | 70.0 | 60.0 | +16.7% |

| CPO Average Price (MYR/mt) | 3,964 | 3,649 | +8.6% |

Future Outlook

Looking ahead to fiscal year 2026, management remains cautiously optimistic. The plantation sector is expected to remain firm due to tight supply and biodiesel mandates in Indonesia. For the manufacturing sector, the group anticipates a recovery as new capacities ramp up and specialized chemical products gain market share. BKB's strategic pivot toward high-value-added chemicals and industrial property development, such as the KLK TechPark collaboration, is expected to provide long-term structural growth.

HDIN Research

Company Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Official Website: www.hdinresearch.com

Contact Email: sales@hdinresearch.com