UBE Corporation Accelerates Strategic Shift to Specialty Chemicals: M&A and Sustainability Drive Vision 2030

Date : 2026-02-04

Reading : 75

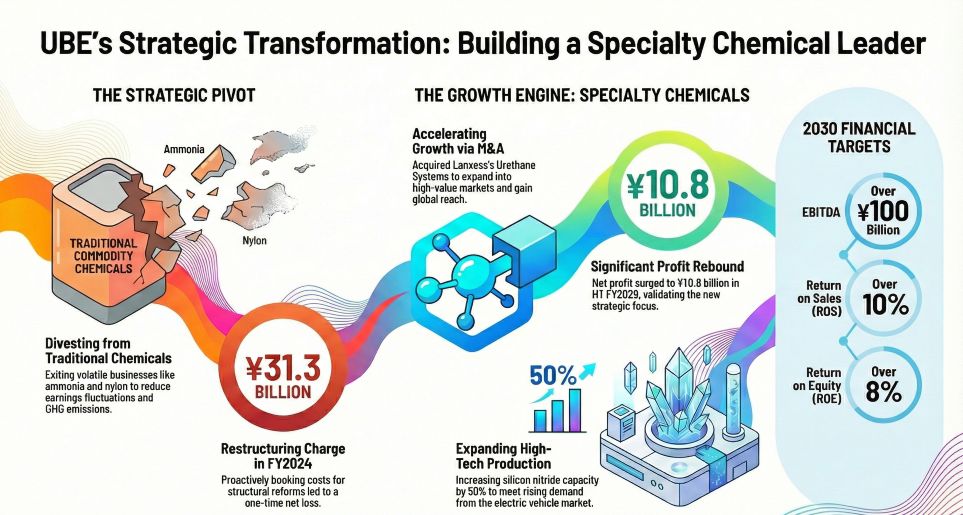

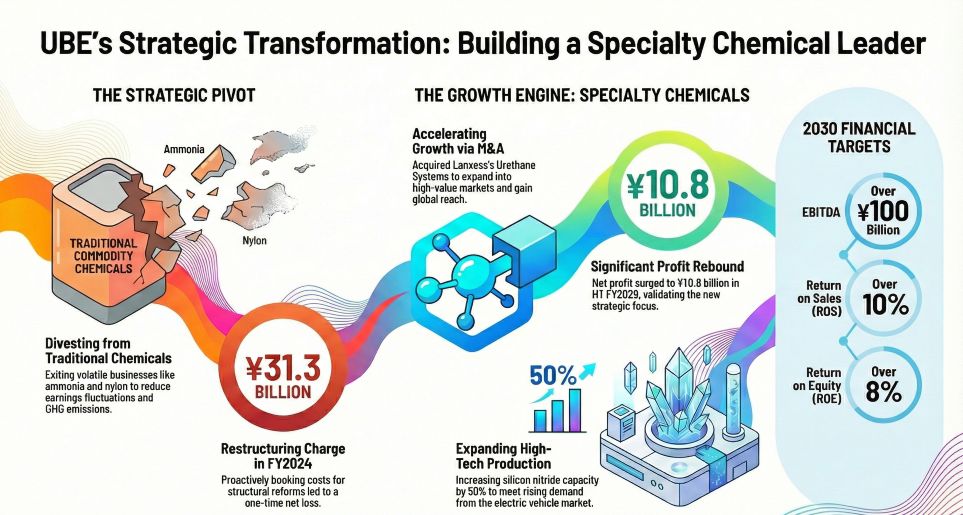

UBE Corporation is currently executing a significant structural transformation under its long-term roadmap, "UBE Vision 2030 Transformation." The company is aggressively pivoting from traditional basic chemicals to becoming a high-value specialty chemical enterprise. This strategic overhaul is driven by a dual approach of active mergers and acquisitions (M&A) in high-growth sectors and the decisive divestment or restructuring of low-margin foundational businesses.

According to recent market analysis by HDIN Research, UBE's transformation focuses on optimizing its business portfolio to enhance capital efficiency (ROE and ROIC) while addressing global environmental challenges. The company has earmarked approximately 460 billion JPY for investment between 2025 and 2030, with 75% of these funds allocated to specialty businesses.

Figure UBE's Strategic Transformation Building a Specialty Chemical Leader

Expansion Through Strategic M&A and Global Positioning

Expansion Through Strategic M&A and Global Positioning

A cornerstone of UBE's growth strategy is the rapid expansion of its specialty portfolio, particularly in polyimides, separation membranes, and high-functionality polyurethanes. A pivotal move in this direction is the acquisition of the Urethane Systems business from German chemical giant LANXESS, effective April 2025. This acquisition grants UBE leading global technology and a substantial market base in North America, creating synergies with its existing C1 chemical supply chain.

In the life sciences sector, UBE has integrated API Corporation to strengthen its Contract Development and Manufacturing Organization (CDMO) capabilities. Furthermore, the company is expanding its footprint in the circular economy with the December 2024 acquisition of Paulowsky, a European recycled resin manufacturer. To facilitate these aggressive moves, UBE established a dedicated "M&A Promotion Office" in April 2025 under direct presidential supervision.

Restructuring and Decarbonization

Simultaneously, UBE is streamlining its operations by withdrawing from volatile basic chemical markets. The company plans to cease ammonia production in Japan by March 2028 and stop caprolactam production in Thailand by March 2026. These measures are designed to reduce exposure to market fluctuations and cut greenhouse gas (GHG) emissions. Consequently, UBE projects it will achieve its 2030 target of a 50% reduction in GHG emissions (compared to 2013 levels) ahead of schedule, likely by fiscal year 2028.

Additionally, UBE is preparing to spin off its machinery and cement businesses to function as independent entities, potentially leading to initial public offerings (IPOs). This separation allows the parent company to concentrate its resources exclusively on the chemical sector.

The following table summarizes UBE's strategic portfolio restructuring:

Market Outlook

The transformation positions UBE to capitalize on the growing demand for semiconductor materials and electric vehicle (EV) components. The company's unique polyimide varnishes and films are critical for OLED displays and next-generation chip packaging, while its separation membranes are seeing increased adoption in biomethane and hydrogen energy projects.

By shifting its portfolio toward these high-barrier-to-entry markets, UBE aims to stabilize earnings and improve its Price-to-Book Ratio (PBR). For industry stakeholders and investors, UBE’s trajectory offers a case study in how traditional chemical conglomerates can successfully navigate the transition toward high-specialty, sustainable business models.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

Contact: sales@hdinresearch.com

According to recent market analysis by HDIN Research, UBE's transformation focuses on optimizing its business portfolio to enhance capital efficiency (ROE and ROIC) while addressing global environmental challenges. The company has earmarked approximately 460 billion JPY for investment between 2025 and 2030, with 75% of these funds allocated to specialty businesses.

Figure UBE's Strategic Transformation Building a Specialty Chemical Leader

Expansion Through Strategic M&A and Global Positioning

Expansion Through Strategic M&A and Global PositioningA cornerstone of UBE's growth strategy is the rapid expansion of its specialty portfolio, particularly in polyimides, separation membranes, and high-functionality polyurethanes. A pivotal move in this direction is the acquisition of the Urethane Systems business from German chemical giant LANXESS, effective April 2025. This acquisition grants UBE leading global technology and a substantial market base in North America, creating synergies with its existing C1 chemical supply chain.

In the life sciences sector, UBE has integrated API Corporation to strengthen its Contract Development and Manufacturing Organization (CDMO) capabilities. Furthermore, the company is expanding its footprint in the circular economy with the December 2024 acquisition of Paulowsky, a European recycled resin manufacturer. To facilitate these aggressive moves, UBE established a dedicated "M&A Promotion Office" in April 2025 under direct presidential supervision.

Restructuring and Decarbonization

Simultaneously, UBE is streamlining its operations by withdrawing from volatile basic chemical markets. The company plans to cease ammonia production in Japan by March 2028 and stop caprolactam production in Thailand by March 2026. These measures are designed to reduce exposure to market fluctuations and cut greenhouse gas (GHG) emissions. Consequently, UBE projects it will achieve its 2030 target of a 50% reduction in GHG emissions (compared to 2013 levels) ahead of schedule, likely by fiscal year 2028.

Additionally, UBE is preparing to spin off its machinery and cement businesses to function as independent entities, potentially leading to initial public offerings (IPOs). This separation allows the parent company to concentrate its resources exclusively on the chemical sector.

The following table summarizes UBE's strategic portfolio restructuring:

| Strategic Direction | Key Business Segments | Action & Market Impact |

|---|---|---|

| Aggressive Expansion (Specialty) | High-Functional Polyurethanes, Polyimides, C1 Chemicals | Acquired LANXESS Urethane Systems; Establishing US-based C1 supply chain for EV batteries and semiconductors. |

| Life Science Growth | CDMO, Separation Membranes | Integrated API Corp; Expanding capacity for biomethane separation and pharmaceutical ingredients. |

| Asset Divestment (Basic) | Ammonia, Caprolactam, Nylon Polymers | Ceasing domestic ammonia production (2028) and Thai caprolactam operations (2026) to improve margins. |

| Independence / Spin-off | Machinery, Cement | Preparing subsidiaries like UBE Machinery for independent listings (IPO) to focus parent capital on chemicals. |

Market Outlook

The transformation positions UBE to capitalize on the growing demand for semiconductor materials and electric vehicle (EV) components. The company's unique polyimide varnishes and films are critical for OLED displays and next-generation chip packaging, while its separation membranes are seeing increased adoption in biomethane and hydrogen energy projects.

By shifting its portfolio toward these high-barrier-to-entry markets, UBE aims to stabilize earnings and improve its Price-to-Book Ratio (PBR). For industry stakeholders and investors, UBE’s trajectory offers a case study in how traditional chemical conglomerates can successfully navigate the transition toward high-specialty, sustainable business models.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

Contact: sales@hdinresearch.com