OCI Aggressively Expands into Semiconductor and Battery Materials via Strategic M&A and Capacity Upgrades

Date : 2026-02-04

Reading : 82

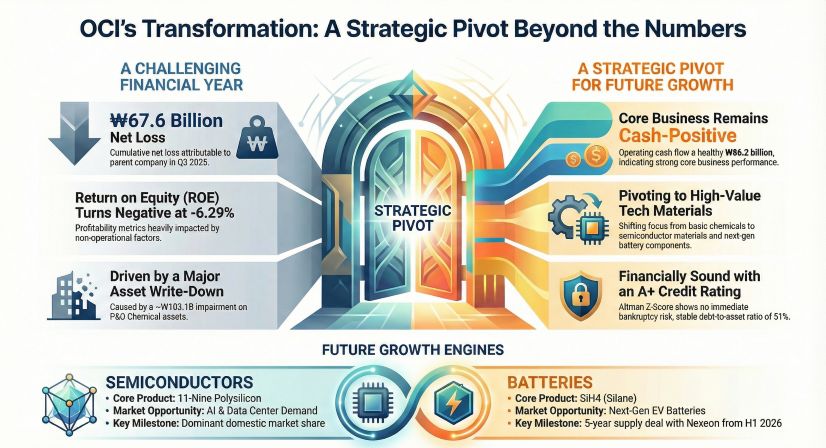

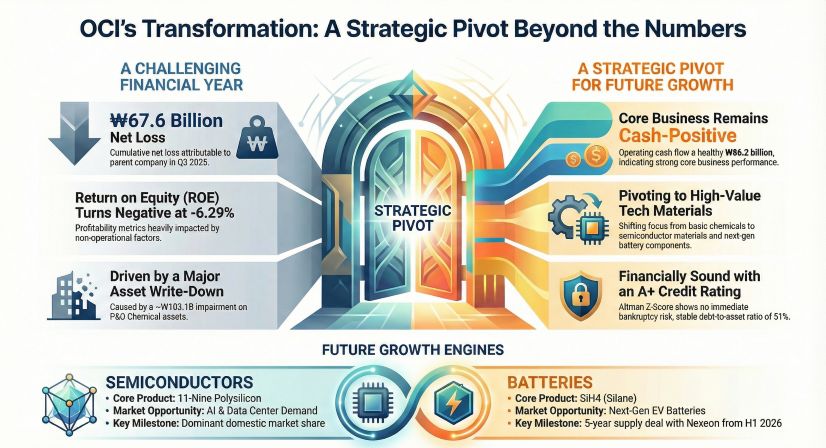

OCI Company Ltd., a leading global chemical powerhouse, is accelerating its strategic transformation from a traditional basic chemical manufacturer to a high-tech material supplier for the semiconductor and electric vehicle (EV) battery sectors. According to recent market analysis by HDIN Research, OCI is consolidating its business portfolio through significant mergers and acquisitions (M&A) and capital expenditures to secure new growth engines for the next decade.

Figure OCl's Transformation A Strategic Pivot Beyond the Numbers

Strategic Consolidation: The P&O Chemical Merger

Strategic Consolidation: The P&O Chemical Merger

A cornerstone of this transformation is the full acquisition and absorption of P&O Chemical. In February 2025, OCI acquired a 51% stake in P&O Chemical from POSCO Future M for approximately 53.7 billion KRW, making it a wholly-owned subsidiary. By late 2025, OCI finalized the absorption merger of this unit.

This strategic move allows OCI to internalize the production of electronic-grade hydrogen peroxide and high-performance carbon materials. The integration aims to streamline the supply chain for semiconductor cleaning agents and battery materials, creating a vertically integrated structure that enhances cost competitiveness and operational efficiency.

Semiconductor Materials: Reinforcing Global Leadership

OCI remains the only South Korean manufacturer capable of producing 11-Nine grade (99.999999999%) polysilicon, a critical raw material for semiconductor wafers. To further strengthen its dominance in the 8 core semiconductor manufacturing processes, OCI provides key materials including high-purity phosphoric acid (where it holds the top market share in Korea), chlor-alkali (CA), and electronic-grade precursors like HCDS.

In a bid to optimize its asset utilization, OCI recently transferred idle assets from its Gunsan plant to its joint venture, OCI Tokuyama Semiconductor Materials. This reallocation of resources is designed to support the expansion of semiconductor material production, positioning the company to meet the rebounding demand driven by AI and data center investments.

Battery Materials: The Silicon Anode Revolution

OCI is rapidly penetrating the secondary battery market by leveraging its chemical expertise. The company is currently constructing a production line for Silane (SiH4) with an annual capacity of 1,000 tons. SiH4 is essential for manufacturing silicon anode materials, which significantly improve EV battery range and charging speed.

Market confidence in OCI's battery strategy is evidenced by a long-term supply agreement signed with Nexeon, a UK-based silicon anode manufacturer. OCI is scheduled to begin commercial supply of SiH4 to Nexeon's Korean subsidiary in the first half of 2026. This project utilizes by-products from OCI's existing polysilicon production, demonstrating a cost-effective circular production model.

Financial Outlook and Business Structure

While OCI faced short-term accounting adjustments in 2025 due to asset impairments related to its restructuring, the company's fundamentals remain strong. The Carbon Chemicals division continues to be a cash cow, accounting for approximately 63% of total revenue, while the Basic Chemicals division is pivoting towards high-value electronic materials.

The following table summarizes OCI's core business segments and recent strategic developments:

HDIN Research notes that OCI's "selection and concentration" strategy places it in a prime position to capitalize on the recovery of the semiconductor cycle and the long-term growth of the EV battery market.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

Contact: sales@hdinresearch.com

Figure OCl's Transformation A Strategic Pivot Beyond the Numbers

Strategic Consolidation: The P&O Chemical Merger

Strategic Consolidation: The P&O Chemical MergerA cornerstone of this transformation is the full acquisition and absorption of P&O Chemical. In February 2025, OCI acquired a 51% stake in P&O Chemical from POSCO Future M for approximately 53.7 billion KRW, making it a wholly-owned subsidiary. By late 2025, OCI finalized the absorption merger of this unit.

This strategic move allows OCI to internalize the production of electronic-grade hydrogen peroxide and high-performance carbon materials. The integration aims to streamline the supply chain for semiconductor cleaning agents and battery materials, creating a vertically integrated structure that enhances cost competitiveness and operational efficiency.

Semiconductor Materials: Reinforcing Global Leadership

OCI remains the only South Korean manufacturer capable of producing 11-Nine grade (99.999999999%) polysilicon, a critical raw material for semiconductor wafers. To further strengthen its dominance in the 8 core semiconductor manufacturing processes, OCI provides key materials including high-purity phosphoric acid (where it holds the top market share in Korea), chlor-alkali (CA), and electronic-grade precursors like HCDS.

In a bid to optimize its asset utilization, OCI recently transferred idle assets from its Gunsan plant to its joint venture, OCI Tokuyama Semiconductor Materials. This reallocation of resources is designed to support the expansion of semiconductor material production, positioning the company to meet the rebounding demand driven by AI and data center investments.

Battery Materials: The Silicon Anode Revolution

OCI is rapidly penetrating the secondary battery market by leveraging its chemical expertise. The company is currently constructing a production line for Silane (SiH4) with an annual capacity of 1,000 tons. SiH4 is essential for manufacturing silicon anode materials, which significantly improve EV battery range and charging speed.

Market confidence in OCI's battery strategy is evidenced by a long-term supply agreement signed with Nexeon, a UK-based silicon anode manufacturer. OCI is scheduled to begin commercial supply of SiH4 to Nexeon's Korean subsidiary in the first half of 2026. This project utilizes by-products from OCI's existing polysilicon production, demonstrating a cost-effective circular production model.

Financial Outlook and Business Structure

While OCI faced short-term accounting adjustments in 2025 due to asset impairments related to its restructuring, the company's fundamentals remain strong. The Carbon Chemicals division continues to be a cash cow, accounting for approximately 63% of total revenue, while the Basic Chemicals division is pivoting towards high-value electronic materials.

The following table summarizes OCI's core business segments and recent strategic developments:

| Business Segment | Core Products | Key Strategic Developments & Outlook |

|---|---|---|

| Semiconductor Materials | 11-Nine Polysilicon, High-Purity Phosphoric Acid, HCDS | Strengthening dominance in cleaning and etching materials; asset optimization via Tokuyama JV. |

| Battery Materials | Silane (SiH4), Electronic Grade Hydrogen Peroxide | Construction of 1,000-ton SiH4 plant; Commercial supply to Nexeon starting 1H 2026. |

| Carbon Chemicals | Carbon Black, Pitch, BTX | Investment in Specialty Carbon Black for high-performance tires; Acquisition of Saehan Recycle for circular economy. |

| Strategic M&A | - | Complete absorption of P&O Chemical to verticalize production of electronic and battery materials. |

HDIN Research notes that OCI's "selection and concentration" strategy places it in a prime position to capitalize on the recovery of the semiconductor cycle and the long-term growth of the EV battery market.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

Contact: sales@hdinresearch.com