Global ADC Drug Market Poised for Commercial Explosion: Market Size Projected to Surpass $22-32 Billion at 2026

Date : 2026-02-11

Reading : 392

The global Antibody-Drug Conjugate (ADC) market is currently undergoing a significant transition from a phase of technological platform formation to a period of comprehensive commercial acceleration. According to the latest market analysis by HDIN Research, the sector is experiencing a "second wave" of product launches that is reshaping the oncology landscape.

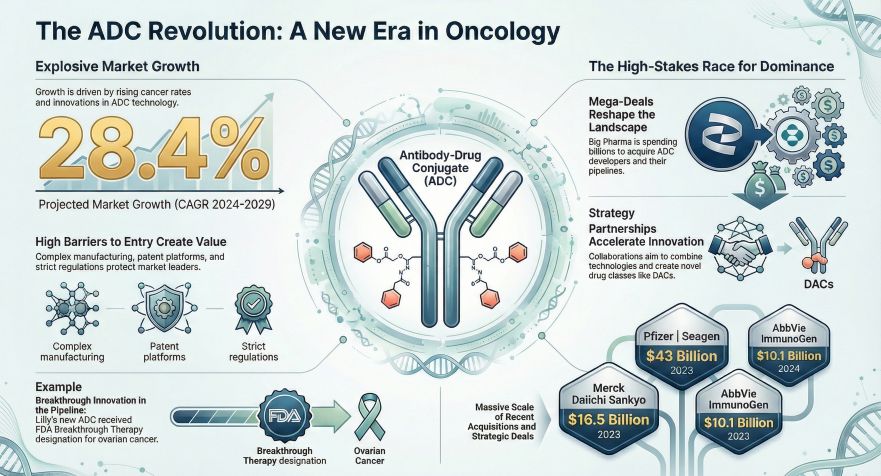

Figure The Antibody-Drug Conjugate (ADC) Revolution A New Era in oncology

Market Scale and Growth Trajectory

Market Scale and Growth Trajectory

The market for ADCs, often referred to as "biological missiles" for their precision targeting capabilities, has shown exponential growth since 2021. Data indicates that the global market size stood at approximately $10.4 billion in 2023 and is estimated to reach between $22 billion and $32 billion in 2026. This surge is primarily driven by the rapid market penetration of blockbuster drugs such as Enhertu, Padcev, and Trodelvy.

Strategic Shifts: M&A and Cross-Border Licensing

The competitive landscape has shifted from internal R&D to aggressive mergers and acquisitions (M&A) and strategic licensing. Multinational pharmaceutical companies are heavily investing to secure dominant positions. Notable transactions include Pfizer’s $43 billion acquisition of Seagen and AbbVie’s $10.1 billion purchase of ImmunoGen. These deals highlight a trend where major players are acquiring established technology platforms to fill pipeline gaps caused by patent expirations.

A significant development in this period is the rise of Chinese pharmaceutical companies as a global "innovation granary." Since 2024, the number of ADC pipelines in China has surpassed that of the United States. Chinese firms such as Kelun-Biotech, Hengrui Medicine, and Baili Tianheng (SystImmune) have become active in out-licensing, providing best-in-class assets to global partners like Merck (MSD) and Bristol Myers Squibb (BMS).

Technological Evolution and Competitive Barriers

The industry is moving beyond simple target discovery to compete on manufacturing complexity, proprietary technology platforms, and clinical differentiation. The emergence of Bispecific ADCs (BsADC) represents the next frontier. By targeting two different antigens, BsADCs aim to overcome tumor heterogeneity and reduce resistance, offering a "dual-lock" mechanism that enhances safety by minimizing off-target toxicity.

However, barriers to entry remain high. The complex manufacturing process (CMC) involving antibodies, linkers, and cytotoxins requires high-containment facilities, creating a natural moat against biosimilar competition. Furthermore, regulatory bodies like the FDA are enforcing stricter dose optimization standards (Project Optimus), increasing the cost and time required for clinical development.

Key Market Players and Strategic Status

The following table summarizes the status of key enterprises leading the global ADC sector as of early 2026:

Future Outlook

The period between 2025 and 2026 is viewed as a watershed moment for the industry. As the "second wave" of ADCs targets broader indications—moving from late-line to first-line therapies—the market will likely see intensified competition. Success will depend on a company's ability to navigate complex global regulations, manage supply chains for highly potent compounds, and demonstrate superior safety profiles in clinical trials.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

Contact: sales@hdinresearch.com

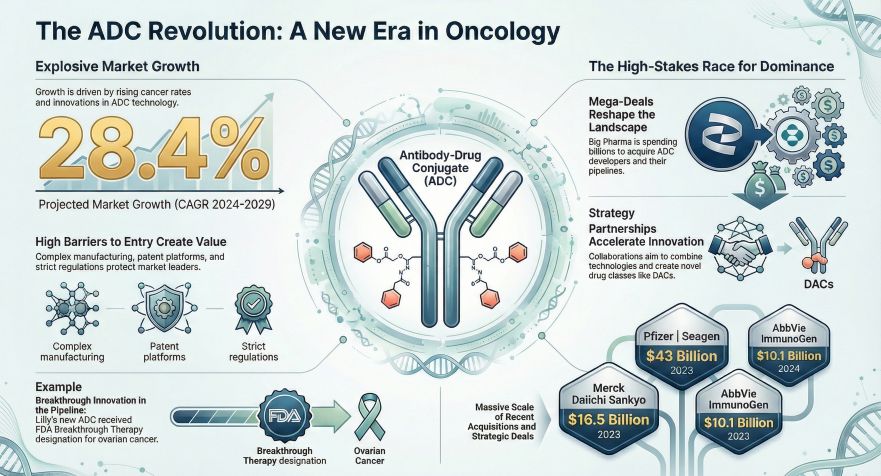

Figure The Antibody-Drug Conjugate (ADC) Revolution A New Era in oncology

Market Scale and Growth Trajectory

Market Scale and Growth TrajectoryThe market for ADCs, often referred to as "biological missiles" for their precision targeting capabilities, has shown exponential growth since 2021. Data indicates that the global market size stood at approximately $10.4 billion in 2023 and is estimated to reach between $22 billion and $32 billion in 2026. This surge is primarily driven by the rapid market penetration of blockbuster drugs such as Enhertu, Padcev, and Trodelvy.

Strategic Shifts: M&A and Cross-Border Licensing

The competitive landscape has shifted from internal R&D to aggressive mergers and acquisitions (M&A) and strategic licensing. Multinational pharmaceutical companies are heavily investing to secure dominant positions. Notable transactions include Pfizer’s $43 billion acquisition of Seagen and AbbVie’s $10.1 billion purchase of ImmunoGen. These deals highlight a trend where major players are acquiring established technology platforms to fill pipeline gaps caused by patent expirations.

A significant development in this period is the rise of Chinese pharmaceutical companies as a global "innovation granary." Since 2024, the number of ADC pipelines in China has surpassed that of the United States. Chinese firms such as Kelun-Biotech, Hengrui Medicine, and Baili Tianheng (SystImmune) have become active in out-licensing, providing best-in-class assets to global partners like Merck (MSD) and Bristol Myers Squibb (BMS).

Technological Evolution and Competitive Barriers

The industry is moving beyond simple target discovery to compete on manufacturing complexity, proprietary technology platforms, and clinical differentiation. The emergence of Bispecific ADCs (BsADC) represents the next frontier. By targeting two different antigens, BsADCs aim to overcome tumor heterogeneity and reduce resistance, offering a "dual-lock" mechanism that enhances safety by minimizing off-target toxicity.

However, barriers to entry remain high. The complex manufacturing process (CMC) involving antibodies, linkers, and cytotoxins requires high-containment facilities, creating a natural moat against biosimilar competition. Furthermore, regulatory bodies like the FDA are enforcing stricter dose optimization standards (Project Optimus), increasing the cost and time required for clinical development.

Key Market Players and Strategic Status

The following table summarizes the status of key enterprises leading the global ADC sector as of early 2026:

| Company | Representative Assets | Strategic Focus and Recent Developments |

|---|---|---|

| Daiichi Sankyo / AstraZeneca | Enhertu (HER2), Dato-DXd (TROP2) | Dominating the HER2 market with proprietary DXd platform; expanding into pan-tumor and early-line treatments. |

| Pfizer (formerly Seagen) | Adcetris, Padcev, Tivdak | Consolidating global leadership following the $43 billion acquisition; heavy focus on urothelial and lung cancers. |

| Gilead Sciences | Trodelvy (TROP2) | Expanding indications for Triple-Negative Breast Cancer (TNBC) and HR+ breast cancer. |

| Roche | Kadcyla, Polivy | Leveraging early-mover advantage; Polivy is gaining significant share in first-line DLBCL treatment. |

| Kelun-Biotech | Sac-TMT (TROP2), HER2-ADC | Rapid progression in TROP2 assets; major licensing collaboration with Merck (MSD). |

| Hengrui Medicine | SHR-A1811 (HER2), SHR-A1921 (TROP2) | Most comprehensive pipeline among Chinese firms; developing products with best-in-class potential. |

| SystImmune (Baili Tianheng) | BL-B01D1 (EGFR x HER3) | Leading the Bispecific ADC space; partnered with BMS to develop the first clinical-stage EGFRxHER3 dual-antibody ADC. |

Future Outlook

The period between 2025 and 2026 is viewed as a watershed moment for the industry. As the "second wave" of ADCs targets broader indications—moving from late-line to first-line therapies—the market will likely see intensified competition. Success will depend on a company's ability to navigate complex global regulations, manage supply chains for highly potent compounds, and demonstrate superior safety profiles in clinical trials.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

Contact: sales@hdinresearch.com