Toyobo Strategic Analysis: Financial Recovery and the Fusion of Polymer and Biotechnology for Sustainable Growth

Date : 2026-02-06

Reading : 116

Toyobo Co., Ltd., a pioneer in the Japanese materials industry with a 143-year history, is currently executing a pivotal shift from a survival-oriented mindset to a strategy focused on sustainable growth. According to the latest market assessment, the company is leveraging its unique heritage in polymer and biotechnology to address global social challenges while restoring its financial performance.

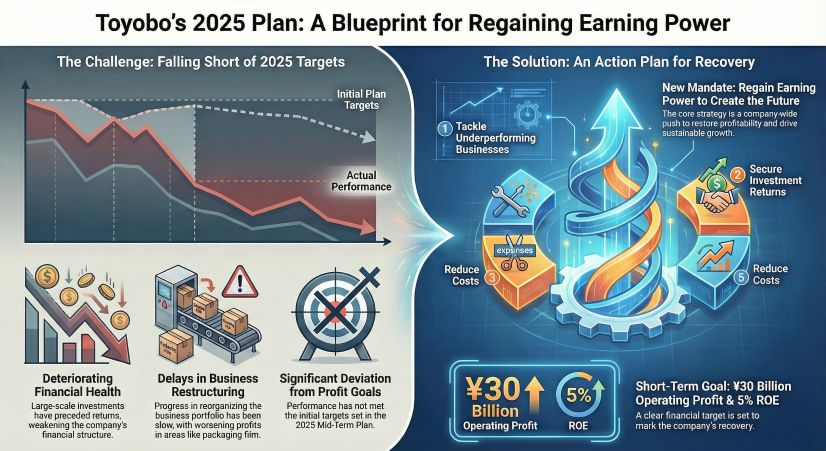

Figure Toyobo's 2025 Plan A Blueprint for Regaining Earning Power

Financial Recovery and Strategic Restructuring

Financial Recovery and Strategic Restructuring

In the first half of fiscal year 2025 (ending September 30, 2024), Toyobo demonstrated a significant rebound in profitability. While net sales saw a slight decline of 2.5 percent to 204 billion JPY, operating profit surged by 70.1 percent to 11.8 billion JPY. This recovery was primarily driven by strong demand for industrial films and improved production efficiency in the packaging film segment.

Under its Sustainable Vision 2030, Toyobo has restructured its business into four strategic quadrants. The company is prioritizing growth in high-value sectors such as industrial films and life sciences, while actively implementing a transformation strategy for underperforming segments like packaging films and non-woven fabrics. The long-term objective is to achieve net sales of 600 billion JPY and an operating profit of 50 billion JPY by 2030, with a target Return on Equity (ROE) exceeding 9 percent.

Innovation through the Fusion of Polymers and Biotechnology

The core of Toyobo's competitive advantage lies in the integration of polymer technologies, inherited from its textile origins, with advanced biotechnology. This fusion has resulted in several breakthrough products:

New Circular Plastic Solutions: Toyobo is developing 100 percent bio-based polymers, such as Polyethylene Furanoate (PEF), to reduce dependence on petroleum-based resources.

Well-Being Solutions: In the medical field, the company introduced the CATAROSEV exosome purification kit. By combining precision filtration membranes with biochemical expertise, Toyobo enables high-purity recovery of exosomes for early disease diagnosis and regenerative medicine.

Bio-based Surfactants: The company has successfully commercialized Mannosylerythritol Lipids (MEL) produced through microbial fermentation, serving as eco-friendly alternatives to traditional chemical surfactants in cosmetics and agriculture.

Decarbonization and Resource Circulation Roadmap

Toyobo has established a rigorous roadmap to achieve carbon neutrality by 2050. For the 2030 fiscal year, the company aims to reduce greenhouse gas (GHG) emissions by more than 46 percent compared to 2013 levels. Key initiatives include a transition from coal to LNG fuel at major production sites, the implementation of internal carbon pricing, and the integration of solar power across global facilities.

Furthermore, Toyobo is committed to a circular economy. In its core film business, the company targets a 60 percent green material ratio (including bio-based, recycled, or volume-reduced materials) by 2030, moving toward 100 percent by 2050. The Film-to-Film recycling model and the development of mono-material packaging are central to this resource-circulation strategy.

The Philosophy of Jun-ri-soku-yu

The ethical foundation of Toyobo's operations remains the Jun-ri-soku-yu philosophy, a motto of its founder, Eiichi Shibusawa. Translated as Adhering to reason leads to prosperity, the concept emphasizes doing what is right to enrich society, which in turn leads to corporate growth. This philosophy is modernized through a Creating Shared Value (CSV) framework, focusing on five key social issues: employee well-being, healthy living, smart communities, decarbonization, and natural environment protection.

Table Toyobo Strategic and Financial Overview

Market Outlook

Toyobo is positioned at a critical junction where significant capital investments in industrial film production lines and biotechnology facilities are beginning to yield returns. While the company faces challenges from high debt levels (D/E ratio of 1.37 in FY2024) and volatile raw material costs, its dominant market share in niche sectors like LCD protection films (60 percent share) provides a stable cash flow base. As the company continues to divest low-margin assets and accelerate its green material portfolio, HDIN Research expects a gradual recovery in its price-to-book (PBR) ratio and overall market valuation.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

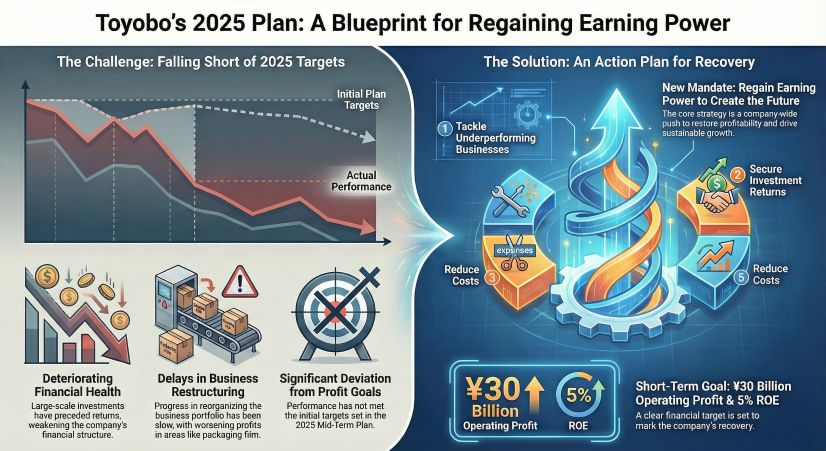

Figure Toyobo's 2025 Plan A Blueprint for Regaining Earning Power

Financial Recovery and Strategic Restructuring

Financial Recovery and Strategic RestructuringIn the first half of fiscal year 2025 (ending September 30, 2024), Toyobo demonstrated a significant rebound in profitability. While net sales saw a slight decline of 2.5 percent to 204 billion JPY, operating profit surged by 70.1 percent to 11.8 billion JPY. This recovery was primarily driven by strong demand for industrial films and improved production efficiency in the packaging film segment.

Under its Sustainable Vision 2030, Toyobo has restructured its business into four strategic quadrants. The company is prioritizing growth in high-value sectors such as industrial films and life sciences, while actively implementing a transformation strategy for underperforming segments like packaging films and non-woven fabrics. The long-term objective is to achieve net sales of 600 billion JPY and an operating profit of 50 billion JPY by 2030, with a target Return on Equity (ROE) exceeding 9 percent.

Innovation through the Fusion of Polymers and Biotechnology

The core of Toyobo's competitive advantage lies in the integration of polymer technologies, inherited from its textile origins, with advanced biotechnology. This fusion has resulted in several breakthrough products:

New Circular Plastic Solutions: Toyobo is developing 100 percent bio-based polymers, such as Polyethylene Furanoate (PEF), to reduce dependence on petroleum-based resources.

Well-Being Solutions: In the medical field, the company introduced the CATAROSEV exosome purification kit. By combining precision filtration membranes with biochemical expertise, Toyobo enables high-purity recovery of exosomes for early disease diagnosis and regenerative medicine.

Bio-based Surfactants: The company has successfully commercialized Mannosylerythritol Lipids (MEL) produced through microbial fermentation, serving as eco-friendly alternatives to traditional chemical surfactants in cosmetics and agriculture.

Decarbonization and Resource Circulation Roadmap

Toyobo has established a rigorous roadmap to achieve carbon neutrality by 2050. For the 2030 fiscal year, the company aims to reduce greenhouse gas (GHG) emissions by more than 46 percent compared to 2013 levels. Key initiatives include a transition from coal to LNG fuel at major production sites, the implementation of internal carbon pricing, and the integration of solar power across global facilities.

Furthermore, Toyobo is committed to a circular economy. In its core film business, the company targets a 60 percent green material ratio (including bio-based, recycled, or volume-reduced materials) by 2030, moving toward 100 percent by 2050. The Film-to-Film recycling model and the development of mono-material packaging are central to this resource-circulation strategy.

The Philosophy of Jun-ri-soku-yu

The ethical foundation of Toyobo's operations remains the Jun-ri-soku-yu philosophy, a motto of its founder, Eiichi Shibusawa. Translated as Adhering to reason leads to prosperity, the concept emphasizes doing what is right to enrich society, which in turn leads to corporate growth. This philosophy is modernized through a Creating Shared Value (CSV) framework, focusing on five key social issues: employee well-being, healthy living, smart communities, decarbonization, and natural environment protection.

Table Toyobo Strategic and Financial Overview

| Category | Metric | Details |

|---|---|---|

| Financial Performance (H1 FY2025) | Operating Profit | 11.8 billion JPY (70.1% year-on-year increase) |

| Growth Strategy | Business Quadrants | Focus on expanding Films and Life Sciences; Transforming Packaging Films. |

| Sustainability Target (2030) | GHG Reduction | 46% reduction vs. 2013; 60% green material ratio for films. |

| Innovation Focus | Technology Fusion | Polymer + Biotechnology (PEF, MEL, Exosome purification). |

| Long-term Goal (2030) | Profitability | Target 50 billion JPY operating profit; ROE over 9%. |

Toyobo is positioned at a critical junction where significant capital investments in industrial film production lines and biotechnology facilities are beginning to yield returns. While the company faces challenges from high debt levels (D/E ratio of 1.37 in FY2024) and volatile raw material costs, its dominant market share in niche sectors like LCD protection films (60 percent share) provides a stable cash flow base. As the company continues to divest low-margin assets and accelerate its green material portfolio, HDIN Research expects a gradual recovery in its price-to-book (PBR) ratio and overall market valuation.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com