LOTTE Chemical Strategic Transformation Toward Battery Materials and Hydrogen Energy under Green Promise 2030

Date : 2026-02-06

Reading : 107

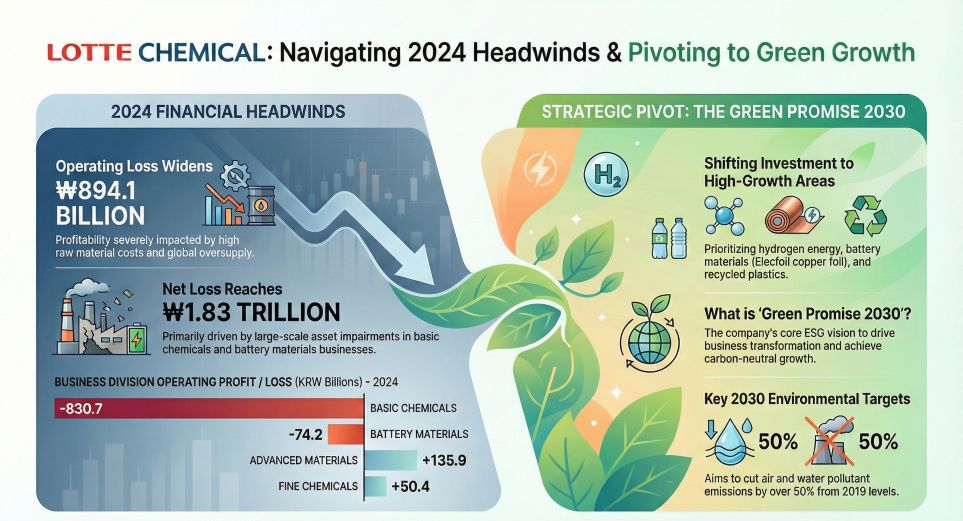

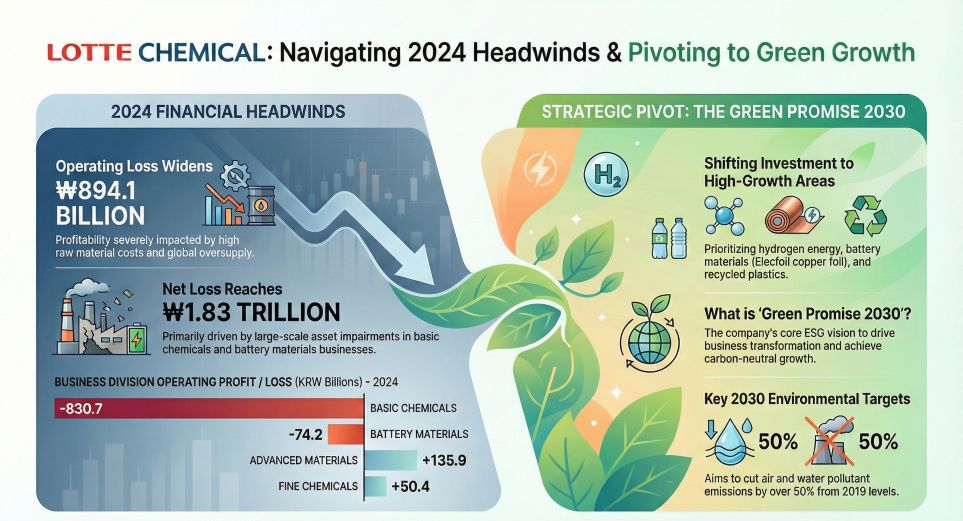

LOTTE Chemical is currently executing a large-scale strategic pivot as it moves away from its traditional role as a commodity petrochemical manufacturer toward becoming a leader in green and high-value materials. This transformation, centered on the Green Promise 2030 vision, involves significant asset restructuring, cross-border acquisitions, and vertical integration across the battery and hydrogen energy sectors.

Figure LOTTE CHEMICAL Navigating 2024 Headwinds & Pivoting to Green Growth

Strategic Breakthrough in Battery Materials

Strategic Breakthrough in Battery Materials

The cornerstone of the LOTTE Chemical transition is its dominance in the secondary battery materials market. This was catalyzed by the acquisition of Lotte Energy Materials (formerly Iljin Materials), which provided the group with world-class production capabilities for copper foil (Elecfoil), a critical component for battery anodes.

To meet the surging demand in North America and Europe, the company is expanding its global production footprint. Key projects include a 50,000-ton capacity electrolytic copper foil plant in Malaysia and ongoing investments in Spain. Beyond copper foil, the LOTTE Chemical R&D centers are developing next-generation materials, including solid-state electrolytes, silicon anode materials, and organic solvents for electrolytes, ensuring a presence in future battery technology cycles.

Building a Comprehensive Hydrogen Ecosystem

The hydrogen strategy for LOTTE Chemical covers the entire value chain from production to application. The company aims to secure a supply of 600,000 tons of clean hydrogen by 2030, increasing to 1.8 million tons by 2035. This supply will be supported by low-carbon supply chains in the United States, Malaysia, and India.

Technological innovation is a major driver in this sector. LOTTE Chemical has developed a proprietary dry-winding technology for ultra-light composite hydrogen tanks, which recently received EU ECE R134 certification. Mass production at the Incheon plant is expected between 2026 and 2027, targeting the fuel cell electric vehicle (FCEV) market. Additionally, the group is involved in hydrogen fuel cell power generation through joint ventures in Ulsan.

Financial Performance and Proactive Liquidity Management

The fiscal year 2024 was a period of consolidation and adjustment for LOTTE Chemical. The company reported a revenue of 20.43 trillion KRW, a 2.4 percent increase year-on-year. However, it recorded an operating loss of 894.1 billion KRW and a net loss of 1.83 trillion KRW. These losses were largely driven by massive asset impairment charges related to LC Titan and Lotte Energy Materials, reflecting a conservative assessment of the current electric vehicle market slowdown and global oversupply in petrochemicals.

To fund its transition and maintain stability, LOTTE Chemical has been divesting non-core assets, such as its shares in Lotte Chemical Pakistan (LC PL) and several subsidiaries in China. The company also demonstrated strong financial resilience by securing waivers for debt covenants and utilizing innovative financing methods like Price Return Swaps (PRS) to secure liquidity without losing operational control of key subsidiaries.

Green Promise 2030 ESG Objectives

The Green Promise 2030 initiative integrates ESG goals directly into the corporate growth strategy. Key targets include:

1. Carbon Neutrality: Reducing carbon emissions by 25 percent by 2030 relative to the 2019 peak, with a target of net-zero emissions by 2050.

2. Resource Circulation: Aiming to sell over 1 million tons of recycled plastic products annually by 2030.

3. Environmental Management: Reducing air and water pollutant emissions by 50 percent compared to 2019 levels.

Table Summary of LOTTE Chemical Key Operational Data

Market Outlook

Market analysts view 2024 as a turning point for LOTTE Chemical, during which it proactively addressed the burdens of its traditional petrochemical assets to reshape its capital structure. While short-term financial indicators are under pressure, the strategic positioning in the hydrogen value chain and high-output copper foil business provides a strong foundation for a performance recovery starting in 2026 as new capacities become operational.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Figure LOTTE CHEMICAL Navigating 2024 Headwinds & Pivoting to Green Growth

Strategic Breakthrough in Battery Materials

Strategic Breakthrough in Battery MaterialsThe cornerstone of the LOTTE Chemical transition is its dominance in the secondary battery materials market. This was catalyzed by the acquisition of Lotte Energy Materials (formerly Iljin Materials), which provided the group with world-class production capabilities for copper foil (Elecfoil), a critical component for battery anodes.

To meet the surging demand in North America and Europe, the company is expanding its global production footprint. Key projects include a 50,000-ton capacity electrolytic copper foil plant in Malaysia and ongoing investments in Spain. Beyond copper foil, the LOTTE Chemical R&D centers are developing next-generation materials, including solid-state electrolytes, silicon anode materials, and organic solvents for electrolytes, ensuring a presence in future battery technology cycles.

Building a Comprehensive Hydrogen Ecosystem

The hydrogen strategy for LOTTE Chemical covers the entire value chain from production to application. The company aims to secure a supply of 600,000 tons of clean hydrogen by 2030, increasing to 1.8 million tons by 2035. This supply will be supported by low-carbon supply chains in the United States, Malaysia, and India.

Technological innovation is a major driver in this sector. LOTTE Chemical has developed a proprietary dry-winding technology for ultra-light composite hydrogen tanks, which recently received EU ECE R134 certification. Mass production at the Incheon plant is expected between 2026 and 2027, targeting the fuel cell electric vehicle (FCEV) market. Additionally, the group is involved in hydrogen fuel cell power generation through joint ventures in Ulsan.

Financial Performance and Proactive Liquidity Management

The fiscal year 2024 was a period of consolidation and adjustment for LOTTE Chemical. The company reported a revenue of 20.43 trillion KRW, a 2.4 percent increase year-on-year. However, it recorded an operating loss of 894.1 billion KRW and a net loss of 1.83 trillion KRW. These losses were largely driven by massive asset impairment charges related to LC Titan and Lotte Energy Materials, reflecting a conservative assessment of the current electric vehicle market slowdown and global oversupply in petrochemicals.

To fund its transition and maintain stability, LOTTE Chemical has been divesting non-core assets, such as its shares in Lotte Chemical Pakistan (LC PL) and several subsidiaries in China. The company also demonstrated strong financial resilience by securing waivers for debt covenants and utilizing innovative financing methods like Price Return Swaps (PRS) to secure liquidity without losing operational control of key subsidiaries.

Green Promise 2030 ESG Objectives

The Green Promise 2030 initiative integrates ESG goals directly into the corporate growth strategy. Key targets include:

1. Carbon Neutrality: Reducing carbon emissions by 25 percent by 2030 relative to the 2019 peak, with a target of net-zero emissions by 2050.

2. Resource Circulation: Aiming to sell over 1 million tons of recycled plastic products annually by 2030.

3. Environmental Management: Reducing air and water pollutant emissions by 50 percent compared to 2019 levels.

Table Summary of LOTTE Chemical Key Operational Data

| Business Segment | Key Products | 2024 Performance | Strategic Focus |

|---|---|---|---|

| Basic Chemicals | Ethylene, PE, PP, BTX | Operating margin of -6.0% due to cyclical downturn | Scaling Southeast Asian production via Indonesia cracking project |

| Advanced Materials | ABS, PC, Engineered Stone | Operating margin of 2.5% | Specialization in IT and automotive high-value plastics |

| Fine Chemicals | ECH, Caustic Soda, Cellulose | Operating margin of 3.0% | High-margin growth in pharmaceutical and construction applications |

| Battery Materials | Copper Foil (Elecfoil) | Expanding overseas capacity (Malaysia/Spain) | Deep integration with global battery manufacturers (LGES, Samsung SDI) |

Market analysts view 2024 as a turning point for LOTTE Chemical, during which it proactively addressed the burdens of its traditional petrochemical assets to reshape its capital structure. While short-term financial indicators are under pressure, the strategic positioning in the hydrogen value chain and high-output copper foil business provides a strong foundation for a performance recovery starting in 2026 as new capacities become operational.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com