AI-Driven Energy Supercycle: Siemens Energy vs. GE Vernova Market Analysis

Date : 2026-02-05

Reading : 180

The explosive growth of Artificial Intelligence (AI) and the subsequent expansion of data centers have fundamentally altered the trajectory of the global energy sector. According to the latest analysis by HDIN Research, this demand has triggered a "Supercycle" for power infrastructure, acting as the core driver for surging orders at industry giants Siemens Energy and GE Vernova.

As an independent third-party consulting firm, HDIN Research has conducted a comprehensive review of the Fiscal Year 2025 (FY25) financial reports and strategic roadmaps of both companies. The findings indicate that while both entities are capitalizing on the electrification boom, they are adopting distinct strategic approaches to capture market share.

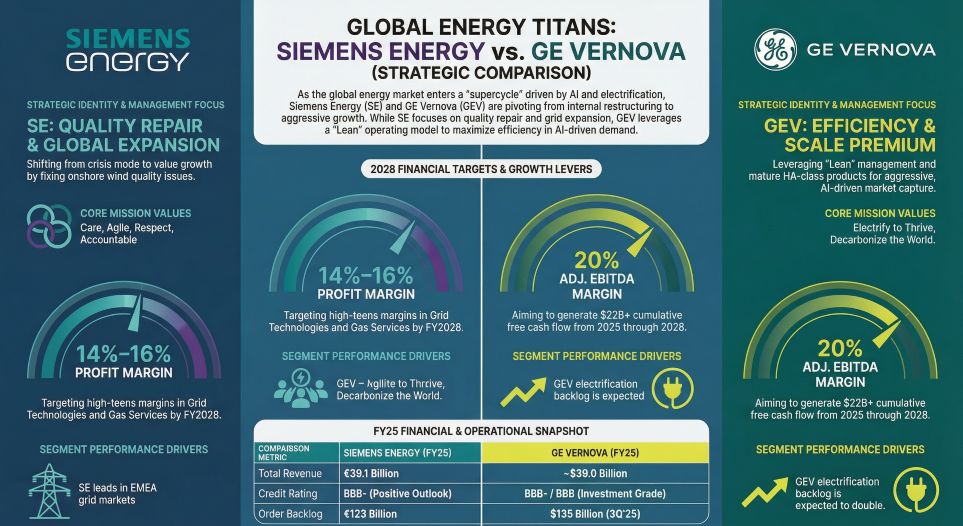

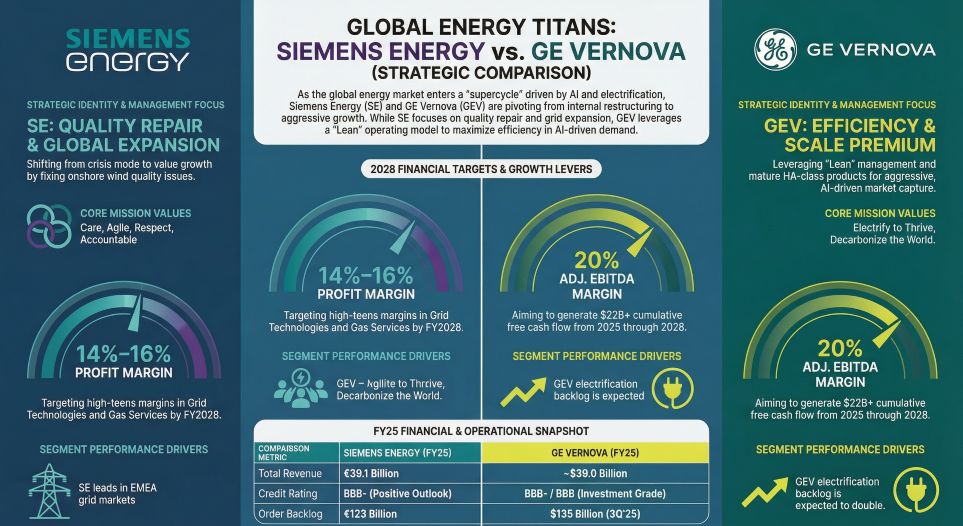

Figure Energy Titans (Siemens Energy & GE Vernova) Competitive_Strategy

The AI Catalyst: From Turbines to Grid Software

The AI Catalyst: From Turbines to Grid Software

The surge in computational power required for AI model training and inference has created an unprecedented demand for reliable, 24/7 electricity (baseload power) and modernized grid infrastructure.

For Siemens Energy, the impact is visible across the entire value chain. In FY25, the company reported a doubling of gas turbine orders, reaching approximately 200 units. A notable example is the Williams data center project in the United States, which ordered 5 GW of power generation equipment to support AI operations. Furthermore, the company expects orders directly related to data centers within its Grid Technologies division to quadruple by fiscal year 2028 compared to FY25 levels.

GE Vernova (GEV) views this trend as a structural shift. Management has positioned the company to serve these "Hyperscalers," resulting in a record-breaking volume of direct orders in Q4 2025. GEV reports substantial demand for transformers, switchgear, and synchronous condensers. The company projects that its Electrification backlog will double over the next three years, driven by the need to connect data centers to the grid efficiently.

Financial and Operational Contrast

While both companies are beneficiaries of the current market environment, their financial structures and operational strategies differ. Siemens Energy is focusing on a recovery trajectory marked by quality control and technical depth, whereas GE Vernova is leveraging a "Lean" management philosophy to maximize margins.

The following table summarizes the key comparative metrics for FY25 as analyzed by HDIN Research:

Table Key Performance Indicators and Strategic Focus (FY25 Analysis)

Strategic Divergence: Solutions vs. Standardization

HDIN Research notes a clear divergence in how these giants are approaching the market.

Siemens Energy is playing the "Solutions" card. The company is heavily investing in expanding its manufacturing capacity for transformers and grid technology, anticipating a long-term deficit in supply. Their strategy emphasizes complex, turnkey engineering projects, particularly in Europe and the Middle East, such as HVDC interconnectors. Their focus on "Blue Portfolio" technology aims to capture the premium market for environmentally friendly grid equipment.

GE Vernova is playing the "Standardization" card. Under its spin-off structure, GEV is aggressively pursuing operational efficiency. By narrowing its focus to high-demand "Workhorse" products and acquiring the remaining stake in Prolec GE, GEV aims to dominate the North American transformer market through scale. Their strategy also heavily emphasizes "Orchestration," utilizing software like GridOS to help data centers manage power loads dynamically.

Conclusion

The analysis by HDIN Research concludes that the AI-driven energy demand is not a temporary spike but a structural change providing 5 to 10 years of revenue visibility for the sector.

Both Siemens Energy and GE Vernova have successfully pivoted from hardware manufacturers to critical infrastructure partners for the digital economy. For investors and enterprise clients, the choice between the two lies in their geographic footprints and strategic preferences: Siemens Energy offers deep technical expertise and global project capability, while GE Vernova offers operational efficiency and strong exposure to the high-growth North American market.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

As an independent third-party consulting firm, HDIN Research has conducted a comprehensive review of the Fiscal Year 2025 (FY25) financial reports and strategic roadmaps of both companies. The findings indicate that while both entities are capitalizing on the electrification boom, they are adopting distinct strategic approaches to capture market share.

Figure Energy Titans (Siemens Energy & GE Vernova) Competitive_Strategy

The AI Catalyst: From Turbines to Grid Software

The AI Catalyst: From Turbines to Grid SoftwareThe surge in computational power required for AI model training and inference has created an unprecedented demand for reliable, 24/7 electricity (baseload power) and modernized grid infrastructure.

For Siemens Energy, the impact is visible across the entire value chain. In FY25, the company reported a doubling of gas turbine orders, reaching approximately 200 units. A notable example is the Williams data center project in the United States, which ordered 5 GW of power generation equipment to support AI operations. Furthermore, the company expects orders directly related to data centers within its Grid Technologies division to quadruple by fiscal year 2028 compared to FY25 levels.

GE Vernova (GEV) views this trend as a structural shift. Management has positioned the company to serve these "Hyperscalers," resulting in a record-breaking volume of direct orders in Q4 2025. GEV reports substantial demand for transformers, switchgear, and synchronous condensers. The company projects that its Electrification backlog will double over the next three years, driven by the need to connect data centers to the grid efficiently.

Financial and Operational Contrast

While both companies are beneficiaries of the current market environment, their financial structures and operational strategies differ. Siemens Energy is focusing on a recovery trajectory marked by quality control and technical depth, whereas GE Vernova is leveraging a "Lean" management philosophy to maximize margins.

The following table summarizes the key comparative metrics for FY25 as analyzed by HDIN Research:

Table Key Performance Indicators and Strategic Focus (FY25 Analysis)

| Metric | Siemens Energy | GE Vernova |

|---|---|---|

| Primary Growth Engine | Grid Technologies (HVDC and Offshore connection solutions) | Electrification Segment and high-margin Gas Power services |

| Order Drivers | European grid modernization and global turnkey projects | North American demand, specifically from Hyperscalers and grid resilience projects |

| Operational Strategy | Technical differentiation (Blue Portfolio / SF6-free) and stabilizing the Wind division | "Lean" operating model focused on "Workhorse" products to reduce complexity and cost |

| Future Outlook | Targets 18-20% profit margins in Grid Technologies by 2028 | Targets 20% Adjusted EBITDA margins by 2028, driven by scale and software |

HDIN Research notes a clear divergence in how these giants are approaching the market.

Siemens Energy is playing the "Solutions" card. The company is heavily investing in expanding its manufacturing capacity for transformers and grid technology, anticipating a long-term deficit in supply. Their strategy emphasizes complex, turnkey engineering projects, particularly in Europe and the Middle East, such as HVDC interconnectors. Their focus on "Blue Portfolio" technology aims to capture the premium market for environmentally friendly grid equipment.

GE Vernova is playing the "Standardization" card. Under its spin-off structure, GEV is aggressively pursuing operational efficiency. By narrowing its focus to high-demand "Workhorse" products and acquiring the remaining stake in Prolec GE, GEV aims to dominate the North American transformer market through scale. Their strategy also heavily emphasizes "Orchestration," utilizing software like GridOS to help data centers manage power loads dynamically.

Conclusion

The analysis by HDIN Research concludes that the AI-driven energy demand is not a temporary spike but a structural change providing 5 to 10 years of revenue visibility for the sector.

Both Siemens Energy and GE Vernova have successfully pivoted from hardware manufacturers to critical infrastructure partners for the digital economy. For investors and enterprise clients, the choice between the two lies in their geographic footprints and strategic preferences: Siemens Energy offers deep technical expertise and global project capability, while GE Vernova offers operational efficiency and strong exposure to the high-growth North American market.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com