AI Power Crunch and Grid Modernization: Chinese Transformer Manufacturers Bridge the Global Supply Gap

Date : 2026-02-13

Reading : 174

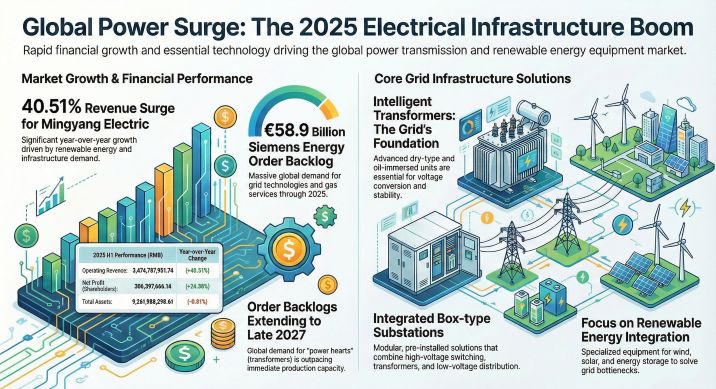

The global power infrastructure sector is currently facing a "Supercycle" driven by two simultaneous forces: the explosive energy demand of Artificial Intelligence (AI) data centers and the urgent need for grid modernization in developed economies. According to the latest industry analysis by HDIN Research, this surge has created a critical supply-demand imbalance in Western markets, positioning Chinese transformer manufacturers as essential hubs in the global supply chain.

Figure Global Power Surge The 2025 Electrical Infrastructure Boom

The Global Bottleneck: A Crisis of Delivery

The Global Bottleneck: A Crisis of Delivery

The rapid expansion of AI computing power has turned the humble transformer into a scarce strategic asset. HDIN Research data indicates that in the North American market, the delivery cycle for large-scale power transformers has extended dramatically. From a standard 50 weeks in 2021, lead times have stretched to approximately 120 weeks by late 2023, with some specific high-voltage models facing delays of up to 210 weeks.

This bottleneck is exacerbated by a lack of local manufacturing capacity. The United States, for instance, relies on imports for approximately 80% of its transformer needs. Furthermore, the supply of Grain Oriented Electrical Steel (GOES), a critical raw material, is heavily constrained globally, with China controlling a significant portion of the production capacity.

The Chinese Advantage: Speed and Scale

While Western manufacturers struggle with backlogs extending into 2027, Chinese enterprises have transitioned from being "scale followers" to "delivery leaders." China currently holds approximately 60% of the global transformer production capacity.

Crucially, the delivery cycle for top-tier Chinese manufacturers is estimated to be less than one-fifth of their European and American counterparts. This "China Speed," underpinned by a complete and autonomous domestic supply chain ranging from copper smelting to insulation manufacturing, has allowed Chinese firms to secure a massive influx of overseas orders. In 2025 alone, China's total export value of transformers reached 64.6 billion RMB, a year-on-year increase of nearly 36%.

Technology Leap: The Solid-State Transformer (SST)

Beyond manufacturing scale, Chinese companies are pioneering advanced technologies specifically designed for the AI era. Traditional transformers are bulky and heavy, but the new generation of Solid-State Transformers (SST) offers a revolutionary solution for modern data centers.

HDIN Research highlights that SSTs using high-frequency power electronic technology can reduce volume and weight by approximately 15%, freeing up valuable space for high-density IT racks. More importantly, SSTs are natively compatible with the 800V DC architecture required by next-generation AI clusters, offering millisecond-level dynamic response to load fluctuations. Leading players like Jinpan Technology have already successfully developed 10kV/2.4MW SST prototypes, positioning them at the technological high ground of the AIDC (AI Data Center) supply chain.

Key Market Players and Strategic Positioning

HDIN Research has identified several key Chinese enterprises that have successfully integrated into the global supply chain, supplying major clients like GE, Vestas, and global hyperscalers.

Table: Core Competitive Strengths of Leading Chinese Transformer Manufacturers

Analyst Outlook: From Export to Localization

The analysis by HDIN Research concludes that Chinese transformer enterprises have evolved beyond being simple exporters. Faced with geopolitical trade barriers and tariffs, leading firms are accelerating their "Global Manufacturing" strategies. By establishing production capacities in regions like Mexico and Southeast Asia, these companies are successfully circumventing trade restrictions while maintaining their core advantages in technology and supply chain efficiency.

As the global power grid undergoes its most significant overhaul in decades, the combination of massive capacity, technological innovation in SSTs, and rapid delivery capabilities has solidified China's position as the central hub of the global power equipment industry.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

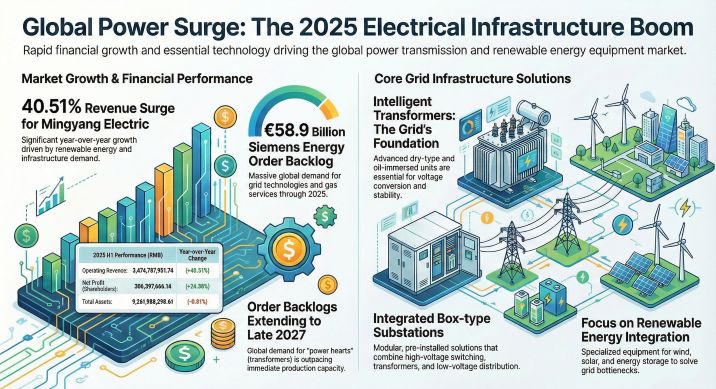

Figure Global Power Surge The 2025 Electrical Infrastructure Boom

The Global Bottleneck: A Crisis of Delivery

The Global Bottleneck: A Crisis of DeliveryThe rapid expansion of AI computing power has turned the humble transformer into a scarce strategic asset. HDIN Research data indicates that in the North American market, the delivery cycle for large-scale power transformers has extended dramatically. From a standard 50 weeks in 2021, lead times have stretched to approximately 120 weeks by late 2023, with some specific high-voltage models facing delays of up to 210 weeks.

This bottleneck is exacerbated by a lack of local manufacturing capacity. The United States, for instance, relies on imports for approximately 80% of its transformer needs. Furthermore, the supply of Grain Oriented Electrical Steel (GOES), a critical raw material, is heavily constrained globally, with China controlling a significant portion of the production capacity.

The Chinese Advantage: Speed and Scale

While Western manufacturers struggle with backlogs extending into 2027, Chinese enterprises have transitioned from being "scale followers" to "delivery leaders." China currently holds approximately 60% of the global transformer production capacity.

Crucially, the delivery cycle for top-tier Chinese manufacturers is estimated to be less than one-fifth of their European and American counterparts. This "China Speed," underpinned by a complete and autonomous domestic supply chain ranging from copper smelting to insulation manufacturing, has allowed Chinese firms to secure a massive influx of overseas orders. In 2025 alone, China's total export value of transformers reached 64.6 billion RMB, a year-on-year increase of nearly 36%.

Technology Leap: The Solid-State Transformer (SST)

Beyond manufacturing scale, Chinese companies are pioneering advanced technologies specifically designed for the AI era. Traditional transformers are bulky and heavy, but the new generation of Solid-State Transformers (SST) offers a revolutionary solution for modern data centers.

HDIN Research highlights that SSTs using high-frequency power electronic technology can reduce volume and weight by approximately 15%, freeing up valuable space for high-density IT racks. More importantly, SSTs are natively compatible with the 800V DC architecture required by next-generation AI clusters, offering millisecond-level dynamic response to load fluctuations. Leading players like Jinpan Technology have already successfully developed 10kV/2.4MW SST prototypes, positioning them at the technological high ground of the AIDC (AI Data Center) supply chain.

Key Market Players and Strategic Positioning

HDIN Research has identified several key Chinese enterprises that have successfully integrated into the global supply chain, supplying major clients like GE, Vestas, and global hyperscalers.

Table: Core Competitive Strengths of Leading Chinese Transformer Manufacturers

| Company Name | Core Competency | Market Strategy |

|---|---|---|

| TBEA | Ultra-High Voltage (UHV) Leadership | As a global leader in UHV transmission, TBEA dominates the large-scale grid infrastructure market. It possesses absolute authority in DC converter transformers and has a strong footprint in the "Belt and Road" energy infrastructure projects. |

| Jinpan Technology | Digital Manufacturing & SST | Leveraging fully digitized factories, Jinpan supplies global wind turbine giants (GE, Siemens Gamesa). It is aggressively targeting the AI data center market with its Solid-State Transformer (SST) technology and has established production bases in Mexico to serve the North American market. |

| Mingyang Electric | Offshore Wind & Renewable Energy | Specialized in renewable energy, Mingyang has broken the monopoly of foreign brands in offshore wind boost transformers. Their products offer high performance at competitive costs, successfully substituting imports in high-end marine engineering. |

| Eaglerise | High-Frequency Technology & Localization | An early entrant into the US and European markets, Eaglerise supplies major photovoltaic inverter manufacturers. The company is deepening its global footprint with manufacturing expansions in Mexico and Malaysia to bypass trade barriers. |

The analysis by HDIN Research concludes that Chinese transformer enterprises have evolved beyond being simple exporters. Faced with geopolitical trade barriers and tariffs, leading firms are accelerating their "Global Manufacturing" strategies. By establishing production capacities in regions like Mexico and Southeast Asia, these companies are successfully circumventing trade restrictions while maintaining their core advantages in technology and supply chain efficiency.

As the global power grid undergoes its most significant overhaul in decades, the combination of massive capacity, technological innovation in SSTs, and rapid delivery capabilities has solidified China's position as the central hub of the global power equipment industry.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com