Strategic Transformation: Tosoh Corporation Drives Social Value and Profitability through Chemical Innovation

Date : 2026-02-11

Reading : 73

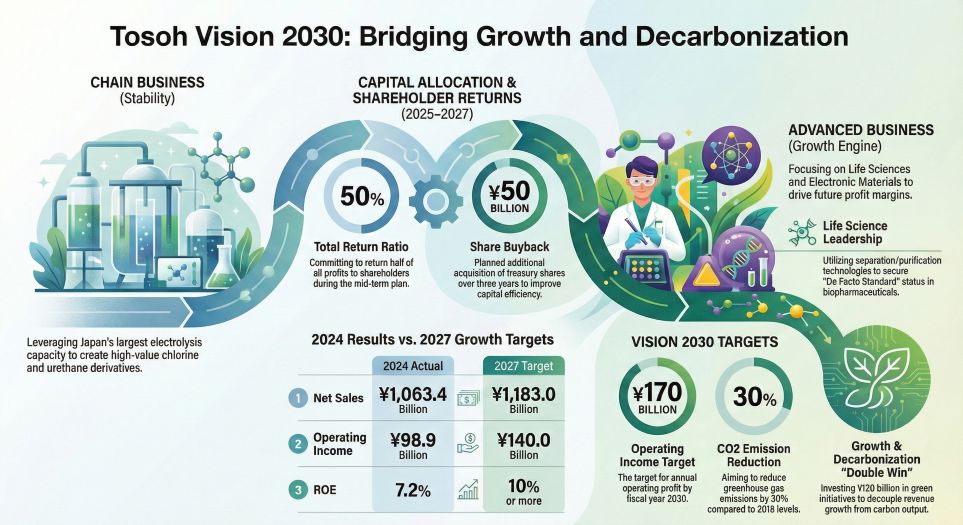

Tosoh Corporation is redefining its strategic focus as it transitions from traditional scale-based management to value-driven business models. Under its comprehensive Vision 2030 framework, the company has integrated social responsibility into its core commercial operations through the Social Issue Solutions certification system. As of the current fiscal period, Tosoh has identified 25 products that significantly contribute to solving global challenges while enhancing corporate value.

Figure Tosoh Vision 2030 Bridging Growth and Decarbonization

Strategic Pillars and Market Impact

Strategic Pillars and Market Impact

Tosoh aims to achieve an operating profit of 170 billion yen by fiscal 2030. This financial target is coupled with an ambitious environmental commitment to reduce greenhouse gas emissions by 30 percent compared to 2018 levels. To facilitate this dual goal, the company has allocated 120 billion yen toward climate change-related investments through 2030.

The Social Issue Solutions portfolio focuses on four critical domains: Medical and Life Sciences, Safety and Disaster Prevention, Environmental Protection, and Energy Efficiency.

Healthcare and Life Science Advancements

The Life Science division serves as a high-growth engine for Tosoh. Its Toyopearl series of separation and purification media has established itself as a de facto standard in the production of antibody drugs and vaccines. In clinical diagnostics, the AIA-CL series and HLC-723 series analyzers provide high-precision monitoring for oncology and diabetes management, installed in thousands of medical institutions worldwide. These products exhibit high market stickiness due to stringent medical certification requirements, ensuring long-term stable revenue streams.

Infrastructure and Disaster Resilience

Tosoh leverages its chemical expertise to enhance social safety. The Flamecut 120G brominated flame retardants prevent electrical fires in consumer electronics, while polymer MDI agents are utilized in tunnel construction to stabilize soil and prevent groundwater leakage. These solutions improve the durability of public infrastructure and protect human life in urban environments.

Decarbonization and Resource Management

A critical component of Tosoh's sustainability strategy is the transition of its energy structure. Approximately 80 percent of the company's greenhouse gas emissions originate from its in-house power generation. To address this, Tosoh is investing 40 billion yen in a biomass power facility at its Nanyang complex, scheduled for operation in April 2026. This project alone is expected to reduce CO2 emissions by 500,000 tons annually.

Furthermore, the company has implemented an Internal Carbon Pricing system, set at 6,000 yen per ton of CO2. This mechanism ensures that environmental impact is a primary consideration in all new capital expenditure decisions.

Table Key Metrics of Tosoh's Strategic Framework

Analyst Insight: Moving Toward Premium Valuation

Market consultants at HDIN Research observe that Tosoh is successfully moving away from commodity-driven price cycles. By pivoting toward the Specialty and Advanced Business segments, particularly in Life Sciences and electronic materials, the company is insulating its profit margins from the volatility of raw material costs like naphtha and coal. The focus on high-barrier products and ESG-compliant manufacturing is likely to drive an improvement in the company's Price-to-Book ratio, which has historically traded below one.

The integration of Carbon Capture and Utilization (CCU) technology at its Nanyang site, which captures 40,000 tons of CO2 annually for use as a raw material in MDI production, serves as a benchmark for circular economy practices in the global chemical industry.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

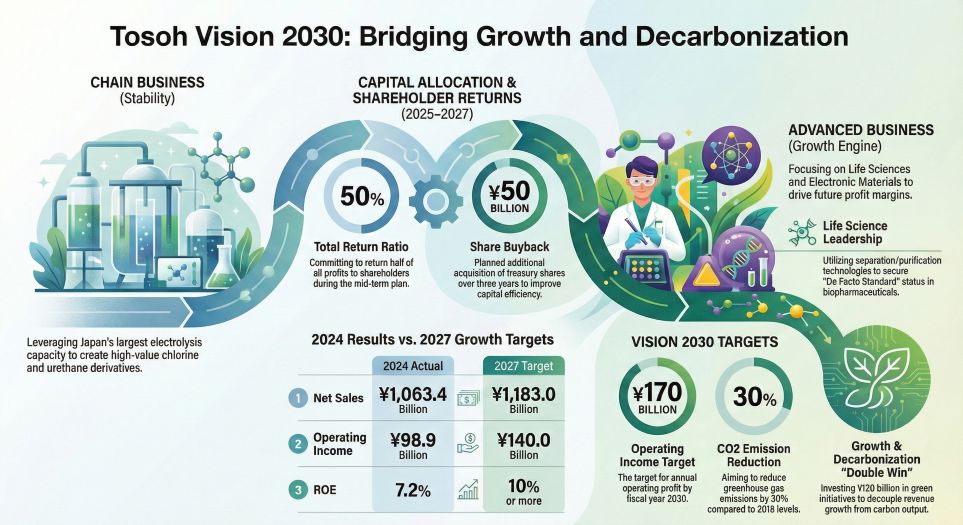

Figure Tosoh Vision 2030 Bridging Growth and Decarbonization

Strategic Pillars and Market Impact

Strategic Pillars and Market ImpactTosoh aims to achieve an operating profit of 170 billion yen by fiscal 2030. This financial target is coupled with an ambitious environmental commitment to reduce greenhouse gas emissions by 30 percent compared to 2018 levels. To facilitate this dual goal, the company has allocated 120 billion yen toward climate change-related investments through 2030.

The Social Issue Solutions portfolio focuses on four critical domains: Medical and Life Sciences, Safety and Disaster Prevention, Environmental Protection, and Energy Efficiency.

Healthcare and Life Science Advancements

The Life Science division serves as a high-growth engine for Tosoh. Its Toyopearl series of separation and purification media has established itself as a de facto standard in the production of antibody drugs and vaccines. In clinical diagnostics, the AIA-CL series and HLC-723 series analyzers provide high-precision monitoring for oncology and diabetes management, installed in thousands of medical institutions worldwide. These products exhibit high market stickiness due to stringent medical certification requirements, ensuring long-term stable revenue streams.

Infrastructure and Disaster Resilience

Tosoh leverages its chemical expertise to enhance social safety. The Flamecut 120G brominated flame retardants prevent electrical fires in consumer electronics, while polymer MDI agents are utilized in tunnel construction to stabilize soil and prevent groundwater leakage. These solutions improve the durability of public infrastructure and protect human life in urban environments.

Decarbonization and Resource Management

A critical component of Tosoh's sustainability strategy is the transition of its energy structure. Approximately 80 percent of the company's greenhouse gas emissions originate from its in-house power generation. To address this, Tosoh is investing 40 billion yen in a biomass power facility at its Nanyang complex, scheduled for operation in April 2026. This project alone is expected to reduce CO2 emissions by 500,000 tons annually.

Furthermore, the company has implemented an Internal Carbon Pricing system, set at 6,000 yen per ton of CO2. This mechanism ensures that environmental impact is a primary consideration in all new capital expenditure decisions.

Table Key Metrics of Tosoh's Strategic Framework

| Category / Metric or Objective | Target / Value |

|---|---|

| Operating Profit Target (Vision 2030) | 170 billion yen |

| GHG Reduction Target (Scope 1 and 2) | 30% by 2030 (vs. 2018 baseline) |

| Total Climate Change Investment | 120 billion yen by 2030 |

| Social Issue Solutions Certified | 25 products |

| Internal Carbon Pricing | 6,000 yen per ton of CO₂ |

| ROE Target | 10% or higher |

| Biomass Emission Reduction | 500,000 tons per year (starting 2026) |

Market consultants at HDIN Research observe that Tosoh is successfully moving away from commodity-driven price cycles. By pivoting toward the Specialty and Advanced Business segments, particularly in Life Sciences and electronic materials, the company is insulating its profit margins from the volatility of raw material costs like naphtha and coal. The focus on high-barrier products and ESG-compliant manufacturing is likely to drive an improvement in the company's Price-to-Book ratio, which has historically traded below one.

The integration of Carbon Capture and Utilization (CCU) technology at its Nanyang site, which captures 40,000 tons of CO2 annually for use as a raw material in MDI production, serves as a benchmark for circular economy practices in the global chemical industry.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com