AMD vs Intel 2025 AI Strategy and Market Performance Analysis

Date : 2026-02-09

Reading : 281

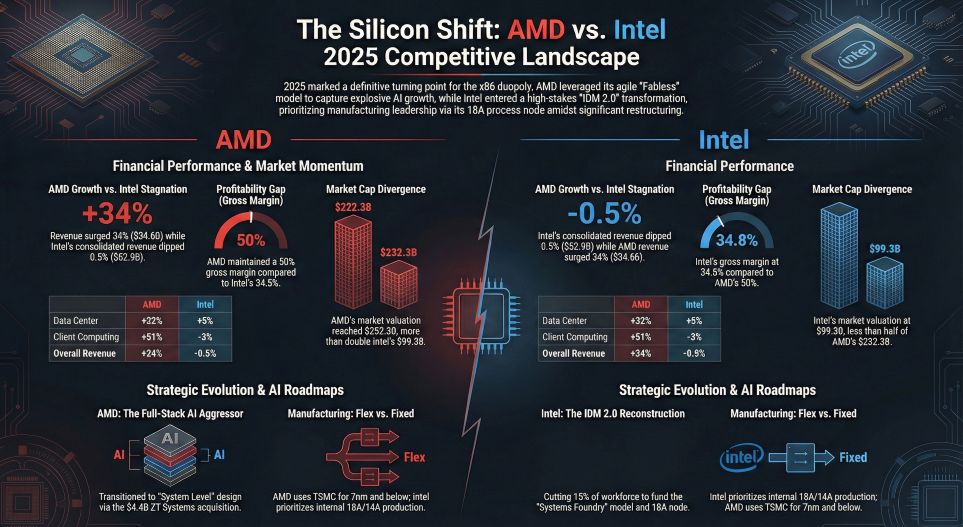

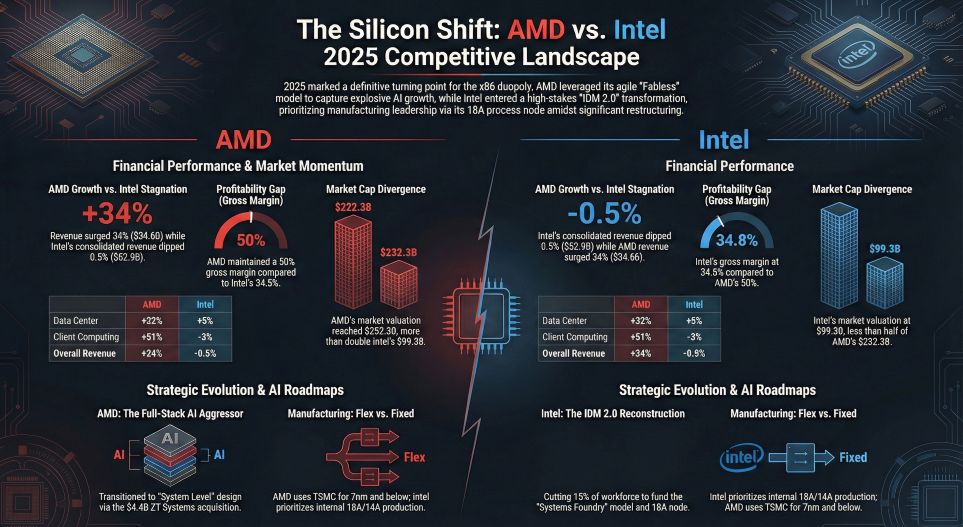

As the semiconductor industry navigates the generational shift toward artificial intelligence, the fiscal year 2025 has highlighted a significant divergence in the technical and financial strategies of the two x86 giants, AMD and Intel. According to the latest market consultation report from HDIN Research, the competition has evolved beyond traditional processor performance into a battle over full-stack AI ecosystems and next-generation manufacturing leadership.

Figure The Silicon Shift AMD vs Intel 2025 Competitive Landscape

Strategic Transformation: Design Excellence vs. Systems Foundry

Strategic Transformation: Design Excellence vs. Systems Foundry

AMD has solidified its position as a full-stack AI leader by prioritizing data center expansion and end-to-end AI infrastructure. A key milestone in its 2025 strategy was the acquisition of ZT Systems. By retaining the design business and selling the manufacturing arm to Sanmina, AMD has maintained a light-asset model while gaining the capability to deliver cloud-scale AI infrastructure. This focus on high-margin design and deep partnerships, such as its 6GW GPU capacity agreement with OpenAI, has fueled its rapid growth.

In contrast, Intel is in the midst of a profound corporate restructuring under its IDM 2.0 vision. Shifting from a product-centric company to a systems foundry, Intel is betting heavily on its 18A process node to regain technology leadership. Its strategy involves revitalizing the x86 ecosystem, expanding external foundry services, and leveraging geopolitical support through the U.S. CHIPS Act, which provided 5.7 billion dollars in accelerated funding in 2025.

Market Segment Performance: Data Centers and AI PCs

In the data center segment, AMD has demonstrated superior execution. Its Instinct MI350 and upcoming MI450 series have gained significant traction among hyperscalers. Financially, AMD data center revenue grew 32 percent year-over-year in 2025. Intel, while still holding a massive installed base with its Xeon 6 processors, faced challenges as customer budgets shifted toward GPU-heavy systems, resulting in a more modest 5 percent growth in its data center and AI segment.

The AI PC market remains a critical battlefield for both firms. AMD maintained an early-mover advantage by being the first to integrate a dedicated NPU into x86 SoCs. Its Ryzen AI 300 and 400 series target the Microsoft Copilot+ PC standard. Intel has countered with its Core Ultra series, specifically the Series 3 mobile processors built on the 18A process, aiming to reclaim the performance-per-watt crown and drive the mass adoption of AI-enabled laptops.

Financial Performance Summary FY2025

The following table summarizes the key financial metrics for AMD and Intel based on the 2025 fiscal year data:

Financial and Geopolitical Risks

Both companies faced significant headwinds due to evolving export controls. AMD recorded a net impact of 440 million dollars in inventory write-downs related to restricted AI products for the China market. Intel faced similar pressures, with its billing revenue from China accounting for 24 percent of total sales. Furthermore, Intel recorded 950 million dollars in non-cash impairments and accelerated depreciation due to underutilized manufacturing assets, highlighting the high fixed-cost risks of its IDM model.

Strategic Outlook

HDIN Research concludes that AMD is currently in a harvest phase, utilizing its agile fabless model and strong GPU roadmap to erode Intel's market share in the data center. Intel remains in a high-risk, high-reward transition phase. The success of its 18A process and its ability to attract external foundry customers will be the primary determinants of its long-term financial recovery. For enterprise clients and investors, the next 24 months will be crucial in observing whether Intel can translate its manufacturing milestones into sustainable profitability or if AMD will continue its trajectory toward AI infrastructure dominance.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Figure The Silicon Shift AMD vs Intel 2025 Competitive Landscape

Strategic Transformation: Design Excellence vs. Systems Foundry

Strategic Transformation: Design Excellence vs. Systems FoundryAMD has solidified its position as a full-stack AI leader by prioritizing data center expansion and end-to-end AI infrastructure. A key milestone in its 2025 strategy was the acquisition of ZT Systems. By retaining the design business and selling the manufacturing arm to Sanmina, AMD has maintained a light-asset model while gaining the capability to deliver cloud-scale AI infrastructure. This focus on high-margin design and deep partnerships, such as its 6GW GPU capacity agreement with OpenAI, has fueled its rapid growth.

In contrast, Intel is in the midst of a profound corporate restructuring under its IDM 2.0 vision. Shifting from a product-centric company to a systems foundry, Intel is betting heavily on its 18A process node to regain technology leadership. Its strategy involves revitalizing the x86 ecosystem, expanding external foundry services, and leveraging geopolitical support through the U.S. CHIPS Act, which provided 5.7 billion dollars in accelerated funding in 2025.

Market Segment Performance: Data Centers and AI PCs

In the data center segment, AMD has demonstrated superior execution. Its Instinct MI350 and upcoming MI450 series have gained significant traction among hyperscalers. Financially, AMD data center revenue grew 32 percent year-over-year in 2025. Intel, while still holding a massive installed base with its Xeon 6 processors, faced challenges as customer budgets shifted toward GPU-heavy systems, resulting in a more modest 5 percent growth in its data center and AI segment.

The AI PC market remains a critical battlefield for both firms. AMD maintained an early-mover advantage by being the first to integrate a dedicated NPU into x86 SoCs. Its Ryzen AI 300 and 400 series target the Microsoft Copilot+ PC standard. Intel has countered with its Core Ultra series, specifically the Series 3 mobile processors built on the 18A process, aiming to reclaim the performance-per-watt crown and drive the mass adoption of AI-enabled laptops.

Financial Performance Summary FY2025

The following table summarizes the key financial metrics for AMD and Intel based on the 2025 fiscal year data:

| Key Metrics | AMD (Group) | Intel (Group) |

|---|---|---|

| Total Revenue | 34.6 billion USD | 52.9 billion USD |

| Revenue Growth (YoY) | +34% | -0.5% |

| Gross Margin | 50.0% | 34.8% |

| Data Center Operating Margin | 21.7% | 20.2% |

| R&D Investment | 8.09 billion USD | 13.77 billion USD |

| Inventory Management | 7.92 billion USD | 11.62 billion USD |

| Total Debt | 3.3 billion USD | 46.6 billion USD |

Both companies faced significant headwinds due to evolving export controls. AMD recorded a net impact of 440 million dollars in inventory write-downs related to restricted AI products for the China market. Intel faced similar pressures, with its billing revenue from China accounting for 24 percent of total sales. Furthermore, Intel recorded 950 million dollars in non-cash impairments and accelerated depreciation due to underutilized manufacturing assets, highlighting the high fixed-cost risks of its IDM model.

Strategic Outlook

HDIN Research concludes that AMD is currently in a harvest phase, utilizing its agile fabless model and strong GPU roadmap to erode Intel's market share in the data center. Intel remains in a high-risk, high-reward transition phase. The success of its 18A process and its ability to attract external foundry customers will be the primary determinants of its long-term financial recovery. For enterprise clients and investors, the next 24 months will be crucial in observing whether Intel can translate its manufacturing milestones into sustainable profitability or if AMD will continue its trajectory toward AI infrastructure dominance.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com