Intuitive Surgical Consolidates Global Dominance in 2025 Strategic Performance Analysis by HDIN Research

Date : 2026-02-11

Reading : 139

As the global leader in robotic-assisted surgery, Intuitive Surgical has demonstrated remarkable financial resilience and technological innovation throughout the 2025 fiscal year. Based on the Harvard Financial Analytical Framework and competitive intensity matrices, HDIN Research has conducted a comprehensive evaluation of the company's strategic positioning, financial health, and future growth drivers.

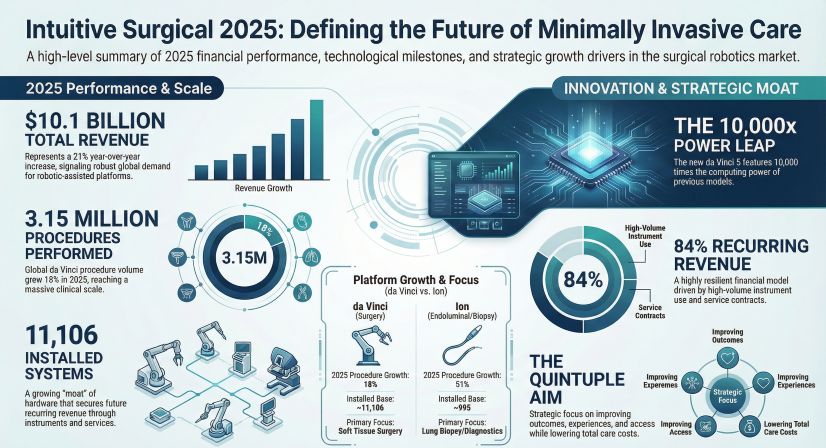

Figure Intuitive Surgical 2025 Defining the Future of Minimally Invasive Care

Financial Performance and the Recurring Revenue Shield

Financial Performance and the Recurring Revenue Shield

In 2025, Intuitive Surgical reached a significant financial milestone, with total revenue climbing to 10.1 billion dollars, representing a 21 percent increase compared to the previous year. This growth was primarily driven by a 20 percent rise in global procedure volumes, totaling approximately 3.15 million da Vinci procedures. Net income for the year reached 2.856 billion dollars, reflecting strong operating leverage and effective cost management.

A cornerstone of the company's financial stability is its recurring revenue model, often referred to as the razor and blade strategy. In 2025, recurring revenue—comprising instruments, accessories, services, and operating leases—accounted for 84 percent of total sales. This high proportion of predictable income provides Intuitive with a significant buffer against macroeconomic volatility and hospital capital expenditure cycles.

Technological Evolution: Da Vinci 5 and the Ion Platform

The launch and rapid adoption of the fifth-generation da Vinci 5 system have been the highlight of the company's 2025 product strategy. With computing power 10,000 times greater than its predecessor and the introduction of integrated force-feedback technology, the da Vinci 5 has redefined the technical boundaries of minimally invasive surgery. In 2025 alone, the company placed 870 da Vinci 5 units, indicating strong replacement demand in mature markets like the United States, Europe, and Japan.

Beyond its core surgical business, the Ion endoluminal system has emerged as a major growth engine. Focused on minimally invasive lung biopsies, Ion procedures grew by 51 percent in 2025, reaching approximately 144,100 cases. The approval and initial rollout of Ion in the Chinese market mark a critical expansion phase, positioning Intuitive to capture the diagnostic segment of the lung cancer care continuum.

Global Operations and Regulatory Landscape

While Intuitive maintains a dominant market share, its global operations are navigating a complex regulatory environment. In China, despite headwinds from healthcare anti-corruption campaigns and pricing caps on robotic procedures, the government's 2023 quota for 559 new surgical robots provides a clear roadmap for long-term growth. Furthermore, the company has successfully localized the production of da Vinci Xi systems through its joint venture with Fosun Pharma.

In Europe, the transition to the Medical Device Regulation (MDR) has created industry-wide certification bottlenecks, yet Intuitive has secured necessary approvals to continue its expansion. However, the company remains vigilant regarding geopolitical risks, specifically new tariff frameworks that increased costs by approximately 63 million dollars in 2025, particularly affecting components sourced from Mexico and China.

FY2025 Key Performance Indicators

The following table summarizes the core financial and operational data for Intuitive Surgical in the 2025 fiscal year:

Strategic Challenges and Market Outlook

Looking ahead, Intuitive Surgical faces a shifting competitive landscape. The rise of GLP-1 weight-loss medications has led to a high-single-digit decline in bariatric surgery volumes in the U.S., a trend the company is monitoring closely. Additionally, the entry of major competitors like Medtronic and Johnson and Johnson, alongside emerging domestic players in China, is intensifying pricing competition.

Despite these challenges, HDIN Research analysts believe Intuitive Surgical remains the absolute leader in the surgical robotics sector. Its focus on the Quintuple Aim—improving clinical outcomes, enhancing patient and care team experiences, reducing the total cost of care, and expanding access—continues to drive its digital ecosystem, including the My Intuitive app and AI-driven Case Insights.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

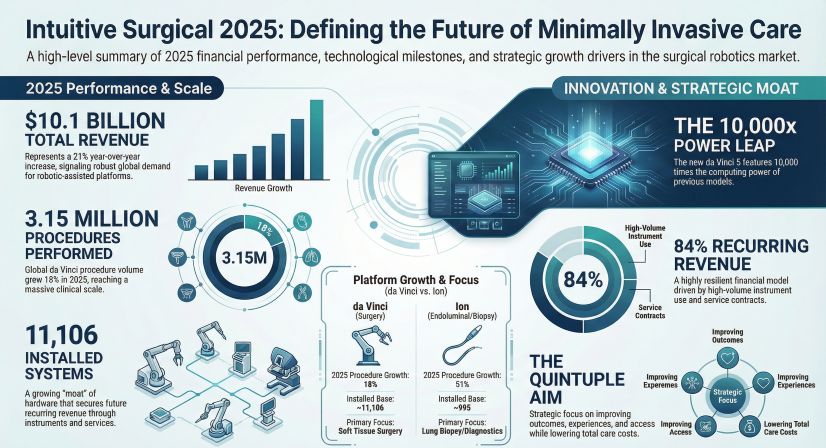

Figure Intuitive Surgical 2025 Defining the Future of Minimally Invasive Care

Financial Performance and the Recurring Revenue Shield

Financial Performance and the Recurring Revenue ShieldIn 2025, Intuitive Surgical reached a significant financial milestone, with total revenue climbing to 10.1 billion dollars, representing a 21 percent increase compared to the previous year. This growth was primarily driven by a 20 percent rise in global procedure volumes, totaling approximately 3.15 million da Vinci procedures. Net income for the year reached 2.856 billion dollars, reflecting strong operating leverage and effective cost management.

A cornerstone of the company's financial stability is its recurring revenue model, often referred to as the razor and blade strategy. In 2025, recurring revenue—comprising instruments, accessories, services, and operating leases—accounted for 84 percent of total sales. This high proportion of predictable income provides Intuitive with a significant buffer against macroeconomic volatility and hospital capital expenditure cycles.

Technological Evolution: Da Vinci 5 and the Ion Platform

The launch and rapid adoption of the fifth-generation da Vinci 5 system have been the highlight of the company's 2025 product strategy. With computing power 10,000 times greater than its predecessor and the introduction of integrated force-feedback technology, the da Vinci 5 has redefined the technical boundaries of minimally invasive surgery. In 2025 alone, the company placed 870 da Vinci 5 units, indicating strong replacement demand in mature markets like the United States, Europe, and Japan.

Beyond its core surgical business, the Ion endoluminal system has emerged as a major growth engine. Focused on minimally invasive lung biopsies, Ion procedures grew by 51 percent in 2025, reaching approximately 144,100 cases. The approval and initial rollout of Ion in the Chinese market mark a critical expansion phase, positioning Intuitive to capture the diagnostic segment of the lung cancer care continuum.

Global Operations and Regulatory Landscape

While Intuitive maintains a dominant market share, its global operations are navigating a complex regulatory environment. In China, despite headwinds from healthcare anti-corruption campaigns and pricing caps on robotic procedures, the government's 2023 quota for 559 new surgical robots provides a clear roadmap for long-term growth. Furthermore, the company has successfully localized the production of da Vinci Xi systems through its joint venture with Fosun Pharma.

In Europe, the transition to the Medical Device Regulation (MDR) has created industry-wide certification bottlenecks, yet Intuitive has secured necessary approvals to continue its expansion. However, the company remains vigilant regarding geopolitical risks, specifically new tariff frameworks that increased costs by approximately 63 million dollars in 2025, particularly affecting components sourced from Mexico and China.

FY2025 Key Performance Indicators

The following table summarizes the core financial and operational data for Intuitive Surgical in the 2025 fiscal year:

| Metric | 2025 Performance Value |

|---|---|

| Total Revenue | 10.1 billion USD |

| Net Income | 2.856 billion USD |

| Recurring Revenue Percentage | 84% |

| Total Installed Base (da Vinci) | 11,106 units |

| Annual da Vinci System Placements | 1,721 units |

| Annual da Vinci Procedures | 3.15 million |

| Ion Procedure Growth | 51% |

| Cash and Investments | 90.3 billion USD |

Looking ahead, Intuitive Surgical faces a shifting competitive landscape. The rise of GLP-1 weight-loss medications has led to a high-single-digit decline in bariatric surgery volumes in the U.S., a trend the company is monitoring closely. Additionally, the entry of major competitors like Medtronic and Johnson and Johnson, alongside emerging domestic players in China, is intensifying pricing competition.

Despite these challenges, HDIN Research analysts believe Intuitive Surgical remains the absolute leader in the surgical robotics sector. Its focus on the Quintuple Aim—improving clinical outcomes, enhancing patient and care team experiences, reducing the total cost of care, and expanding access—continues to drive its digital ecosystem, including the My Intuitive app and AI-driven Case Insights.

About HDIN Research

Profile: HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com