United Rentals 2025 Financial Analysis: Specialty Segment Drives Revenue to $16.1 Billion Despite Inflationary Headwinds

Date : 2026-02-12

Reading : 69

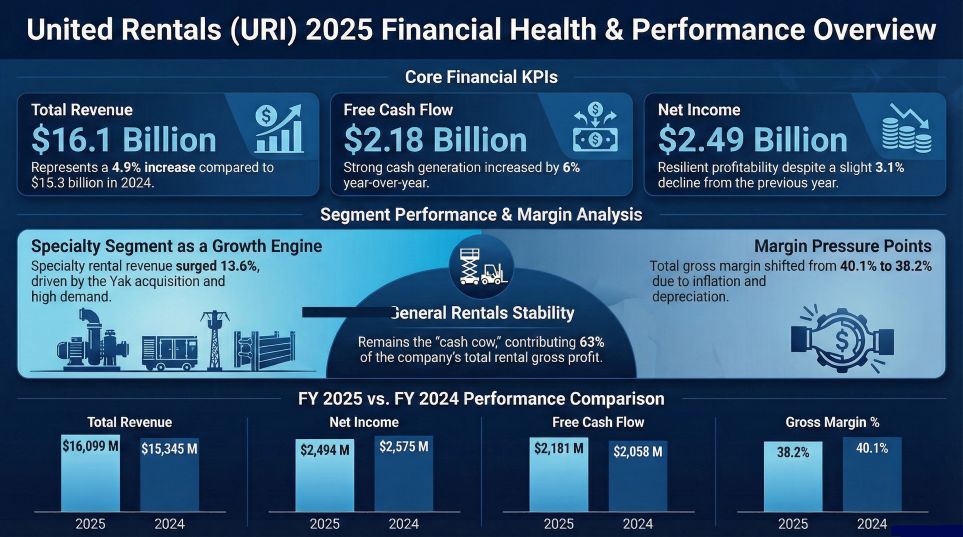

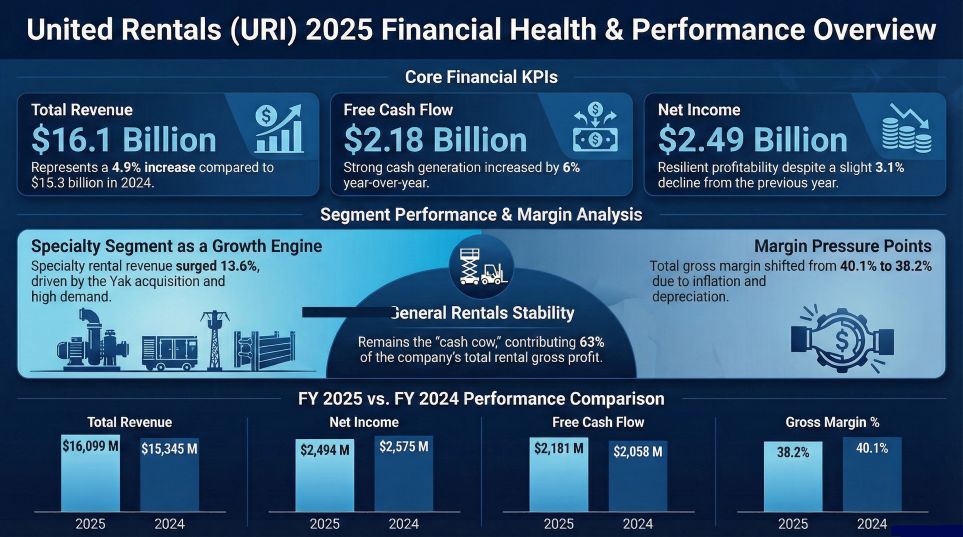

United Rentals, Inc. (URI), the global leader in the equipment rental industry, reported total revenue of $16.099 billion for the fiscal year 2025, marking a 4.9 percent year-over-year increase. According to a new analysis by HDIN Research based on the company's 2025 Annual Report (Form 10-K), the growth highlights the efficacy of the company's strategic shift toward "Total Jobsite Solutions," even as macroeconomic pressures and integration costs weighed on profit margins.

Financial Performance and Margin Analysis

The 2025 fiscal year demonstrated the resilience of the United Rentals business model amidst a complex economic environment. While top-line revenue grew, the company faced headwinds that impacted profitability. The net profit margin decreased from 16.8 percent in 2024 to 15.5 percent in 2025. HDIN Research analysts attribute this contraction primarily to increased depreciation expenses associated with fleet expansion and the inflationary costs of equipment delivery and maintenance.

Despite the margin compression, cash generation remained a stronghold for the corporation. Operating cash flow reached a robust $5.19 billion, providing substantial liquidity to support capital expenditures and shareholder returns. The company maintains a high financial leverage ratio with approximately $14.2 billion in total debt, yet its strong free cash flow of $2.18 billion ensures solvency and operational flexibility.

Figure United Rentals (URl) 2025 Financial Health & Performance Overview

Segment Performance: The Rise of Specialty Rentals

Segment Performance: The Rise of Specialty Rentals

A distinct divergence in performance was observed between the company's two primary reporting segments: General Rentals and Specialty Rentals. General Rentals remains the company's cash cow, contributing roughly 69 percent of total revenue. However, the Specialty segment has emerged as the primary growth engine, driven by the integration of the Yak acquisition and increased demand for technical solutions like trench safety and fluid management.

The following table summarizes the key performance metrics for the fiscal year 2025:

The Specialty segment achieved a rental revenue increase of 13.6 percent, significantly outpacing the 2.5 percent growth seen in General Rentals. However, the gross margin for Specialty Rentals dipped to 43.6 percent, a decline of 450 basis points, largely due to the initial depreciation load from the Yak acquisition and a shift in revenue mix toward lower-margin ancillary services.

Strategic Positioning and Digital Transformation

United Rentals continues to consolidate its market leadership, currently holding approximately 15 percent of the North American market share. The company is actively transitioning from a traditional equipment provider to a consultative partner through its "Total Jobsite Solutions" strategy. This approach leverages digital tools such as Total Control and artificial intelligence to offer customers real-time asset management and utilization tracking.

In the Frost Radar competitiveness assessment, United Rentals is positioned as a leader in innovation. The company's investment in technology aims to increase customer stickiness among large national accounts, which now represent 46 percent of rental revenues.

Risk Factors and Future Outlook

The HDIN Research analysis highlights several risk factors facing the corporation moving into 2026. The company's capital structure is sensitive to interest rate fluctuations; a one percent increase in rates could reduce annual after-tax profits by approximately $31 million. Furthermore, the company faces operational risks related to the cyclical nature of non-residential construction and the challenges of integrating large-scale acquisitions.

To mitigate these risks, management has outlined a cost reduction plan for 2026 targeting $30 million to $60 million in savings. Additionally, a new $5 billion share repurchase authorization signals management's confidence in the company's intrinsic value and future cash flow generation.

As United Rentals enters the deep waters of its digital and specialty transformation, its ability to manage high depreciation costs while capturing the higher margins of specialized services will be the defining factor of its medium-term success.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Financial Performance and Margin Analysis

The 2025 fiscal year demonstrated the resilience of the United Rentals business model amidst a complex economic environment. While top-line revenue grew, the company faced headwinds that impacted profitability. The net profit margin decreased from 16.8 percent in 2024 to 15.5 percent in 2025. HDIN Research analysts attribute this contraction primarily to increased depreciation expenses associated with fleet expansion and the inflationary costs of equipment delivery and maintenance.

Despite the margin compression, cash generation remained a stronghold for the corporation. Operating cash flow reached a robust $5.19 billion, providing substantial liquidity to support capital expenditures and shareholder returns. The company maintains a high financial leverage ratio with approximately $14.2 billion in total debt, yet its strong free cash flow of $2.18 billion ensures solvency and operational flexibility.

Figure United Rentals (URl) 2025 Financial Health & Performance Overview

Segment Performance: The Rise of Specialty Rentals

Segment Performance: The Rise of Specialty RentalsA distinct divergence in performance was observed between the company's two primary reporting segments: General Rentals and Specialty Rentals. General Rentals remains the company's cash cow, contributing roughly 69 percent of total revenue. However, the Specialty segment has emerged as the primary growth engine, driven by the integration of the Yak acquisition and increased demand for technical solutions like trench safety and fluid management.

The following table summarizes the key performance metrics for the fiscal year 2025:

| Metric | General Rentals | Specialty Rentals |

|---|---|---|

| Total Segment Revenue | $11.01 Billion | $5.098 Billion |

| Rental Revenue Growth | +2.5% | +13.6% |

| Gross Margin | 35.2% | 43.6% |

| Strategic Role | Core Revenue Stability | High-Growth Expansion |

| Primary Challenges | Labor Inflation & Delivery Costs | Integration Costs & Depreciation |

Strategic Positioning and Digital Transformation

United Rentals continues to consolidate its market leadership, currently holding approximately 15 percent of the North American market share. The company is actively transitioning from a traditional equipment provider to a consultative partner through its "Total Jobsite Solutions" strategy. This approach leverages digital tools such as Total Control and artificial intelligence to offer customers real-time asset management and utilization tracking.

In the Frost Radar competitiveness assessment, United Rentals is positioned as a leader in innovation. The company's investment in technology aims to increase customer stickiness among large national accounts, which now represent 46 percent of rental revenues.

Risk Factors and Future Outlook

The HDIN Research analysis highlights several risk factors facing the corporation moving into 2026. The company's capital structure is sensitive to interest rate fluctuations; a one percent increase in rates could reduce annual after-tax profits by approximately $31 million. Furthermore, the company faces operational risks related to the cyclical nature of non-residential construction and the challenges of integrating large-scale acquisitions.

To mitigate these risks, management has outlined a cost reduction plan for 2026 targeting $30 million to $60 million in savings. Additionally, a new $5 billion share repurchase authorization signals management's confidence in the company's intrinsic value and future cash flow generation.

As United Rentals enters the deep waters of its digital and specialty transformation, its ability to manage high depreciation costs while capturing the higher margins of specialized services will be the defining factor of its medium-term success.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com