General Motors and Tesla 2025 Financial Analysis: A Strategic Divergence in the Age of AI and EV Consolidation

Date : 2026-02-09

Reading : 135

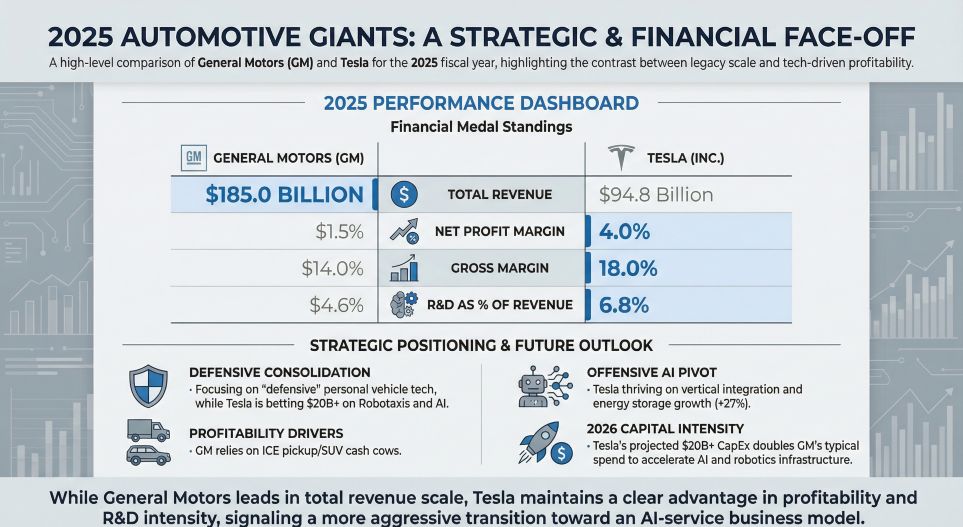

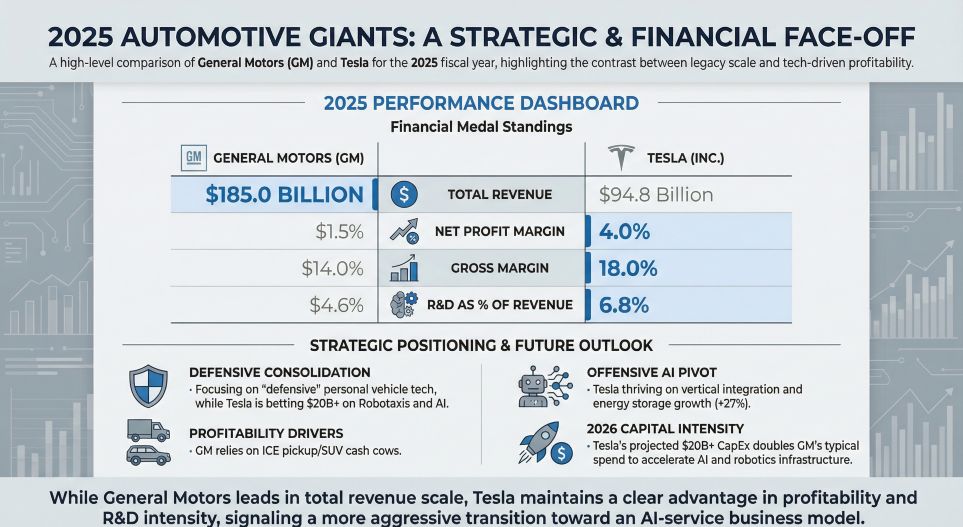

The 2025 fiscal year marked a decisive point of separation for the North American automotive industry. According to a new comparative analysis by HDIN Research based on 2025 Annual Reports, General Motors (GM) and Tesla have adopted radically different strategies to navigate slowing electric vehicle demand and shifting regulatory landscapes. While GM executed a defensive contraction to protect profitability, Tesla accelerated an aggressive transition toward an artificial intelligence and energy-centric business model.

Financial Performance and Strategic Realignment

The fiscal data reveals two distinct narratives. General Motors focused on cementing its financial foundation through significant restructuring, recording a total of $7.9 billion in charges related to electric vehicle capacity realignment and asset impairments. This defensive maneuver was designed to protect the company's core profit engine: internal combustion engine trucks and SUVs. Consequently, GM reported a net profit margin of 1.5 percent, weighed down by these one-time costs and a 2.0 percent revenue decline in its North American segment.

In contrast, Tesla faced its own headwinds with a 9 percent decline in automotive sales revenue, driven by price cuts and financing incentives intended to stimulate demand. However, the company offset this weakness through substantial growth in its Energy Generation and Storage division. Tesla reported a consolidated net margin of 4.0 percent, supported by a 27 percent surge in energy revenue and improved manufacturing efficiencies.

Figure 2025 AUTOMOTIVE CIANTS A STRATECIC & FINANCIAL FACE-OFF

The Robotaxi Divide

One of the most significant strategic splits identified by HDIN Research lies in autonomous vehicle development. General Motors has effectively retreated from the standalone robotaxi race, ceasing funding for dedicated Cruise robotaxi development and integrating the technology team back into GM North America to focus on personal passenger vehicle automation. This restructuring incurred approximately $1.1 billion in charges but aims to reduce long-term capital intensity.

Conversely, Tesla doubled down on its autonomous ambitions, officially launching its Robotaxi service in June 2025. The company is transitioning its business model from hardware manufacturing to an AI-driven service platform. This pivot is capital intensive; Tesla projects capital expenditures to exceed $20 billion in 2026, primarily to build out AI training clusters like Cortex and expand its specialized Cybercab fleet.

Table Key Financial Metrics Comparison (Fiscal Year 2025)

Energy Storage and Vertical Integration

While automotive revenues fluctuated, the energy sector emerged as a stabilizer for Tesla. The Energy Generation and Storage segment achieved a gross margin of 29.8 percent in 2025, up from 26.2 percent the previous year. This profitability was driven by the deployment of 46.7 GWh of storage products, specifically the Megapack, which is seeing high demand from data centers requiring reliable power for AI infrastructure.

General Motors continues to leverage its vertically integrated Ultium battery platform but faces pressure from the One Big Beautiful Bill Act (OBBBA). The company anticipates potential impairments of up to $1.1 billion on purchased regulatory credits due to shifting EPA greenhouse gas targets.

Future Outlook and Risks

HDIN Research analysts conclude that both companies face a complex 2026. General Motors must navigate the balance between milking its mature internal combustion business to fund a slower, more disciplined electric transition. Its ability to maintain a return on invested capital above 20 percent will depend on the success of its cost-avoidance measures.

Tesla faces a valuation risk tied to the execution of its AI roadmap. With a 2025 CEO performance award tied to ambitious milestones like one million operating robotaxis, the company is betting its future on overcoming global regulatory fragmentation. The divergence is clear: GM is fortifying the castle, while Tesla is betting everything on the next technological frontier.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Financial Performance and Strategic Realignment

The fiscal data reveals two distinct narratives. General Motors focused on cementing its financial foundation through significant restructuring, recording a total of $7.9 billion in charges related to electric vehicle capacity realignment and asset impairments. This defensive maneuver was designed to protect the company's core profit engine: internal combustion engine trucks and SUVs. Consequently, GM reported a net profit margin of 1.5 percent, weighed down by these one-time costs and a 2.0 percent revenue decline in its North American segment.

In contrast, Tesla faced its own headwinds with a 9 percent decline in automotive sales revenue, driven by price cuts and financing incentives intended to stimulate demand. However, the company offset this weakness through substantial growth in its Energy Generation and Storage division. Tesla reported a consolidated net margin of 4.0 percent, supported by a 27 percent surge in energy revenue and improved manufacturing efficiencies.

Figure 2025 AUTOMOTIVE CIANTS A STRATECIC & FINANCIAL FACE-OFF

The Robotaxi Divide

One of the most significant strategic splits identified by HDIN Research lies in autonomous vehicle development. General Motors has effectively retreated from the standalone robotaxi race, ceasing funding for dedicated Cruise robotaxi development and integrating the technology team back into GM North America to focus on personal passenger vehicle automation. This restructuring incurred approximately $1.1 billion in charges but aims to reduce long-term capital intensity.

Conversely, Tesla doubled down on its autonomous ambitions, officially launching its Robotaxi service in June 2025. The company is transitioning its business model from hardware manufacturing to an AI-driven service platform. This pivot is capital intensive; Tesla projects capital expenditures to exceed $20 billion in 2026, primarily to build out AI training clusters like Cortex and expand its specialized Cybercab fleet.

Table Key Financial Metrics Comparison (Fiscal Year 2025)

| Metric | General Motors (GM) | Tesla (Tesla, Inc.) |

|---|---|---|

| Primary Strategy | Defensive Restructuring | Offensive AI Pivot |

| Core Profit Driver | ICE Trucks & SUVs | Energy Storage & Software |

| Net Profit Margin | 1.5% | 4.0% |

| Key Growth/Loss Area | $7.9B EV Impairment Charge | Energy Revenue +27% |

| AV Strategy | Consolidation (Personal AV) | Expansion (Robotaxi Service) |

| Liquidity Position | High Leverage (Financing Arm) | $44B Cash & Investments |

While automotive revenues fluctuated, the energy sector emerged as a stabilizer for Tesla. The Energy Generation and Storage segment achieved a gross margin of 29.8 percent in 2025, up from 26.2 percent the previous year. This profitability was driven by the deployment of 46.7 GWh of storage products, specifically the Megapack, which is seeing high demand from data centers requiring reliable power for AI infrastructure.

General Motors continues to leverage its vertically integrated Ultium battery platform but faces pressure from the One Big Beautiful Bill Act (OBBBA). The company anticipates potential impairments of up to $1.1 billion on purchased regulatory credits due to shifting EPA greenhouse gas targets.

Future Outlook and Risks

HDIN Research analysts conclude that both companies face a complex 2026. General Motors must navigate the balance between milking its mature internal combustion business to fund a slower, more disciplined electric transition. Its ability to maintain a return on invested capital above 20 percent will depend on the success of its cost-avoidance measures.

Tesla faces a valuation risk tied to the execution of its AI roadmap. With a 2025 CEO performance award tied to ambitious milestones like one million operating robotaxis, the company is betting its future on overcoming global regulatory fragmentation. The divergence is clear: GM is fortifying the castle, while Tesla is betting everything on the next technological frontier.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com