Hyperscaler Capital Expenditure Report: Analyzing the 292 Billion Dollar AI Infrastructure War

Date : 2026-02-10

Reading : 239

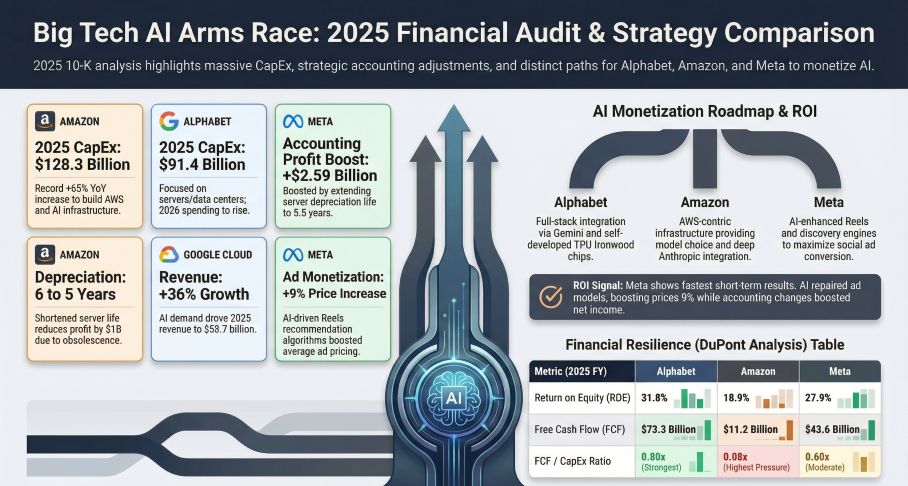

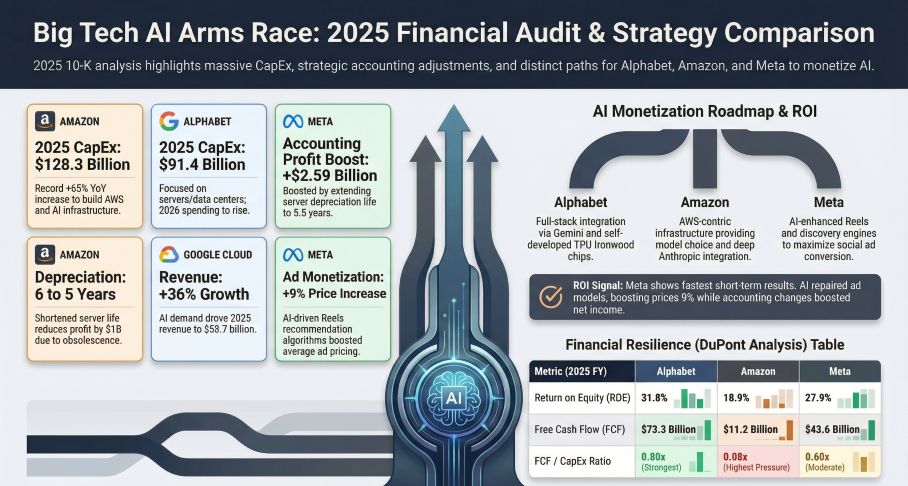

The fiscal year 2025 marked a definitive transition for Silicon Valley’s largest technology firms, moving from the era of visionary artificial intelligence narratives to a period of intense capital execution. According to a new deep-dive analysis by HDIN Research based on recently released 10-K filings, Alphabet, Amazon, and Meta Platforms collectively deployed nearly $292 billion in capital expenditures (CapEx) over the last twelve months. This historic spending spree highlights a divergence in strategy, aiming to secure dominance in the generative AI era while managing shareholder expectations regarding profitability and efficiency.

Figure Big Tech Al Arms Race 2025 Financial Audit & Strategy Comparison

The Scale of Infrastructure Investment

The Scale of Infrastructure Investment

The race to secure computing power has resulted in unprecedented spending levels, primarily driven by the need for data centers, servers, and specialized networking equipment. Amazon emerged as the most aggressive investor in 2025. The company reported a record-breaking capital expenditure of $128.3 billion, a year-over-year increase exceeding 65 percent. These funds were largely directed toward technical infrastructure to support AWS growth and complex logistics networks.

Alphabet followed with a substantial $91.4 billion in capital investments, focusing on a full-stack vertical integration strategy that includes its custom TPU silicon and data center expansions. The company has signaled to investors that this figure will increase significantly in fiscal year 2026.

Meta Platforms, operating as the efficiency challenger, reported $72.2 billion in spending. However, the company’s forward-looking guidance suggests a massive acceleration, projecting 2026 expenditures to range between $115 billion and $135 billion as it scales its AI discovery engines and next-generation hardware.

Accounting Adjustments and Profit Implications

A critical finding in the HDIN Research analysis reveals how divergent accounting policies regarding server useful life significantly impacted reported net income for these giants in 2025.

Meta Platforms adopted a policy that boosted its paper profits. Effective January 1, 2025, the company extended the estimated useful life of its servers and network assets from four years to 5.5 years. This accounting adjustment reduced depreciation expenses by approximately $2.92 billion, effectively increasing net income by $2.59 billion.

Conversely, Amazon took a more conservative approach, signaling a rapid obsolescence cycle for AI hardware. The company shortened the useful life of certain servers from six years to five years, citing the rapid evolution of AI and machine learning technologies. This decision increased depreciation expenses by $1.4 billion, negatively impacting net income by $1 billion but reflecting a rigorous approach to infrastructure modernization. Alphabet maintained its six-year depreciation schedule, though its total depreciation costs rose by $5.8 billion due to the sheer volume of new asset deployment.

Monetization and Return on Investment

The massive capital outlays are beginning to show divergent returns across the three companies. Alphabet successfully navigated the integration of AI into its core search product without eroding margins. Its search and other advertising revenues grew to $224.5 billion. The analysis indicates that traffic acquisition costs as a percentage of revenue actually declined, suggesting that proprietary AI models like Gemini are driving efficiency rather than just cost.

Meta Platforms saw a resurgence in its advertising business, with revenue growing 22 percent. This growth was attributed to AI-driven improvements in its recommendation engines, particularly within Instagram Reels, which drove a 9 percent increase in average price per ad.

Amazon continues to leverage AI to diversify AWS revenue, moving beyond basic storage to higher-margin AI infrastructure and application layers. Additionally, the company is applying AI to its logistics operations to mitigate labor costs, a crucial factor as fulfillment costs rose 11 percent in 2025.

Strategic Positioning Summary

The following table summarizes the key financial and strategic positions of the three tech giants for the fiscal year 2025:

Financial Resilience and Future Outlook

The analysis concludes that while all three companies are heavily invested, their financial resilience varies. Alphabet displays the strongest financial buffer, with free cash flows covering a significant portion of its capital expenditures. Amazon faces the tightest liquidity pressure relative to spending, reinvesting nearly all operating cash flow back into the business to maintain its infrastructure lead.

As the industry moves into 2026, the focus is expected to shift from acquiring capacity to maximizing utilization rates. With regulatory pressures mounting and energy constraints becoming a physical limit on growth, the ability to convert these massive infrastructure bets into sustainable operating margins will define the next phase of the digital economy.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Figure Big Tech Al Arms Race 2025 Financial Audit & Strategy Comparison

The Scale of Infrastructure Investment

The Scale of Infrastructure InvestmentThe race to secure computing power has resulted in unprecedented spending levels, primarily driven by the need for data centers, servers, and specialized networking equipment. Amazon emerged as the most aggressive investor in 2025. The company reported a record-breaking capital expenditure of $128.3 billion, a year-over-year increase exceeding 65 percent. These funds were largely directed toward technical infrastructure to support AWS growth and complex logistics networks.

Alphabet followed with a substantial $91.4 billion in capital investments, focusing on a full-stack vertical integration strategy that includes its custom TPU silicon and data center expansions. The company has signaled to investors that this figure will increase significantly in fiscal year 2026.

Meta Platforms, operating as the efficiency challenger, reported $72.2 billion in spending. However, the company’s forward-looking guidance suggests a massive acceleration, projecting 2026 expenditures to range between $115 billion and $135 billion as it scales its AI discovery engines and next-generation hardware.

Accounting Adjustments and Profit Implications

A critical finding in the HDIN Research analysis reveals how divergent accounting policies regarding server useful life significantly impacted reported net income for these giants in 2025.

Meta Platforms adopted a policy that boosted its paper profits. Effective January 1, 2025, the company extended the estimated useful life of its servers and network assets from four years to 5.5 years. This accounting adjustment reduced depreciation expenses by approximately $2.92 billion, effectively increasing net income by $2.59 billion.

Conversely, Amazon took a more conservative approach, signaling a rapid obsolescence cycle for AI hardware. The company shortened the useful life of certain servers from six years to five years, citing the rapid evolution of AI and machine learning technologies. This decision increased depreciation expenses by $1.4 billion, negatively impacting net income by $1 billion but reflecting a rigorous approach to infrastructure modernization. Alphabet maintained its six-year depreciation schedule, though its total depreciation costs rose by $5.8 billion due to the sheer volume of new asset deployment.

Monetization and Return on Investment

The massive capital outlays are beginning to show divergent returns across the three companies. Alphabet successfully navigated the integration of AI into its core search product without eroding margins. Its search and other advertising revenues grew to $224.5 billion. The analysis indicates that traffic acquisition costs as a percentage of revenue actually declined, suggesting that proprietary AI models like Gemini are driving efficiency rather than just cost.

Meta Platforms saw a resurgence in its advertising business, with revenue growing 22 percent. This growth was attributed to AI-driven improvements in its recommendation engines, particularly within Instagram Reels, which drove a 9 percent increase in average price per ad.

Amazon continues to leverage AI to diversify AWS revenue, moving beyond basic storage to higher-margin AI infrastructure and application layers. Additionally, the company is applying AI to its logistics operations to mitigate labor costs, a crucial factor as fulfillment costs rose 11 percent in 2025.

Strategic Positioning Summary

The following table summarizes the key financial and strategic positions of the three tech giants for the fiscal year 2025:

| Metric | Alphabet (Google) | Amazon (AWS) | Meta Platforms |

|---|---|---|---|

| 2025 CapEx | $91.4 Billion | $128.3 Billion | $72.2 Billion |

| Core AI Strategy | Vertical Integration (Custom TPU + Gemini) | Infrastructure Scale (AWS Bedrock + Chips) | Open Source Ecosystem (Llama + Ad Algorithms) |

| Server Accounting | Neutral (6 Years) | Conservative (Shortened to 5 Years) | Aggressive (Extended to 5.5 Years) |

| Free Cash Flow Coverage | High (0.80x coverage of CapEx) | Low (0.08x coverage of CapEx) | Moderate (0.60x coverage of CapEx) |

| Primary ROI Driver | Search Quality & Cloud Efficiency | Cloud AI Services & Logistics | Ad Targeting & User Engagement |

The analysis concludes that while all three companies are heavily invested, their financial resilience varies. Alphabet displays the strongest financial buffer, with free cash flows covering a significant portion of its capital expenditures. Amazon faces the tightest liquidity pressure relative to spending, reinvesting nearly all operating cash flow back into the business to maintain its infrastructure lead.

As the industry moves into 2026, the focus is expected to shift from acquiring capacity to maximizing utilization rates. With regulatory pressures mounting and energy constraints becoming a physical limit on growth, the ability to convert these massive infrastructure bets into sustainable operating margins will define the next phase of the digital economy.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com