Nurix Therapeutics 2025 Fiscal Review: Accelerating Clinical Momentum Amid Rising Capital Intensity

Date : 2026-02-14

Reading : 78

As the biotechnology sector transitions from platform validation to commercial execution, Nurix Therapeutics has emerged as a central figure in the Targeted Protein Degradation (TPD) landscape. A comprehensive analysis by HDIN Research of the company's fiscal year 2025 annual report (Form 10-K) reveals a strategic pivot. The company is aggressively deploying capital to advance its lead asset, Bexobrutideg (NX-5948), into pivotal trials while managing a widening net loss driven by a 43 percent surge in research and development expenses.

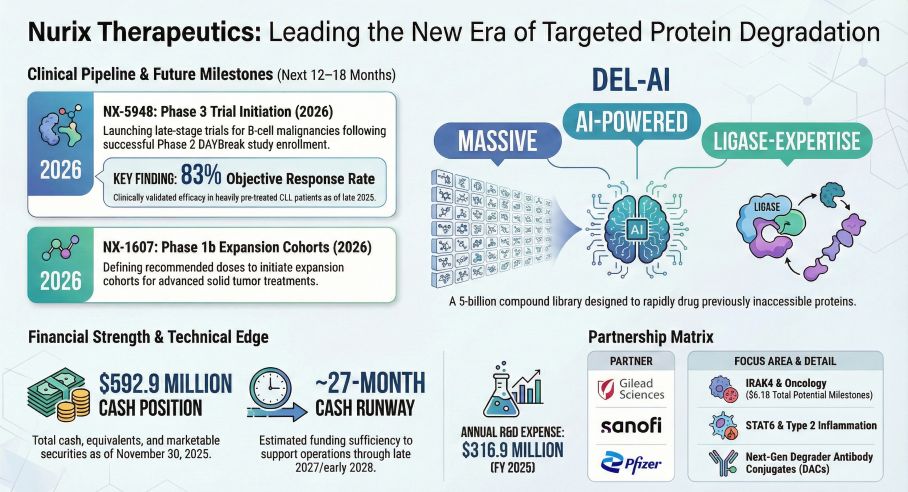

Figure Nurix Therapeutics Leading the New Era of Targeted Protein Degradation

The Clinical Pivot to Late-Stage Development

The Clinical Pivot to Late-Stage Development

The focal point of Nurix's fiscal year was the initiation of the DAYBreak Phase 2 pivotal study for Bexobrutideg in October 2025. This asset targets the $10.6 billion Bruton's tyrosine kinase (BTK) inhibitor market, specifically addressing the critical unmet need for patients with resistance to current standard-of-care therapies. Clinical data presented at the American Society of Hematology annual meeting highlighted an objective response rate of 83 percent in heavily pre-treated CLL patients, positioning the drug as a potential best-in-class therapy.

To support this clinical advancement, Nurix increased its R&D expenditure to $317 million for the fiscal year ended November 30, 2025. This represents a significant year-over-year increase, reflecting the higher costs associated with late-stage clinical trials and the expansion of its proprietary DEL-AI drug discovery engine.

Financial Health and Cash Runway

Despite the intensified spending, Nurix maintains a robust balance sheet. The company closed the fiscal year with $592.9 million in cash, cash equivalents, and marketable securities. HDIN Research analysis indicates that this liquidity provides a cash runway of approximately 28 months, sufficient to fund operations well into the data readout phase of its key clinical programs.

However, the path to commercialization has come at a cost. The company reported a net loss of $264.5 million for fiscal 2025, up from $193.6 million in the prior year. The analysis notes that for every dollar of collaboration revenue recognized, the company currently incurs substantial operating losses, a typical profile for clinical-stage biotechs transitioning to late-stage development.

Strategic Alliances and Accounting Nuances

Nurix continues to mitigate risk through a dual-track strategy of internal pipeline development and external partnerships. Alliances with industry giants Gilead Sciences, Sanofi, and Pfizer remain a cornerstone of its financial architecture, offering a safety net of up to $6.1 billion in potential future milestone payments.

From an accounting perspective, the company utilizes a cost-based input method to recognize revenue from these collaborations. This approach aligns revenue recognition with the estimated effort and costs required to satisfy performance obligations. While this is standard industry practice, it requires significant management estimation regarding total project hours and costs, which auditors have identified as a key audit matter due to the complexity involved.

Fiscal 2025 Key Financial Metrics

The following table outlines the core financial performance indicators for Nurix Therapeutics for the fiscal year ending November 30, 2025:

Future Outlook and Risks

The immediate future for Nurix hinges on the execution of the DAYBreak study. The company faces the dual challenge of managing complex manufacturing processes for its degraders while navigating a competitive landscape populated by other major pharmaceutical players. While the current cash position is strong, the projected acceleration of Phase 3 trials in 2026 suggests that capital efficiency will remain a critical metric for investors to monitor.

Furthermore, the company retains access to approximately $205 million through its at-the-market (ATM) equity offering facility, providing a flexible mechanism to bolster its balance sheet should market conditions remain favorable. As Nurix moves closer to potential regulatory filings, the clarity of its clinical data will likely dictate its ability to transition from a platform-based research entity to a commercial-stage pharmaceutical company.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

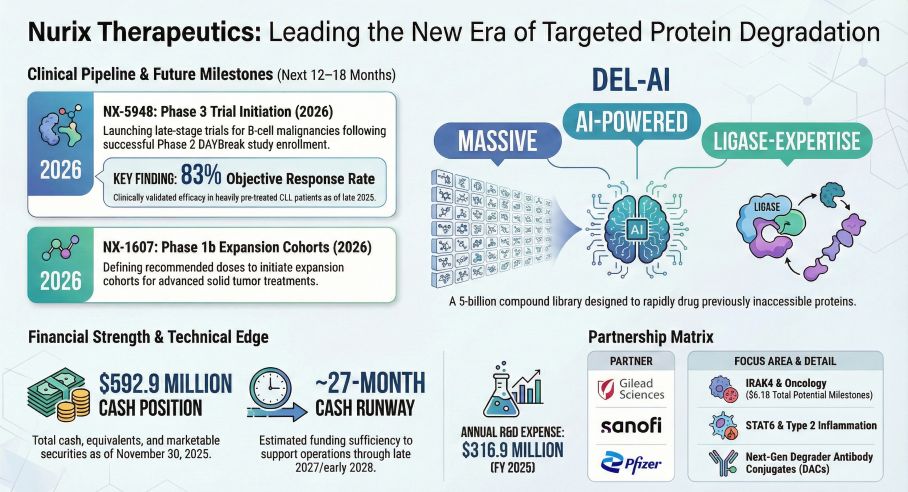

Figure Nurix Therapeutics Leading the New Era of Targeted Protein Degradation

The Clinical Pivot to Late-Stage Development

The Clinical Pivot to Late-Stage DevelopmentThe focal point of Nurix's fiscal year was the initiation of the DAYBreak Phase 2 pivotal study for Bexobrutideg in October 2025. This asset targets the $10.6 billion Bruton's tyrosine kinase (BTK) inhibitor market, specifically addressing the critical unmet need for patients with resistance to current standard-of-care therapies. Clinical data presented at the American Society of Hematology annual meeting highlighted an objective response rate of 83 percent in heavily pre-treated CLL patients, positioning the drug as a potential best-in-class therapy.

To support this clinical advancement, Nurix increased its R&D expenditure to $317 million for the fiscal year ended November 30, 2025. This represents a significant year-over-year increase, reflecting the higher costs associated with late-stage clinical trials and the expansion of its proprietary DEL-AI drug discovery engine.

Financial Health and Cash Runway

Despite the intensified spending, Nurix maintains a robust balance sheet. The company closed the fiscal year with $592.9 million in cash, cash equivalents, and marketable securities. HDIN Research analysis indicates that this liquidity provides a cash runway of approximately 28 months, sufficient to fund operations well into the data readout phase of its key clinical programs.

However, the path to commercialization has come at a cost. The company reported a net loss of $264.5 million for fiscal 2025, up from $193.6 million in the prior year. The analysis notes that for every dollar of collaboration revenue recognized, the company currently incurs substantial operating losses, a typical profile for clinical-stage biotechs transitioning to late-stage development.

Strategic Alliances and Accounting Nuances

Nurix continues to mitigate risk through a dual-track strategy of internal pipeline development and external partnerships. Alliances with industry giants Gilead Sciences, Sanofi, and Pfizer remain a cornerstone of its financial architecture, offering a safety net of up to $6.1 billion in potential future milestone payments.

From an accounting perspective, the company utilizes a cost-based input method to recognize revenue from these collaborations. This approach aligns revenue recognition with the estimated effort and costs required to satisfy performance obligations. While this is standard industry practice, it requires significant management estimation regarding total project hours and costs, which auditors have identified as a key audit matter due to the complexity involved.

Fiscal 2025 Key Financial Metrics

The following table outlines the core financial performance indicators for Nurix Therapeutics for the fiscal year ending November 30, 2025:

| Metric | Fiscal Year 2025 | Fiscal Year 2024 | Year-Over-Year Change |

|---|---|---|---|

| Cash & Equivalents | $592.9 Million | -- | Stable Liquidity |

| R&D Expenses | $317.0 Million | $221.7 Million | +43.0% |

| Net Loss | $264.5 Million | $193.6 Million | +36.6% |

| Burn Rate (Ops Cash Flow) | ($249.5 Million) | -- | Increased Outflow |

| Current Ratio | ~7.0x | -- | High Solvency |

The immediate future for Nurix hinges on the execution of the DAYBreak study. The company faces the dual challenge of managing complex manufacturing processes for its degraders while navigating a competitive landscape populated by other major pharmaceutical players. While the current cash position is strong, the projected acceleration of Phase 3 trials in 2026 suggests that capital efficiency will remain a critical metric for investors to monitor.

Furthermore, the company retains access to approximately $205 million through its at-the-market (ATM) equity offering facility, providing a flexible mechanism to bolster its balance sheet should market conditions remain favorable. As Nurix moves closer to potential regulatory filings, the clarity of its clinical data will likely dictate its ability to transition from a platform-based research entity to a commercial-stage pharmaceutical company.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com