GRI Bio 2025-2027 Outlook: Financial Risks & NKT Pipeline Analysis

Date : 2026-02-13

Reading : 45

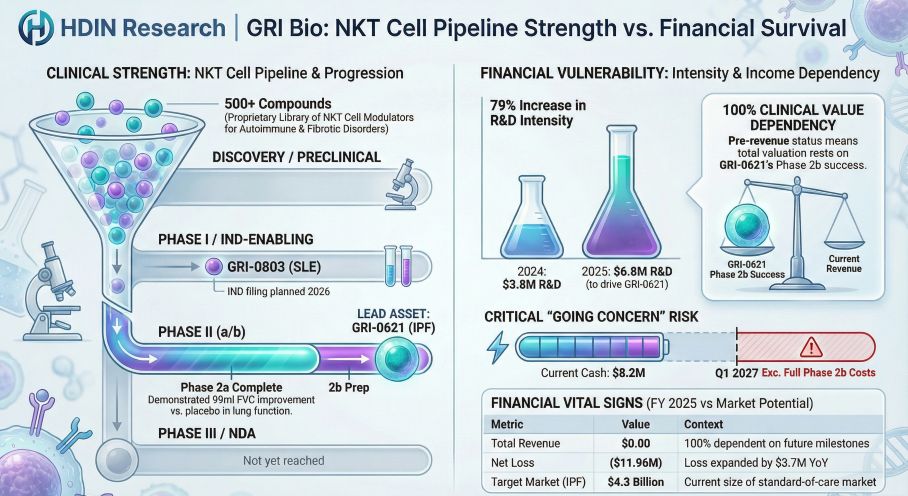

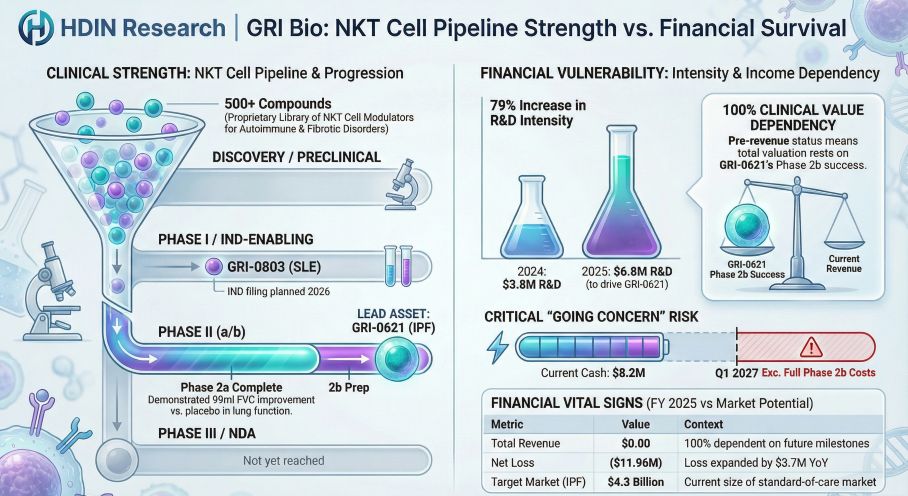

HDIN Research, a leading independent market consulting firm, has released a comprehensive deep-dive analysis of GRI Bio, Inc. (NASDAQ: GRI). The report highlights a significant disconnect between the company’s projected operational survival and its ability to execute core clinical milestones. While GRI Bio reports a cash runway extending to the first quarter of 2027, HDIN Research identifies a severe capital deficit that threatens the continuity of its flagship GRI-0621 program.

Figure GRl Bio NKT Cell Pipeline Strength vs Financial Survival

The "Paper" Runway vs. Clinical Reality

The "Paper" Runway vs. Clinical Reality

According to the latest financial data analyzed by HDIN Research, GRI Bio held approximately $8.23 million in cash and equivalents as of December 31, 2025. While management projects this capital is sufficient to fund operations into Q1 2027, the analysis reveals that this budget is highly restricted. It covers only the preliminary preparatory work for the Phase 2b clinical trial of GRI-0621 for Idiopathic Pulmonary Fibrosis (IPF), but is insufficient to conduct or complete the trial itself.

Key Findings from the HDIN Market Report:

* Financial Distress & Going Concern: With a net operating cash outflow of $10.19 million in fiscal year 2025 and an accumulated deficit of $51.7 million, the company’s auditors have issued a "going concern" warning. The current cash position is tight, and 2026 is identified as a decisive "do-or-die" year for fundraising.

* Clinical Pipeline Potential: GRI Bio’s proprietary Natural Killer T (NKT) cell modulation platform shows promise. The Phase 2a trial for GRI-0621 demonstrated a positive trend in Forced Vital Capacity (FVC) improvement (99 ml vs. placebo in the primary analysis), validating its potential as a disease-modifying therapy in a market dominated by symptomatic treatments.

* Dilution & Valuation Risks: To maintain listing compliance, GRI Bio executed a 1:28 reverse stock split in January 2026. The report notes high dilution risks for investors due to the reliance on equity financing and outstanding warrants.

* Patent & Competitive Landscape: The company faces a looming "patent cliff" with core IP for GRI-0621 and GRI-0803 expiring around 2032. Furthermore, the IPF market remains intensely competitive, populated by major players such as Boehringer Ingelheim, AbbVie, and AstraZeneca.

Expert Commentary

"GRI Bio represents a classic high-risk, high-reward biotech scenario where scientific differentiation clashes with financial fragility," said the Lead Biotech Analyst at HDIN Research. "While the NKT modulation mechanism offers a unique approach to fibrosis, the company's current liquidity is a 'survival budget' rather than a 'growth budget.' Without a strategic partnership or significant non-dilutive financing in the first half of 2026, the Phase 2b trial—and by extension, the company’s primary value driver—faces imminent delay."

Access the Full Report

This analysis provides crucial insights for institutional investors and industry stakeholders monitoring the niche fibrosis and autoimmune markets. To view the full analysis or request sample pages of the "GRI Bio 2025 Financial & Strategic Deep Dive," please visit our website or contact our team below.

Download via the PDF link under “Related Topics” at the bottom of this page.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports to support strategic decision-making for investors and corporate executives.

Media Contact:

HDIN Research

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Figure GRl Bio NKT Cell Pipeline Strength vs Financial Survival

The "Paper" Runway vs. Clinical Reality

The "Paper" Runway vs. Clinical RealityAccording to the latest financial data analyzed by HDIN Research, GRI Bio held approximately $8.23 million in cash and equivalents as of December 31, 2025. While management projects this capital is sufficient to fund operations into Q1 2027, the analysis reveals that this budget is highly restricted. It covers only the preliminary preparatory work for the Phase 2b clinical trial of GRI-0621 for Idiopathic Pulmonary Fibrosis (IPF), but is insufficient to conduct or complete the trial itself.

Key Findings from the HDIN Market Report:

* Financial Distress & Going Concern: With a net operating cash outflow of $10.19 million in fiscal year 2025 and an accumulated deficit of $51.7 million, the company’s auditors have issued a "going concern" warning. The current cash position is tight, and 2026 is identified as a decisive "do-or-die" year for fundraising.

* Clinical Pipeline Potential: GRI Bio’s proprietary Natural Killer T (NKT) cell modulation platform shows promise. The Phase 2a trial for GRI-0621 demonstrated a positive trend in Forced Vital Capacity (FVC) improvement (99 ml vs. placebo in the primary analysis), validating its potential as a disease-modifying therapy in a market dominated by symptomatic treatments.

* Dilution & Valuation Risks: To maintain listing compliance, GRI Bio executed a 1:28 reverse stock split in January 2026. The report notes high dilution risks for investors due to the reliance on equity financing and outstanding warrants.

* Patent & Competitive Landscape: The company faces a looming "patent cliff" with core IP for GRI-0621 and GRI-0803 expiring around 2032. Furthermore, the IPF market remains intensely competitive, populated by major players such as Boehringer Ingelheim, AbbVie, and AstraZeneca.

Expert Commentary

"GRI Bio represents a classic high-risk, high-reward biotech scenario where scientific differentiation clashes with financial fragility," said the Lead Biotech Analyst at HDIN Research. "While the NKT modulation mechanism offers a unique approach to fibrosis, the company's current liquidity is a 'survival budget' rather than a 'growth budget.' Without a strategic partnership or significant non-dilutive financing in the first half of 2026, the Phase 2b trial—and by extension, the company’s primary value driver—faces imminent delay."

Access the Full Report

This analysis provides crucial insights for institutional investors and industry stakeholders monitoring the niche fibrosis and autoimmune markets. To view the full analysis or request sample pages of the "GRI Bio 2025 Financial & Strategic Deep Dive," please visit our website or contact our team below.

Download via the PDF link under “Related Topics” at the bottom of this page.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports to support strategic decision-making for investors and corporate executives.

Media Contact:

HDIN Research

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com