Ocular Therapeutix Strategy & AXPAXLI Outlook

Date : 2026-02-13

Reading : 70

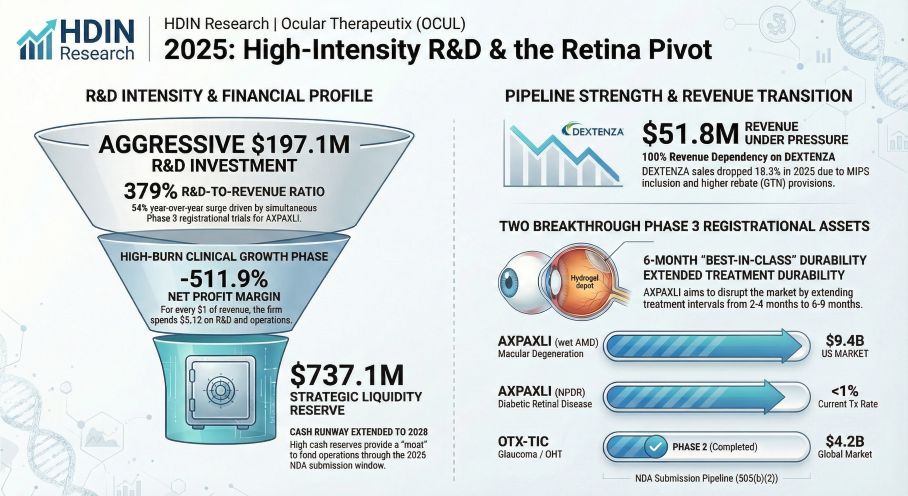

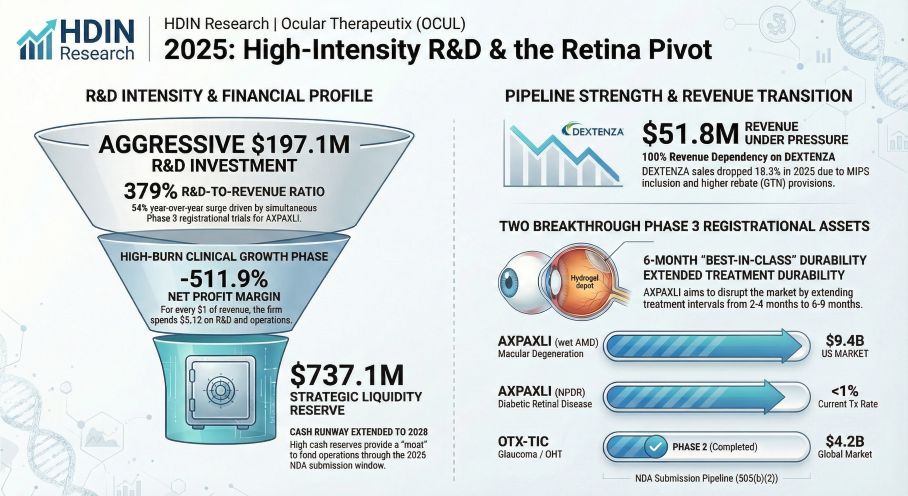

HDIN Research, a premier independent market consulting firm, has released its comprehensive *2025 Financial and Strategic Analysis Report on Ocular Therapeutix, Inc. (OCUL)*. The report details the company’s pivotal transition from a single-product commercial entity to a leader in retinal long-acting drug delivery, highlighted by its flagship candidate AXPAXLI (OTX-TKI).

According to HDIN Research, Ocular Therapeutix is approaching a critical valuation inflection point in early 2026. The company’s strategic focus has shifted decisively toward its ELUTYX™ hydrogel platform, aiming to disrupt the $9.4 billion wet AMD market by addressing the clinical burden of frequent injections.

Figure Ocular Therapeutix 2025 High-Intensity R&D & the Retina Pivot

Key Findings from the 2025 Report:

Key Findings from the 2025 Report:

* Robust Financial Health & Cash Runway: Despite a net loss widening to $266 million in 2025 due to accelerated R&D, the company maintains a fortress balance sheet. With $737.1 million in cash and equivalents as of December 31, 2025, OCUL possesses a liquidity runway extending into 2028, sufficient to support operations through the potential NDA submission for AXPAXLI.

* AXPAXLI (OTX-TKI) Market Potential: The report identifies AXPAXLI as a potential "Best-in-Class" maintenance therapy. Clinical data suggests a 6-9 month durability profile, offering a significant advantage over current standard-of-care biologics like Eylea and Vabysmo (typically 2-4 months). The report forecasts that capturing even a conservative share of the wet AMD market, combined with the untapped Non-Proliferative Diabetic Retinopathy (NPDR) prevention market, offers multi-billion dollar revenue potential.

* Commercial Challenges for DEXTENZA: While DEXTENZA generated $51.8 million in gross sales, net revenue was heavily impacted by Gross-to-Net (GTN) provisions, which surged to 51.6% in 2025 (up from 38.5% in 2024). This underscores the necessity of the strategic pivot toward the higher-margin retinal pipeline.

* Regulatory Catalysts: The immediate focus for investors is the SOL-1 Phase 3 trial 52-week data, expected in February 2026. The report analyzes the regulatory risks, noting that while a 505(b)(2) pathway is possible based on SOL-1 data, the FDA may require the completion of the confirmatory SOL-R trial, potentially adjusting the commercialization timeline to 2027.

Analyst Commentary

“Ocular Therapeutix has effectively built a financial 'moat' through its successful 2025 financing, eliminating near-term dilution risks,” said the Lead Healthcare Analyst at HDIN Research. “The investment thesis now hinges entirely on the clinical execution of AXPAXLI. If the SOL-1 data validates the safety and durability of the bio-resorbable hydrogel, we anticipate a significant re-rating of the company’s valuation as it targets a $9.4 billion addressable market with high barriers to entry, including patent protection extending to 2044.”

About the Report

The full report provides a granular "Harvard Framework" analysis, including:

* R&D Deep Dive: Detailed assessment of the SOL-1, SOL-R, and HELIOS-3 (NPDR) clinical trials.

* Dupont Analysis: Breakdown of ROE factors (-40.3%) and asset turnover ratios.

* Competitive Landscape: Comparison against emerging TKIs and Gene Therapies.

* ESG Assessment: Evaluation of the company's governance and patient impact metrics.

To view sample pages or download the full analysis, please visit the "Related Topics" section on our website or contact our sales team.

Media Contact:

HDIN Research

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports to industry executives and investors globally.

According to HDIN Research, Ocular Therapeutix is approaching a critical valuation inflection point in early 2026. The company’s strategic focus has shifted decisively toward its ELUTYX™ hydrogel platform, aiming to disrupt the $9.4 billion wet AMD market by addressing the clinical burden of frequent injections.

Figure Ocular Therapeutix 2025 High-Intensity R&D & the Retina Pivot

Key Findings from the 2025 Report:

Key Findings from the 2025 Report:* Robust Financial Health & Cash Runway: Despite a net loss widening to $266 million in 2025 due to accelerated R&D, the company maintains a fortress balance sheet. With $737.1 million in cash and equivalents as of December 31, 2025, OCUL possesses a liquidity runway extending into 2028, sufficient to support operations through the potential NDA submission for AXPAXLI.

* AXPAXLI (OTX-TKI) Market Potential: The report identifies AXPAXLI as a potential "Best-in-Class" maintenance therapy. Clinical data suggests a 6-9 month durability profile, offering a significant advantage over current standard-of-care biologics like Eylea and Vabysmo (typically 2-4 months). The report forecasts that capturing even a conservative share of the wet AMD market, combined with the untapped Non-Proliferative Diabetic Retinopathy (NPDR) prevention market, offers multi-billion dollar revenue potential.

* Commercial Challenges for DEXTENZA: While DEXTENZA generated $51.8 million in gross sales, net revenue was heavily impacted by Gross-to-Net (GTN) provisions, which surged to 51.6% in 2025 (up from 38.5% in 2024). This underscores the necessity of the strategic pivot toward the higher-margin retinal pipeline.

* Regulatory Catalysts: The immediate focus for investors is the SOL-1 Phase 3 trial 52-week data, expected in February 2026. The report analyzes the regulatory risks, noting that while a 505(b)(2) pathway is possible based on SOL-1 data, the FDA may require the completion of the confirmatory SOL-R trial, potentially adjusting the commercialization timeline to 2027.

Analyst Commentary

“Ocular Therapeutix has effectively built a financial 'moat' through its successful 2025 financing, eliminating near-term dilution risks,” said the Lead Healthcare Analyst at HDIN Research. “The investment thesis now hinges entirely on the clinical execution of AXPAXLI. If the SOL-1 data validates the safety and durability of the bio-resorbable hydrogel, we anticipate a significant re-rating of the company’s valuation as it targets a $9.4 billion addressable market with high barriers to entry, including patent protection extending to 2044.”

About the Report

The full report provides a granular "Harvard Framework" analysis, including:

* R&D Deep Dive: Detailed assessment of the SOL-1, SOL-R, and HELIOS-3 (NPDR) clinical trials.

* Dupont Analysis: Breakdown of ROE factors (-40.3%) and asset turnover ratios.

* Competitive Landscape: Comparison against emerging TKIs and Gene Therapies.

* ESG Assessment: Evaluation of the company's governance and patient impact metrics.

To view sample pages or download the full analysis, please visit the "Related Topics" section on our website or contact our sales team.

Media Contact:

HDIN Research

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports to industry executives and investors globally.