2025 Strategic Divergence: 3M’s Compliance Transformation vs. H.B. Fuller’s Specialist Expansion

Date : 2026-02-15

Reading : 70

While both manufacturing giants face headwinds from raw material volatility and global economic deceleration, their 2025 fiscal strategies reveal a stark divergence: 3M is contracting to survive regulatory pressures, while H.B. Fuller is leveraging acquisitions to dominate vertical niches.

In 2025, the global chemical and materials sector witnessed a definitive split in strategic priorities between generalist conglomerates and specialized pure-plays. According to the latest analysis by HDIN Research, 3M (MMM) and H.B. Fuller (FUL) represent two distinct responses to the current industrial climate. 3M’s narrative is defined by aggressive portfolio optimization and debt management following the Solventum spin-off, whereas H.B. Fuller has prioritized market penetration through targeted M&A in medical and engineering adhesives.

Figure 3M & H.B. Fuller Strategic Performance Benchmark 2025

Financial Health: Leverage vs. Efficiency

Financial Health: Leverage vs. Efficiency

The financial structures of the two companies highlight their differing strategic phases. 3M’s reported Return on Equity (ROE) surged to approximately 68.5%, a figure that HDIN Research identifies not merely as operational brilliance, but as a symptom of high financial leverage (87.4% asset-liability ratio) and a reduced equity base following major divestitures. The company is effectively engineering returns while managing a massive $18.5 billion projection for legal settlements regarding PFAS and Combat Arms earplugs.

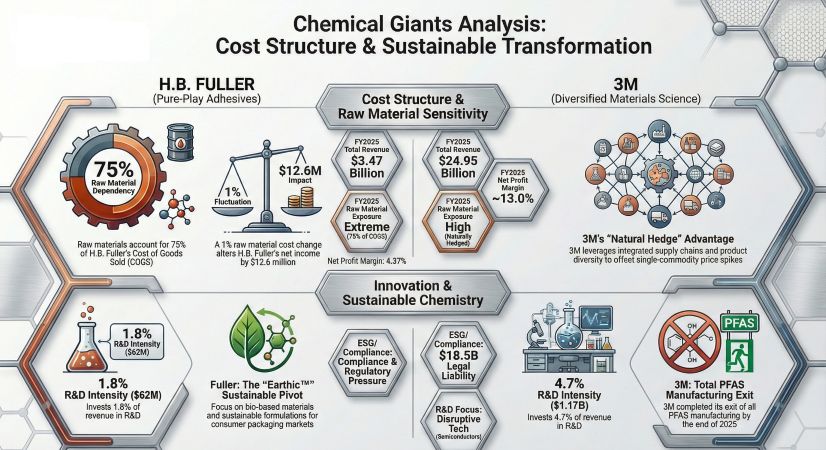

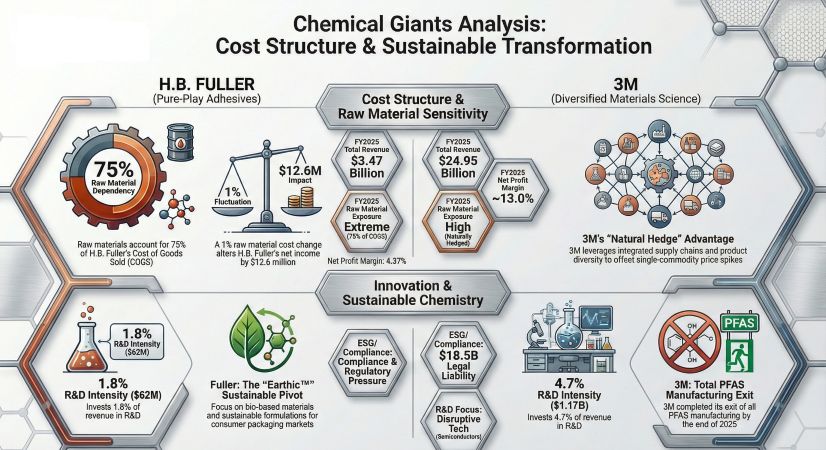

Conversely, H.B. Fuller presents a more traditional, albeit constrained, financial profile. With a net profit margin of 4.37% compared to 3M’s ~13%, Fuller’s profitability is heavily suppressed by its cost structure. The company’s "So What" lies in its sensitivity: with raw materials constituting 75% of its Cost of Goods Sold (COGS), Fuller’s bottom line is inextricably linked to the crude oil and natural gas derivatives market, where a 1% price fluctuation can swing net profits by over $12 million.

Strategic Pivots: Deep Tech vs. Application Engineering

The R&D disparities between the two firms signal where they see future value.

* 3M (The Deep Tech Play): With an R&D spend of $11.69 billion (4.7% of revenue), 3M is betting on high-barrier technologies. The company is pivoting away from commoditized manufacturing toward high-margin sectors like data center immersion cooling, semiconductor packaging, and automotive electrification. This is a clear attempt to rebuild a "moat" based on proprietary material science rather than volume.

* H.B. Fuller (The Application Play): Spending only 1.8% of revenue on R&D, Fuller’s strategy is not to invent new molecules, but to own the application. Their 2025 acquisitions of ND Industries, GEM, and Medifill demonstrate a strategy to capture high-value "verticals" such as medical-grade sutures and battery sealants.

The Regulatory Elephant: PFAS and Beyond

Regulatory compliance has transitioned from a background operational cost to a primary valuation driver. 3M’s complete exit from PFAS manufacturing by the end of 2025 is a defensive maneuver essential for its long-term viability. HDIN Research notes that while this incurs heavy short-term restructuring costs, it effectively "de-risks" the portfolio for future ESG-focused investors. H.B. Fuller faces less direct exposure to billion-dollar settlements but must navigate increasingly strict environmental standards in Europe and the US, driving their shift toward bio-based adhesive solutions like the Earthic™ line.

HDIN Viewpoint: The Valuation Gap

At HDIN Research, we believe the market is currently pricing these two companies on different timelines.

1. 3M is a "Turnaround" Story: Investors are currently weighing the clarity of 3M’s legal liabilities against its underlying prowess in material science. The "So What" for capital allocators is that 3M’s value is currently obscured by litigation; once the $12.5 billion PWS and $6 billion earplug settlements are fully digested, the remaining core business—focused on electrification and digital infrastructure—may be significantly undervalued.

2. H.B. Fuller is a "Supply Chain" Proxy: Fuller offers stability but lacks the explosive upside of deep-tech breakthroughs. Its performance is a derivative of global industrial activity (housing starts, consumer goods). The strategic opportunity here lies in their ability to pass through raw material costs; if they can maintain margins while integrating high-value medical acquisitions, they could break out of their traditional valuation multiples.

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports to empower strategic decision-making.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

In 2025, the global chemical and materials sector witnessed a definitive split in strategic priorities between generalist conglomerates and specialized pure-plays. According to the latest analysis by HDIN Research, 3M (MMM) and H.B. Fuller (FUL) represent two distinct responses to the current industrial climate. 3M’s narrative is defined by aggressive portfolio optimization and debt management following the Solventum spin-off, whereas H.B. Fuller has prioritized market penetration through targeted M&A in medical and engineering adhesives.

Figure 3M & H.B. Fuller Strategic Performance Benchmark 2025

Financial Health: Leverage vs. Efficiency

Financial Health: Leverage vs. EfficiencyThe financial structures of the two companies highlight their differing strategic phases. 3M’s reported Return on Equity (ROE) surged to approximately 68.5%, a figure that HDIN Research identifies not merely as operational brilliance, but as a symptom of high financial leverage (87.4% asset-liability ratio) and a reduced equity base following major divestitures. The company is effectively engineering returns while managing a massive $18.5 billion projection for legal settlements regarding PFAS and Combat Arms earplugs.

Conversely, H.B. Fuller presents a more traditional, albeit constrained, financial profile. With a net profit margin of 4.37% compared to 3M’s ~13%, Fuller’s profitability is heavily suppressed by its cost structure. The company’s "So What" lies in its sensitivity: with raw materials constituting 75% of its Cost of Goods Sold (COGS), Fuller’s bottom line is inextricably linked to the crude oil and natural gas derivatives market, where a 1% price fluctuation can swing net profits by over $12 million.

Strategic Pivots: Deep Tech vs. Application Engineering

The R&D disparities between the two firms signal where they see future value.

* 3M (The Deep Tech Play): With an R&D spend of $11.69 billion (4.7% of revenue), 3M is betting on high-barrier technologies. The company is pivoting away from commoditized manufacturing toward high-margin sectors like data center immersion cooling, semiconductor packaging, and automotive electrification. This is a clear attempt to rebuild a "moat" based on proprietary material science rather than volume.

* H.B. Fuller (The Application Play): Spending only 1.8% of revenue on R&D, Fuller’s strategy is not to invent new molecules, but to own the application. Their 2025 acquisitions of ND Industries, GEM, and Medifill demonstrate a strategy to capture high-value "verticals" such as medical-grade sutures and battery sealants.

The Regulatory Elephant: PFAS and Beyond

Regulatory compliance has transitioned from a background operational cost to a primary valuation driver. 3M’s complete exit from PFAS manufacturing by the end of 2025 is a defensive maneuver essential for its long-term viability. HDIN Research notes that while this incurs heavy short-term restructuring costs, it effectively "de-risks" the portfolio for future ESG-focused investors. H.B. Fuller faces less direct exposure to billion-dollar settlements but must navigate increasingly strict environmental standards in Europe and the US, driving their shift toward bio-based adhesive solutions like the Earthic™ line.

HDIN Viewpoint: The Valuation Gap

At HDIN Research, we believe the market is currently pricing these two companies on different timelines.

1. 3M is a "Turnaround" Story: Investors are currently weighing the clarity of 3M’s legal liabilities against its underlying prowess in material science. The "So What" for capital allocators is that 3M’s value is currently obscured by litigation; once the $12.5 billion PWS and $6 billion earplug settlements are fully digested, the remaining core business—focused on electrification and digital infrastructure—may be significantly undervalued.

2. H.B. Fuller is a "Supply Chain" Proxy: Fuller offers stability but lacks the explosive upside of deep-tech breakthroughs. Its performance is a derivative of global industrial activity (housing starts, consumer goods). The strategic opportunity here lies in their ability to pass through raw material costs; if they can maintain margins while integrating high-value medical acquisitions, they could break out of their traditional valuation multiples.

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports to empower strategic decision-making.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com