Dow 2025 Analysis: Strategic Restructuring Amid Cyclical Lows

Date : 2026-02-14

Reading : 63

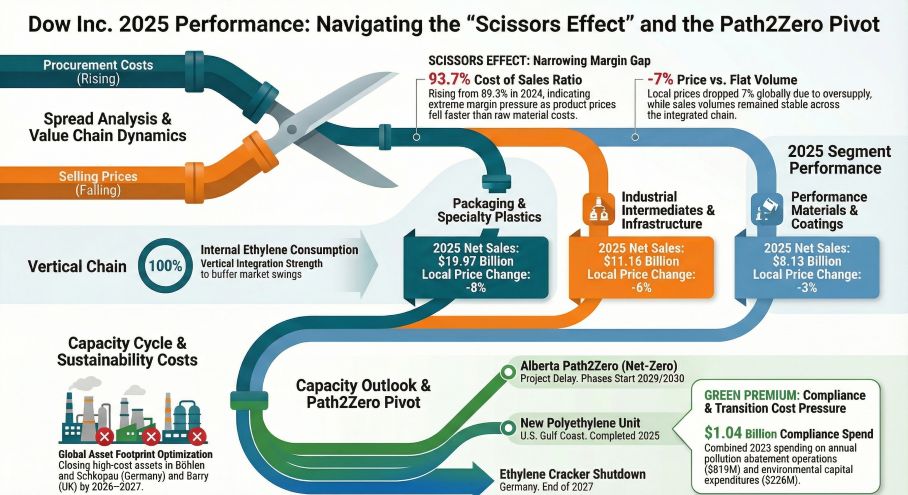

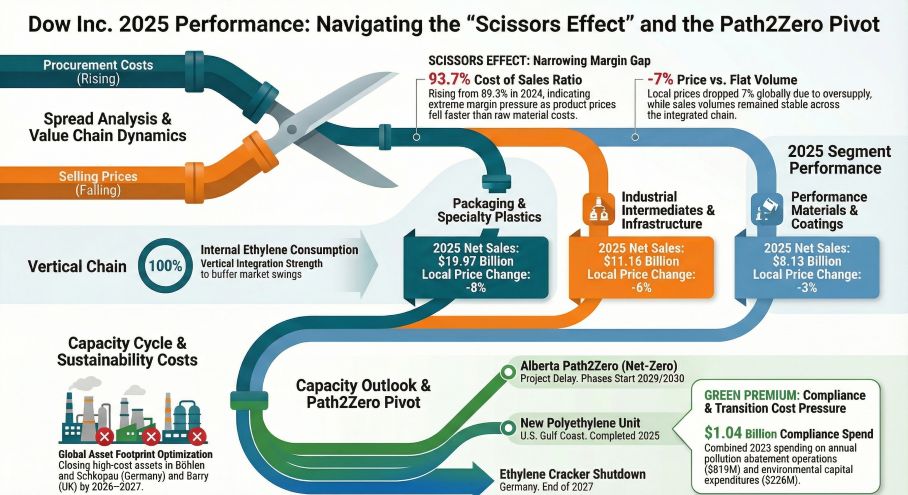

In a defining moment for the global chemical sector, Dow Inc. closed fiscal year 2025 with a $2.62 billion net loss, signaling not merely a cyclical trough but a structural inflection point for the industry. While the 7% decline in net sales to $40 billion reflects macroeconomic deceleration, HDIN Research identifies Dow’s aggressive strategic pivot—specifically the "Transform to Outperform" initiative and a 50% dividend cut—as a necessary prioritization of balance sheet preservation over short-term yield.

The 2025 fiscal year was characterized by severe "volume-price decoupling," where local price erosion outpaced raw material cost deflations, compressing margins across the board.

Figure Dow Inc. 2025 Performance Navigating the “Scissors Effect and the Path2Zero Pivot

Financial Health: The Cost of Capital Preservation

Financial Health: The Cost of Capital Preservation

The reported net loss was heavily influenced by $1.856 billion in non-recurring charges, including significant impairments and restructuring costs. Specifically, the Industrial Intermediates & Infrastructure (II&I) segment recorded a $690 million goodwill impairment, underscoring the severity of the supply glut in polyurethane and construction chemicals.

To defend liquidity, Dow’s Board took the rare defensive measure of slashing the quarterly dividend to $0.35 per share. While this impacts immediate shareholder returns, it aligns with a strategy to maintain financial flexibility. The monetization of non-core assets, such as the divestment of a 49% stake in Diamond Infrastructure Solutions (generating ~$3 billion), further illustrates a shift toward rigorous capital allocation efficiency to weather the bottom of the cycle.

Asset Rationalization: Exiting the High-Cost Curve

Dow’s "Transform to Outperform" strategy is not a simple cost-cutting exercise; it is a geographic and structural realignment of the cost curve. The company is systematically exiting assets in Europe that lack competitiveness due to high energy prices:

* Germany: The shutdown of the Böhlen ethylene facility and Schkopau chlor-alkali assets by 2027.

* UK: The closure of the Barry silicone base plant by mid-2026 to reduce exposure to volatile merchant markets.

This "asset cleansing" aims to shift the company's center of gravity toward low-cost feedstock regions (US Gulf Coast and Canada) and high-value derivatives. Furthermore, the strategic delay of the Path2Zero project (now pushed to 2029/2030) represents a pragmatic "space for time" approach, balancing long-term decarbonization goals with near-term capital expenditure constraints.

Sector Positioning: The Operating Leverage Challenge

The cost of sales (COS) as a percentage of net sales surged to 93.7% in 2025 (up from 89.3% in 2024), indicating that pricing power has significantly diminished. While Dow benefits from a feedstock advantage in North America (NGLs vs. Naphtha), the collapse of integrated spreads globally has eroded this buffer. The imminent reduction of approximately 6,000 roles (1,500 initially, followed by 4,500 under the new plan) aims to deliver $2 billion in structural EBITDA growth, positioning the firm to capture maximum operating leverage once global demand rebounds.

HDIN Viewpoint: Interpreting the Bottom

At HDIN Research, we view Dow’s 2025 performance as a classic "clearing event" typical of a cycle bottom. The heavy impairments and dividend reduction are painful but necessary to reset the valuation baseline.

Critically, the market should look beyond the headline loss. The confirmed $1.2 billion cash settlement from Nova Chemicals provides a vital liquidity bridge. Dow’s strategy is now squarely focused on "shrinking to grow"—sacrificing volume in high-cost regions to protect margins in advantaged zones.

For investors and industry stakeholders, the key metric to watch in 2026 is not just revenue recovery, but the stabilization of the cash flow conversion rate, which dipped to 32.6% in 2025. If the "Transform to Outperform" plan executes effectively, Dow is positioning itself to emerge with a significantly lower break-even point when the inventory destocking cycle finally reverses.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

The 2025 fiscal year was characterized by severe "volume-price decoupling," where local price erosion outpaced raw material cost deflations, compressing margins across the board.

Figure Dow Inc. 2025 Performance Navigating the “Scissors Effect and the Path2Zero Pivot

Financial Health: The Cost of Capital Preservation

Financial Health: The Cost of Capital PreservationThe reported net loss was heavily influenced by $1.856 billion in non-recurring charges, including significant impairments and restructuring costs. Specifically, the Industrial Intermediates & Infrastructure (II&I) segment recorded a $690 million goodwill impairment, underscoring the severity of the supply glut in polyurethane and construction chemicals.

To defend liquidity, Dow’s Board took the rare defensive measure of slashing the quarterly dividend to $0.35 per share. While this impacts immediate shareholder returns, it aligns with a strategy to maintain financial flexibility. The monetization of non-core assets, such as the divestment of a 49% stake in Diamond Infrastructure Solutions (generating ~$3 billion), further illustrates a shift toward rigorous capital allocation efficiency to weather the bottom of the cycle.

Asset Rationalization: Exiting the High-Cost Curve

Dow’s "Transform to Outperform" strategy is not a simple cost-cutting exercise; it is a geographic and structural realignment of the cost curve. The company is systematically exiting assets in Europe that lack competitiveness due to high energy prices:

* Germany: The shutdown of the Böhlen ethylene facility and Schkopau chlor-alkali assets by 2027.

* UK: The closure of the Barry silicone base plant by mid-2026 to reduce exposure to volatile merchant markets.

This "asset cleansing" aims to shift the company's center of gravity toward low-cost feedstock regions (US Gulf Coast and Canada) and high-value derivatives. Furthermore, the strategic delay of the Path2Zero project (now pushed to 2029/2030) represents a pragmatic "space for time" approach, balancing long-term decarbonization goals with near-term capital expenditure constraints.

Sector Positioning: The Operating Leverage Challenge

The cost of sales (COS) as a percentage of net sales surged to 93.7% in 2025 (up from 89.3% in 2024), indicating that pricing power has significantly diminished. While Dow benefits from a feedstock advantage in North America (NGLs vs. Naphtha), the collapse of integrated spreads globally has eroded this buffer. The imminent reduction of approximately 6,000 roles (1,500 initially, followed by 4,500 under the new plan) aims to deliver $2 billion in structural EBITDA growth, positioning the firm to capture maximum operating leverage once global demand rebounds.

HDIN Viewpoint: Interpreting the Bottom

At HDIN Research, we view Dow’s 2025 performance as a classic "clearing event" typical of a cycle bottom. The heavy impairments and dividend reduction are painful but necessary to reset the valuation baseline.

Critically, the market should look beyond the headline loss. The confirmed $1.2 billion cash settlement from Nova Chemicals provides a vital liquidity bridge. Dow’s strategy is now squarely focused on "shrinking to grow"—sacrificing volume in high-cost regions to protect margins in advantaged zones.

For investors and industry stakeholders, the key metric to watch in 2026 is not just revenue recovery, but the stabilization of the cash flow conversion rate, which dipped to 32.6% in 2025. If the "Transform to Outperform" plan executes effectively, Dow is positioning itself to emerge with a significantly lower break-even point when the inventory destocking cycle finally reverses.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com