Clearmind’s CMND-100: Strategic Moat or Capital Trap?

Date : 2026-02-17

Reading : 80

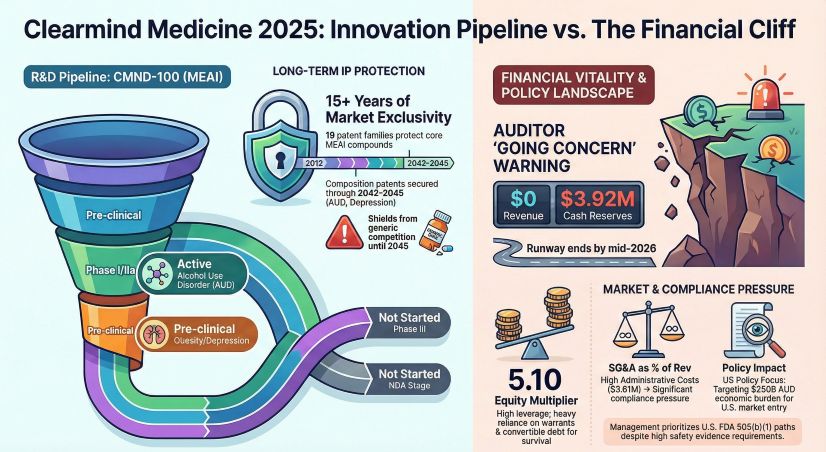

Clearmind Medicine’s CMND-100 represents a potential paradigm shift in treating Alcohol Use Disorder (AUD) by bypassing the logistical bottlenecks of traditional psychedelic therapies. However, HDIN Research’s latest assessment reveals a critical tension: a high-potential asset currently constrained by a "terminal dilution risk" financial structure.

Figure Clearmind Medicine 2025 Innovation Pipeline vs. The Financial Cliff

The Commercial Logic of Non-Hallucinogenic Efficacy

The Commercial Logic of Non-Hallucinogenic Efficacy

The global Alcohol Use Disorder (AUD) market is characterized by a "high demand, low penetration" dynamic, with a patient baseline of approximately 284 million. The strategic differentiator for Clearmind’s CMND-100 (MEAI) is not merely its biological target, but its non-hallucinogenic profile.

Unlike competitors utilizing Psilocybin or MDMA, which often require strict Risk Evaluation and Mitigation Strategies (REMS) and 2–8 hours of in-clinic monitoring, CMND-100 is engineered for potential home use. This distinction is the primary driver of its valuation premium. By enabling distribution through General Practitioners (GPs) rather than specialized psychiatric facilities, CMND-100 eliminates the physical infrastructure burden that caps the scalability of traditional psychedelic competitors. If clinical endpoints validate this safety profile, the asset could unlock a mass-market prescription model previously inaccessible to CNS hallucinogens.

Capital Allocation and Solvency Headwinds

Despite the disruptive potential of the underlying technology, the financial vehicle remains fragile. HDIN Research analysis of the fiscal year 2025 data highlights a severe "Liquidity Crunch."

As of October 31, 2025, Clearmind reported cash and equivalents of only ~$3.92 million, set against an annual operating loss of $5.66 million. This imbalance suggests the company faces a "Going Concern" risk, with current capital insufficient to support operations through late 2026 without significant intervention.

Investors must account for the "Flow-Through Dilution Effect." The company’s reliance on equity financing and warrants to fund Phase I/IIa trials creates a structural ceiling on share price appreciation. With a high burn rate and no commercial revenue, the Net Present Value (NPV) of the pipeline is currently suppressed by a liquidity discount of 30-50%.

Regulatory Horizons and Intellectual Property Matrices

The long-term value of the CMND-100 pipeline is anchored by a patent matrix extending from 2035 to 2043. However, a "Time-Value Scissors" risk exists. With the asset currently in Phase I/IIa (2025), a prolonged Phase III timeline could erode the commercial exclusivity window before the 2035 core patent expiry.

Furthermore, operational risks are elevated by geopolitical factors. Key clinical sites (TASMC, Hadassah) and supply chain dependencies are located in Israel. Ongoing regional instability poses a tangible threat to patient enrollment velocity and cGMP supply consistency, potentially delaying critical data readouts required for FDA regulatory advancement.

HDIN Viewpoint

HDIN Research maintains a cautious outlook. While the "non-hallucinogenic" mechanism offers a clear strategic moat and optionality in obesity and depression, the investment thesis is currently binary. The technology is sound, but the balance sheet is distressed.

We classify CMND-100 as a "Capital-Intensive Option Play." The pivotal catalyst for valuation re-rating will not just be clinical efficacy, but the ability to secure non-dilutive funding or a licensing partnership with a major pharma player to bridge the cash flow gap. Until the "Going Concern" status is resolved, the asset’s intrinsic value remains heavily discounted by execution risk.

Download the Analysis

To explore the detailed financial modeling, patent expiration timelines, and the complete risk matrix for Clearmind Medicine, please click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Figure Clearmind Medicine 2025 Innovation Pipeline vs. The Financial Cliff

The Commercial Logic of Non-Hallucinogenic Efficacy

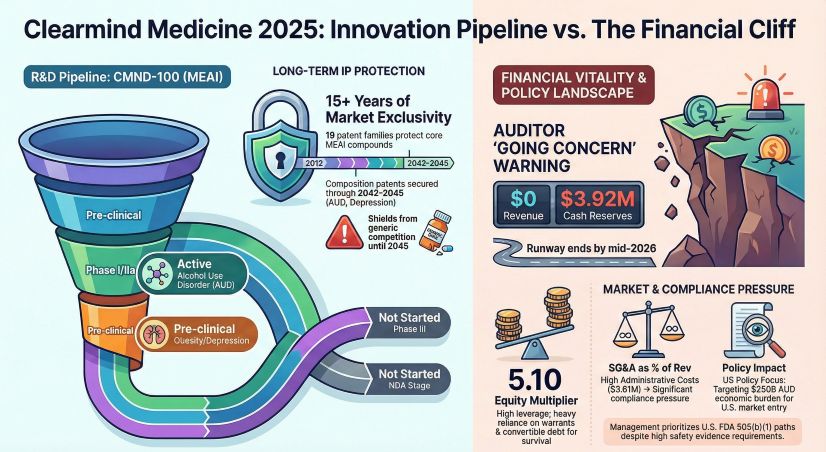

The Commercial Logic of Non-Hallucinogenic EfficacyThe global Alcohol Use Disorder (AUD) market is characterized by a "high demand, low penetration" dynamic, with a patient baseline of approximately 284 million. The strategic differentiator for Clearmind’s CMND-100 (MEAI) is not merely its biological target, but its non-hallucinogenic profile.

Unlike competitors utilizing Psilocybin or MDMA, which often require strict Risk Evaluation and Mitigation Strategies (REMS) and 2–8 hours of in-clinic monitoring, CMND-100 is engineered for potential home use. This distinction is the primary driver of its valuation premium. By enabling distribution through General Practitioners (GPs) rather than specialized psychiatric facilities, CMND-100 eliminates the physical infrastructure burden that caps the scalability of traditional psychedelic competitors. If clinical endpoints validate this safety profile, the asset could unlock a mass-market prescription model previously inaccessible to CNS hallucinogens.

Capital Allocation and Solvency Headwinds

Despite the disruptive potential of the underlying technology, the financial vehicle remains fragile. HDIN Research analysis of the fiscal year 2025 data highlights a severe "Liquidity Crunch."

As of October 31, 2025, Clearmind reported cash and equivalents of only ~$3.92 million, set against an annual operating loss of $5.66 million. This imbalance suggests the company faces a "Going Concern" risk, with current capital insufficient to support operations through late 2026 without significant intervention.

Investors must account for the "Flow-Through Dilution Effect." The company’s reliance on equity financing and warrants to fund Phase I/IIa trials creates a structural ceiling on share price appreciation. With a high burn rate and no commercial revenue, the Net Present Value (NPV) of the pipeline is currently suppressed by a liquidity discount of 30-50%.

Regulatory Horizons and Intellectual Property Matrices

The long-term value of the CMND-100 pipeline is anchored by a patent matrix extending from 2035 to 2043. However, a "Time-Value Scissors" risk exists. With the asset currently in Phase I/IIa (2025), a prolonged Phase III timeline could erode the commercial exclusivity window before the 2035 core patent expiry.

Furthermore, operational risks are elevated by geopolitical factors. Key clinical sites (TASMC, Hadassah) and supply chain dependencies are located in Israel. Ongoing regional instability poses a tangible threat to patient enrollment velocity and cGMP supply consistency, potentially delaying critical data readouts required for FDA regulatory advancement.

HDIN Viewpoint

HDIN Research maintains a cautious outlook. While the "non-hallucinogenic" mechanism offers a clear strategic moat and optionality in obesity and depression, the investment thesis is currently binary. The technology is sound, but the balance sheet is distressed.

We classify CMND-100 as a "Capital-Intensive Option Play." The pivotal catalyst for valuation re-rating will not just be clinical efficacy, but the ability to secure non-dilutive funding or a licensing partnership with a major pharma player to bridge the cash flow gap. Until the "Going Concern" status is resolved, the asset’s intrinsic value remains heavily discounted by execution risk.

Download the Analysis

To explore the detailed financial modeling, patent expiration timelines, and the complete risk matrix for Clearmind Medicine, please click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com