Nuvectis Pharma 2025 Analysis: The Strategic “All-In” Bet on NXP900

Date : 2026-02-17

Reading : 73

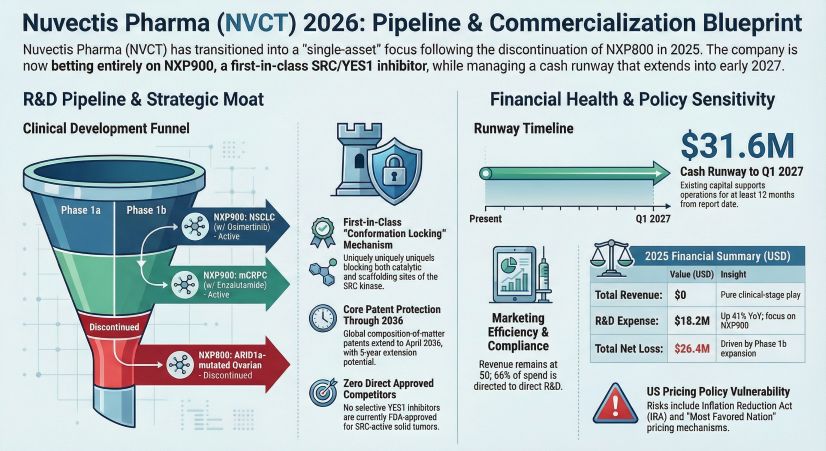

For Nuvectis Pharma (NVCT), 2025 was not merely a fiscal year; it was a year of ruthless strategic consolidation. The company’s decision to discontinue its NXP800 program (HSF1 pathway) following Phase 1b data has effectively transformed Nuvectis into a high-stakes, single-asset play. The investment thesis now rests entirely on NXP900, a novel SRC/YES1 kinase inhibitor designed to overcome resistance in solid tumors.

At HDIN Research, our analysis of the 2025 Annual Report suggests that while the company faces significant capital constraints, its "virtual R&D" model and the unique mechanism of action of NXP900 offer a distinct—albeit binary—value proposition in the precision oncology sector.

Figure Nuvectis Pharma 2026 Pipeline & Commercialization Blueprint

The Strategic Moat: NXP900’s "Conformation Lock"

The biopharmaceutical market is saturated with kinase inhibitors, but NXP900 differentiates itself through structural mechanics rather than simple enzymatic inhibition. Unlike existing drugs such as Dasatinib, which primarily inhibit catalytic activity, NXP900 induces a "conformation lock."

This mechanism freezes the SRC kinase in its native inactive state, simultaneously blocking both its catalytic and scaffolding functions. This is a critical differentiator for treating Non-Small Cell Lung Cancer (NSCLC) patients who have developed resistance to Osimertinib due to YES1 amplification. By preventing the kinase from forming complexes with partner proteins, NXP900 theoretically closes the escape routes that tumors use to evade current standard-of-care therapies.

Capital Allocation & Survival Analysis: The 12-Month Runway

Financial sustainability remains the primary headwind for Nuvectis. As of December 31, 2025, the company reported $31.6 million in cash and cash equivalents.

* Cash Burn Efficiency: With a 2025 operating loss of $27.6 million and a quarterly burn rate estimated between $6.5M and $7M, HDIN Research models a cash runway extending through Q1 2027.

* Dilution Impact: To sustain operations, Nuvectis executed significant equity financing in 2025, raising approximately $29 million via direct offerings and ATM facilities. This expanded the outstanding share count from ~19.5 million to ~26.5 million, diluting early shareholders to fund the NXP900 Phase 1b expansion.

* The "Invisible" Debt: Investors must note the off-balance-sheet obligations. The company faces up to $45.5 million in pre-approval milestone payments for the NXP900 license. While these are contingent on success, they represent a massive future capital requirement relative to the current balance sheet.

Sector Positioning: The 2026 Catalyst

The discontinuation of NXP800 has removed a layer of diversification, concentrating all risk on the upcoming clinical readouts. The critical catalyst for 2026 will be the Phase 1b early efficacy data for NXP900, specifically in combination with Osimertinib for EGFR-mutated NSCLC.

Currently, there are no FDA-approved selective YES1 inhibitors, giving Nuvectis a potential "First-in-Class" advantage. However, the lack of a diversified pipeline means the company has zero margin for error regarding clinical safety or efficacy signals in the coming quarters.

HDIN Viewpoint: The "Binary Option" Valuation

HDIN Research assesses Nuvectis Pharma as transitioning into a pure "Clinical Option Value" stage. The company’s asset-light structure (virtual R&D with minimal fixed assets) allows for high capital efficiency, where ~$0.66 of every dollar spent goes directly into clinical development.

However, the valuation is no longer tethered to traditional financial metrics but is strictly correlated to the probability of success (PoS) of the NXP900 expansion studies. The market is pricing NVCT not on its current cash flow (which is negative), but on the potential to unlock the multi-billion dollar market for post-Osimertinib resistance.

For investors, the 2026 data readouts represent a binary event: NXP900 will either validate the "conformation lock" hypothesis and trigger a repricing, or the company will face an existential liquidity crisis given the heavy milestone burdens.

Presentation Download

Want to see the deep-dive numbers behind this analysis?

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

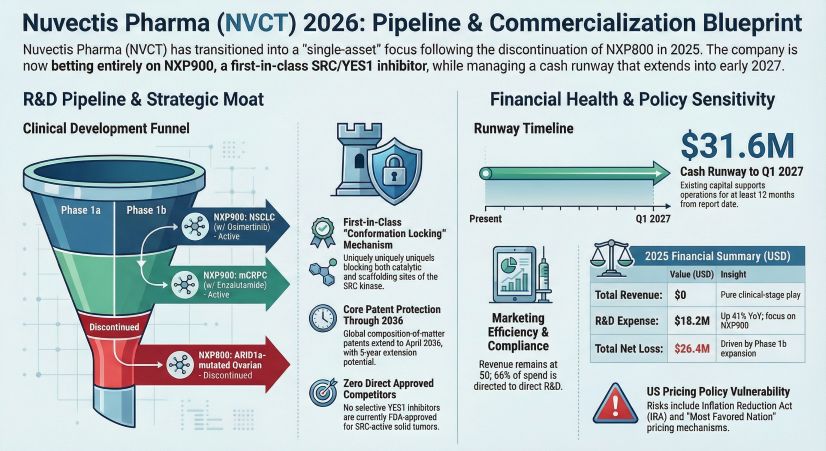

At HDIN Research, our analysis of the 2025 Annual Report suggests that while the company faces significant capital constraints, its "virtual R&D" model and the unique mechanism of action of NXP900 offer a distinct—albeit binary—value proposition in the precision oncology sector.

Figure Nuvectis Pharma 2026 Pipeline & Commercialization Blueprint

The Strategic Moat: NXP900’s "Conformation Lock"

The biopharmaceutical market is saturated with kinase inhibitors, but NXP900 differentiates itself through structural mechanics rather than simple enzymatic inhibition. Unlike existing drugs such as Dasatinib, which primarily inhibit catalytic activity, NXP900 induces a "conformation lock."

This mechanism freezes the SRC kinase in its native inactive state, simultaneously blocking both its catalytic and scaffolding functions. This is a critical differentiator for treating Non-Small Cell Lung Cancer (NSCLC) patients who have developed resistance to Osimertinib due to YES1 amplification. By preventing the kinase from forming complexes with partner proteins, NXP900 theoretically closes the escape routes that tumors use to evade current standard-of-care therapies.

Capital Allocation & Survival Analysis: The 12-Month Runway

Financial sustainability remains the primary headwind for Nuvectis. As of December 31, 2025, the company reported $31.6 million in cash and cash equivalents.

* Cash Burn Efficiency: With a 2025 operating loss of $27.6 million and a quarterly burn rate estimated between $6.5M and $7M, HDIN Research models a cash runway extending through Q1 2027.

* Dilution Impact: To sustain operations, Nuvectis executed significant equity financing in 2025, raising approximately $29 million via direct offerings and ATM facilities. This expanded the outstanding share count from ~19.5 million to ~26.5 million, diluting early shareholders to fund the NXP900 Phase 1b expansion.

* The "Invisible" Debt: Investors must note the off-balance-sheet obligations. The company faces up to $45.5 million in pre-approval milestone payments for the NXP900 license. While these are contingent on success, they represent a massive future capital requirement relative to the current balance sheet.

Sector Positioning: The 2026 Catalyst

The discontinuation of NXP800 has removed a layer of diversification, concentrating all risk on the upcoming clinical readouts. The critical catalyst for 2026 will be the Phase 1b early efficacy data for NXP900, specifically in combination with Osimertinib for EGFR-mutated NSCLC.

Currently, there are no FDA-approved selective YES1 inhibitors, giving Nuvectis a potential "First-in-Class" advantage. However, the lack of a diversified pipeline means the company has zero margin for error regarding clinical safety or efficacy signals in the coming quarters.

HDIN Viewpoint: The "Binary Option" Valuation

HDIN Research assesses Nuvectis Pharma as transitioning into a pure "Clinical Option Value" stage. The company’s asset-light structure (virtual R&D with minimal fixed assets) allows for high capital efficiency, where ~$0.66 of every dollar spent goes directly into clinical development.

However, the valuation is no longer tethered to traditional financial metrics but is strictly correlated to the probability of success (PoS) of the NXP900 expansion studies. The market is pricing NVCT not on its current cash flow (which is negative), but on the potential to unlock the multi-billion dollar market for post-Osimertinib resistance.

For investors, the 2026 data readouts represent a binary event: NXP900 will either validate the "conformation lock" hypothesis and trigger a repricing, or the company will face an existential liquidity crisis given the heavy milestone burdens.

Presentation Download

Want to see the deep-dive numbers behind this analysis?

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com