2025 Strategic Audit: GM vs. Ford and the EV "Valley of Death"

Date : 2026-02-17

Reading : 102

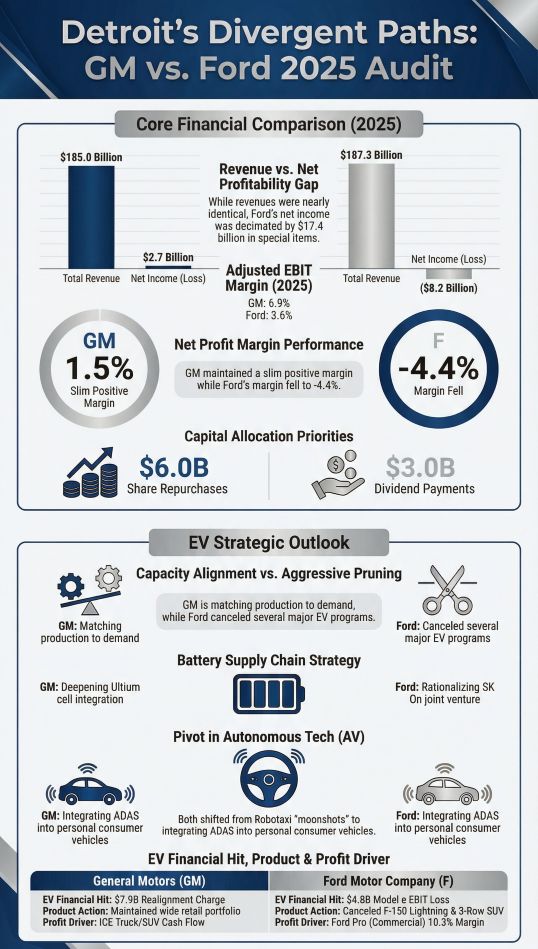

The 2025 fiscal year has proven to be a brutal "valley of death" for legacy automakers navigating the transition from Internal Combustion Engines (ICE) to Electric Vehicles (EV). While top-line revenue remains comparable between General Motors (GM) and Ford Motor Company, an in-depth audit of their 10-K filings reveals a stark divergence in operational resilience. While GM has moved into a "harvest" phase—prioritizing shareholder returns and margin protection—Ford is entangled in a massive structural rationalization, heavily reliant on its commercial fleet business to subsidize significant EV losses.

Figure GM vs Ford 2025 Audit

Financial Health: The Tale of Two Balance Sheets

The raw numbers tell a story of strategic realignment. GM outperformed Ford on nearly every core profitability metric in 2025. While Ford maintained higher top-line revenue ($187.3 billion), its net income was decimated by $17.4 billion in pre-tax special items, primarily driven by asset impairments within its "Model e" unit. Conversely, GM utilized its cleaner balance sheet to execute aggressive capital returns, including $6.0 billion in share repurchases.

The strategic implication here is clear: GM has successfully insulated its core operations from the volatility of the EV transition, achieving an adjusted EBIT margin of approximately 6.9%. Ford, however, is paying the price for transparency. Its "Ford+" reporting structure exposed a $4.8 billion EBIT loss in the "Model e" segment, necessitating a reliance on the "Ford Pro" commercial unit—which generated a robust $6.8 billion EBIT—to stabilize the enterprise.

Policy Headwinds: The "One Big Beautiful Bill Act"

The regulatory moat that once protected domestic OEMs began to erode in July 2025 with the signing of the "One Big Beautiful Bill Act." This legislation fundamentally altered the market dynamics by canceling the $7,500 federal tax credit, which immediately cooled EV demand.

Furthermore, the relaxation of CAFE (Corporate Average Fuel Economy) fines created a paradox for financial planning. While it reduced short-term compliance costs for ICE portfolios, it collapsed the value of emission credits. Consequently, GM faces a potential $1.1 billion impairment on its credit inventory, while Ford recorded a $7 billion charge due to the reduced utility of its banked credits. The era of regulatory-driven profit padding has effectively ended.

Operational Resilience & Supply Chain Fragility

2025 exposed significant vulnerabilities in the "Just-in-Time" manufacturing model. Ford’s F-Series, traditionally the market leader, faced a $2 billion headwinds due to a fire at a Novelis aluminum plant, severely impacting Q4 production.

Both giants are also grappling with the "liability" of long-term off-take agreements for battery materials. With EV demand falling below 2022-2023 projections, the risk has shifted from suppliers to OEMs. Both Ford and GM now face the prospect of paying penalties or reselling lithium and cobalt at a loss. Ford’s proactive response—taking a massive $13.8 billion hit in Q4 2025 to cancel its three-row electric SUV and rationalize its battery JV with SK On—demonstrates a painful but necessary pivot toward capital preservation over blind expansion.

HDIN Viewpoint: The Global Order is Shifting

At HDIN Research, we believe the 2025 global sales rankings signal a permanent restructuring of the automotive hierarchy. The rise of Chinese OEMs is no longer a forecast; it is a financial reality.

* BYD has surged to #5 globally (4.6 million units), growing 18.3% YoY.

* Geely has entered the Top 10 at #7, surpassing both Ford and Honda with 26% growth.

In contrast, the "Big Two" American firms are in a defensive posture. GM holds the #6 spot (-1.5% YoY), while Ford sits at #9. The strategic imperative for US automakers is no longer just about "electrification"—it is about efficient retrenchment.

GM’s decision to end its "Cruise" robotaxi moonshot to focus on ADAS integration, and Ford’s retreat to its commercial "Ford Pro" stronghold, suggests that 2026 will be defined by who can best monetize their legacy assets while waiting for the EV cost curve to stabilize. The winners will not be those who sell the most cars, but those who can best manage the structural costs of a bifurcated market.

Presentation Download

For a comprehensive breakdown of the financial metrics, supply chain impact analysis, and global sales rankings discussed in this article:

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

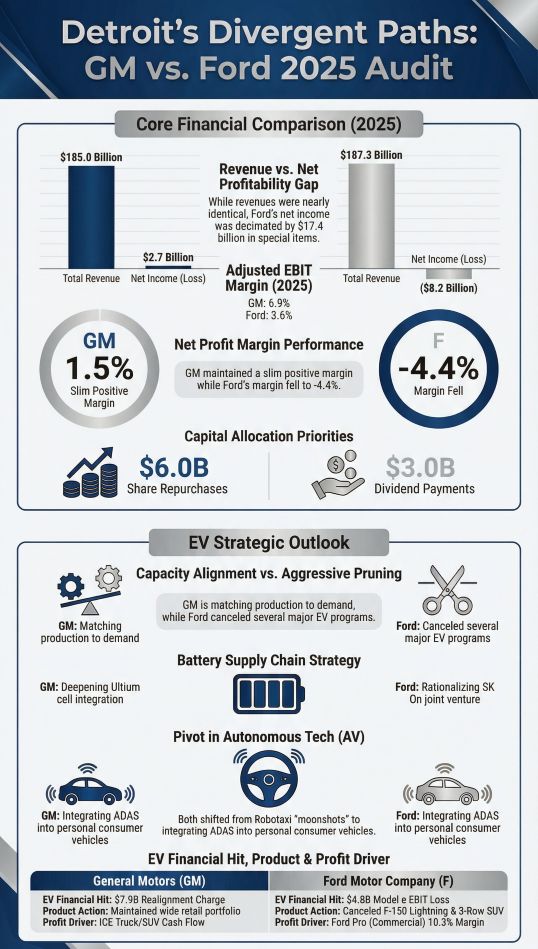

Figure GM vs Ford 2025 Audit

Financial Health: The Tale of Two Balance Sheets

The raw numbers tell a story of strategic realignment. GM outperformed Ford on nearly every core profitability metric in 2025. While Ford maintained higher top-line revenue ($187.3 billion), its net income was decimated by $17.4 billion in pre-tax special items, primarily driven by asset impairments within its "Model e" unit. Conversely, GM utilized its cleaner balance sheet to execute aggressive capital returns, including $6.0 billion in share repurchases.

The strategic implication here is clear: GM has successfully insulated its core operations from the volatility of the EV transition, achieving an adjusted EBIT margin of approximately 6.9%. Ford, however, is paying the price for transparency. Its "Ford+" reporting structure exposed a $4.8 billion EBIT loss in the "Model e" segment, necessitating a reliance on the "Ford Pro" commercial unit—which generated a robust $6.8 billion EBIT—to stabilize the enterprise.

Policy Headwinds: The "One Big Beautiful Bill Act"

The regulatory moat that once protected domestic OEMs began to erode in July 2025 with the signing of the "One Big Beautiful Bill Act." This legislation fundamentally altered the market dynamics by canceling the $7,500 federal tax credit, which immediately cooled EV demand.

Furthermore, the relaxation of CAFE (Corporate Average Fuel Economy) fines created a paradox for financial planning. While it reduced short-term compliance costs for ICE portfolios, it collapsed the value of emission credits. Consequently, GM faces a potential $1.1 billion impairment on its credit inventory, while Ford recorded a $7 billion charge due to the reduced utility of its banked credits. The era of regulatory-driven profit padding has effectively ended.

Operational Resilience & Supply Chain Fragility

2025 exposed significant vulnerabilities in the "Just-in-Time" manufacturing model. Ford’s F-Series, traditionally the market leader, faced a $2 billion headwinds due to a fire at a Novelis aluminum plant, severely impacting Q4 production.

Both giants are also grappling with the "liability" of long-term off-take agreements for battery materials. With EV demand falling below 2022-2023 projections, the risk has shifted from suppliers to OEMs. Both Ford and GM now face the prospect of paying penalties or reselling lithium and cobalt at a loss. Ford’s proactive response—taking a massive $13.8 billion hit in Q4 2025 to cancel its three-row electric SUV and rationalize its battery JV with SK On—demonstrates a painful but necessary pivot toward capital preservation over blind expansion.

HDIN Viewpoint: The Global Order is Shifting

At HDIN Research, we believe the 2025 global sales rankings signal a permanent restructuring of the automotive hierarchy. The rise of Chinese OEMs is no longer a forecast; it is a financial reality.

* BYD has surged to #5 globally (4.6 million units), growing 18.3% YoY.

* Geely has entered the Top 10 at #7, surpassing both Ford and Honda with 26% growth.

In contrast, the "Big Two" American firms are in a defensive posture. GM holds the #6 spot (-1.5% YoY), while Ford sits at #9. The strategic imperative for US automakers is no longer just about "electrification"—it is about efficient retrenchment.

GM’s decision to end its "Cruise" robotaxi moonshot to focus on ADAS integration, and Ford’s retreat to its commercial "Ford Pro" stronghold, suggests that 2026 will be defined by who can best monetize their legacy assets while waiting for the EV cost curve to stabilize. The winners will not be those who sell the most cars, but those who can best manage the structural costs of a bifurcated market.

Presentation Download

For a comprehensive breakdown of the financial metrics, supply chain impact analysis, and global sales rankings discussed in this article:

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com