Oilfield Services (OFS) 2.0: How AI, Electric Fleets, and Geopolitics Are Decoupling the Sector

Date : 2026-02-18

Reading : 141

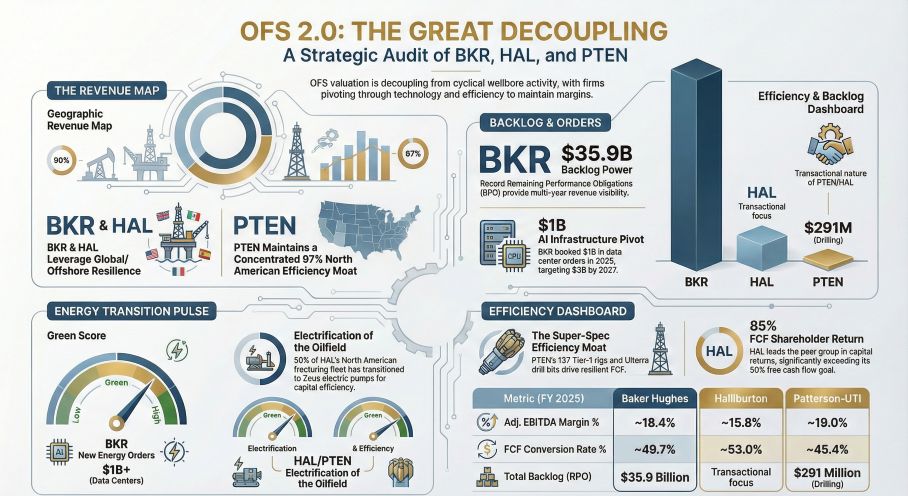

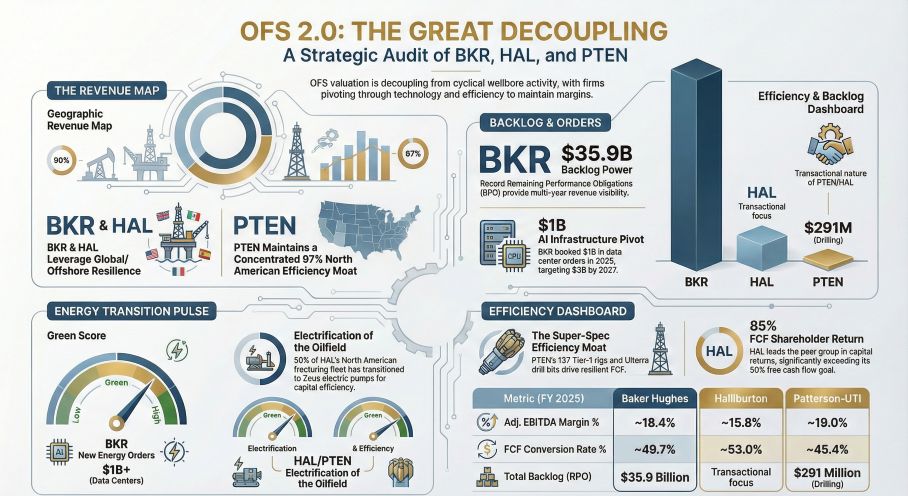

The fiscal year 2025 reporting cycle has confirmed a structural transformation within the global energy services sector. According to the latest comprehensive audit by HDIN Research, the correlation between rig counts and corporate valuation is fracturing. The "Big Three"—Baker Hughes (BKR), Halliburton (HAL), and Patterson-UTI (PTEN)—are no longer moving in lockstep. Instead, they are executing a strategy of "decoupling," utilizing technology moats, industrial diversification, and capital discipline to insulate themselves from North American (NAM) land softness while capitalizing on international resilience and the burgeoning demand for data center power.

Figure Oilfield Services (OFS) 2.0 THE GREAT DECOUPLING

Beyond the Barrel: The Rise of Industrial Energy Technology

The most distinct strategic pivot identified in our analysis belongs to Baker Hughes. By rebranding as an "Energy Technology Company," BKR has effectively removed the ceiling imposed by cyclical oilfield service dynamics. The "So What" for investors is found in the company’s Industrial & Energy Technology (IET) segment, which now holds a record backlog (RPO) of $32.4 billion.

This backlog is not merely a buffer; it is a growth engine driven by the "molecule economy." HDIN Research notes that BKR has identified AI and data centers as a structural layer of new power demand. With $1 billion in data center-related orders booked in 2025 and a projection to triple this to $3 billion by 2027, BKR is leveraging its turbine and power solution capabilities to serve digital infrastructure rather than just upstream operators. Furthermore, the pending $13.6 billion acquisition of Chart Industries (expected close Q2 2026) will solidify BKR’s dominance in the gas and hydrogen value chain, further distancing its revenue stream from crude oil volatility.

North American Consolidation: Value Over Volume

While BKR pivots to industrial tech, Halliburton is rewriting the playbook for mature markets through its "Value over Volume" strategy. Facing a consolidated and softening North American land market, HAL has chosen margin protection over market share, explicitly "stacking uneconomic fleets" to maintain pricing power.

The strategic differentiator here is the Zeus electric fracturing platform. Our analysis confirms that 50% of HAL’s North American fleet has now transitioned to Zeus electric pumps. This implies a massive leap in capital efficiency and emissions compliance, creating a technical moat that smaller competitors cannot bridge. Despite a slight revenue dip in 2025, this discipline allowed HAL to return approximately $1.6 billion to shareholders (85% of Free Cash Flow), demonstrating that a shrinking top line in NAM does not necessitate shrinking shareholder returns.

The Efficiency Moat: High-Grading the Asset Base

Patterson-UTI provides the definitive case study for resilience in pure-play drilling. In an environment where U.S. operating days dropped by 11.1%, PTEN generated $416.3 million in Free Cash Flow.

The strategic implication is clear: in a consolidated market, only "Tier-1" assets command utilization. PTEN’s fleet of 137 super-spec rigs ensures it remains the provider of choice for complex horizontal wells. Additionally, the 2023 acquisition of Ulterra has proven vital, giving PTEN dominance in the high-margin PDC drill bit market. This "efficiency moat" allows PTEN to generate recurring revenue even as the broader rig count faces cyclical headwinds.

Navigating Geopolitical Friction and Tariff Impacts

The transition to "OFS 2.0" is not without external friction. HDIN Research’s geopolitical audit highlights that 2026 will be a "Rebalancing Year" fraught with trade policy risks.

* Tariff Costs: Halliburton explicitly quantified a $89 million incremental cost in 2025 due to new tariff policies, highlighting the vulnerability of global supply chains.

* Currency & Credit: Operations in Argentina continue to face headwinds from currency controls (Blue Chip Swaps), while credit risks in Mexico and Venezuela have necessitated aggressive hedging via Credit Default Swaps (CDS) and bad debt provisions.

HDIN Viewpoint: The Valuation Divergence

At HDIN Research, we believe the market is witnessing a permanent divergence in how these equities should be valued.

* Baker Hughes is transitioning toward an industrial multiple, justified by its massive IET backlog and exposure to the secular growth of AI power demand.

* Halliburton remains the premier "Cash Cow," optimizing free cash flow conversion through the digitalization of the oilfield.

* Patterson-UTI stands as the defensive efficiency play, offering stability through asset quality.

For 2026, the critical metric is no longer "rig count," but "revenue quality"—specifically, how much revenue is protected by long-term service agreements, technological lock-in, or non-oil industrial demand.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Figure Oilfield Services (OFS) 2.0 THE GREAT DECOUPLING

Beyond the Barrel: The Rise of Industrial Energy Technology

The most distinct strategic pivot identified in our analysis belongs to Baker Hughes. By rebranding as an "Energy Technology Company," BKR has effectively removed the ceiling imposed by cyclical oilfield service dynamics. The "So What" for investors is found in the company’s Industrial & Energy Technology (IET) segment, which now holds a record backlog (RPO) of $32.4 billion.

This backlog is not merely a buffer; it is a growth engine driven by the "molecule economy." HDIN Research notes that BKR has identified AI and data centers as a structural layer of new power demand. With $1 billion in data center-related orders booked in 2025 and a projection to triple this to $3 billion by 2027, BKR is leveraging its turbine and power solution capabilities to serve digital infrastructure rather than just upstream operators. Furthermore, the pending $13.6 billion acquisition of Chart Industries (expected close Q2 2026) will solidify BKR’s dominance in the gas and hydrogen value chain, further distancing its revenue stream from crude oil volatility.

North American Consolidation: Value Over Volume

While BKR pivots to industrial tech, Halliburton is rewriting the playbook for mature markets through its "Value over Volume" strategy. Facing a consolidated and softening North American land market, HAL has chosen margin protection over market share, explicitly "stacking uneconomic fleets" to maintain pricing power.

The strategic differentiator here is the Zeus electric fracturing platform. Our analysis confirms that 50% of HAL’s North American fleet has now transitioned to Zeus electric pumps. This implies a massive leap in capital efficiency and emissions compliance, creating a technical moat that smaller competitors cannot bridge. Despite a slight revenue dip in 2025, this discipline allowed HAL to return approximately $1.6 billion to shareholders (85% of Free Cash Flow), demonstrating that a shrinking top line in NAM does not necessitate shrinking shareholder returns.

The Efficiency Moat: High-Grading the Asset Base

Patterson-UTI provides the definitive case study for resilience in pure-play drilling. In an environment where U.S. operating days dropped by 11.1%, PTEN generated $416.3 million in Free Cash Flow.

The strategic implication is clear: in a consolidated market, only "Tier-1" assets command utilization. PTEN’s fleet of 137 super-spec rigs ensures it remains the provider of choice for complex horizontal wells. Additionally, the 2023 acquisition of Ulterra has proven vital, giving PTEN dominance in the high-margin PDC drill bit market. This "efficiency moat" allows PTEN to generate recurring revenue even as the broader rig count faces cyclical headwinds.

Navigating Geopolitical Friction and Tariff Impacts

The transition to "OFS 2.0" is not without external friction. HDIN Research’s geopolitical audit highlights that 2026 will be a "Rebalancing Year" fraught with trade policy risks.

* Tariff Costs: Halliburton explicitly quantified a $89 million incremental cost in 2025 due to new tariff policies, highlighting the vulnerability of global supply chains.

* Currency & Credit: Operations in Argentina continue to face headwinds from currency controls (Blue Chip Swaps), while credit risks in Mexico and Venezuela have necessitated aggressive hedging via Credit Default Swaps (CDS) and bad debt provisions.

HDIN Viewpoint: The Valuation Divergence

At HDIN Research, we believe the market is witnessing a permanent divergence in how these equities should be valued.

* Baker Hughes is transitioning toward an industrial multiple, justified by its massive IET backlog and exposure to the secular growth of AI power demand.

* Halliburton remains the premier "Cash Cow," optimizing free cash flow conversion through the digitalization of the oilfield.

* Patterson-UTI stands as the defensive efficiency play, offering stability through asset quality.

For 2026, the critical metric is no longer "rig count," but "revenue quality"—specifically, how much revenue is protected by long-term service agreements, technological lock-in, or non-oil industrial demand.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com