A. O. Smith vs. Whirlpool: The K-Shaped Divergence in 2026 Durables

Date : 2026-02-18

Reading : 81

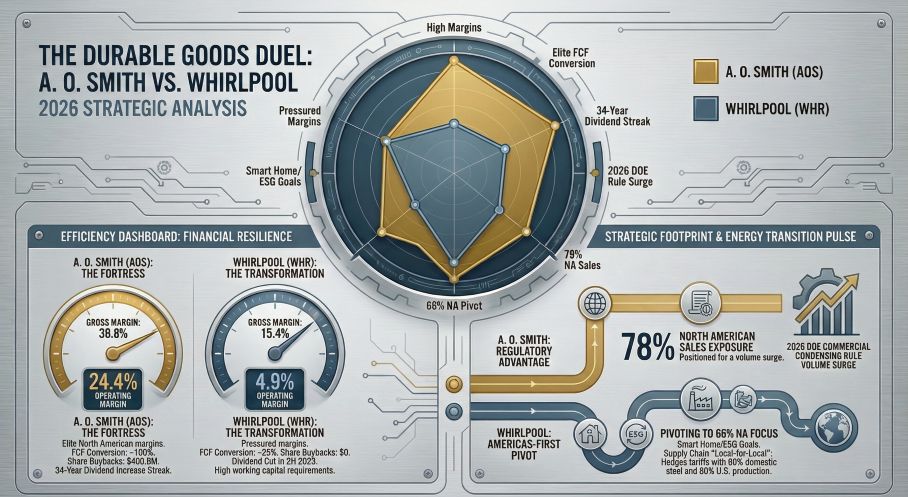

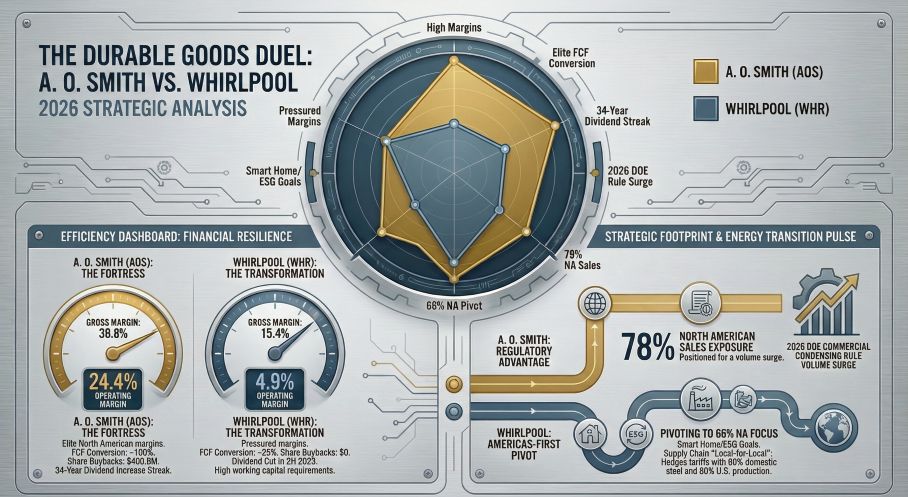

While the broader industry navigates macroeconomic volatility, HDIN Research identifies a stark bifurcation in corporate strategy. A. O. Smith (AOS) is leveraging a "Fortress" balance sheet to capture regulatory-driven growth, whereas Whirlpool (WHR) is engaged in a complex structural transformation to defend its core Americas business against credit-rating headwinds.

Our latest analysis of FY 2025-2026 data reveals that operational efficiency and capital allocation strategies have become the primary differentiators in shareholder value creation.

Figure The Durable Goods Duel: AO Smith vs Whirlpool

Capital Allocation: The "Fortress" vs. The "Turnaround"

Capital Allocation: The "Fortress" vs. The "Turnaround"

The most significant disparity lies in financial flexibility. A. O. Smith has maintained a "premium compounder" status, boasting a ~100% Free Cash Flow (FCF) conversion rate and a robust 38.8% gross margin. This liquidity has allowed AOS to deploy a dual-pronged strategy: aggressively repurchasing $400 million in stock while simultaneously executing the strategic $470 million acquisition of Leonard Valve to dominate the commercial water management adjacency.

Conversely, Whirlpool is navigating a liquidity-constrained environment. Following credit downgrades to non-investment grade (Ba2/BB) status, Whirlpool’s capital allocation has shifted entirely to defense. By slashing dividends and halting buybacks, WHR is prioritizing debt repayment. While the "Americas-first" strategy—cemented by the deconsolidation of European operations and the reduction of its India stake—aims to stabilize margins, the company currently trades at a "transformation discount" with North American EBIT margins hovering at 4.9%, significantly below AOS’s ~24% operating margin.

Regulatory Alpha: The Hidden Valuation Driver

HDIN Research emphasizes that "Regulatory Alpha" will be a critical volume driver in late 2026, overwhelmingly favoring A. O. Smith.

The upcoming October 2026 Department of Energy (DOE) rule, mandating condensing technology for commercial water heaters, creates a "forced demand" event. This regulatory moat insulates AOS from the cyclical volatility of the U.S. housing market. We project a significant "buy-ahead" volume surge in 2026, allowing AOS to leverage its market leadership in condensing units to drive pricing power.

Whirlpool, conversely, faces a "discretionary spending" hurdle. While its investments in Smart Home IoT are innovative, they lack the non-discretionary urgency of water heater replacement. Furthermore, Whirlpool faces higher compliance risks associated with its ambitious "Net Zero 2050" targets, whereas AOS’s ESG strategy is pragmatically aligned with product sales (e.g., heat pumps) rather than capital-intensive operational overhauls.

Operational Resilience in a Tariff-Heavy World

Despite financial headwinds, Whirlpool maintains a formidable operational edge in supply chain localization. Its "local-for-local" manufacturing model acts as a hedge against global trade volatility. With 80% of U.S. sales produced domestically and 96% of steel sourced within the U.S., Whirlpool has effectively neutralized direct tariff exposure.

A. O. Smith utilizes a different defense mechanism: contractual pass-throughs. By locking in pricing adjustments based on steel indices, AOS protects its gross margins. However, HDIN Research notes that AOS faces higher geopolitical exposure regarding its China operations, where sales declined 12% in 2025. The company’s ongoing strategic assessment of its China footprint represents a pivotal variable for investors to watch.

HDIN Viewpoint: The 2026 Strategic Verdict

At HDIN Research, we believe the market is currently witnessing a decoupling of the durable goods sector.

* A. O. Smith is positioned as the strategic winner for 2026. Its "critical need" product portfolio (60%+ replacement demand), combined with the upcoming DOE regulatory tailwinds, provides a clear path to earnings expansion regardless of interest rate environments.

* Whirlpool offers a value play contingent on successful restructuring. While its domestic manufacturing resilience is best-in-class, the company must resolve its credit overhang and stabilize EBIT margins above 6% before it can shed its transformation discount.

For institutional investors, the choice is between the stability of a regulatory monopoly (AOS) and the high-beta potential of a turnaround story (WHR).

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Our latest analysis of FY 2025-2026 data reveals that operational efficiency and capital allocation strategies have become the primary differentiators in shareholder value creation.

Figure The Durable Goods Duel: AO Smith vs Whirlpool

Capital Allocation: The "Fortress" vs. The "Turnaround"

Capital Allocation: The "Fortress" vs. The "Turnaround"The most significant disparity lies in financial flexibility. A. O. Smith has maintained a "premium compounder" status, boasting a ~100% Free Cash Flow (FCF) conversion rate and a robust 38.8% gross margin. This liquidity has allowed AOS to deploy a dual-pronged strategy: aggressively repurchasing $400 million in stock while simultaneously executing the strategic $470 million acquisition of Leonard Valve to dominate the commercial water management adjacency.

Conversely, Whirlpool is navigating a liquidity-constrained environment. Following credit downgrades to non-investment grade (Ba2/BB) status, Whirlpool’s capital allocation has shifted entirely to defense. By slashing dividends and halting buybacks, WHR is prioritizing debt repayment. While the "Americas-first" strategy—cemented by the deconsolidation of European operations and the reduction of its India stake—aims to stabilize margins, the company currently trades at a "transformation discount" with North American EBIT margins hovering at 4.9%, significantly below AOS’s ~24% operating margin.

Regulatory Alpha: The Hidden Valuation Driver

HDIN Research emphasizes that "Regulatory Alpha" will be a critical volume driver in late 2026, overwhelmingly favoring A. O. Smith.

The upcoming October 2026 Department of Energy (DOE) rule, mandating condensing technology for commercial water heaters, creates a "forced demand" event. This regulatory moat insulates AOS from the cyclical volatility of the U.S. housing market. We project a significant "buy-ahead" volume surge in 2026, allowing AOS to leverage its market leadership in condensing units to drive pricing power.

Whirlpool, conversely, faces a "discretionary spending" hurdle. While its investments in Smart Home IoT are innovative, they lack the non-discretionary urgency of water heater replacement. Furthermore, Whirlpool faces higher compliance risks associated with its ambitious "Net Zero 2050" targets, whereas AOS’s ESG strategy is pragmatically aligned with product sales (e.g., heat pumps) rather than capital-intensive operational overhauls.

Operational Resilience in a Tariff-Heavy World

Despite financial headwinds, Whirlpool maintains a formidable operational edge in supply chain localization. Its "local-for-local" manufacturing model acts as a hedge against global trade volatility. With 80% of U.S. sales produced domestically and 96% of steel sourced within the U.S., Whirlpool has effectively neutralized direct tariff exposure.

A. O. Smith utilizes a different defense mechanism: contractual pass-throughs. By locking in pricing adjustments based on steel indices, AOS protects its gross margins. However, HDIN Research notes that AOS faces higher geopolitical exposure regarding its China operations, where sales declined 12% in 2025. The company’s ongoing strategic assessment of its China footprint represents a pivotal variable for investors to watch.

HDIN Viewpoint: The 2026 Strategic Verdict

At HDIN Research, we believe the market is currently witnessing a decoupling of the durable goods sector.

* A. O. Smith is positioned as the strategic winner for 2026. Its "critical need" product portfolio (60%+ replacement demand), combined with the upcoming DOE regulatory tailwinds, provides a clear path to earnings expansion regardless of interest rate environments.

* Whirlpool offers a value play contingent on successful restructuring. While its domestic manufacturing resilience is best-in-class, the company must resolve its credit overhang and stabilize EBIT margins above 6% before it can shed its transformation discount.

For institutional investors, the choice is between the stability of a regulatory monopoly (AOS) and the high-beta potential of a turnaround story (WHR).

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com