Illumina FY25 Review: The Strategic Pivot from Hardware to Multi-Omics

Date : 2026-02-17

Reading : 96

In the wake of divestitures and global macroeconomic shifts, Illumina, Inc. (ILMN) has entered a definitive phase of "Tactical Repair." While top-line revenue remained flat at $4.34 billion for Fiscal Year 2025, a deeper look into the financials reveals a company transitioning from a hardware-centric growth model to a high-margin, integrated multi-omics platform. With the asset-heavy GRAIL chapter closed, the critical question for investors is no longer about survival, but about the efficacy of its new growth engines.

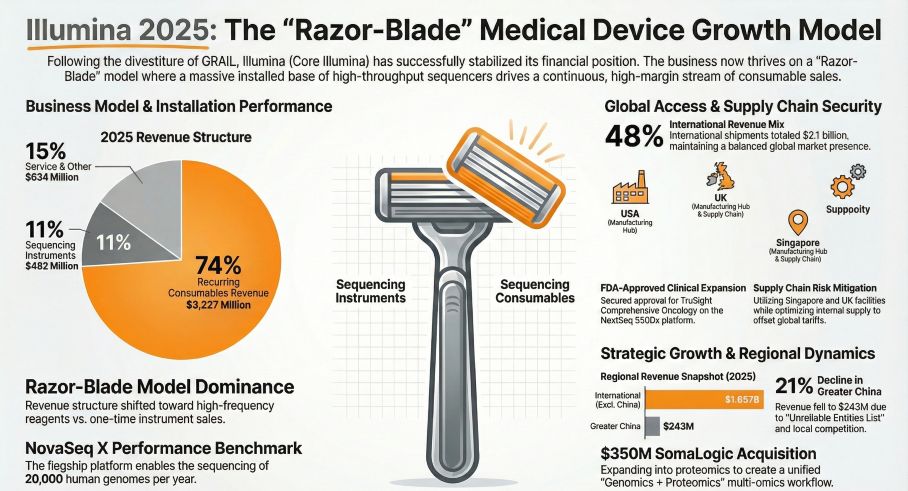

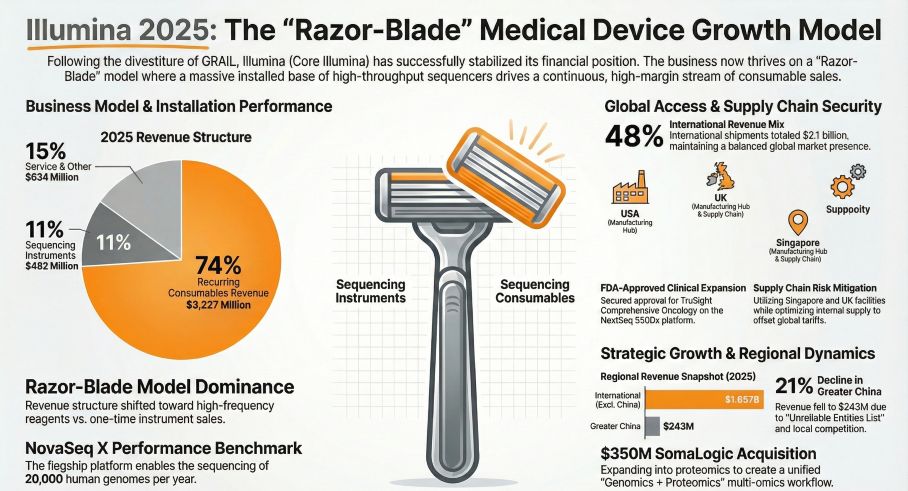

Figure lllumina 2025: The Razor-Blade Medical Device Growth Model

The "Razor-Blade" Moat: Resilience in Recurring Revenue

The "Razor-Blade" Moat: Resilience in Recurring Revenue

Despite a 4% decline in instrument revenue due to global capital expenditure constraints, Illumina’s core thesis remains intact. The company’s "razor-blade" business model demonstrated remarkable resilience, with sequencing consumables accounting for 74% of Core Illumina revenue ($3.23 billion).

This high stickiness is the company’s primary defensive moat. Even as instrument placements faced headwinds, consumable revenue grew by nearly 2%, driven by the migration of customers to the high-throughput NovaSeq X series. For stakeholders, the strategic implication is clear: Illumina has successfully decoupled its cash flow stability from the volatile cycles of hardware capital purchasing. The 31.3% surge in Free Cash Flow (FCF) to $931 million underscores a significant improvement in operating efficiency.

Strategic Pivot: Integrating Multi-Omics and Clinical Utility

The acquisition of SomaLogic marks a paradigm shift from pure genomic sequencing to a broader "Multi-omics + AI" strategy. HDIN Research notes that this is not merely an asset consolidation but a strategic necessity to combat market saturation in core sequencing.

By integrating proteomics reagents into existing workflows, Illumina aims to leverage its massive install base to drive cross-selling opportunities. However, this pivot is not without friction. The transition from Research Use Only (RUO) to clinical diagnostics—particularly in oncology and NIPT (Non-Invasive Prenatal Testing)—requires navigating complex regulatory landscapes (FDA PMA/510(k)). While the logic is sound, the revenue realization from these synergies will likely be a 24-to-36-month play rather than an immediate windfall.

Geopolitical Headwinds and Margin Compression

The 2025 report highlights significant external vulnerabilities. The inclusion of Illumina on China’s "Unreliable Entity List" (UEL) resulted in a direct revenue loss of $65 million in the Greater China region. Coupled with tariff hikes and reduced strategic partnership revenues, Core Illumina’s gross margin contracted by 100 basis points to 66.1%.

These factors suggest that while Illumina maintains a technological lead via its XLEAP-SBS chemistry, its command over external policy risks remains weak. The geographic revenue mix is under pressure, necessitating a rapid diversification of its supply chain and market focus to mitigate "hard decoupling" risks.

HDIN Viewpoint: A Year of "Further Progress"

HDIN Research categorizes Illumina’s current status as a "Strategic Reset." The 2025 GAAP Net Income turnaround to $850 million signals that the balance sheet has been effectively "detoxed" following the GRAIL divestiture and associated impairments.

Our analysts believe the management’s guidance for 2026—characterized by the phrase "Further Progress"—indicates a conservative approach focused on cost discipline rather than aggressive expansion. The explicit $100 million cost-reduction plan and the authorization of $1.5 billion in share buybacks provide a solid floor for valuation.

The HDIN Verdict: Illumina has stabilized the ship. The upside potential now hinges on two factors: the successful commercial integration of SomaLogic’s proteomics capabilities and the ability to navigate export controls in the APAC region. Investors should view 2026 as a pivotal accumulation period where operational efficiency takes precedence over top-line explosion.

Download the Presentation

To delve deeper into the financial audits, risk assessments, and the Frost Radar positioning of Illumina, please access the complete report.

Click here to download the PDF presentation under "Related Topics"

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Figure lllumina 2025: The Razor-Blade Medical Device Growth Model

The "Razor-Blade" Moat: Resilience in Recurring Revenue

The "Razor-Blade" Moat: Resilience in Recurring RevenueDespite a 4% decline in instrument revenue due to global capital expenditure constraints, Illumina’s core thesis remains intact. The company’s "razor-blade" business model demonstrated remarkable resilience, with sequencing consumables accounting for 74% of Core Illumina revenue ($3.23 billion).

This high stickiness is the company’s primary defensive moat. Even as instrument placements faced headwinds, consumable revenue grew by nearly 2%, driven by the migration of customers to the high-throughput NovaSeq X series. For stakeholders, the strategic implication is clear: Illumina has successfully decoupled its cash flow stability from the volatile cycles of hardware capital purchasing. The 31.3% surge in Free Cash Flow (FCF) to $931 million underscores a significant improvement in operating efficiency.

Strategic Pivot: Integrating Multi-Omics and Clinical Utility

The acquisition of SomaLogic marks a paradigm shift from pure genomic sequencing to a broader "Multi-omics + AI" strategy. HDIN Research notes that this is not merely an asset consolidation but a strategic necessity to combat market saturation in core sequencing.

By integrating proteomics reagents into existing workflows, Illumina aims to leverage its massive install base to drive cross-selling opportunities. However, this pivot is not without friction. The transition from Research Use Only (RUO) to clinical diagnostics—particularly in oncology and NIPT (Non-Invasive Prenatal Testing)—requires navigating complex regulatory landscapes (FDA PMA/510(k)). While the logic is sound, the revenue realization from these synergies will likely be a 24-to-36-month play rather than an immediate windfall.

Geopolitical Headwinds and Margin Compression

The 2025 report highlights significant external vulnerabilities. The inclusion of Illumina on China’s "Unreliable Entity List" (UEL) resulted in a direct revenue loss of $65 million in the Greater China region. Coupled with tariff hikes and reduced strategic partnership revenues, Core Illumina’s gross margin contracted by 100 basis points to 66.1%.

These factors suggest that while Illumina maintains a technological lead via its XLEAP-SBS chemistry, its command over external policy risks remains weak. The geographic revenue mix is under pressure, necessitating a rapid diversification of its supply chain and market focus to mitigate "hard decoupling" risks.

HDIN Viewpoint: A Year of "Further Progress"

HDIN Research categorizes Illumina’s current status as a "Strategic Reset." The 2025 GAAP Net Income turnaround to $850 million signals that the balance sheet has been effectively "detoxed" following the GRAIL divestiture and associated impairments.

Our analysts believe the management’s guidance for 2026—characterized by the phrase "Further Progress"—indicates a conservative approach focused on cost discipline rather than aggressive expansion. The explicit $100 million cost-reduction plan and the authorization of $1.5 billion in share buybacks provide a solid floor for valuation.

The HDIN Verdict: Illumina has stabilized the ship. The upside potential now hinges on two factors: the successful commercial integration of SomaLogic’s proteomics capabilities and the ability to navigate export controls in the APAC region. Investors should view 2026 as a pivotal accumulation period where operational efficiency takes precedence over top-line explosion.

Download the Presentation

To delve deeper into the financial audits, risk assessments, and the Frost Radar positioning of Illumina, please access the complete report.

Click here to download the PDF presentation under "Related Topics"

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com