Stryker 2025 Strategic Audit: MedTech Dominance & M&A Synergy

Date : 2026-02-18

Reading : 115

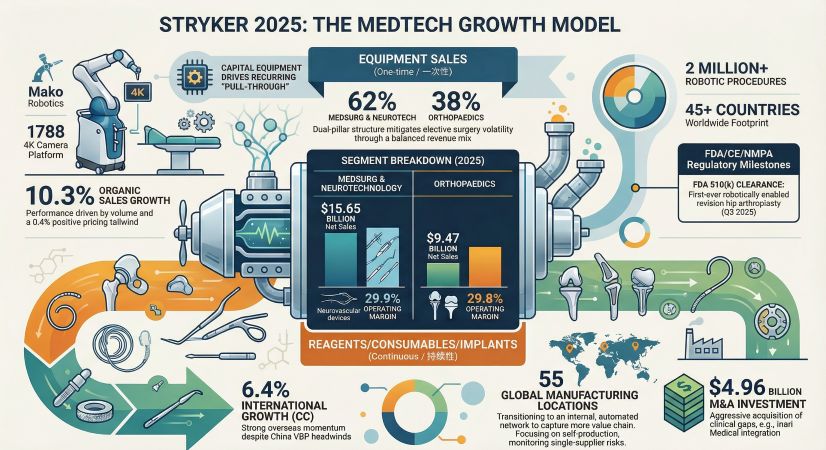

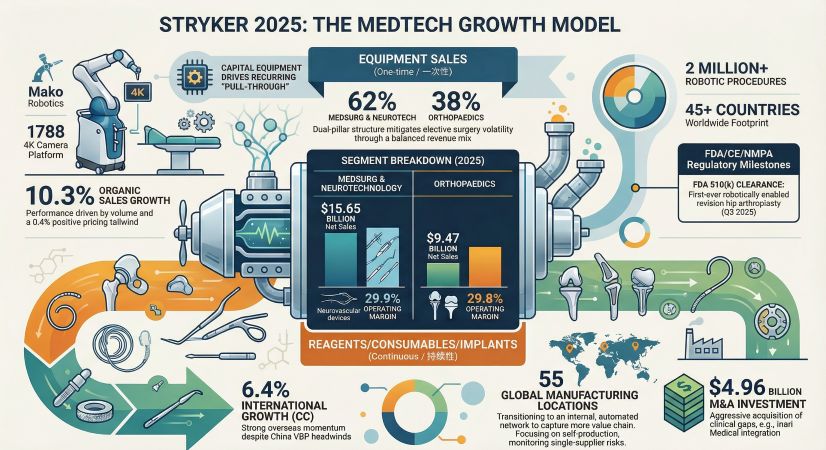

Stryker Corporation (NYSE: SYK) has solidified its position as a premier "MedTech compounding machine," delivering a robust $25.1 billion in net sales for fiscal year 2025. This 11.2% reported surge—comprising 10.3% organic growth—reflects a masterclass in strategic execution. Beyond the raw numbers, Stryker’s performance underscores a successful transition from a traditional hardware manufacturer to a diversified, digitally-integrated medical technology leader.

Figure Stryker 2025: The Medtech Growth Model

Financial Fortitude: Capital Efficiency Amidst Macro Volatility

Financial Fortitude: Capital Efficiency Amidst Macro Volatility

Stryker’s financial architecture remains exceptionally resilient. Despite persistent inflationary pressures on labor and raw materials, the company achieved an adjusted operating margin of 26.3%, a 100-basis-point expansion over the previous year. This margin discipline was driven by high-velocity innovation and the ability to command premium pricing (+0.4%) to neutralize supply chain headwinds.

According to internal modeling by HDIN Research, Stryker’s Altman Z-Score of 5.05 places the firm in a "Safe Zone," indicating extreme financial stability. While the company’s aggressive M&A strategy has resulted in a $158.6 billion long-term debt profile, a net asset return (ROE) of 14.48% demonstrates that capital is being deployed with high efficiency. The firm’s "M&A-first" capital allocation priority saw $4.96 billion deployed in 2025, primarily to fund high-growth clinical gaps.

The Robotics Moat: From Surgical Tools to Data Platforms

The Orthopaedics segment, contributing $9.47 billion in sales, continues to be anchored by the Mako SmartRobotics ecosystem. With over two million robotic procedures performed to date, the "Mako Moat" is widening. The 2025 launch of the Mako 4 platform, integrated with the Q-Guidance system, has transformed the operating room into a data-driven environment.

The strategic implication here is a "lock-in" effect. By securing 510(k) clearance for the first-ever robotically enabled revision hip arthroplasty, Stryker is capturing the complex revision market—a segment where manual failure rates are high and robotic precision provides an insurmountable competitive edge. As the company prepares for the full commercial launch of Mako Shoulder in Q1 2026, it is poised to replicate its hip and knee dominance in the extremities market.

Strategic Pivots: The Inari Integration and Portfolio Optimization

A critical theme of the 2025 fiscal year was the renaming of the Neurovascular business to "Vascular" following the $4.8 billion acquisition of Inari Medical. This move signifies a strategic pivot into the high-growth venous thromboembolism (VTE) treatment market. The Vascular unit reported a 50.6% growth surge, validating Stryker’s ability to integrate "platform" acquisitions that offer higher growth tailwinds than traditional implants.

Simultaneously, Stryker optimized its portfolio by divesting its Spinal Implants business to Viscogliosi Brothers. This divestiture allows management to focus resources on the "Interventional Spine" business, which aligns more closely with the high-margin MedSurg and Neurotechnology segment (now 62% of total revenue).

Navigating Global Headwinds: Pricing and Regulatory Pressure

Despite its strengths, Stryker faces structural challenges. The ongoing implementation of Volume-Based Procurement (VBP) in China continues to exert pricing pressure in the Asia Pacific region. Furthermore, compliance with the European Union Medical Device Regulation (MDR) remains a significant cost center, though the company is on track for the staggered transition through 2028.

Macroeconomic risks, including high interest rates and geopolitical trade restrictions, may also impact hospital capital expenditure (CAPEX). HDIN Research notes that fluctuations in hospital orders for capital equipment—such as the LIFEPAK 35 and 1788 4K Camera platforms—will be a key metric to monitor in the 2026-2027 cycle.

HDIN Viewpoint: The Shift to Surgical Intelligence

At HDIN Research, we view Stryker not merely as a medical device provider but as a pioneer of "Surgical Intelligence." The synergy between the "Connected OR" (via the 1788 4K platform) and Mako robotics creates an ecosystem that is increasingly difficult for competitors to displace. Stryker’s ability to capture the entire surgical episode—from preoperative planning to post-operative wound care—is its most significant strategic moat. As the company moves toward its 2030 vision, we anticipate that its interventional technologies and digital platforms will drive consistent high-single-digit organic growth, outpacing the broader MedTech sector.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report, featuring in-depth DuPont analysis and segment-specific growth forecasts.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Figure Stryker 2025: The Medtech Growth Model

Financial Fortitude: Capital Efficiency Amidst Macro Volatility

Financial Fortitude: Capital Efficiency Amidst Macro VolatilityStryker’s financial architecture remains exceptionally resilient. Despite persistent inflationary pressures on labor and raw materials, the company achieved an adjusted operating margin of 26.3%, a 100-basis-point expansion over the previous year. This margin discipline was driven by high-velocity innovation and the ability to command premium pricing (+0.4%) to neutralize supply chain headwinds.

According to internal modeling by HDIN Research, Stryker’s Altman Z-Score of 5.05 places the firm in a "Safe Zone," indicating extreme financial stability. While the company’s aggressive M&A strategy has resulted in a $158.6 billion long-term debt profile, a net asset return (ROE) of 14.48% demonstrates that capital is being deployed with high efficiency. The firm’s "M&A-first" capital allocation priority saw $4.96 billion deployed in 2025, primarily to fund high-growth clinical gaps.

The Robotics Moat: From Surgical Tools to Data Platforms

The Orthopaedics segment, contributing $9.47 billion in sales, continues to be anchored by the Mako SmartRobotics ecosystem. With over two million robotic procedures performed to date, the "Mako Moat" is widening. The 2025 launch of the Mako 4 platform, integrated with the Q-Guidance system, has transformed the operating room into a data-driven environment.

The strategic implication here is a "lock-in" effect. By securing 510(k) clearance for the first-ever robotically enabled revision hip arthroplasty, Stryker is capturing the complex revision market—a segment where manual failure rates are high and robotic precision provides an insurmountable competitive edge. As the company prepares for the full commercial launch of Mako Shoulder in Q1 2026, it is poised to replicate its hip and knee dominance in the extremities market.

Strategic Pivots: The Inari Integration and Portfolio Optimization

A critical theme of the 2025 fiscal year was the renaming of the Neurovascular business to "Vascular" following the $4.8 billion acquisition of Inari Medical. This move signifies a strategic pivot into the high-growth venous thromboembolism (VTE) treatment market. The Vascular unit reported a 50.6% growth surge, validating Stryker’s ability to integrate "platform" acquisitions that offer higher growth tailwinds than traditional implants.

Simultaneously, Stryker optimized its portfolio by divesting its Spinal Implants business to Viscogliosi Brothers. This divestiture allows management to focus resources on the "Interventional Spine" business, which aligns more closely with the high-margin MedSurg and Neurotechnology segment (now 62% of total revenue).

Navigating Global Headwinds: Pricing and Regulatory Pressure

Despite its strengths, Stryker faces structural challenges. The ongoing implementation of Volume-Based Procurement (VBP) in China continues to exert pricing pressure in the Asia Pacific region. Furthermore, compliance with the European Union Medical Device Regulation (MDR) remains a significant cost center, though the company is on track for the staggered transition through 2028.

Macroeconomic risks, including high interest rates and geopolitical trade restrictions, may also impact hospital capital expenditure (CAPEX). HDIN Research notes that fluctuations in hospital orders for capital equipment—such as the LIFEPAK 35 and 1788 4K Camera platforms—will be a key metric to monitor in the 2026-2027 cycle.

HDIN Viewpoint: The Shift to Surgical Intelligence

At HDIN Research, we view Stryker not merely as a medical device provider but as a pioneer of "Surgical Intelligence." The synergy between the "Connected OR" (via the 1788 4K platform) and Mako robotics creates an ecosystem that is increasingly difficult for competitors to displace. Stryker’s ability to capture the entire surgical episode—from preoperative planning to post-operative wound care—is its most significant strategic moat. As the company moves toward its 2030 vision, we anticipate that its interventional technologies and digital platforms will drive consistent high-single-digit organic growth, outpacing the broader MedTech sector.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report, featuring in-depth DuPont analysis and segment-specific growth forecasts.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com