Albemarle 2026 Strategy: Navigating Lithium Price Volatility

Date : 2026-02-18

Reading : 148

Albemarle Corporation (ALB) has successfully navigated a transformative FY 2025, transitioning from a phase of aggressive global expansion to a disciplined "defensive growth" posture. According to recent analysis by HDIN Research, while the company faced a 4% decline in net sales to $5.14 billion due to an 85–95% collapse in lithium prices from their 2023 peak, its strategic focus on capital preservation and operational efficiency has fortified its balance sheet for the 2026 market recovery.

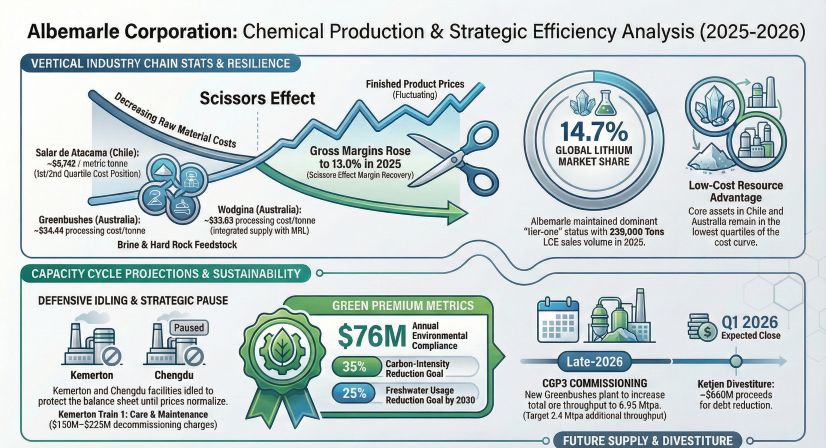

Figure Albemarle Corporation Chemical Production & Strategic Eficiency Analysis (2025-2026)

Financial Forensics: Efficiency Over Top-Line Expansion

Financial Forensics: Efficiency Over Top-Line Expansion

The "So What" of Albemarle’s FY 2025 performance lies not in the revenue contraction, but in the radical optimization of its cash flow bridge. Despite market headwinds, the company achieved a 57% improvement in GAAP net loss compared to the previous year. This recovery was engineered through a 65% reduction in Capital Expenditures (CAPEX), plummeting from $1.68 billion in 2024 to $589.8 million in 2025.

HDIN Research notes that the realization of approximately $692.5 million in Free Cash Flow (FCF) was further bolstered by a $350 million customer prepayment and aggressive working capital management. With a liquidity buffer of $1.6 billion and a Net Debt-to-Adjusted EBITDA ratio of 1.37x—well below its 5.0x covenant—Albemarle has secured the financial flexibility required to withstand prolonged cyclical lows.

Strategic Pivots: Asset Discipline and Portfolio Pruning

Albemarle’s 2026 roadmap is defined by "Strategic Moats"—prioritizing low-cost resource advantages over high-cost conversion capacity. The company’s decision to place Kemerton Trains 1 & 2 and the Chengdu facility into "Care and Maintenance" reflects a sophisticated approach to asset discipline. By idling these higher-cost conversion sites, Albemarle is concentrating production at its Tier-1 resources: the Salar de Atacama in Chile and Greenbushes in Australia.

Furthermore, the divestiture of the Ketjen Refining Solutions business, expected to close in Q1 2026, is a critical move in capital allocation efficiency. The projected $660 million in net proceeds will be channeled toward debt reduction, allowing the firm to focus exclusively on its core Energy Storage and Specialties (Bromine) segments.

Industry Outlook: Positioning for the 2027 Deficit

Looking toward 2026, Albemarle’s strategy assumes a "re-phasing" of the lithium supply-demand balance. While current markets remain oversupplied, the company anticipates a return to a deficit phase by 2027 as high-cost supply is curtailed and global EV sales continue their trajectory toward a forecasted 50 million units by 2032.

The Specialties segment remains a pillar of stability. Leveraging low-cost bromine resources in Arkansas and the Jordan Dead Sea, Albemarle is positioning its flame-retardant solutions as a long-term growth engine for the expanding data center and renewable energy infrastructure sectors.

HDIN Viewpoint: Institutional Perspective

At HDIN Research, we view Albemarle’s current trajectory as a masterclass in cyclical management. The shift from a volume-at-all-costs model to a margin-protection model is not a retreat, but a strategic "hibernation" of marginal assets. By maintaining its ultra-low-cost resource base (with Chilean brine costs at ~$6,742/mt and Greenbushes ore processing at ~$34.44/mt), Albemarle is effectively widening its competitive moat.

We believe Albemarle is uniquely positioned to capture massive upside once index-referenced pricing stabilizes. The company’s "Leaner & Disciplined" structure ensures that it remains the lowest-cost producer in the Western hemisphere, providing a structural advantage over Chinese competitors who face higher variable costs and less integrated supply chains.

Presentation Download

For a detailed breakdown of the financial models and asset-specific cost forensics mentioned in this analysis, please access our comprehensive visual report.

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

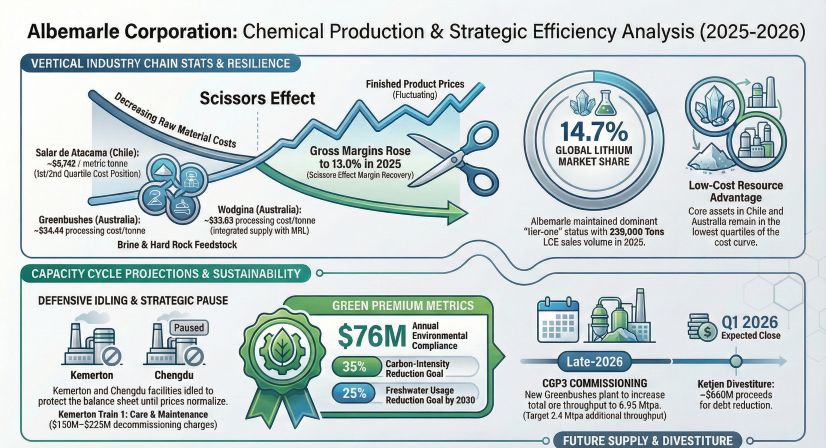

Figure Albemarle Corporation Chemical Production & Strategic Eficiency Analysis (2025-2026)

Financial Forensics: Efficiency Over Top-Line Expansion

Financial Forensics: Efficiency Over Top-Line ExpansionThe "So What" of Albemarle’s FY 2025 performance lies not in the revenue contraction, but in the radical optimization of its cash flow bridge. Despite market headwinds, the company achieved a 57% improvement in GAAP net loss compared to the previous year. This recovery was engineered through a 65% reduction in Capital Expenditures (CAPEX), plummeting from $1.68 billion in 2024 to $589.8 million in 2025.

HDIN Research notes that the realization of approximately $692.5 million in Free Cash Flow (FCF) was further bolstered by a $350 million customer prepayment and aggressive working capital management. With a liquidity buffer of $1.6 billion and a Net Debt-to-Adjusted EBITDA ratio of 1.37x—well below its 5.0x covenant—Albemarle has secured the financial flexibility required to withstand prolonged cyclical lows.

Strategic Pivots: Asset Discipline and Portfolio Pruning

Albemarle’s 2026 roadmap is defined by "Strategic Moats"—prioritizing low-cost resource advantages over high-cost conversion capacity. The company’s decision to place Kemerton Trains 1 & 2 and the Chengdu facility into "Care and Maintenance" reflects a sophisticated approach to asset discipline. By idling these higher-cost conversion sites, Albemarle is concentrating production at its Tier-1 resources: the Salar de Atacama in Chile and Greenbushes in Australia.

Furthermore, the divestiture of the Ketjen Refining Solutions business, expected to close in Q1 2026, is a critical move in capital allocation efficiency. The projected $660 million in net proceeds will be channeled toward debt reduction, allowing the firm to focus exclusively on its core Energy Storage and Specialties (Bromine) segments.

Industry Outlook: Positioning for the 2027 Deficit

Looking toward 2026, Albemarle’s strategy assumes a "re-phasing" of the lithium supply-demand balance. While current markets remain oversupplied, the company anticipates a return to a deficit phase by 2027 as high-cost supply is curtailed and global EV sales continue their trajectory toward a forecasted 50 million units by 2032.

The Specialties segment remains a pillar of stability. Leveraging low-cost bromine resources in Arkansas and the Jordan Dead Sea, Albemarle is positioning its flame-retardant solutions as a long-term growth engine for the expanding data center and renewable energy infrastructure sectors.

HDIN Viewpoint: Institutional Perspective

At HDIN Research, we view Albemarle’s current trajectory as a masterclass in cyclical management. The shift from a volume-at-all-costs model to a margin-protection model is not a retreat, but a strategic "hibernation" of marginal assets. By maintaining its ultra-low-cost resource base (with Chilean brine costs at ~$6,742/mt and Greenbushes ore processing at ~$34.44/mt), Albemarle is effectively widening its competitive moat.

We believe Albemarle is uniquely positioned to capture massive upside once index-referenced pricing stabilizes. The company’s "Leaner & Disciplined" structure ensures that it remains the lowest-cost producer in the Western hemisphere, providing a structural advantage over Chinese competitors who face higher variable costs and less integrated supply chains.

Presentation Download

For a detailed breakdown of the financial models and asset-specific cost forensics mentioned in this analysis, please access our comprehensive visual report.

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com