Hexcel 2025 Strategic Audit: Moats, Margins & The Duopoly Trap

Date : 2026-02-19

Reading : 121

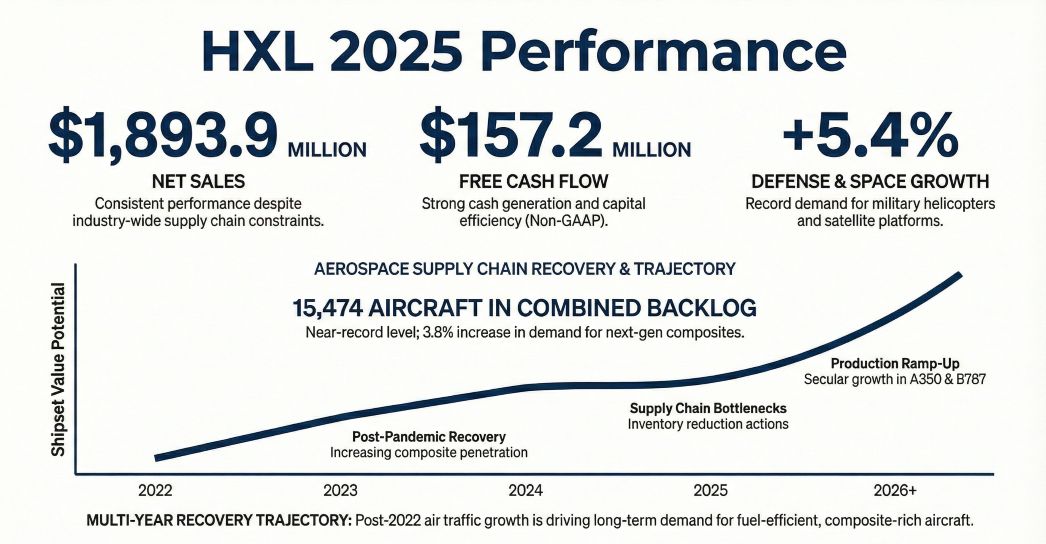

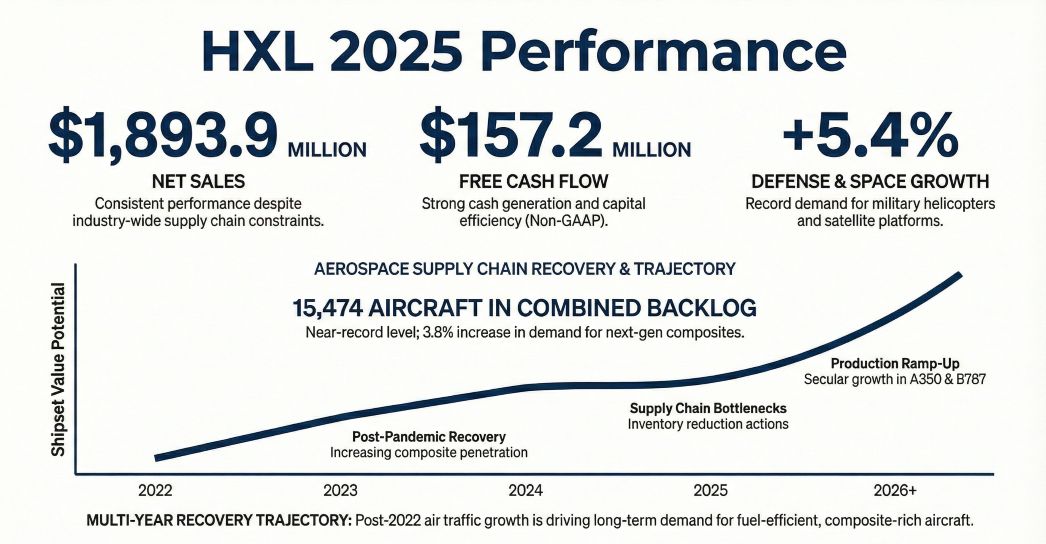

Hexcel Corporation (HXL), the global leader in advanced lightweight composites, faces a complex paradox in its 2025 fiscal year performance. While the company maintains an unassailable technological moat and robust solvency, a forensic analysis of the 10-K reveals that shareholder returns are currently being sustained by financial engineering rather than operational expansion. The critical narrative for 2025 is not growth, but "purification"—as the company divests non-core assets and navigates the extreme cyclicality of the Airbus-Boeing duopoly.

Figure Hexcel Corporation 2025 Performance

Financial Quality: The ROE "Mirage"

Financial Quality: The ROE "Mirage"

At first glance, Hexcel’s Return on Equity (ROE) appears resilient, ticking up to 8.75%. However, HDIN Research’s DuPont analysis exposes the lower quality of these earnings. The slight ROE expansion was not driven by improved Net Profit Margins, which actually compressed from 6.94% to 5.78%. Instead, it was engineered through a significant increase in the Equity Multiplier (financial leverage).

The Strategic Implication: The company executed approximately $454 million in share repurchases in 2025, effectively shrinking the equity base to prop up per-share metrics. Operationally, Hexcel faced "unfavorable cost leverage." By proactively reducing inventory to align with softer demand, the company absorbed higher fixed costs per unit, dragging gross margins down to 23.0%. While this inventory reduction generated $45.4 million in operating cash flow, it highlights the friction between managing working capital and maintaining profitability during demand lulls.

The "Duopoly Trap": Concentration Risk as a Double-Edged Sword

Hexcel’s destiny remains inextricably linked to the production "build rates" of two entities: Airbus and Boeing. In 2025, these two OEMs and their subcontractors accounted for a staggering 52% of Hexcel’s total net sales (39% Airbus, 13% Boeing).

The "So What?": This concentration creates a distinct "derivative risk." Because Hexcel delivers materials 4 to 6 months prior to aircraft assembly, it acts as a leading indicator for the industry but suffers from a "bullwhip effect" when OEMs face delays. The reported risks surrounding the Boeing 737 MAX regulatory scrutiny and supply chain constraints illustrate this vulnerability. Hexcel possesses limited power to influence its own volume; it must wait for the supply chain bottlenecks at the OEM level to clear before its installed capacity can return to optimal utilization.

Strategic Moat: Vertical Integration and Portfolio Purification

Despite short-term headwinds, Hexcel’s strategic positioning remains defensive and "pure." The company effectively utilizes a high barrier to entry—specifically, the rigorous certification requirements and the need for 100% material traceability—to insulate itself from new entrants.

* Portfolio Rationalization: The divestiture of the Neumarkt facility (industrial/wind energy) and the associated $4.5 million in 2025 divestiture costs signal a strategic exit from low-margin, commoditized markets. Hexcel is doubling down on high-margin Aerospace, where its "Secular Penetration" thesis remains intact—evidenced by the 50%+ composite weight by volume in the B787 and A350 programs.

* Vertical Integration: By producing its own PAN precursor (the raw material for carbon fiber) in Decatur, Alabama, Hexcel controls its supply chain depth. While this increases fixed asset intensity (CapEx of $73.3 million in 2025), it secures the intellectual property of their polymer chemistry, preventing commoditization of their core product.

HDIN Viewpoint

At HDIN Research, we classify Hexcel’s 2025 performance as a "bridge year" characterized by defensive capital allocation.

Our Institutional Perspective:

1. Solvency is Not in Question: With an Altman Z-Score analysis revealing high retained earnings ($2.3 billion) relative to assets and a safe debt profile, bankruptcy risk is negligible. The company has the balance sheet to outlast the current aerospace cycle trough.

2. The "Step Zero" Concern: While the company’s qualitative "Step Zero" assessment concluded no goodwill impairment, the drop in operating income within the Engineered Products division (from $39.6M to $13.1M) warrants monitoring. Reliance on qualitative assessments during periods of declining segment profitability can sometimes delay necessary write-downs.

3. The Verdict: Hexcel is trading operational agility for stability. The aggressive share buybacks suggest management believes the stock is undervalued relative to the long-term "secular growth" of composites. However, until the Airbus and Boeing supply chains stabilize, Hexcel’s margins will remain capped by underutilized capacity leverage.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Figure Hexcel Corporation 2025 Performance

Financial Quality: The ROE "Mirage"

Financial Quality: The ROE "Mirage"At first glance, Hexcel’s Return on Equity (ROE) appears resilient, ticking up to 8.75%. However, HDIN Research’s DuPont analysis exposes the lower quality of these earnings. The slight ROE expansion was not driven by improved Net Profit Margins, which actually compressed from 6.94% to 5.78%. Instead, it was engineered through a significant increase in the Equity Multiplier (financial leverage).

The Strategic Implication: The company executed approximately $454 million in share repurchases in 2025, effectively shrinking the equity base to prop up per-share metrics. Operationally, Hexcel faced "unfavorable cost leverage." By proactively reducing inventory to align with softer demand, the company absorbed higher fixed costs per unit, dragging gross margins down to 23.0%. While this inventory reduction generated $45.4 million in operating cash flow, it highlights the friction between managing working capital and maintaining profitability during demand lulls.

The "Duopoly Trap": Concentration Risk as a Double-Edged Sword

Hexcel’s destiny remains inextricably linked to the production "build rates" of two entities: Airbus and Boeing. In 2025, these two OEMs and their subcontractors accounted for a staggering 52% of Hexcel’s total net sales (39% Airbus, 13% Boeing).

The "So What?": This concentration creates a distinct "derivative risk." Because Hexcel delivers materials 4 to 6 months prior to aircraft assembly, it acts as a leading indicator for the industry but suffers from a "bullwhip effect" when OEMs face delays. The reported risks surrounding the Boeing 737 MAX regulatory scrutiny and supply chain constraints illustrate this vulnerability. Hexcel possesses limited power to influence its own volume; it must wait for the supply chain bottlenecks at the OEM level to clear before its installed capacity can return to optimal utilization.

Strategic Moat: Vertical Integration and Portfolio Purification

Despite short-term headwinds, Hexcel’s strategic positioning remains defensive and "pure." The company effectively utilizes a high barrier to entry—specifically, the rigorous certification requirements and the need for 100% material traceability—to insulate itself from new entrants.

* Portfolio Rationalization: The divestiture of the Neumarkt facility (industrial/wind energy) and the associated $4.5 million in 2025 divestiture costs signal a strategic exit from low-margin, commoditized markets. Hexcel is doubling down on high-margin Aerospace, where its "Secular Penetration" thesis remains intact—evidenced by the 50%+ composite weight by volume in the B787 and A350 programs.

* Vertical Integration: By producing its own PAN precursor (the raw material for carbon fiber) in Decatur, Alabama, Hexcel controls its supply chain depth. While this increases fixed asset intensity (CapEx of $73.3 million in 2025), it secures the intellectual property of their polymer chemistry, preventing commoditization of their core product.

HDIN Viewpoint

At HDIN Research, we classify Hexcel’s 2025 performance as a "bridge year" characterized by defensive capital allocation.

Our Institutional Perspective:

1. Solvency is Not in Question: With an Altman Z-Score analysis revealing high retained earnings ($2.3 billion) relative to assets and a safe debt profile, bankruptcy risk is negligible. The company has the balance sheet to outlast the current aerospace cycle trough.

2. The "Step Zero" Concern: While the company’s qualitative "Step Zero" assessment concluded no goodwill impairment, the drop in operating income within the Engineered Products division (from $39.6M to $13.1M) warrants monitoring. Reliance on qualitative assessments during periods of declining segment profitability can sometimes delay necessary write-downs.

3. The Verdict: Hexcel is trading operational agility for stability. The aggressive share buybacks suggest management believes the stock is undervalued relative to the long-term "secular growth" of composites. However, until the Airbus and Boeing supply chains stabilize, Hexcel’s margins will remain capped by underutilized capacity leverage.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com