Zoetis 2025 Strategic Review: The "Continuum of Care" Moat & ROE Surge

Date : 2026-02-19

Reading : 132

Zoetis Inc. (ZTS) has officially decoupled its growth narrative from the cyclical volatility of the livestock market. In Fiscal Year 2025, the global leader in animal health demonstrated a masterclass in portfolio optimization: despite a modest headline revenue growth of 2% (driven by the strategic divestiture of the medicated feed additive business), the company delivered a 10.1% surge in Earnings Per Share (EPS).

This divergence between top-line stability and bottom-line expansion signals a fundamental shift in the company’s identity. Zoetis is no longer just a pharmaceutical manufacturer; it is evolving into a high-margin, tech-enabled ecosystem provider for the "human-animal bond" economy.

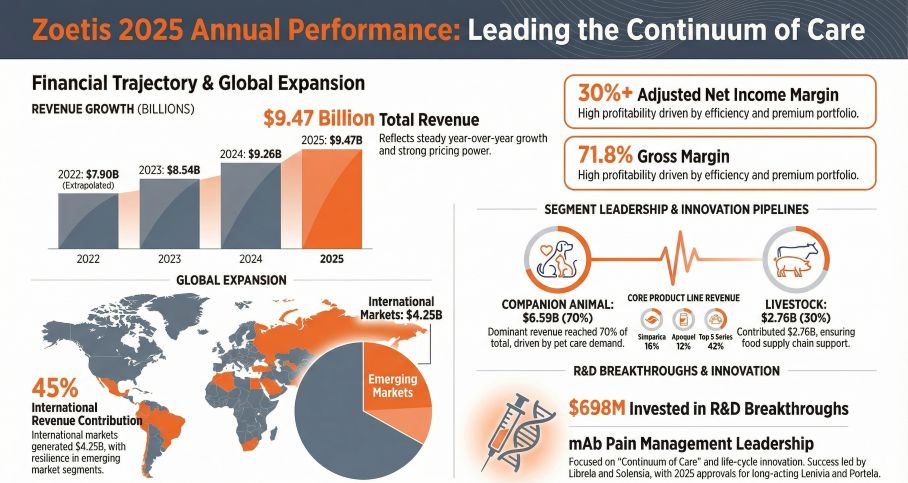

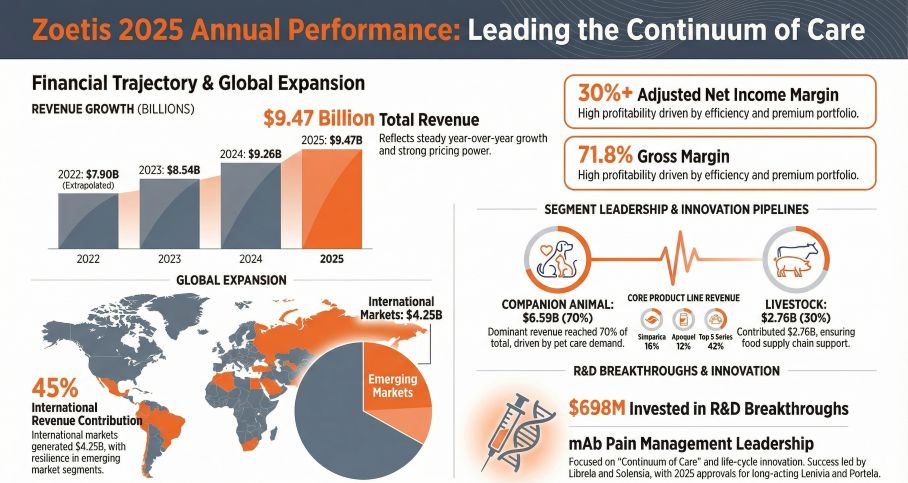

Figure Zoetis 2025 Annual Performance Leading the Continuum of Care

Financial Health: The Logic Behind the 80% ROE

Financial Health: The Logic Behind the 80% ROE

The most striking metric in the 2025 financial report is the explosion in Return on Equity (ROE), which vaulted to 80.2% from 52.1% in the previous year.

The "So What?": This surge was not accidental but engineered through aggressive capital allocation and pricing power.

* Operational Excellence: Zoetis maintained a net profit margin of 28.2%, underscoring its ability to pass on costs in the specialized pet care market.

* Leverage Optimization: The primary driver of the ROE jump was the equity multiplier. By executing $3.2 billion in share buybacks, Zoetis reduced its equity base while increasing financial leverage. Crucially, the Altman Z-Score analysis indicates this leverage is safe; with an EBIT-to-Total Assets ratio of 22.9% and strong operating cash flows ($2.9 billion) fully covering net income, the company retains exceptional financial flexibility.

Strategic Pivot: The "Companion Animal" Supercycle

The Companion Animal segment has solidified its status as the primary growth engine, now commanding 70% of total revenue ($6.59 billion). This structural shift insulates Zoetis from the commoditization risks inherent in the livestock sector.

* Blockbuster Therapeutics: The growth is concentrated in high-barrier innovation. The *Simparica* franchise (parasiticides) generated approximately $1.52 billion, while the monoclonal antibody (mAb) therapies for osteoarthritis (OA)—*Librela* (canine) and *Solensia* (feline)—have become top-tier revenue drivers.

* Lifecycle Innovation: To combat patent cliffs (such as the generic erosion seen with *Draxxin*), Zoetis is aggressively extending product lifecycles. New approvals for *Lenivia* and *Portela* (long-acting OA injectables) in 2025 demonstrate a strategy of "cannibalizing" their own older products with superior, longer-lasting iterations before competitors can gain a foothold.

Operational Moat: The "Continuum of Care"

In a market threatened by generics, Zoetis has constructed a defensive moat described as the "Continuum of Care." This strategy integrates diagnostics, genetics, and therapeutics into a single workflow.

The "So What?": By acquiring diagnostic capabilities (Abaxis) and integrating AI-driven platforms like *Vetscan Imagyst*, Zoetis locks veterinarians into its ecosystem. A clinic using Zoetis diagnostics to detect dermatological issues is statistically more likely to prescribe Zoetis therapeutics (like *Apoquel* or *Cytopoint*). This integration raises switching costs for veterinary practices, providing a structural defense against cheaper, standalone generic alternatives that lack connected diagnostic support.

HDIN Viewpoint

At HDIN Research, we view Zoetis’ 2025 performance as a successful transition from "Volume" to "Value."

Our Institutional Perspective:

1. Concentration Risk: While the financial metrics are stellar, investors must monitor product concentration. The top five product lines now contribute 42% of total revenue. Any regulatory challenge or safety signal regarding the *Simparica* or *Apoquel* franchises would have outsized impacts on the P&L.

2. The "Draxxin" Lesson: The 66% cumulative revenue decline in *Draxxin* (US) post-patent expiry serves as a warning. However, the company’s pivot to biologics (mAbs) offers better protection, as biosimilars are significantly harder and more expensive to develop than generic small molecules.

3. Future Outlook: The alignment of global financial reporting in 2026 and the continued migration of ERP systems to the cloud suggest further operational efficiency gains. We remain bullish on the company’s ability to defend its margins through the "Continuum of Care" strategy, despite headwinds in the Chinese market and foreign exchange volatility.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

This divergence between top-line stability and bottom-line expansion signals a fundamental shift in the company’s identity. Zoetis is no longer just a pharmaceutical manufacturer; it is evolving into a high-margin, tech-enabled ecosystem provider for the "human-animal bond" economy.

Figure Zoetis 2025 Annual Performance Leading the Continuum of Care

Financial Health: The Logic Behind the 80% ROE

Financial Health: The Logic Behind the 80% ROEThe most striking metric in the 2025 financial report is the explosion in Return on Equity (ROE), which vaulted to 80.2% from 52.1% in the previous year.

The "So What?": This surge was not accidental but engineered through aggressive capital allocation and pricing power.

* Operational Excellence: Zoetis maintained a net profit margin of 28.2%, underscoring its ability to pass on costs in the specialized pet care market.

* Leverage Optimization: The primary driver of the ROE jump was the equity multiplier. By executing $3.2 billion in share buybacks, Zoetis reduced its equity base while increasing financial leverage. Crucially, the Altman Z-Score analysis indicates this leverage is safe; with an EBIT-to-Total Assets ratio of 22.9% and strong operating cash flows ($2.9 billion) fully covering net income, the company retains exceptional financial flexibility.

Strategic Pivot: The "Companion Animal" Supercycle

The Companion Animal segment has solidified its status as the primary growth engine, now commanding 70% of total revenue ($6.59 billion). This structural shift insulates Zoetis from the commoditization risks inherent in the livestock sector.

* Blockbuster Therapeutics: The growth is concentrated in high-barrier innovation. The *Simparica* franchise (parasiticides) generated approximately $1.52 billion, while the monoclonal antibody (mAb) therapies for osteoarthritis (OA)—*Librela* (canine) and *Solensia* (feline)—have become top-tier revenue drivers.

* Lifecycle Innovation: To combat patent cliffs (such as the generic erosion seen with *Draxxin*), Zoetis is aggressively extending product lifecycles. New approvals for *Lenivia* and *Portela* (long-acting OA injectables) in 2025 demonstrate a strategy of "cannibalizing" their own older products with superior, longer-lasting iterations before competitors can gain a foothold.

Operational Moat: The "Continuum of Care"

In a market threatened by generics, Zoetis has constructed a defensive moat described as the "Continuum of Care." This strategy integrates diagnostics, genetics, and therapeutics into a single workflow.

The "So What?": By acquiring diagnostic capabilities (Abaxis) and integrating AI-driven platforms like *Vetscan Imagyst*, Zoetis locks veterinarians into its ecosystem. A clinic using Zoetis diagnostics to detect dermatological issues is statistically more likely to prescribe Zoetis therapeutics (like *Apoquel* or *Cytopoint*). This integration raises switching costs for veterinary practices, providing a structural defense against cheaper, standalone generic alternatives that lack connected diagnostic support.

HDIN Viewpoint

At HDIN Research, we view Zoetis’ 2025 performance as a successful transition from "Volume" to "Value."

Our Institutional Perspective:

1. Concentration Risk: While the financial metrics are stellar, investors must monitor product concentration. The top five product lines now contribute 42% of total revenue. Any regulatory challenge or safety signal regarding the *Simparica* or *Apoquel* franchises would have outsized impacts on the P&L.

2. The "Draxxin" Lesson: The 66% cumulative revenue decline in *Draxxin* (US) post-patent expiry serves as a warning. However, the company’s pivot to biologics (mAbs) offers better protection, as biosimilars are significantly harder and more expensive to develop than generic small molecules.

3. Future Outlook: The alignment of global financial reporting in 2026 and the continued migration of ERP systems to the cloud suggest further operational efficiency gains. We remain bullish on the company’s ability to defend its margins through the "Continuum of Care" strategy, despite headwinds in the Chinese market and foreign exchange volatility.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com