Waste Connections (WCN) vs. Waste Management (WM) 2025: The Great Strategic Divergence in North American Waste

Date : 2026-02-19

Reading : 133

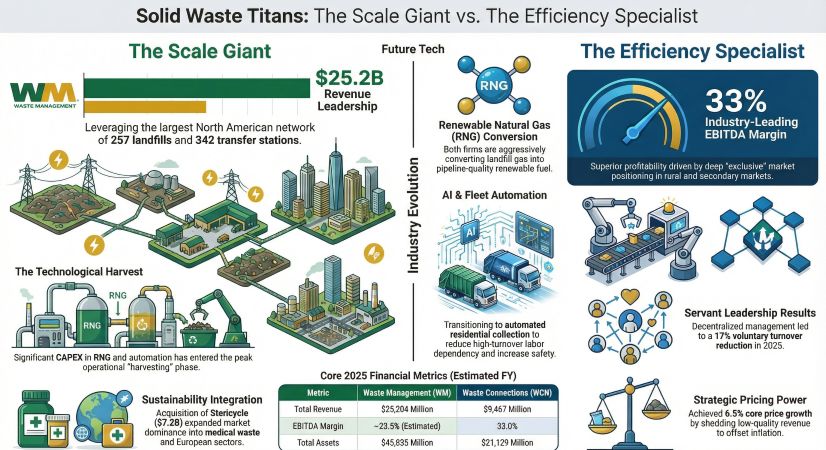

The 2025 fiscal year marked a definitive strategic divergence between the two titans of the North American solid waste industry. While Waste Management (WM) and Waste Connections (WCN) both capitalized on inflation-driven pricing, their paths to value creation have fundamentally split. WM has engaged in a capital-intensive transformation into a technology-led sustainability conglomerate, while WCN has doubled down on its high-margin, decentralized "rural moat" strategy.

Figure Solid Waste Titans The Scale Giant vs. The Efficiency Specialist

Financial Health: The Tale of Two ROEs

Financial Health: The Tale of Two ROEs

The financial data reveals two distinct methods of generating Return on Equity (ROE).

* WCN: The Pricing Power Play: Waste Connections delivered an industry-leading Adjusted EBITDA margin of 33.0%. The "So What?" here is the resilience of their Core Price growth (6.5%). By operating in secondary and exclusive franchise markets, WCN possesses the pricing leverage to fully offset inflationary pressures (5.1% cost increase) without risking customer churn. Their ROE is driven by pure operational efficiency and margin quality.

* WM: The Leverage & Scale Play: Conversely, Waste Management’s ROE expansion is driven by financial leverage and asset turnover. Following the transformational $7.2 billion acquisition of Stericycle, WM’s debt load increased to $22.9 billion. While their EBITDA margin hovers around 28.5%, their strategy relies on cross-selling healthcare solutions and leveraging their massive network of 257 landfills to dilute fixed costs.

Strategic M&A: Transformation vs. Densification

The M&A landscape in 2025 highlighted a clash of philosophies.

WM's "Cross-Sector" Ambition: WM is no longer just a trash company; it is an environmental solutions provider. The acquisition of Stericycle moves them aggressively into medical waste and secure information destruction, diversifying revenue streams beyond traditional collection. Coupled with heavy CAPEX in Renewable Natural Gas (RNG)—with 103 landfill gas projects now active—WM is betting on the "Circular Economy" as its next major growth engine.

WCN's "Tuck-in" Discipline: Waste Connections remained disciplined, deploying roughly $966 million in 2025 on 19 "tuck-in" acquisitions. Their strategy is strictly geographical: buying independent operators in non-urban basins (including E&P waste) to secure exclusive market share. This decentralized approach minimizes integration risk and protects their high-margin profile from the hyper-competition of urban centers.

The Regulatory Moat: The PFAS Paradigm

The designation of PFOA and PFOS as hazardous substances under CERCLA has altered the liability landscape for landfill operators.

* Defensive vs. Offensive: WCN views PFAS primarily as a cost burden, focusing on the potential increase in leachate treatment costs and asset retirement obligations. WM, however, is pivoting to an offensive strategy. By lobbying for passive receiver exemptions while simultaneously investing in treatment technologies, WM aims to turn PFAS compliance into a new revenue stream, managing complex waste streams that smaller competitors cannot handle.

HDIN Viewpoint

At HDIN Research, we identify a clear trade-off for investors in the 2025 data.

Our Institutional Perspective:

1. Operational Alpha: Waste Connections (WCN) remains the superior operator for margin protection. Their "Servant Leadership" culture has driven voluntary turnover down by 17%, a critical hidden advantage in a labor-tight market. Their ability to shed low-quality revenue while raising prices 6.5% demonstrates unmatched discipline.

2. Structural Beta: Waste Management (WM) offers structural stability through sheer scale. They are entering the "harvest phase" of their massive RNG investments, expecting up to $425 million in tax credits by 2027.

3. The Verdict: The industry is bifurcating. WCN is the choice for "Quality Growth" through pricing power and rural monopolies. WM is the play for "Asset Aggregation" and green energy dividends. However, we caution that WM’s integration of Stericycle carries significant execution risk, while WCN faces long-term headwinds from potential regulatory crackdowns on exclusive franchise agreements.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

Figure Solid Waste Titans The Scale Giant vs. The Efficiency Specialist

Financial Health: The Tale of Two ROEs

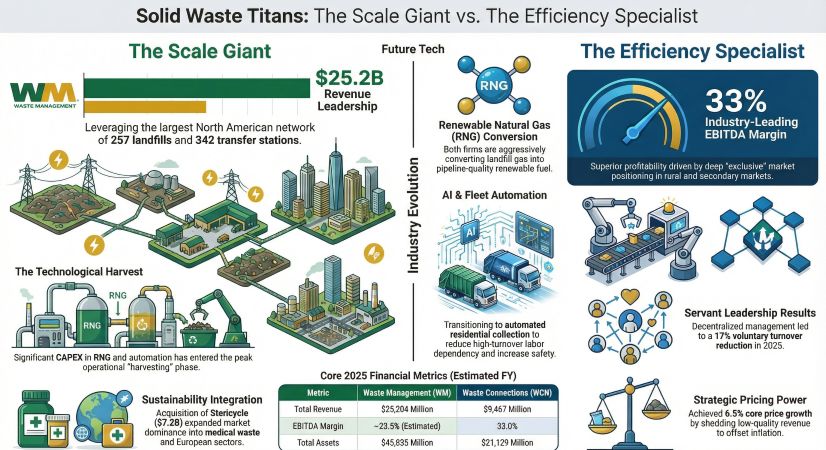

Financial Health: The Tale of Two ROEsThe financial data reveals two distinct methods of generating Return on Equity (ROE).

* WCN: The Pricing Power Play: Waste Connections delivered an industry-leading Adjusted EBITDA margin of 33.0%. The "So What?" here is the resilience of their Core Price growth (6.5%). By operating in secondary and exclusive franchise markets, WCN possesses the pricing leverage to fully offset inflationary pressures (5.1% cost increase) without risking customer churn. Their ROE is driven by pure operational efficiency and margin quality.

* WM: The Leverage & Scale Play: Conversely, Waste Management’s ROE expansion is driven by financial leverage and asset turnover. Following the transformational $7.2 billion acquisition of Stericycle, WM’s debt load increased to $22.9 billion. While their EBITDA margin hovers around 28.5%, their strategy relies on cross-selling healthcare solutions and leveraging their massive network of 257 landfills to dilute fixed costs.

Strategic M&A: Transformation vs. Densification

The M&A landscape in 2025 highlighted a clash of philosophies.

WM's "Cross-Sector" Ambition: WM is no longer just a trash company; it is an environmental solutions provider. The acquisition of Stericycle moves them aggressively into medical waste and secure information destruction, diversifying revenue streams beyond traditional collection. Coupled with heavy CAPEX in Renewable Natural Gas (RNG)—with 103 landfill gas projects now active—WM is betting on the "Circular Economy" as its next major growth engine.

WCN's "Tuck-in" Discipline: Waste Connections remained disciplined, deploying roughly $966 million in 2025 on 19 "tuck-in" acquisitions. Their strategy is strictly geographical: buying independent operators in non-urban basins (including E&P waste) to secure exclusive market share. This decentralized approach minimizes integration risk and protects their high-margin profile from the hyper-competition of urban centers.

The Regulatory Moat: The PFAS Paradigm

The designation of PFOA and PFOS as hazardous substances under CERCLA has altered the liability landscape for landfill operators.

* Defensive vs. Offensive: WCN views PFAS primarily as a cost burden, focusing on the potential increase in leachate treatment costs and asset retirement obligations. WM, however, is pivoting to an offensive strategy. By lobbying for passive receiver exemptions while simultaneously investing in treatment technologies, WM aims to turn PFAS compliance into a new revenue stream, managing complex waste streams that smaller competitors cannot handle.

HDIN Viewpoint

At HDIN Research, we identify a clear trade-off for investors in the 2025 data.

Our Institutional Perspective:

1. Operational Alpha: Waste Connections (WCN) remains the superior operator for margin protection. Their "Servant Leadership" culture has driven voluntary turnover down by 17%, a critical hidden advantage in a labor-tight market. Their ability to shed low-quality revenue while raising prices 6.5% demonstrates unmatched discipline.

2. Structural Beta: Waste Management (WM) offers structural stability through sheer scale. They are entering the "harvest phase" of their massive RNG investments, expecting up to $425 million in tax credits by 2027.

3. The Verdict: The industry is bifurcating. WCN is the choice for "Quality Growth" through pricing power and rural monopolies. WM is the play for "Asset Aggregation" and green energy dividends. However, we caution that WM’s integration of Stericycle carries significant execution risk, while WCN faces long-term headwinds from potential regulatory crackdowns on exclusive franchise agreements.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com