GE HealthCare 2025: AI Strategy & Margin Resilience

Date : 2026-02-21

Reading : 81

In an era defined by capital constraints and supply chain volatility, GE HealthCare (GEHC) is executing a decisive pivot: transitioning from a hardware-centric manufacturing model to a digital precision care ecosystem. HDIN Research’s analysis of the FY2025 filings reveals that Artificial Intelligence (AI) and Cloud integration are no longer peripheral features for the giant, but the central financial hedge against global margin compression and geopolitical headwinds.

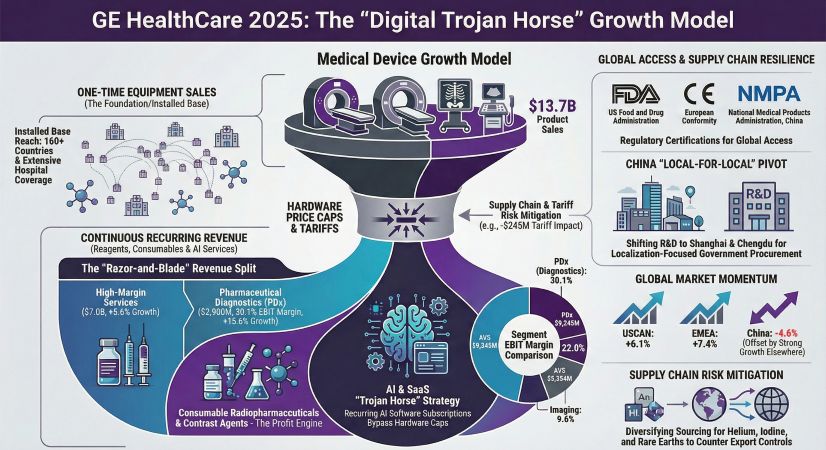

Figure GE HealthCare 2025: The “Digital Trojan Horse Growth Model

From Hardware to "Smart" Recurring Revenue

From Hardware to "Smart" Recurring Revenue

The most significant takeaway from the 2025 reporting period is the structural shift in GEHC’s revenue quality. Facing "structural compression" on hardware pricing due to global competitive bidding, the company is aggressively moving toward a "Razor-and-Blade" model where hardware serves as the entry point for high-margin software services.

Data indicates that Service revenue has stabilized at approximately 34% of total revenue ($6.96 billion), driven by a 5.6% year-over-year growth. This shift is intentional. By embedding AI into its installed base—such as the integration of MIM Software for radiation oncology and icometrix for brain imaging—GEHC is converting one-time capital expenditures into long-term SaaS (Software as a Service) contracts. This strategy not only increases customer stickiness across complex hospital networks but also insulates the company’s bottom line from the cyclical volatility of equipment sales.

The VBP Counter-Strategy: Monetizing Clinical Efficiency

Nowhere is this digital pivot more critical than in the Chinese market, where Volume-Based Procurement (VBP) has placed immense pressure on unit pricing. HDIN Research notes that while China revenue faced a 4.6% decline due to these policy headwinds, GEHC is successfully deploying a "value-layering" defense.

Rather than competing solely on hardware price, GEHC is monetizing "clinical efficiency." By deploying AI-guided ultrasound (AVS) and automated workflows, the company offers hospitals a solution to staff shortages—a value proposition that transcends the VBP catalog. Furthermore, the strong 15.6% growth in the Pharmaceutical Diagnostics (PDx) segment highlights a "drug-device synergy." By coupling proprietary tracers with AI-enhanced Molecular Imaging hardware, GEHC creates a closed-loop ecosystem that generic competitors cannot easily replicate.

Capital Allocation: Digital M&A as a Geopolitical Buffer

The 2025 financial disclosures also paint a stark picture of the geopolitical toll on operations, with tariffs impacting operating profit by approximately $245 million. In response, GEHC’s capital allocation has shifted toward acquiring intangible assets that are less sensitive to physical supply chain disruptions.

The proposed $2.3 billion acquisition of Intelerad and the strategic investment in Cloud-native workflow solutions signal a move to secure the "digital workflow entry point." By owning the software layer that manages radiology workflows, GEHC aims to secure recurring revenue streams that are immune to tariffs, raw material shortages (such as helium or rare earth elements), and logistics bottlenecks.

HDIN Viewpoint: The Execution Risk in Data Sovereignty

At HDIN Research, we believe GE HealthCare’s strategy represents a sophisticated evolution of the MedTech business model. The company is effectively attempting to re-rate itself from an industrial manufacturer to a digital platform provider.

However, this transition brings new risks. As GEHC moves from selling "iron" to selling "insights," it walks directly into the crosshairs of global data sovereignty laws. Our analysis suggests that the company’s ability to navigate the regulatory friction between Western cloud architectures and China’s strict data localization laws (PIPL/DSL) will be the deciding factor in its ability to scale this digital ecosystem globally. Success will depend not just on innovation speed, but on the agility of its compliance infrastructure.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

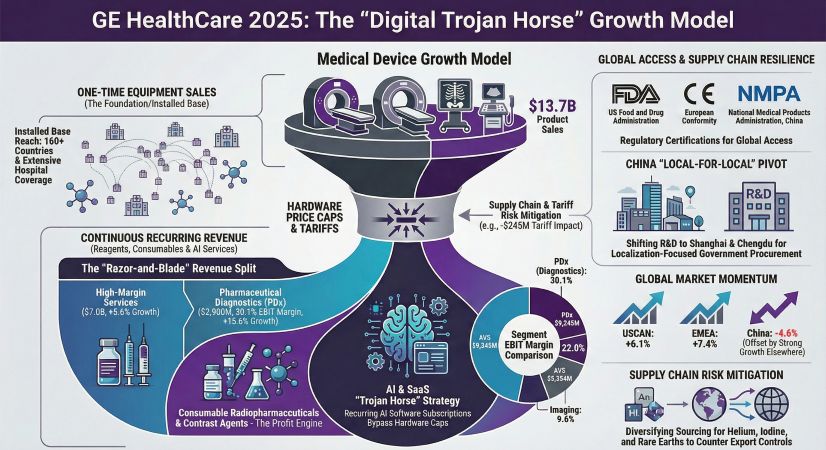

Figure GE HealthCare 2025: The “Digital Trojan Horse Growth Model

From Hardware to "Smart" Recurring Revenue

From Hardware to "Smart" Recurring RevenueThe most significant takeaway from the 2025 reporting period is the structural shift in GEHC’s revenue quality. Facing "structural compression" on hardware pricing due to global competitive bidding, the company is aggressively moving toward a "Razor-and-Blade" model where hardware serves as the entry point for high-margin software services.

Data indicates that Service revenue has stabilized at approximately 34% of total revenue ($6.96 billion), driven by a 5.6% year-over-year growth. This shift is intentional. By embedding AI into its installed base—such as the integration of MIM Software for radiation oncology and icometrix for brain imaging—GEHC is converting one-time capital expenditures into long-term SaaS (Software as a Service) contracts. This strategy not only increases customer stickiness across complex hospital networks but also insulates the company’s bottom line from the cyclical volatility of equipment sales.

The VBP Counter-Strategy: Monetizing Clinical Efficiency

Nowhere is this digital pivot more critical than in the Chinese market, where Volume-Based Procurement (VBP) has placed immense pressure on unit pricing. HDIN Research notes that while China revenue faced a 4.6% decline due to these policy headwinds, GEHC is successfully deploying a "value-layering" defense.

Rather than competing solely on hardware price, GEHC is monetizing "clinical efficiency." By deploying AI-guided ultrasound (AVS) and automated workflows, the company offers hospitals a solution to staff shortages—a value proposition that transcends the VBP catalog. Furthermore, the strong 15.6% growth in the Pharmaceutical Diagnostics (PDx) segment highlights a "drug-device synergy." By coupling proprietary tracers with AI-enhanced Molecular Imaging hardware, GEHC creates a closed-loop ecosystem that generic competitors cannot easily replicate.

Capital Allocation: Digital M&A as a Geopolitical Buffer

The 2025 financial disclosures also paint a stark picture of the geopolitical toll on operations, with tariffs impacting operating profit by approximately $245 million. In response, GEHC’s capital allocation has shifted toward acquiring intangible assets that are less sensitive to physical supply chain disruptions.

The proposed $2.3 billion acquisition of Intelerad and the strategic investment in Cloud-native workflow solutions signal a move to secure the "digital workflow entry point." By owning the software layer that manages radiology workflows, GEHC aims to secure recurring revenue streams that are immune to tariffs, raw material shortages (such as helium or rare earth elements), and logistics bottlenecks.

HDIN Viewpoint: The Execution Risk in Data Sovereignty

At HDIN Research, we believe GE HealthCare’s strategy represents a sophisticated evolution of the MedTech business model. The company is effectively attempting to re-rate itself from an industrial manufacturer to a digital platform provider.

However, this transition brings new risks. As GEHC moves from selling "iron" to selling "insights," it walks directly into the crosshairs of global data sovereignty laws. Our analysis suggests that the company’s ability to navigate the regulatory friction between Western cloud architectures and China’s strict data localization laws (PIPL/DSL) will be the deciding factor in its ability to scale this digital ecosystem globally. Success will depend not just on innovation speed, but on the agility of its compliance infrastructure.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com