SiTime 2025 Strategy: AI, The Renesas Deal, and the End of Quartz

Date : 2026-02-22

Reading : 109

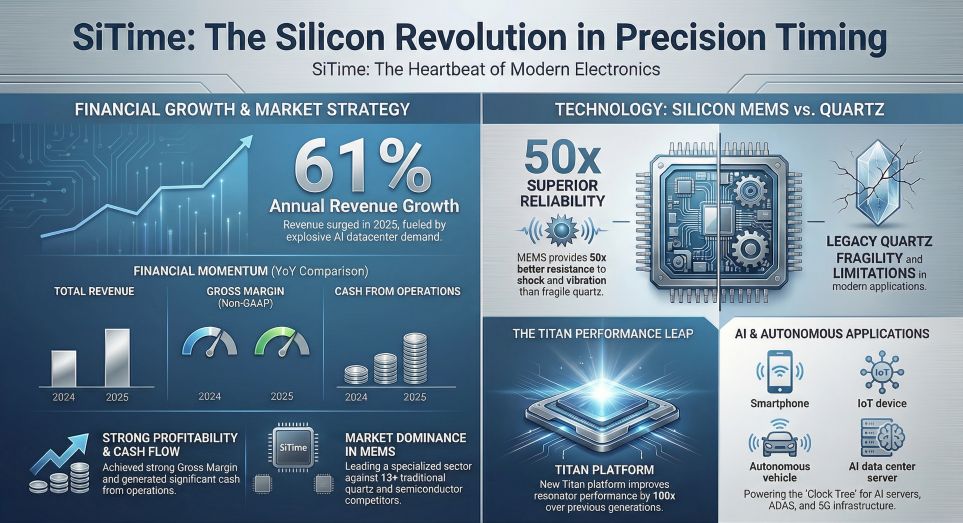

In the semiconductor sector, timing is everything—literally and strategically. HDIN Research’s deep dive into SiTime’s (SITM) FY2025 filings reveals a company in the midst of a violent structural evolution. Having posted a staggering 61% revenue growth year-over-year, SiTime is no longer content with being a niche component supplier. Through its proposed $1.5 billion acquisition of Renesas’ timing assets, the company is aggressively pivoting to become a comprehensive "system-level" architect, aiming to monopolize the heartbeat of the AI era.

Figure SiTime: The Silicon Revolution in Precision Timing

The "So What": AI Physicality Demands a Material Shift

The "So What": AI Physicality Demands a Material Shift

The headline growth numbers ($327 million revenue) are driven by a fundamental physical reality: traditional quartz timing crystals are failing under the stress of modern computing.

* Environmental Resilience: AI data centers are hostile environments characterized by extreme heat gradients and vibration from cooling fans. HDIN Research notes that SiTime’s MEMS (Micro-Electro-Mechanical Systems) technology is gaining market share because it offers up to 50x better vibration resistance than legacy quartz.

* The Titan Platform: The launch of the *Titan* platform represents a technological leap, improving resonator performance by 100x. This allows SiTime to eliminate external quartz resonators entirely, integrating them into a "System-in-Package," which saves critical board space and power—metrics that are non-negotiable for hyperscale clients.

Strategic M&A: The $1.5 Billion "Clock Tree" Moat

The most critical strategic development is SiTime’s move to acquire Renesas Electronics’ timing division. This is not merely a revenue grab; it is a defensive moat construction.

* Completing the Circuit: Previously, SiTime dominated the *source* of the clock signal (Oscillators). With the Renesas and Aura assets, they now control the distribution (Clock ICs, Buffers, and Jitter Cleaners). This allows SiTime to sell the entire "Clock Tree," locking clients into a unified ecosystem.

* Software as a Differentiator: By pairing this hardware with its *TimeFabric* software, SiTime is moving toward a recurring revenue model. The software ensures synchronization across thousands of AI chips with IEEE 1588 precision, a capability that legacy quartz vendors cannot replicate digitally.

De-Risking the Customer Concentration

For years, SiTime’s valuation discount was driven by its heavy reliance on Apple. The FY2025 data shows a successful diversification strategy in motion.

* Diluting the Apple Factor: While Apple remains a critical partner, its revenue contribution has dropped from 22% (FY2024) to 17% (FY2025). This dilution is not due to lost business, but rather the explosive growth of the Non-Consumer segment (AI and Comms), which now commands higher Average Selling Prices (ASPs).

* Supply Chain Sovereignty: Geopolitical friction remains a key risk, given the company's reliance on Taiwan for fabrication (TSMC/UMC). However, the fabless model allows SiTime to rapidly shift mix without the capital drag of owning foundries, a distinct advantage over IDM (Integrated Device Manufacturer) competitors like Epson or Kyocera.

HDIN Viewpoint: The Integration Execution Risk

At HDIN Research, we view SiTime’s trajectory as a textbook example of "Category Creation." The company is effectively forcing a paradigm shift from mechanical quartz to digital silicon.

However, the "All-Silicon" thesis now faces its biggest test: Integration. The acquisition of Renesas’ assets introduces significant complexity. SiTime is transitioning from a lean, high-cash-balance operation to a leveraged entity with a complex global workforce. The strategic imperative for 2026 will not be technology innovation, but operational integration—ensuring that the cultural merge does not slow down the R&D velocity required to keep pace with the AI hardware cycle.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com

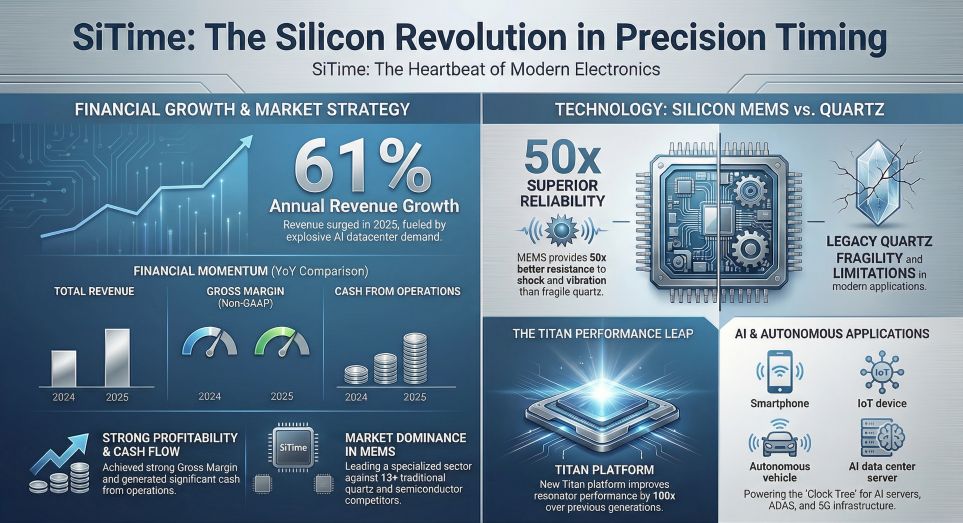

Figure SiTime: The Silicon Revolution in Precision Timing

The "So What": AI Physicality Demands a Material Shift

The "So What": AI Physicality Demands a Material ShiftThe headline growth numbers ($327 million revenue) are driven by a fundamental physical reality: traditional quartz timing crystals are failing under the stress of modern computing.

* Environmental Resilience: AI data centers are hostile environments characterized by extreme heat gradients and vibration from cooling fans. HDIN Research notes that SiTime’s MEMS (Micro-Electro-Mechanical Systems) technology is gaining market share because it offers up to 50x better vibration resistance than legacy quartz.

* The Titan Platform: The launch of the *Titan* platform represents a technological leap, improving resonator performance by 100x. This allows SiTime to eliminate external quartz resonators entirely, integrating them into a "System-in-Package," which saves critical board space and power—metrics that are non-negotiable for hyperscale clients.

Strategic M&A: The $1.5 Billion "Clock Tree" Moat

The most critical strategic development is SiTime’s move to acquire Renesas Electronics’ timing division. This is not merely a revenue grab; it is a defensive moat construction.

* Completing the Circuit: Previously, SiTime dominated the *source* of the clock signal (Oscillators). With the Renesas and Aura assets, they now control the distribution (Clock ICs, Buffers, and Jitter Cleaners). This allows SiTime to sell the entire "Clock Tree," locking clients into a unified ecosystem.

* Software as a Differentiator: By pairing this hardware with its *TimeFabric* software, SiTime is moving toward a recurring revenue model. The software ensures synchronization across thousands of AI chips with IEEE 1588 precision, a capability that legacy quartz vendors cannot replicate digitally.

De-Risking the Customer Concentration

For years, SiTime’s valuation discount was driven by its heavy reliance on Apple. The FY2025 data shows a successful diversification strategy in motion.

* Diluting the Apple Factor: While Apple remains a critical partner, its revenue contribution has dropped from 22% (FY2024) to 17% (FY2025). This dilution is not due to lost business, but rather the explosive growth of the Non-Consumer segment (AI and Comms), which now commands higher Average Selling Prices (ASPs).

* Supply Chain Sovereignty: Geopolitical friction remains a key risk, given the company's reliance on Taiwan for fabrication (TSMC/UMC). However, the fabless model allows SiTime to rapidly shift mix without the capital drag of owning foundries, a distinct advantage over IDM (Integrated Device Manufacturer) competitors like Epson or Kyocera.

HDIN Viewpoint: The Integration Execution Risk

At HDIN Research, we view SiTime’s trajectory as a textbook example of "Category Creation." The company is effectively forcing a paradigm shift from mechanical quartz to digital silicon.

However, the "All-Silicon" thesis now faces its biggest test: Integration. The acquisition of Renesas’ assets introduces significant complexity. SiTime is transitioning from a lean, high-cash-balance operation to a leveraged entity with a complex global workforce. The strategic imperative for 2026 will not be technology innovation, but operational integration—ensuring that the cultural merge does not slow down the R&D velocity required to keep pace with the AI hardware cycle.

Presentation Download

Click the PDF download link under “Related Topics” to access the presentation of this report.

About HDIN Research

HDIN Research focuses on providing market consulting services. As an independent third-party consulting firm, it is committed to providing in-depth market research and analysis reports.

Website: www.hdinresearch.com

E-mail: sales@hdinresearch.com